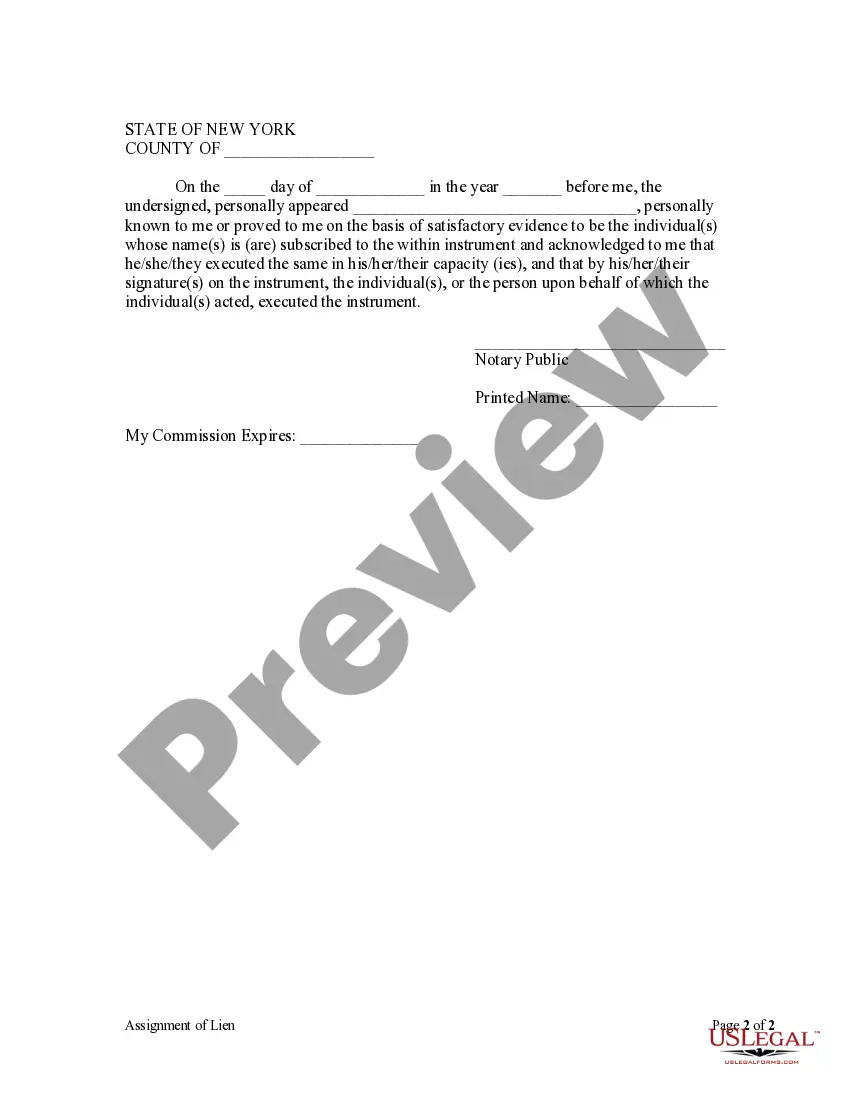

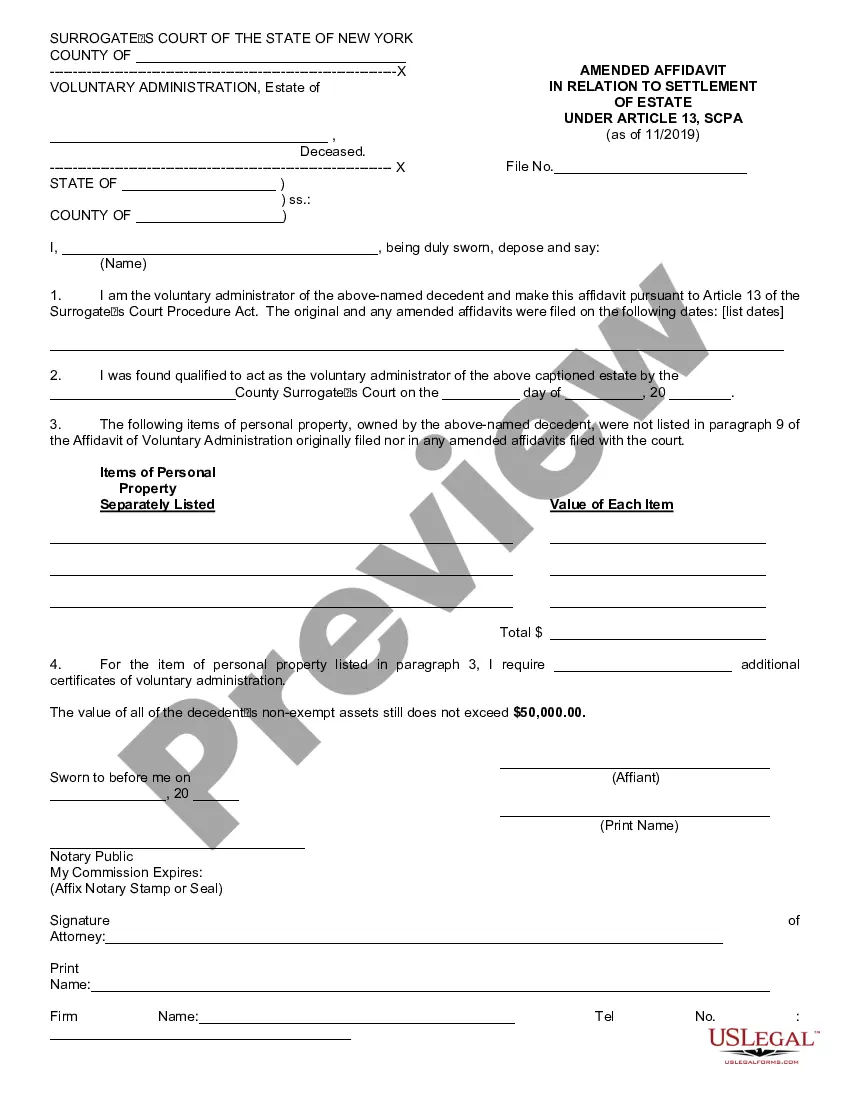

New York law permits a party to assign a lien using a written form signed and acknowledged by the lien holder.

