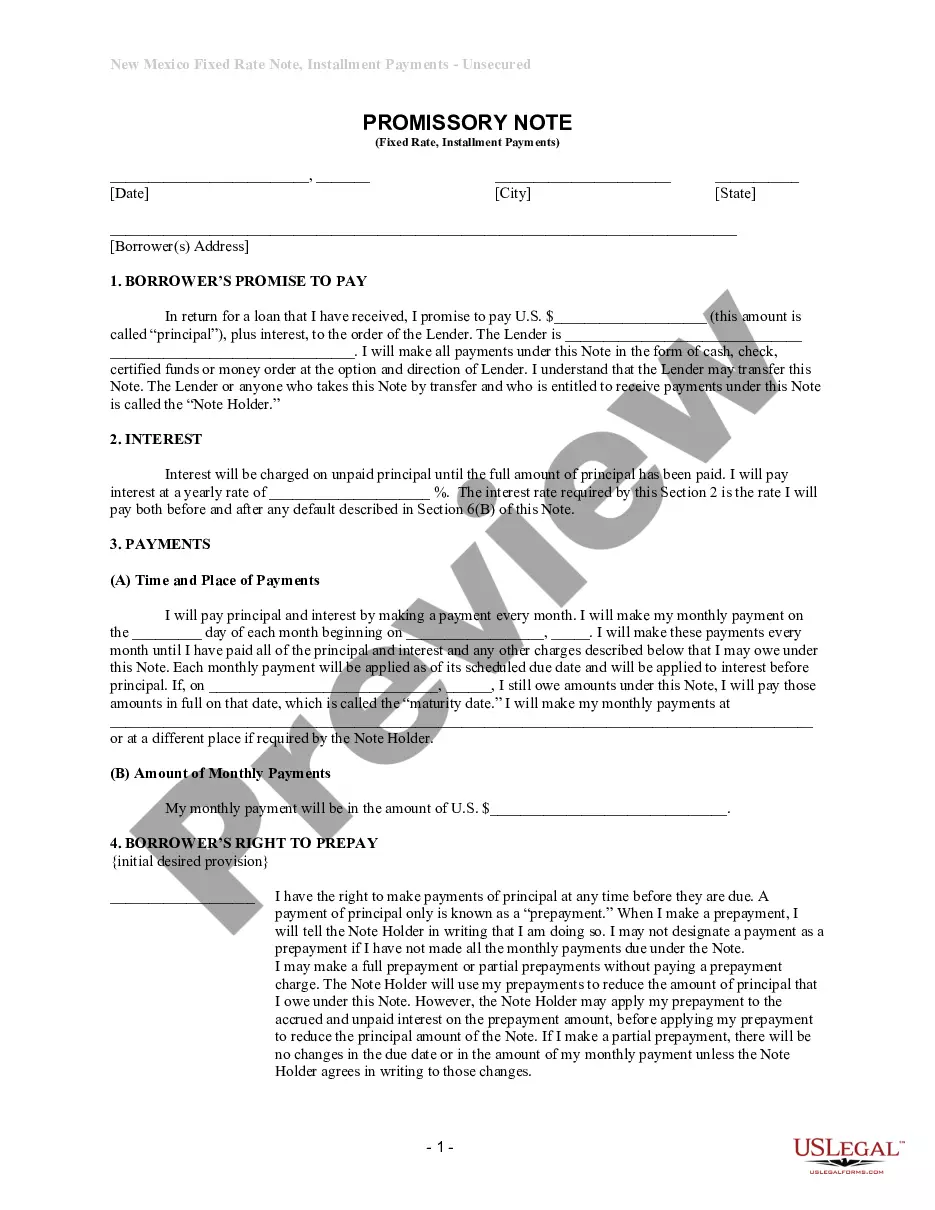

New Mexico Unsecured Installment Payment Promissory Note for Fixed Rate

What this document covers

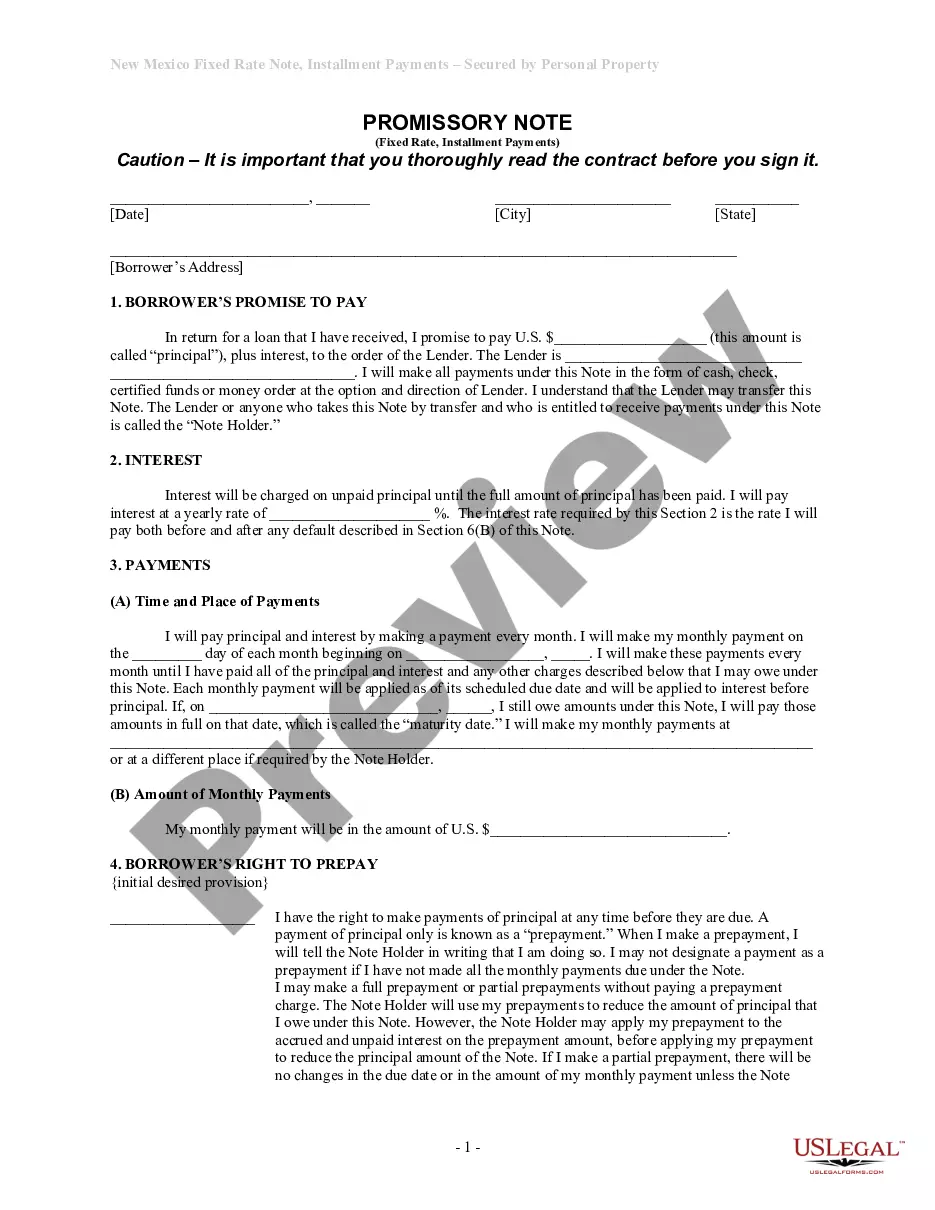

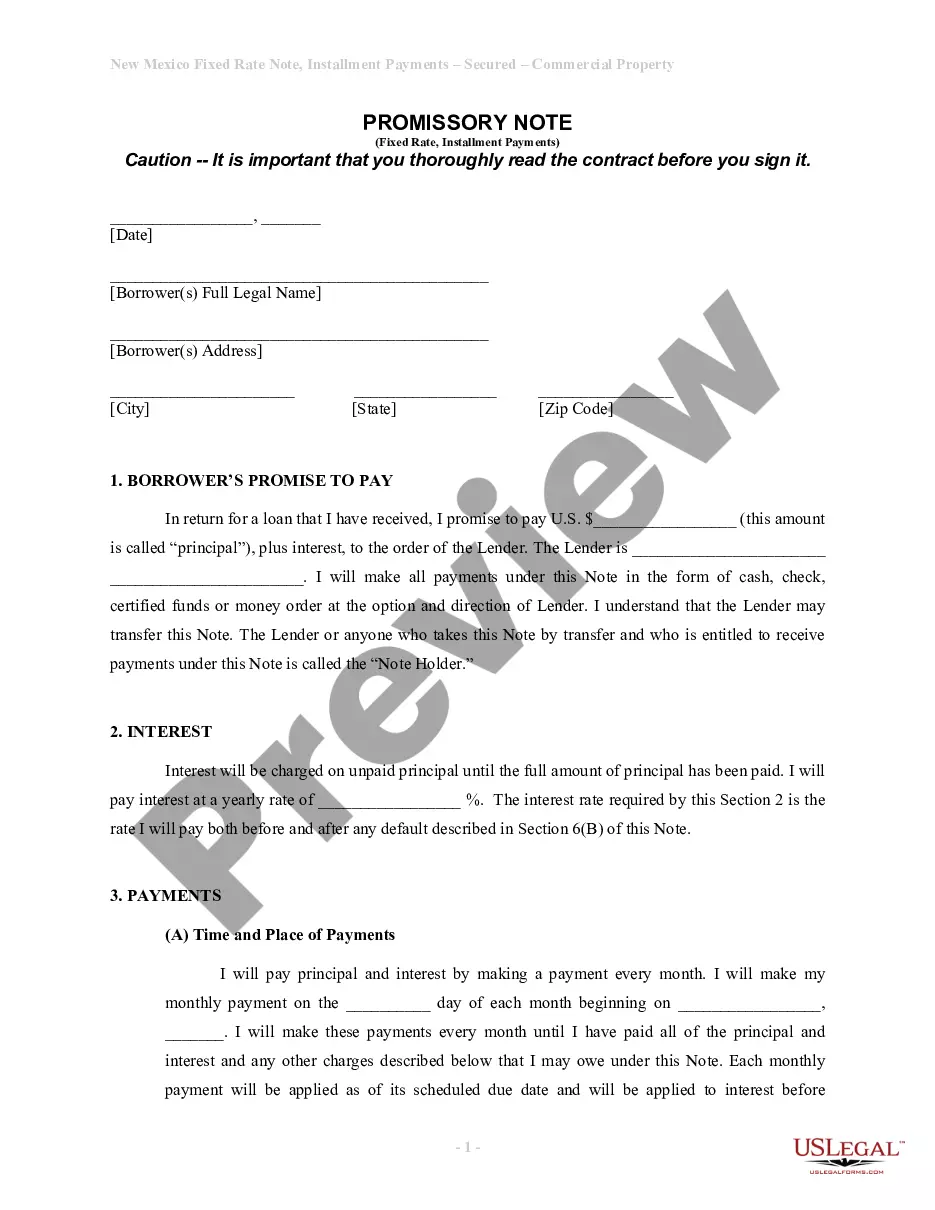

The New Mexico Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document used to outline the terms of a loan that is repaid in installments. This form is unsecured, meaning it does not require collateral, and features a fixed interest rate. It serves to establish a written record of the borrower's promise to repay the loan, making it distinct from secured promissory notes which involve additional guarantees.

