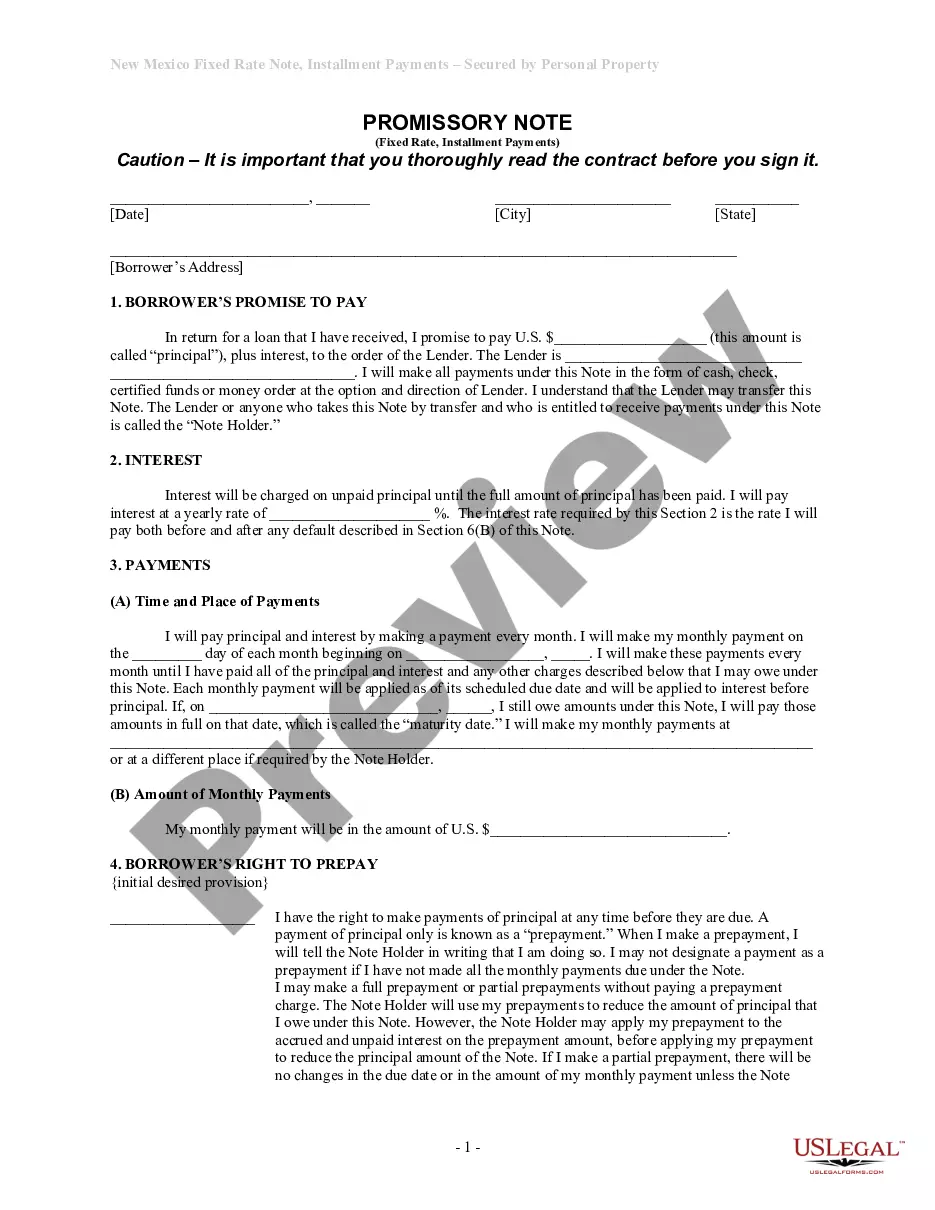

Las Cruces New Mexico Installments Fixed Rate Promissory Note Secured by Personal Property

