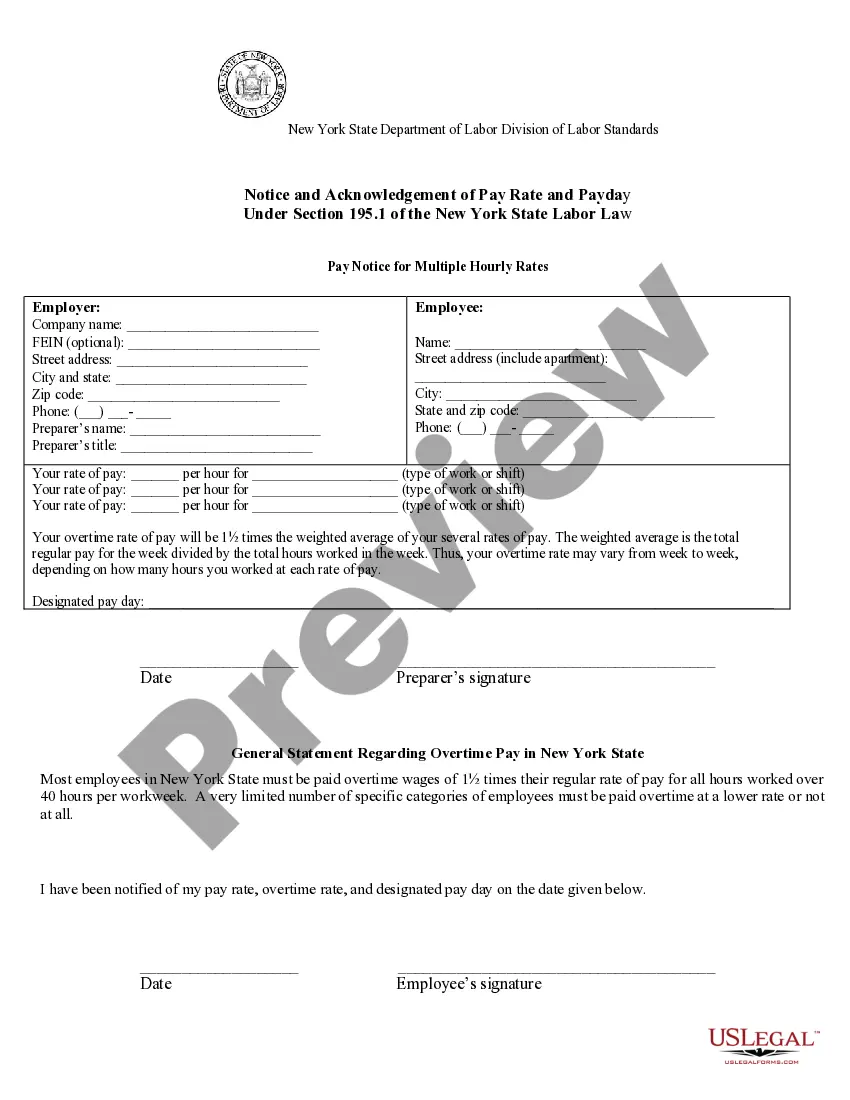

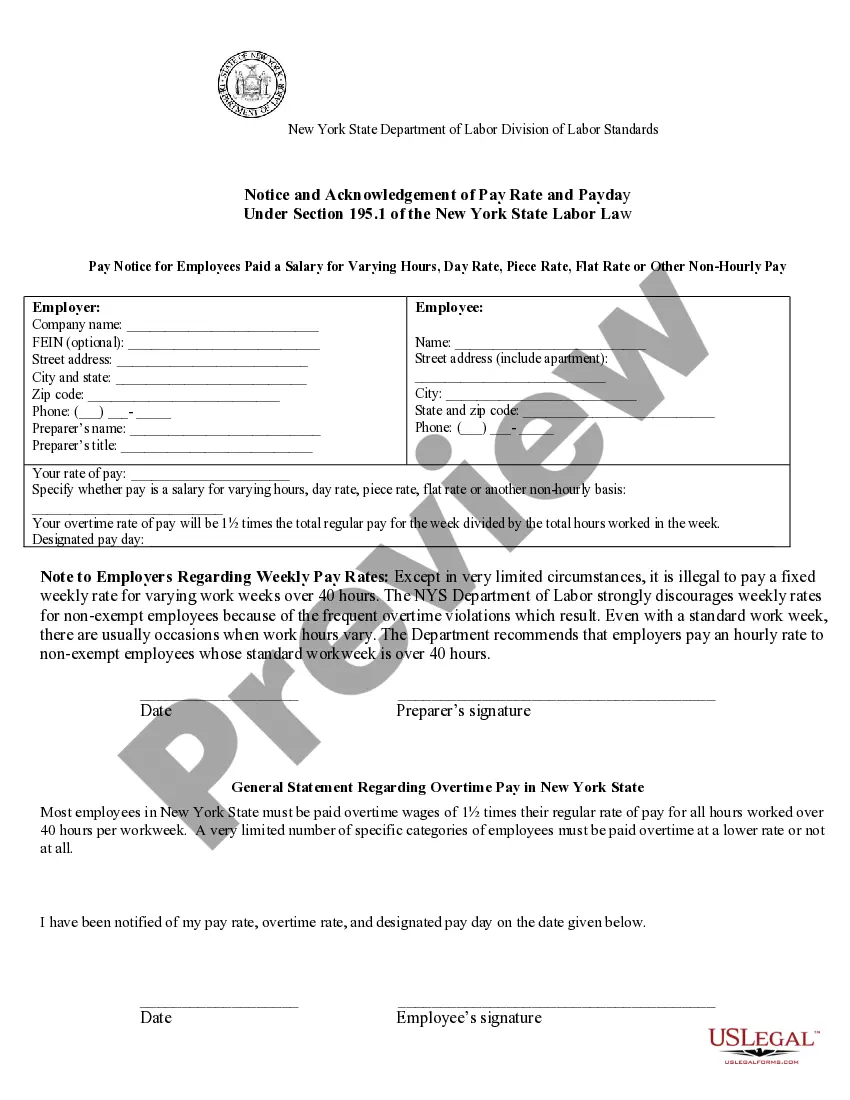

Bronx New York Pay Notice for Prevailing Rate and Other Jobs - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Prevailing Rate And Other Jobs - Notice And Acknowledgement Of Pay Rate And Payday?

We consistently aim to minimize or steer clear of legal complications when engaging with intricate legal or financial matters.

To achieve this, we enlist the services of attorneys, which are typically quite costly.

However, not all legal matters are of the same complexity.

A majority can be handled by ourselves.

Take advantage of US Legal Forms whenever you wish to obtain and download the Bronx New York Pay Notice for Prevailing Rate and Other Jobs - Notice and Acknowledgement of Pay Rate and Payday or any other document seamlessly and securely.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our collection empowers you to manage your affairs independently without resorting to legal counsel.

- We offer access to legal document templates that aren’t always readily available to the public.

- Our templates are specific to states and regions, significantly simplifying the search process.

Form popularity

FAQ

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.

If you are required or permitted to report to work, even if you are not assigned actual work, you may be entitled to ?call-in pay.? Usually, restaurant or hotel workers are entitled to three hours' pay at the applicable minimum rate, and employees in other private workplaces are entitled to four hours' pay at the

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

If you no longer have your paycheck stubs, contact your payroll department or human resources department to request copies. If you're getting paid by direct deposit, your paystubs are most likely emailed to you, so there's a good chance they're in your email inbox already.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

All commissions earned by a commission salesperson are legally considered wages and must be paid to the salesperson even if the employment relationship with the employer has ended.

Employers in California are required to provide employees with an itemized wage statement, also known as a pay stub. Pay period regulations require employers to provide pay stubs semi-monthly or at the time of each payday.

A wage statement (sometimes called a pay stub) is a document employers give their employees every pay period that explains how their paycheck was calculated. ?1 California has specific laws that govern the information that employees are entitled to receive when they are paid.

Penalties for violating pay stub laws vary by state. In California, an employer who refuses to provide pay stubs can incur a penalty of up to $4,000 per employee.

Who gets a payslip. Employers must give all their employees and workers payslips, by law (Employment Rights Act 1996). Workers can include people on zero-hours contracts and agency workers. Agency workers get their payslips from their agency.