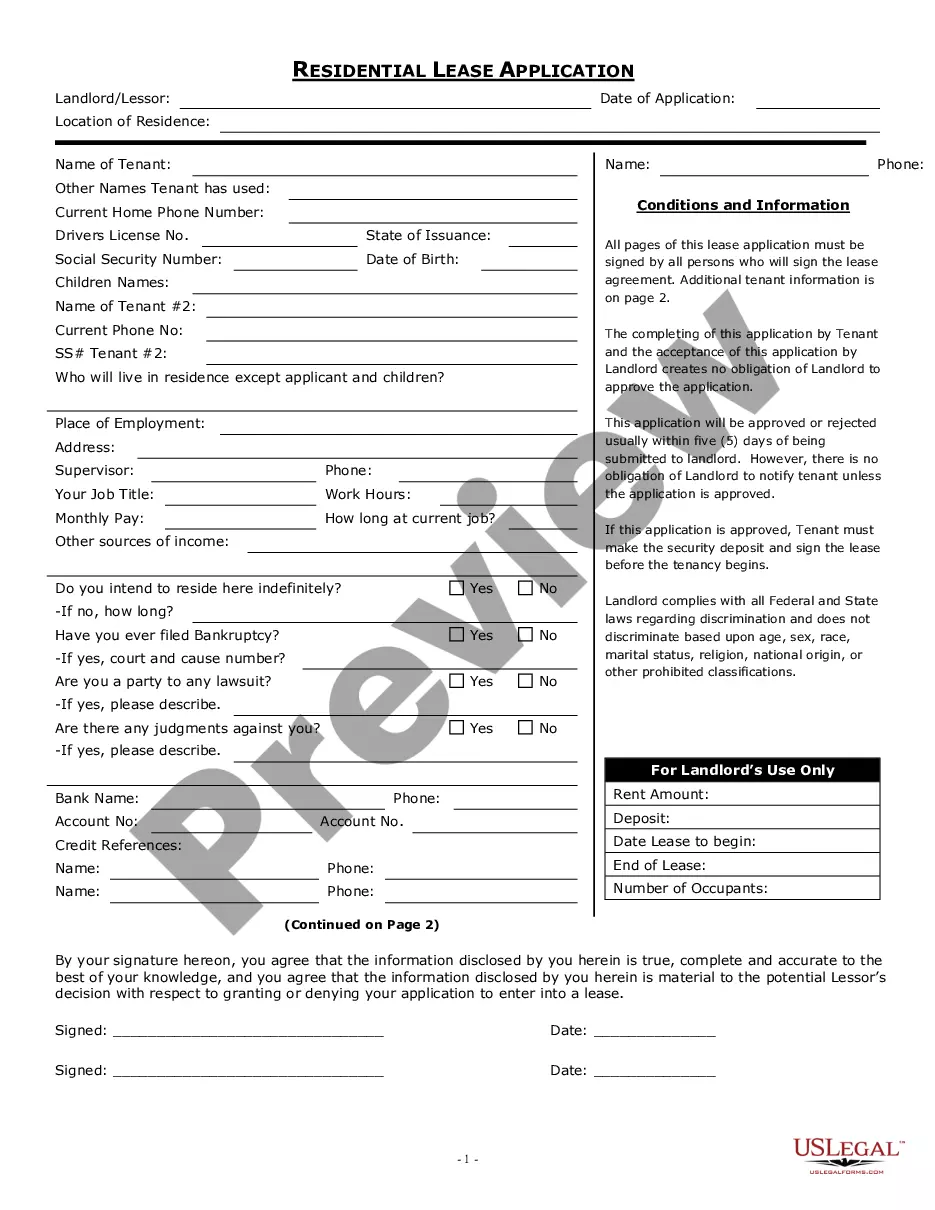

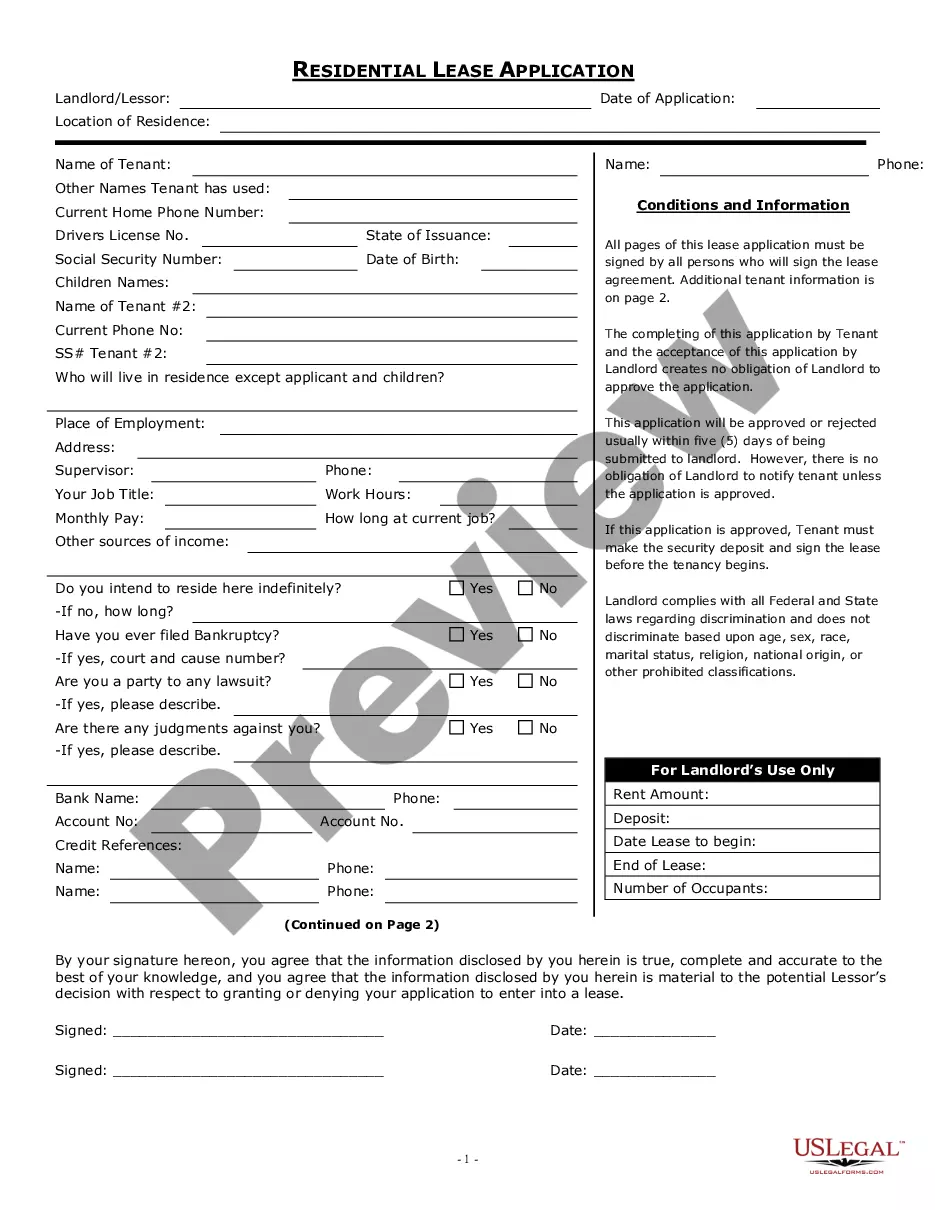

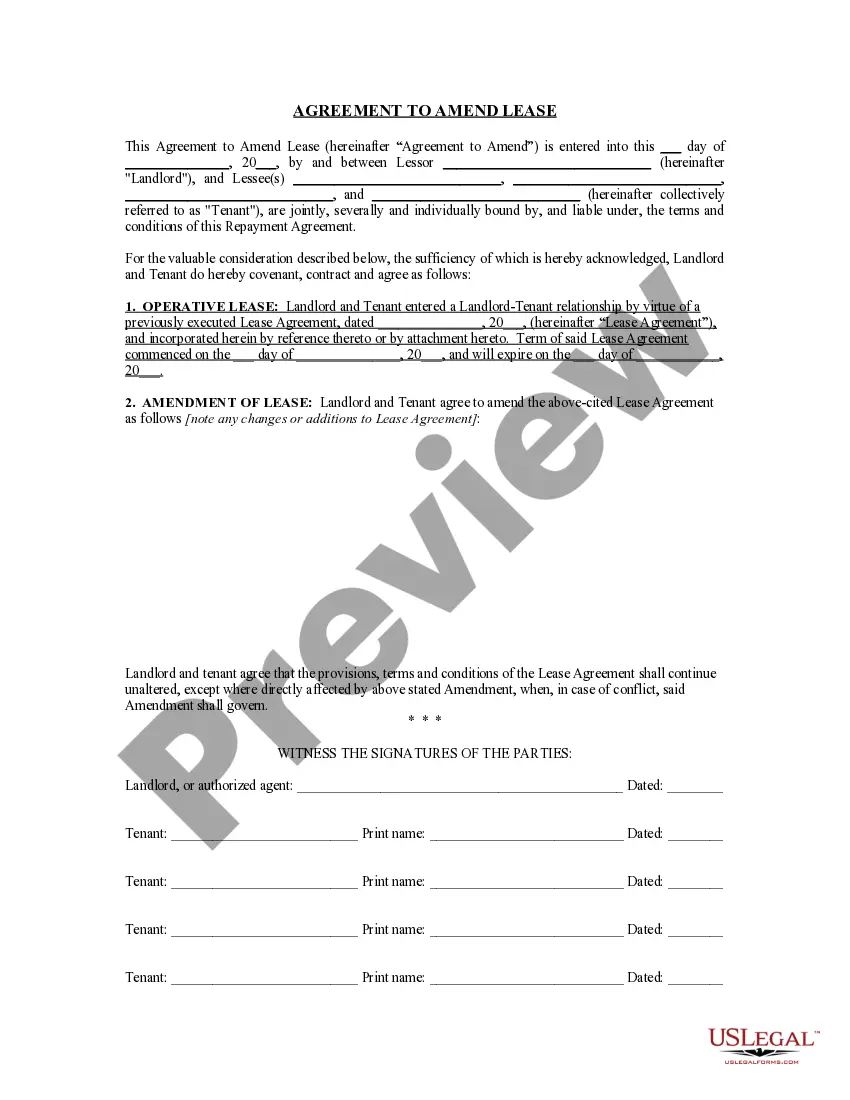

Form components explained

- Borrower's promise to pay the specified principal amount plus interest to the lender.

- Details regarding the interest rate to be charged on the unpaid principal.

- Schedule and amount of installment payments, including due dates.

