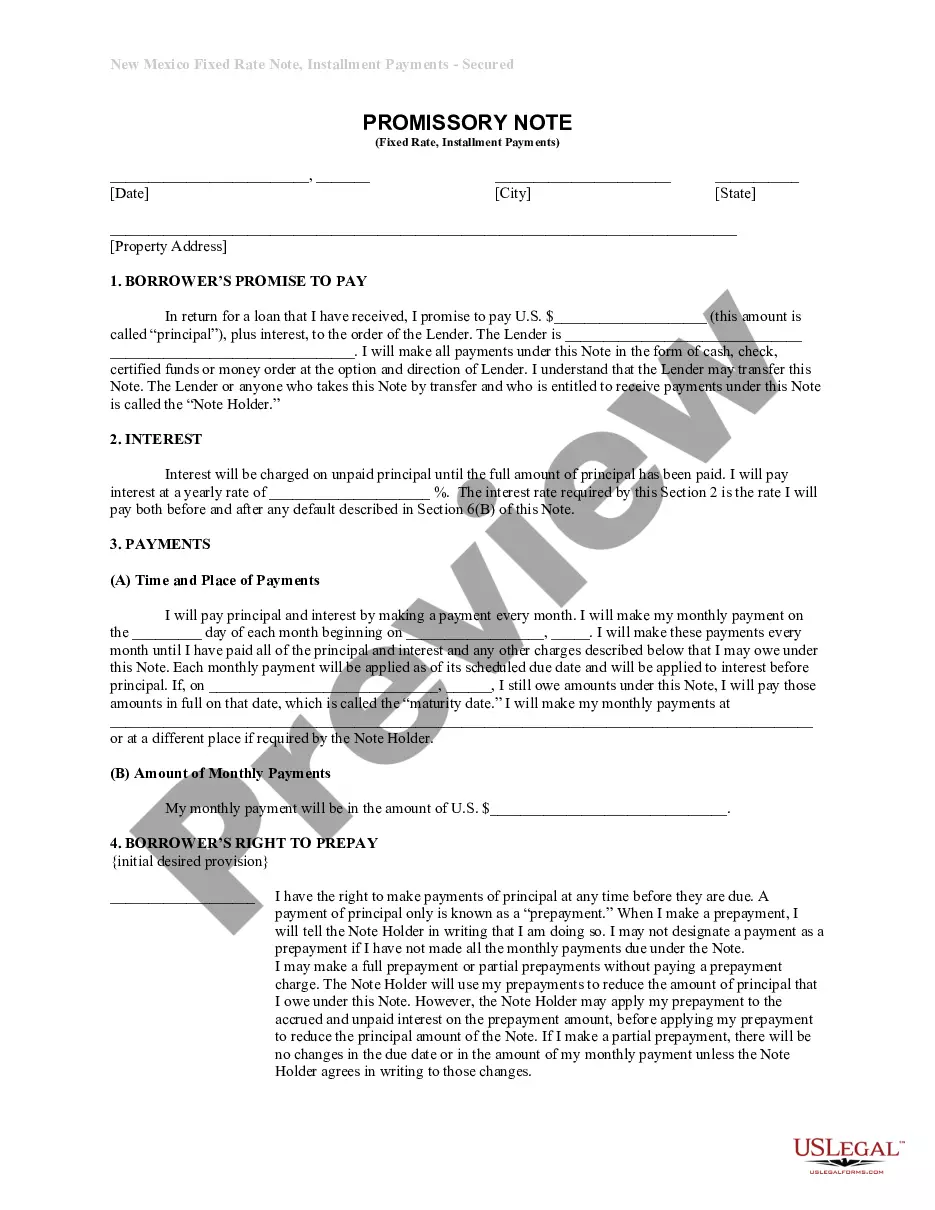

Albuquerque New Mexico Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

We consistently work to minimize or evade legal harm when navigating complex legal or financial matters.

To achieve this, we enlist legal services that are often quite costly.

However, not all legal matters are equally intricate.

The majority can be managed independently.

Make the most of US Legal Forms when you need to locate and download the Albuquerque New Mexico Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other document quickly and securely.

