Manchester New Hampshire Partial Release of Property From Mortgage by Individual Holder

Description

How to fill out New Hampshire Partial Release Of Property From Mortgage By Individual Holder?

Locating authenticated templates tailored to your local statutes can be challenging unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents for personal and professional requirements as well as any real-life scenarios.

All the papers are correctly categorized by usage area and jurisdictional regions, so finding the Manchester New Hampshire Partial Release of Property From Mortgage by Individual Holder turns into a straightforward process.

Maintaining documentation organized and aligned with legal standards is crucial. Utilize the US Legal Forms library to consistently have necessary document templates for any requirements readily available!

- Review the Preview mode and document summary.

- Ensure you’ve picked the accurate one that satisfies your needs and fully complies with your local jurisdiction standards.

- Look for another template, if necessary.

- If you spot any discrepancies, use the Search tab above to find the correct one. If it meets your criteria, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

To obtain a partial release of a mortgage, a homeowner should contact their lender and express their intention to release a portion of the property. The lender often requires documentation, such as an appraisal or legal descriptions of the property being released. For residents in Manchester, New Hampshire, using platforms like uslegalforms can help streamline the process, providing the necessary forms and guidance to acquire a partial release of property from mortgage by individual holder.

A partial release is a formal agreement that frees a portion of a property from mortgage obligations while the remainder stays tied to the existing mortgage. This can benefit property owners who want to sell or refinance specific parts of their property. In the context of Manchester, New Hampshire, a partial release of property from mortgage by individual holder can be a strategic financial tool for managing your property assets.

Yes, you can sell part of your property even if you have a mortgage, but it often requires obtaining a partial release from your lender first. This ensures the mortgage holds only the remaining property, allowing the sale to proceed without complications. In Manchester, New Hampshire, navigating a partial release of property from mortgage by individual holder can facilitate smooth transactions for those looking to sell part of their real estate.

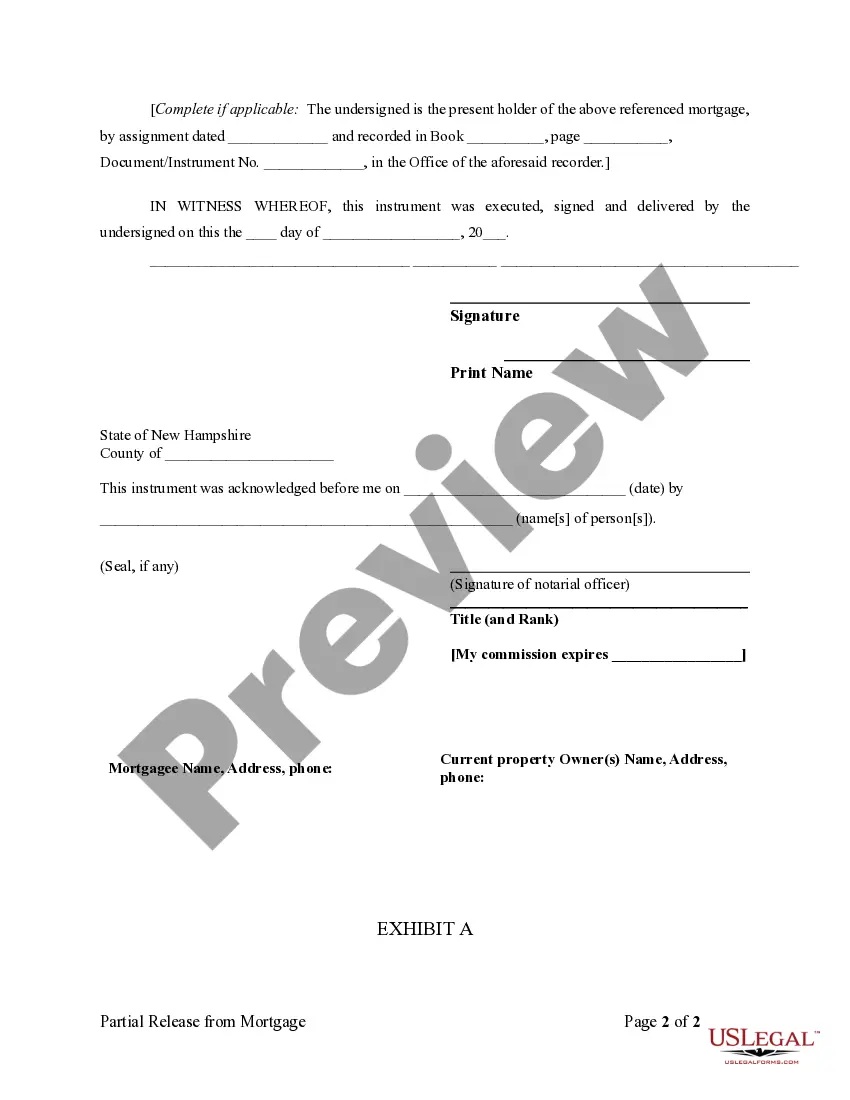

In a partial release of a mortgage, the grantor typically refers to the individual or entity who holds the mortgage, agreeing to release part of the property from the mortgage obligation. This can include banks, financial institutions, or private lenders. Understanding who the grantor is vital for homeowners in Manchester, New Hampshire, seeking a partial release of property from mortgage by individual holder, as it affects the terms of the agreement.

Partial redemption of a mortgage occurs when a property owner pays off a portion of their mortgage debt, which can happen during a refinancing or property sale. This process can effectively lower the outstanding debt and can simplify future financial responsibilities. In Manchester, New Hampshire, this often ties into a partial release of property from a mortgage by the individual holder, allowing the owner to retain part of their property while managing their mortgage effectively.

