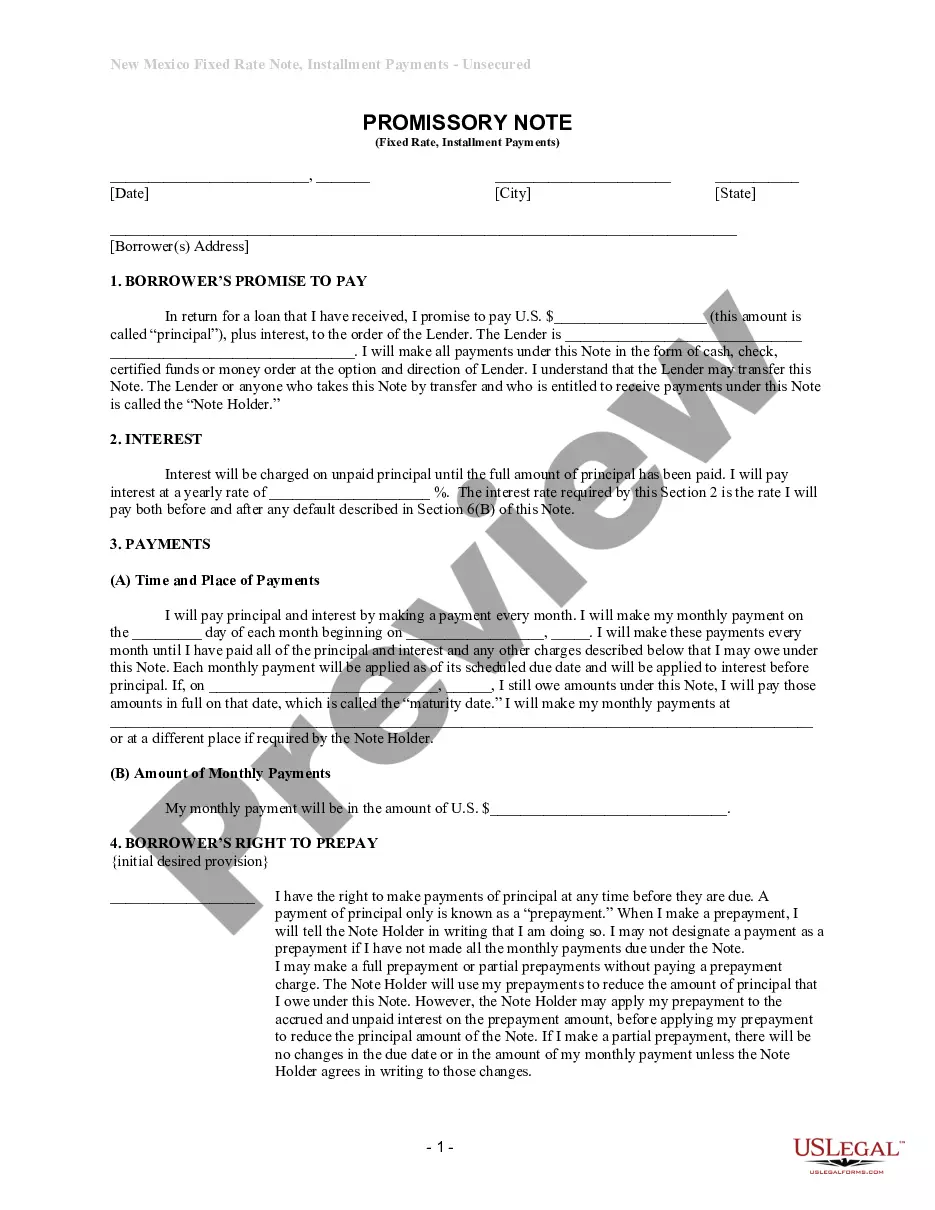

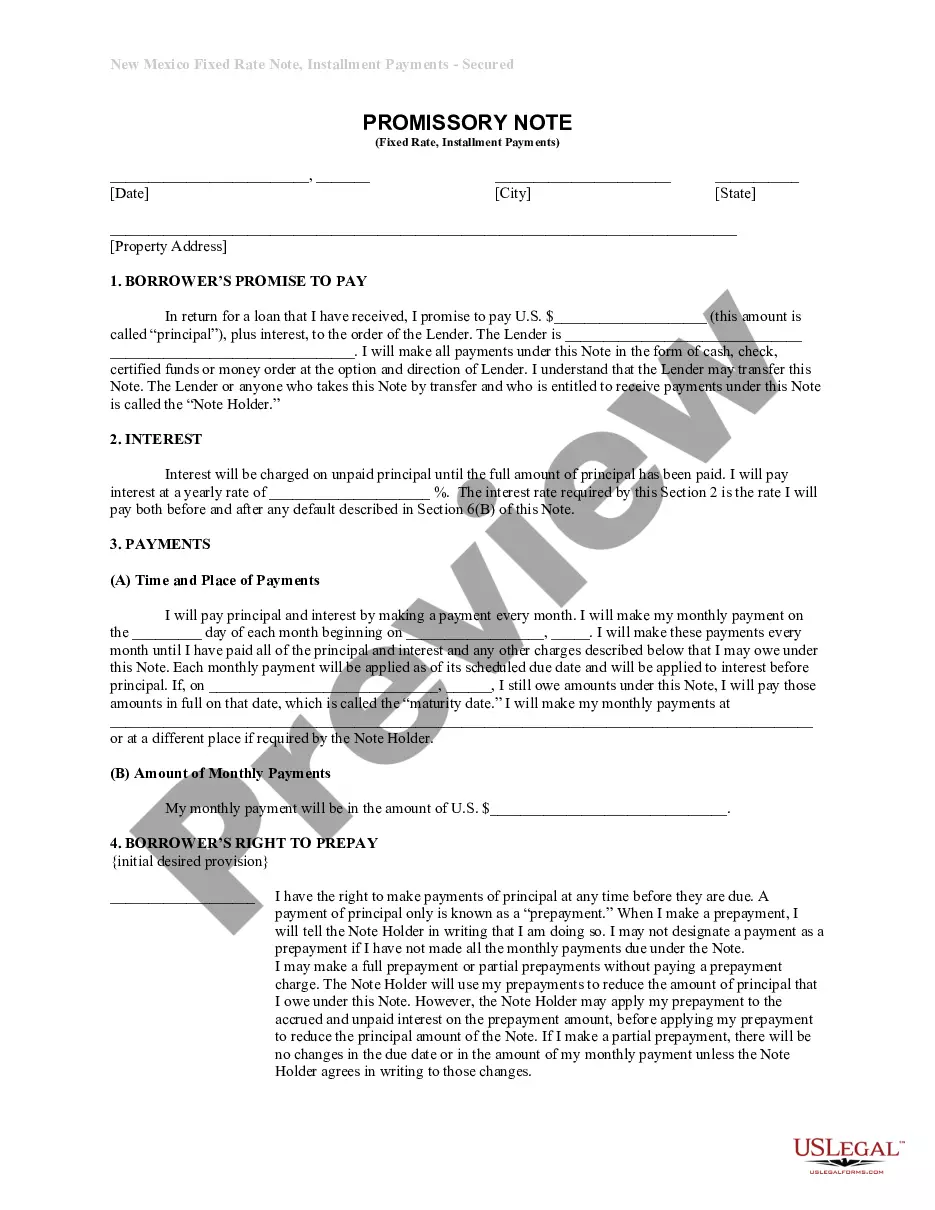

Albuquerque New Mexico Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate?

Are you searching for a reliable and budget-friendly provider of legal documents to obtain the Albuquerque New Mexico Unsecured Installment Payment Promissory Note for Fixed Rate? US Legal Forms is your ideal solution.

Whether you require a simple agreement to establish guidelines for living with your partner or a collection of papers to facilitate your divorce proceedings, we have you covered. Our platform features over 85,000 current legal document templates for personal and business use. All templates we provide are not generic and are tailored to meet the specifications of individual states and regions.

To retrieve the document, you'll need to Log In to your account, find the necessary template, and click the Download button adjacent to it. Please keep in mind that you can redownload your previously acquired form templates at any time from the My documents section.

Are you unfamiliar with our platform? No problem. You can easily create an account, but before you do, make sure to follow these steps.

Now, you can set up your account. Then select the subscription plan and continue to payment. Once the payment is completed, download the Albuquerque New Mexico Unsecured Installment Payment Promissory Note for Fixed Rate in any of the available formats. You can revisit the site at any moment and redownload the document at no additional cost.

Finding current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time trying to understand legal paperwork online once and for all.

- Verify that the Albuquerque New Mexico Unsecured Installment Payment Promissory Note for Fixed Rate complies with your state and local laws.

- Review the form's information (if available) to understand who and what the document is applicable for.

- Restart your search if the template doesn't suit your particular circumstances.