- US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to manage your affairs independently without consulting an attorney.

- We offer access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, significantly easing the search process.

Form popularity

FAQ

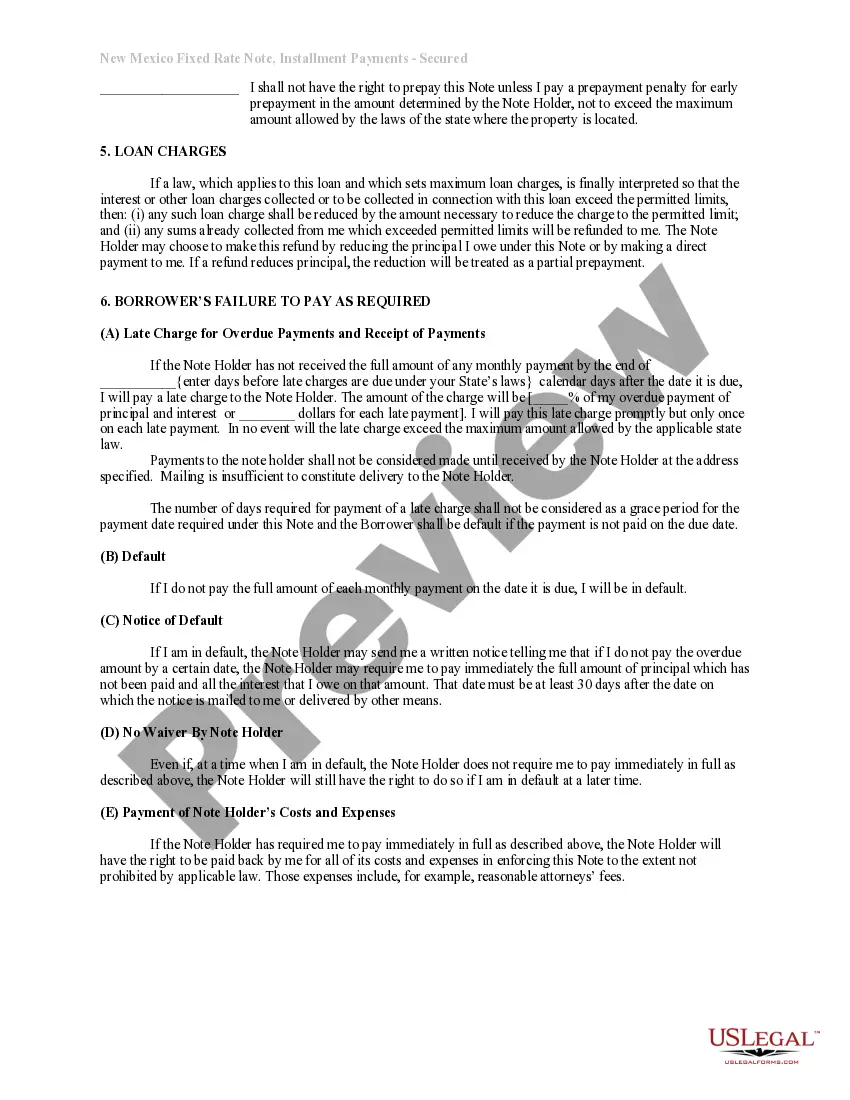

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

Some promissory notes require the payment of the full amount owed, plus interest, on a certain date. If the promissory note requires that periodic payments be made, such as quarterly, monthly, or even weekly, it is called an installment promissory note.

In California, loans can be secured by real property through a deed of trust. Accordingly, a deed of trust is a security instrument that functions like a mortgage.

An installment note is a form of promissory note calling for payment of both principal and interest in specified amounts, or specified minimum amounts, at specific time intervals. This periodic reduction of principal amortizes the loan.

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.

Promissory notes, also known as mortgage notes, are written agreements in which one party promises to pay another party a certain amount of money at a later date in time. Banks and borrowers typically agree to these notes during the mortgage process.

A home mortgage effectively secures a promissory note with the title to the property in question in case the lender should need to foreclose and sell the property in event of nonpayment. Your lender will keep the original promissory note until your loan is paid off.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.