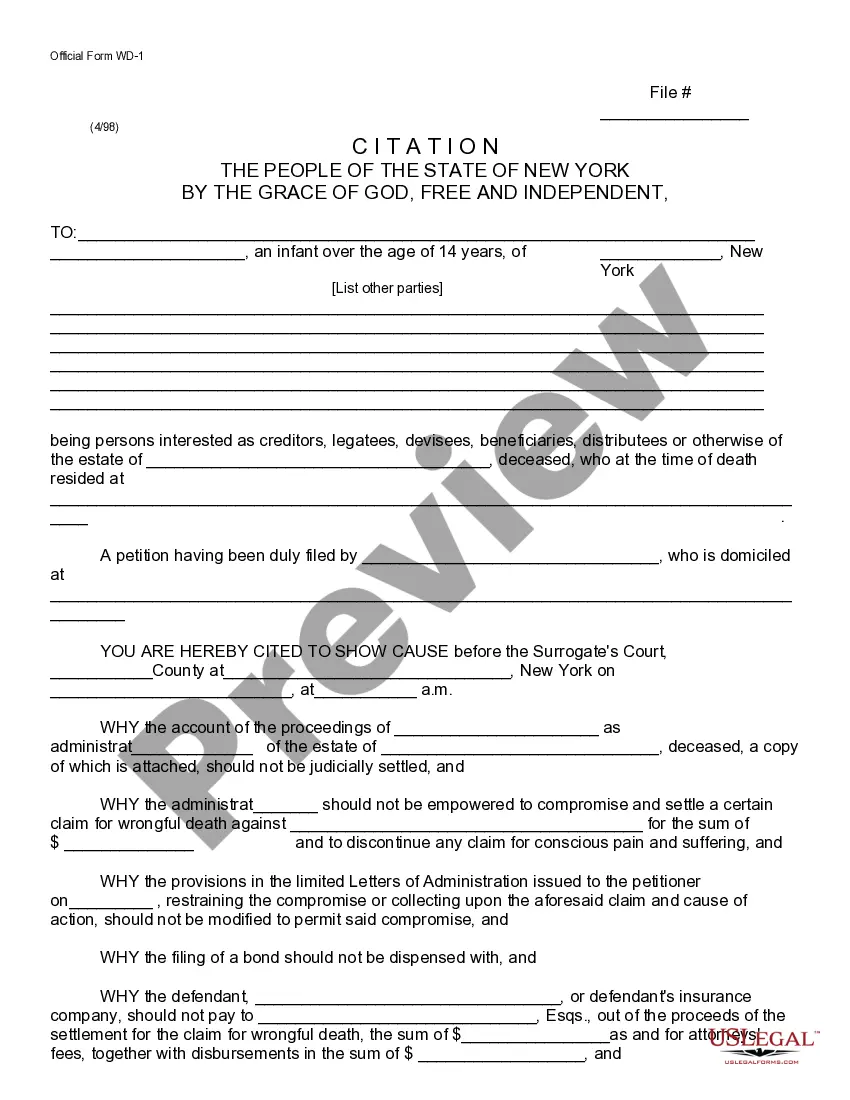

Suffolk New York Assignment of Lien by Individual

Description

How to fill out New York Assignment Of Lien By Individual?

We consistently aim to minimize or evade legal complications when managing delicate legal or financial matters.

To achieve this, we enlist legal services that are generally quite costly.

Nevertheless, not every legal concern is equally intricate. Most can be handled independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform enables you to manage your matters autonomously without the necessity of seeking legal advice.

The procedure is just as easy if you’re a newcomer to the site! You can set up your account within minutes. Ensure to verify if the Suffolk New York Assignment of Lien by Individual complies with your state and local regulations. Additionally, it’s essential to review the form’s outline (if available), and if you find any inconsistencies with your initial expectations, look for a different form. Once you confirm that the Suffolk New York Assignment of Lien by Individual suits your needs, you can select a subscription plan and process your payment. Then, you can download the form in any format offered. Over 24 years of our operation, we have assisted millions of individuals by providing customizable and current legal documents. Take advantage of US Legal Forms now to conserve time and resources!

- Access to legal form templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, simplifying the search process considerably.

- Utilize US Legal Forms whenever you require obtaining and downloading the Suffolk New York Assignment of Lien by Individual or any other form quickly and securely.

- Easily Log In to your account and click the Get button next to the form. If you misplace the form, you can always retrieve it again from the My documents section.

Form popularity

FAQ

To find your deed in Suffolk County, NY, start by visiting the Suffolk County Clerk’s Office website. You can search property records online using the property’s address or owner’s name. If you need assistance, the staff at the Clerk’s Office can guide you, especially for inquiries related to the Suffolk New York Assignment of Lien by Individual.

Finding a copy of a deed online can be done through the Suffolk County Clerk’s website. They provide a digital lookup tool for property records, making your search easier and more efficient. This is particularly useful if you need to review documents associated with the Suffolk New York Assignment of Lien by Individual.

If you lose the deed to your house, don’t worry; you can obtain a replacement. Contact the Suffolk County Clerk’s Office to request a certified copy of your deed. It’s important to act promptly, especially if you intend to use the property for the Suffolk New York Assignment of Lien by Individual process.

Obtaining a copy of your property deed in Suffolk County, NY, is straightforward. You can request it through the County Clerk’s Office, either online or in person. Having details like the property address and owner's name will help, especially when dealing with documents related to the Suffolk New York Assignment of Lien by Individual.

To request public records in Suffolk County, you can contact the Suffolk County Clerk's Office directly. They offer online services, allowing you to submit requests for documents related to matters such as the Suffolk New York Assignment of Lien by Individual. Additionally, check their official website for specific instructions and forms to streamline your request process.

To find a lien on a property in New York, you can start by searching the public records at your local County Clerk’s office. Online databases can also provide useful information about liens on properties. Engaging with the Suffolk New York Assignment of Lien by Individual process is essential for accurately locating and interpreting lien information.