Form popularity

FAQ

A promissory note is like a written promise or IOU for everything from car loans to loans between family members. Even without a signature from a notary public, it can still be a valid promissory note.

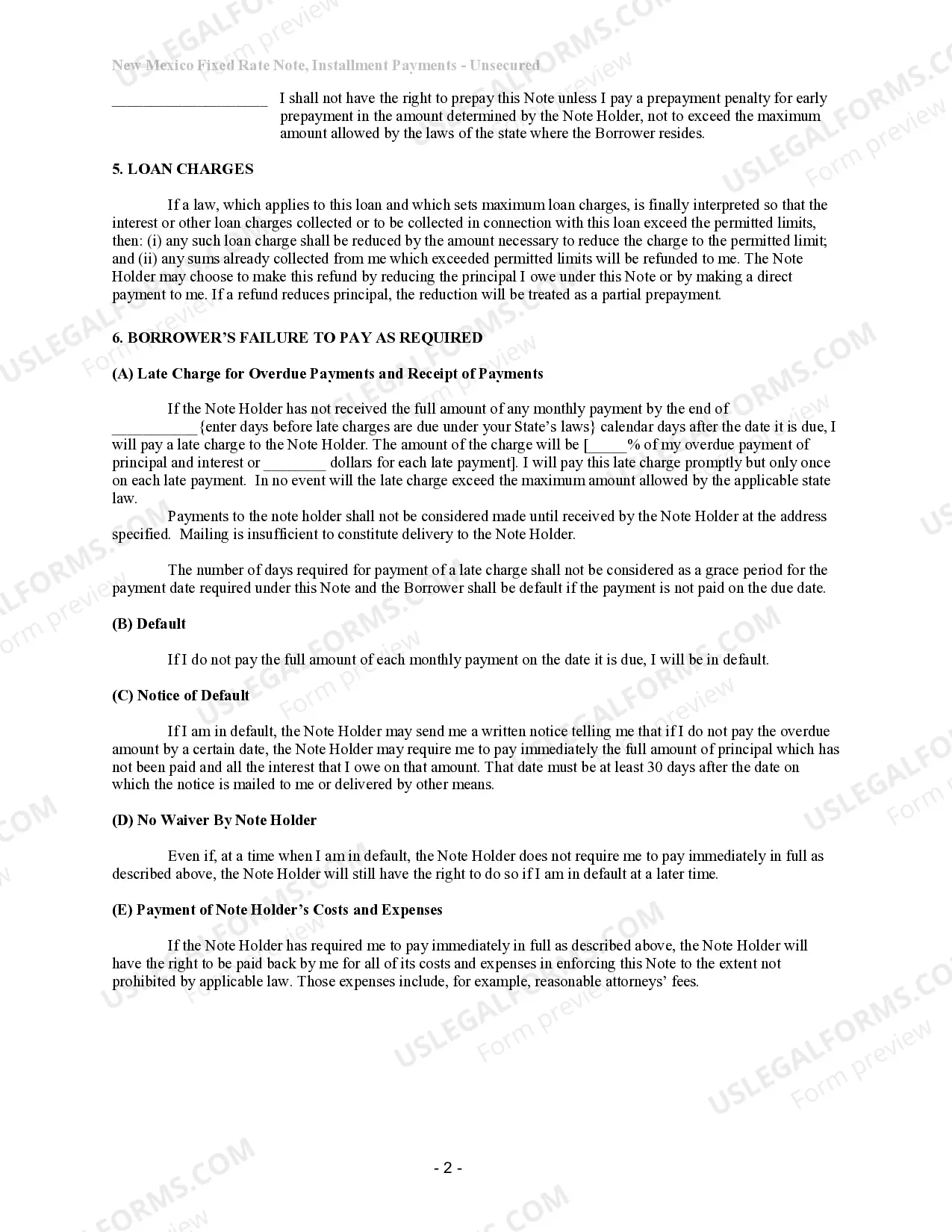

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan. If the payor does not have sufficient assets, the payee is out of luck.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Collecting on an unsecured promissory note through the courts is a two-step process. First, you need to go through the court process to obtain a judgment against the borrower. Then you need to try to attach the borrower's wages, bank accounts, or other assets in order actually get paid.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

In real world transactions, interest rates for small privately held notes typically range from 12% to 20%.

There is no legal requirement for promissory notes to be witnessed or notarized in New Mexico. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

A valid promissory note only needs the signatures of the participating parties involved in the agreement, not necessitating acknowledgment or being witnessed by a notary public to be legitimate.