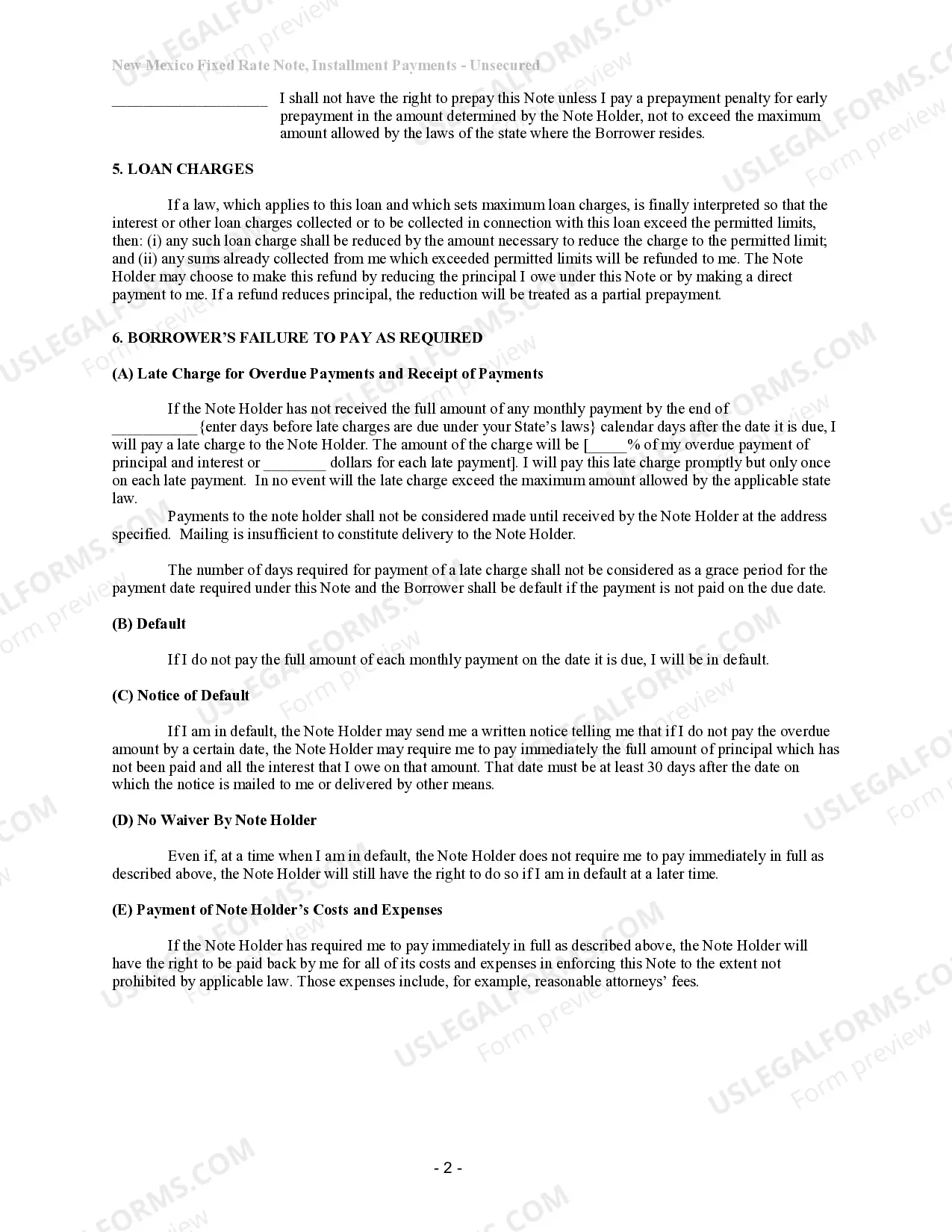

- Provisions for prepayment of the loan and any penalties that may be applicable.

- Consequences of default, including late payment charges.

- Requirements for giving notices under the agreement.

Situations where this form applies

This form is ideal for situations where an individual or business is borrowing money without providing any assets as security. Use this promissory note when you need to formalize a loan agreement, ensuring clarity on repayment terms, interest rates, and the ramifications of missed payments. It is especially useful in personal loans, informal lending situations, or when establishing payment plans among friends or family.

Who should use this form

- Individuals who need to borrow money from family or friends.

- Small business owners seeking loans without collateral.

- Lenders looking to outline the terms of repayment formally.

- Anyone requiring a written agreement to secure loan conditions.

How to complete this form

- Identify the parties involved: Fill in the names and addresses of the borrower(s) and lender.

- Specify the loan amount: Clearly state the principal amount being borrowed.

- Enter the interest rate: Include the fixed annual interest rate to be applied.

- Detail the repayment schedule: Indicate the payment amounts and due dates for each installment.

- Include provisions for prepayment: Decide if you will allow prepayments and outline any penalties.

- Sign and date the document: Ensure all parties sign and date the form for it to be legally binding.

Notarization requirements for this form

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Leaving out the interest rate or not specifying it clearly.

- Failing to sign and date the document by all parties involved.

- Not providing correct, complete information about the payment schedule.

- Ignoring state-specific laws regarding maximum allowable interest rates.

Why complete this form online

- Convenience of completing the form from anywhere at any time.

- Editability allows for customization to fit specific needs.

- Access to legally vetted templates drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.