Tax liens are risky due to the potential for property owners to default or not redeem their properties. Additionally, you may encounter legal complications or disputes regarding the lien status. Familiarizing yourself with the Suffolk New York Assignment of Lien by Individual process can help mitigate these risks and ensure you make informed decisions.

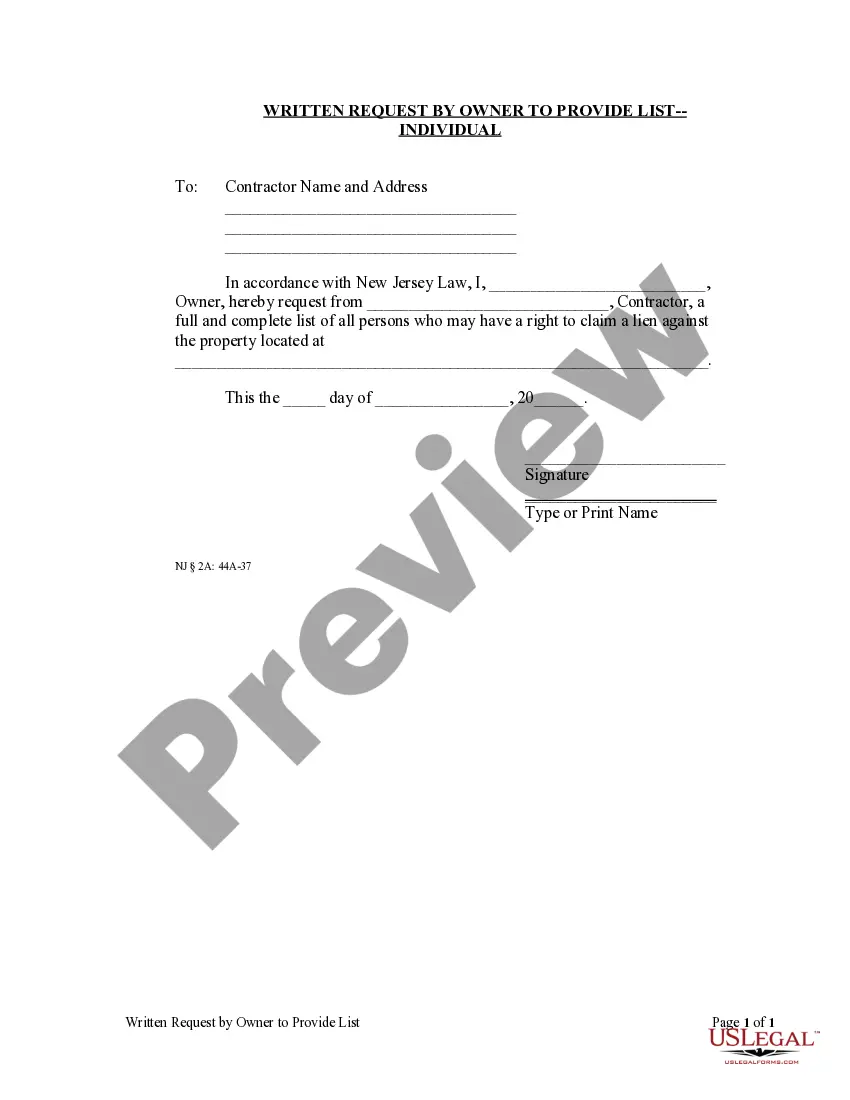

To file a mechanics lien in Suffolk County, you first need to prepare your lien document with accurate information about the property and the work performed. Once completed, you should file the lien with the County Clerk’s office. Utilizing the Suffolk New York Assignment of Lien by Individual can guide you through the proper documentation and filing procedures for a successful claim.

You can explore tax lien properties in several states, including Arizona, Florida, and Illinois, among others. Each state has its own rules and processes regarding tax lien sales. If you are specifically interested in Suffolk New York Assignment of Lien by Individual, New York offers unique procedures that you should understand before making any investments.

Recording a deed in Suffolk County involves submitting the deed document to the Suffolk County Clerk's Office. Ensure you complete the appropriate forms and provide necessary identification. Once the office processes your submission, they will officially record the deed, which is essential for transactions like a Suffolk New York Assignment of Lien by Individual. For your convenience, consider using services like uslegalforms to streamline the process.