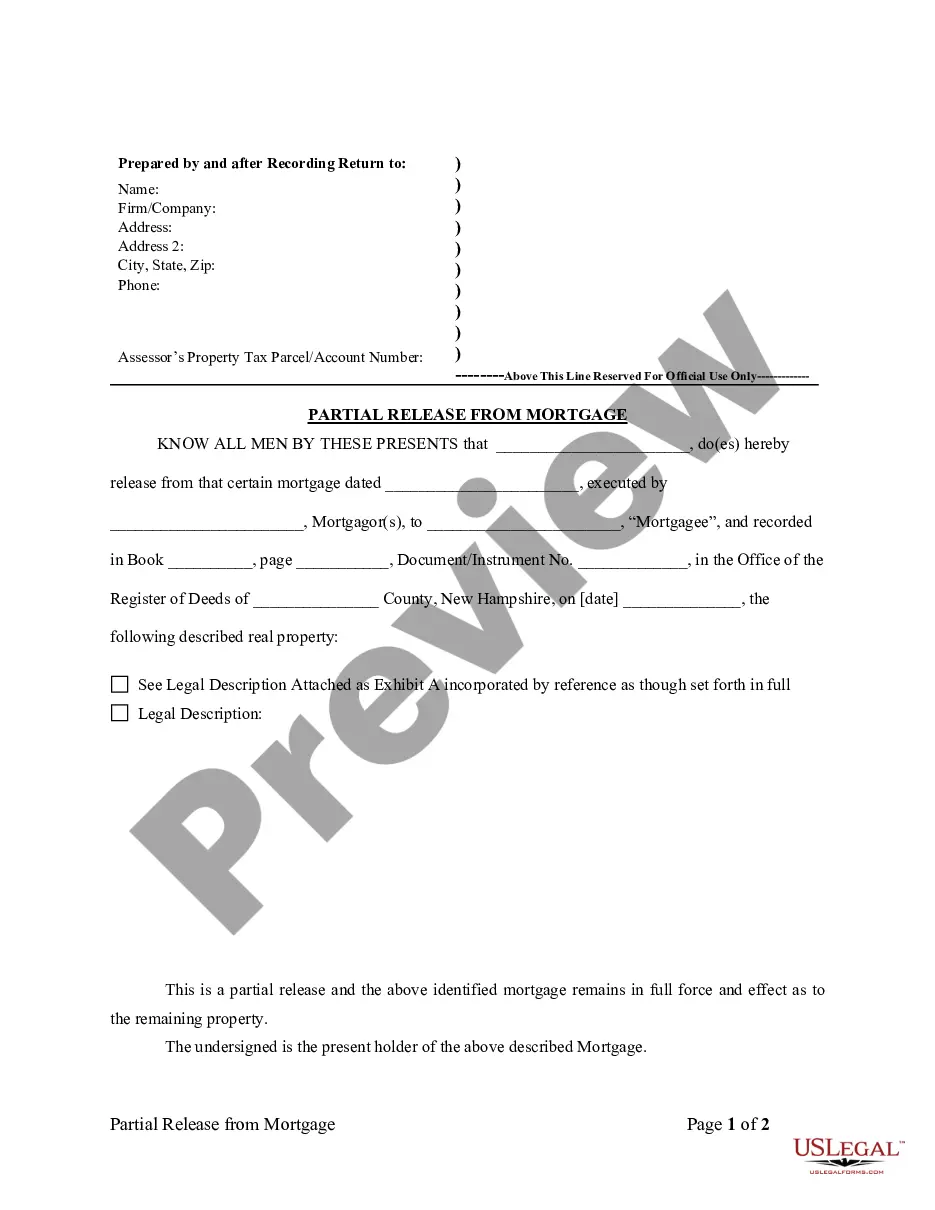

A mortgage release document is a formal legal document that confirms the release of a mortgage lien on a property. This document proves that the borrower has satisfied their obligations, whether completely or partially. In the context of a Manchester New Hampshire Partial Release of Property From Mortgage by Individual Holder, this document specifies which parts of the property are freed from lien. For accurate preparation of this document, you can rely on US Legal Forms to provide you with the right templates and guidance.

An example of a partial release of a mortgage would be when a homeowner sells a portion of their land or property while retaining ownership of the remaining part. In this scenario, the lender agrees to release its claim on the sold section but maintains the mortgage on the rest. This allows both the borrower and lender to benefit, as the borrower can access funds from the sale while still holding onto their home. Utilizing a clear contract for this transaction is essential, and platforms like US Legal Forms can help you draft it effectively.

For a partial release of mortgage in Manchester, New Hampshire, you typically need a written request from the borrower, identifying the specific portion of the property to be released. Additionally, you may require the lender's consent and documentation demonstrating the fair value of the divided property. After securing the necessary approvals, properly record the partial release to protect your ownership. US Legal Forms can assist you in preparing the required documents for this process.

A release of mortgage is commonly known as a 'mortgage discharge' or 'satisfaction of mortgage.' This document serves as formal evidence that the borrower has fulfilled the mortgage obligations. In the case of a Manchester New Hampshire Partial Release of Property From Mortgage by Individual Holder, this release indicates that part of the property is no longer encumbered by the mortgage. Understanding this terminology helps clarify your rights as a property owner.

A partial release deed allows a borrower to release a specific part of a property from a mortgage while retaining the rest. In the context of a Manchester New Hampshire Partial Release of Property From Mortgage by Individual Holder, this process can help homeowners sell or refinance part of their property without paying off the entire mortgage. This can be particularly beneficial if you want to retain ownership of the remaining property. You can find great resources and templates for creating a partial release deed on platforms like USLegalForms.