Description

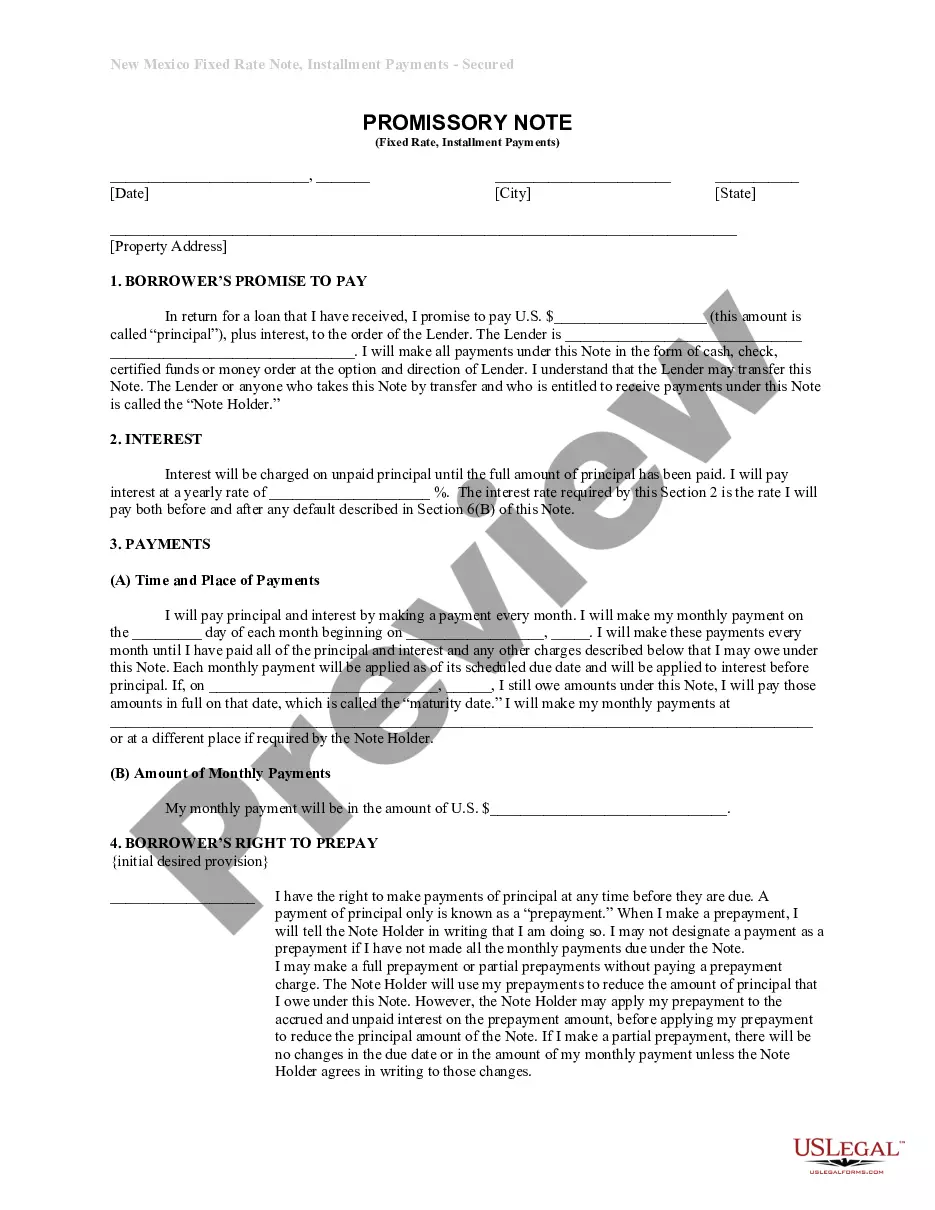

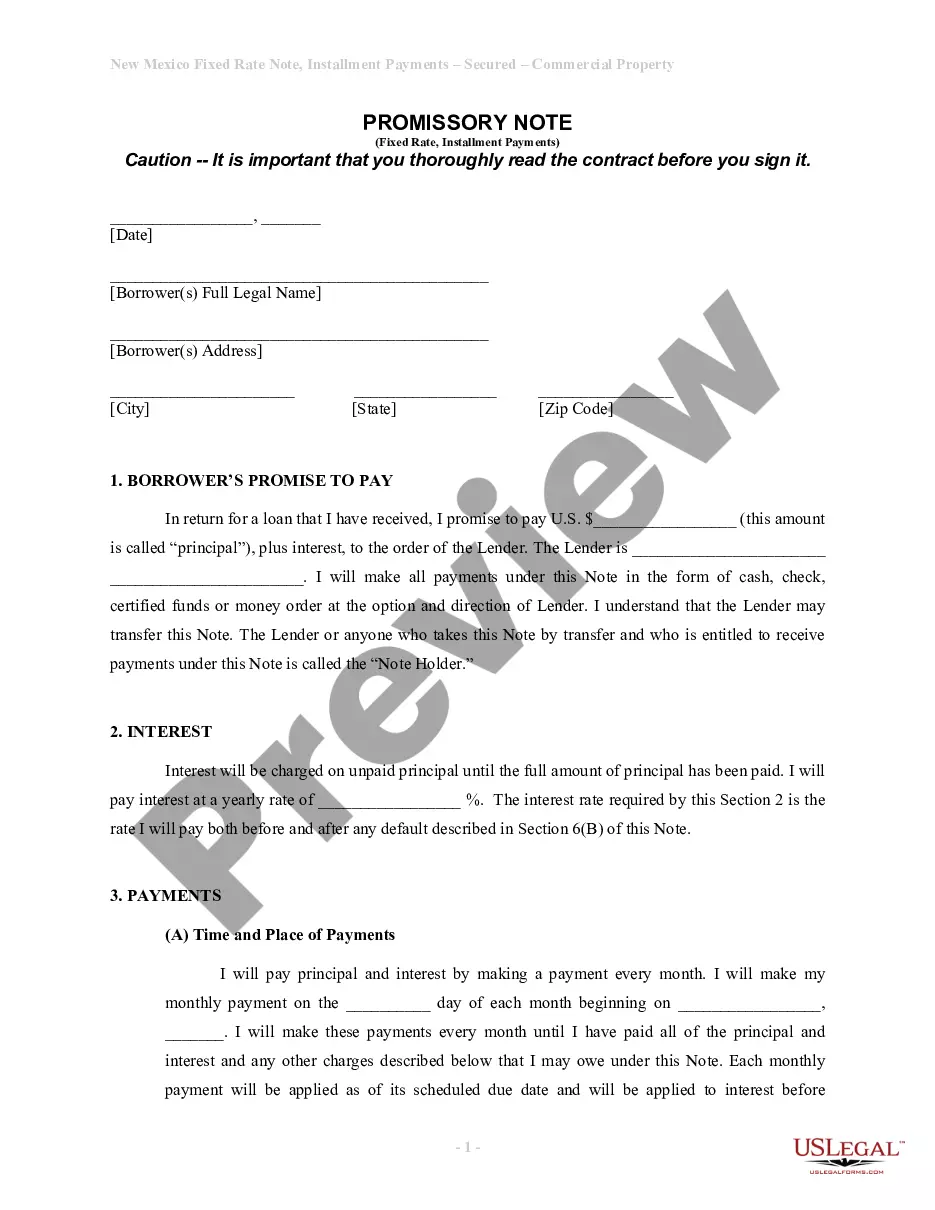

How to fill out New Mexico Installments Fixed Rate Promissory Note Secured By Personal Property?

Regardless of social or occupational standing, completing law-related documents is a regrettable requirement in the current professional landscape.

Frequently, it’s nearly impossible for an individual lacking any legal experience to generate these kinds of documents from the ground up, primarily because of the intricate language and legal nuances they entail.

This is where US Legal Forms steps in.

However, if you are new to our library, please ensure to follow these instructions before acquiring the Las Cruces New Mexico Installments Fixed Rate Promissory Note Secured by Personal Property.

Make sure the template you have selected is appropriate for your region, as the laws of one state or county may not apply to another state or county.

- Our platform provides an extensive assortment with over 85,000 state-specific templates that cater to nearly any legal situation.

- US Legal Forms also acts as a remarkable aid for associates or legal advisors looking to save time utilizing our DIY templates.

- Whether you need the Las Cruces New Mexico Installments Fixed Rate Promissory Note Secured by Personal Property or any other documentation that will be accepted in your jurisdiction, with US Legal Forms, everything is within reach.

- Here’s how you can obtain the Las Cruces New Mexico Installments Fixed Rate Promissory Note Secured by Personal Property in just a few minutes using our reliable platform.

- If you are an existing subscriber, you can simply Log In to your account to retrieve the necessary form.

Form popularity

FAQ

You can obtain a promissory note through various channels, including legal offices and online platforms. One of the most reliable ways is to visit uslegalforms, where you can find templates for a Las Cruces New Mexico Installments Fixed Rate Promissory Note Secured by Personal Property. This resource streamlines the process, ensuring that the document adheres to all legal requirements while fitting your specific needs.

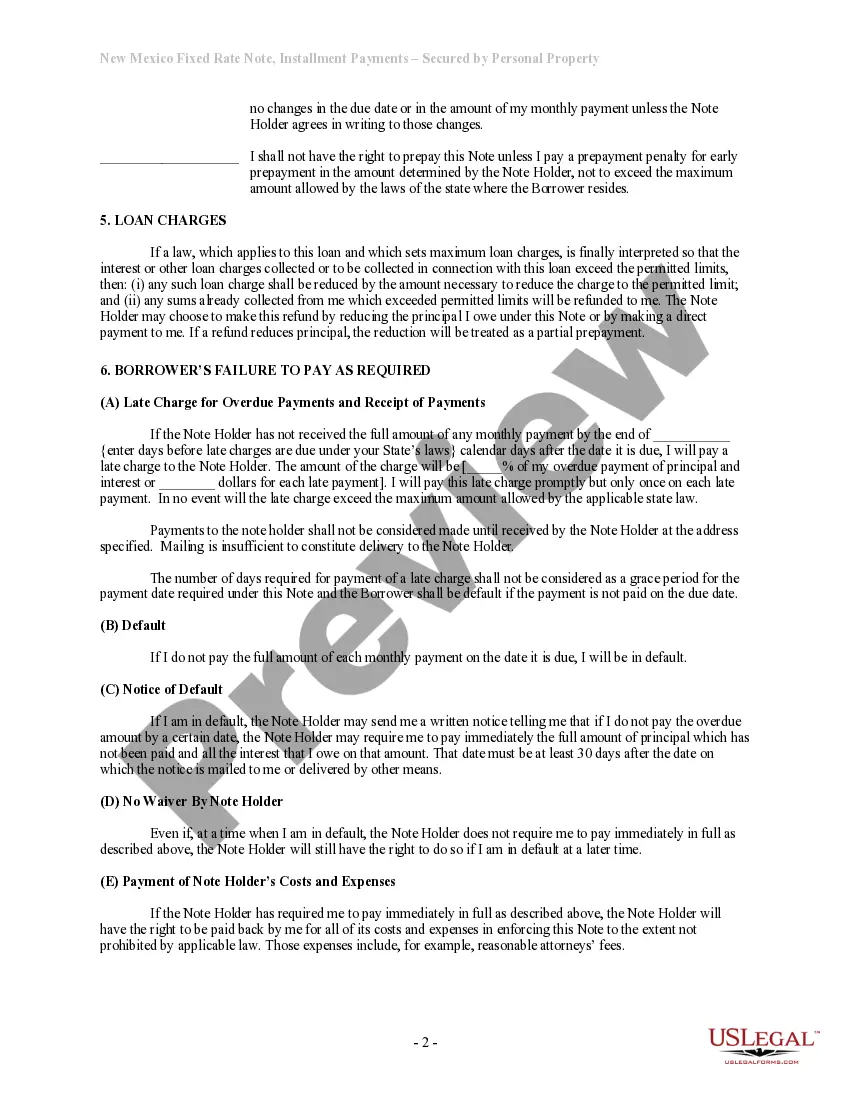

For a promissory note to be valid in Las Cruces, New Mexico, it must contain certain essential elements. First, it should include a clear statement of the borrowed amount and terms of repayment. Additionally, both parties must sign the document, and it should indicate the interest rate, if applicable. When following these guidelines, you can ensure that your Las Cruces New Mexico Installments Fixed Rate Promissory Note Secured by Personal Property holds legal weight.

Yes, a promissory note can indeed be secured by real property, although this is more common with mortgage agreements. In relation to the Las Cruces New Mexico Installments Fixed Rate Promissory Note Secured by Personal Property, securing a note with real property adds another layer of protection for the lender. It’s vital to ensure all parties understand the implications of using real property as collateral. If you need guidance, consider using uslegalforms for clear documentation.

Recording a secured promissory note is not always required, but doing so can strengthen the lender's position. In the context of Las Cruces New Mexico Installments Fixed Rate Promissory Note Secured by Personal Property, recording provides public notice of the lender’s interest in the personal property. This action can help prevent disputes over ownership and clarify the terms of the agreement. Using a platform like uslegalforms can simplify the recording process.

The format of a promissory note generally includes a title, the date of the agreement, and the details of the aforementioned parties. It should clearly outline the principal amount, interest rate, payment schedule, and any terms related to the secured personal property. When creating a Las Cruces New Mexico Installments Fixed Rate Promissory Note Secured by Personal Property, ensure that the layout is neat, and the information is easy to read and understand.

To report a promissory note on your taxes, you generally report the interest income received on the note. This income should be included on your tax return. If you secured the note with personal property, ensure you keep records of all payments. For specific guidance related to your Las Cruces New Mexico Installments Fixed Rate Promissory Note Secured by Personal Property, consider consulting with a tax professional or using resources from platforms like US Legal Forms.

There is no legal requirement for promissory notes to be witnessed or notarized in New Mexico. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

In California, loans can be secured by real property through a deed of trust. Accordingly, a deed of trust is a security instrument that functions like a mortgage.

With a secured promissory note, the borrower is required to put up some form of collateral, usually property or assets. If the borrower fails to pay back the lender, they will receive the collateral to make up for the lost payments. Loans are typically accompanied by unsecured promissory notes.

A promissory note is a debt instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on-demand or at a specified future date.