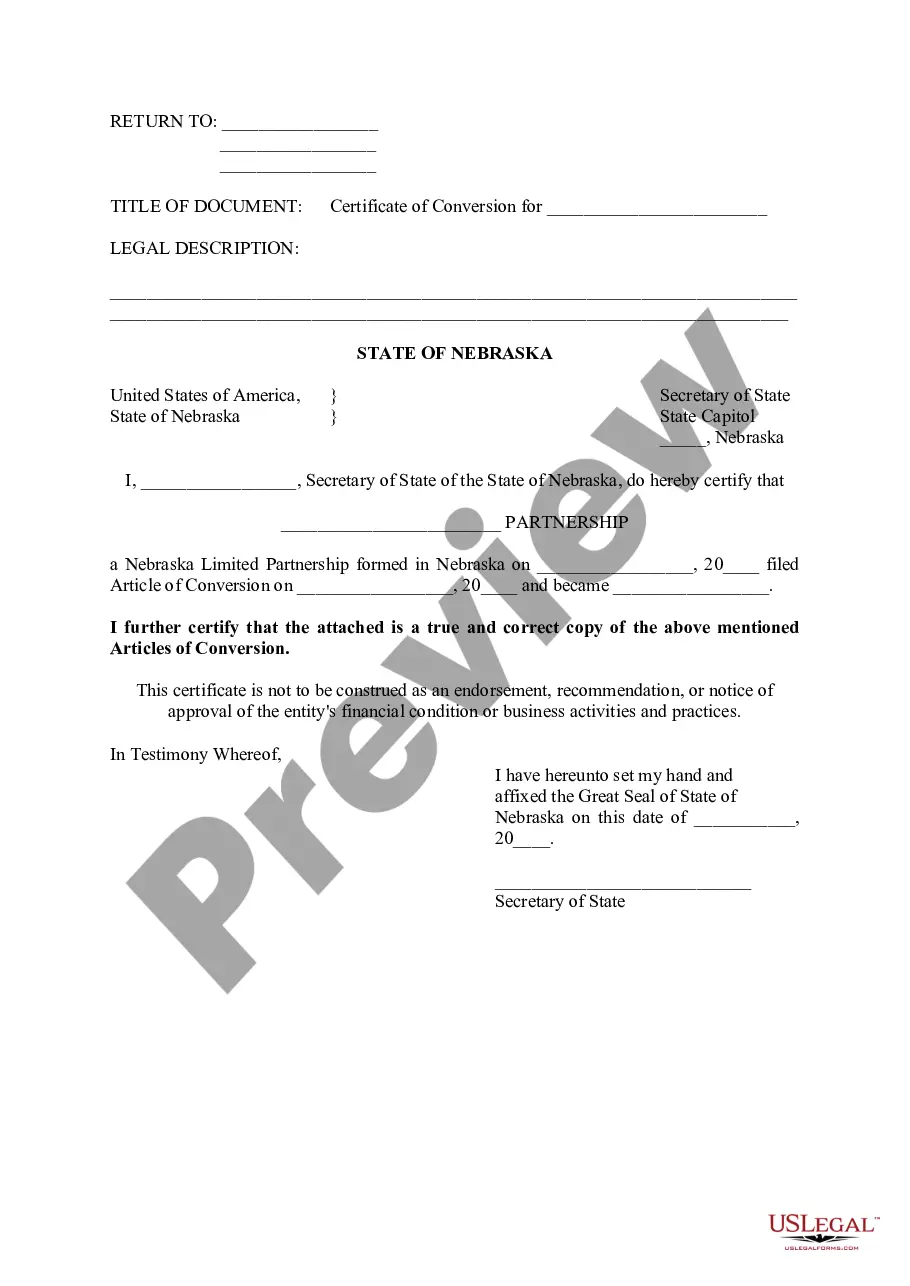

Omaha Nebraska Notice of Articles of Conversion

Description

How to fill out Nebraska Notice Of Articles Of Conversion?

Locating validated templates that pertain to your regional regulations can be difficult unless you utilize the US Legal Forms library.

This is an online repository comprising over 85,000 legal documents for both personal and professional purposes and various real-world situations.

All the files are appropriately categorized by usage area and jurisdiction, making it as straightforward as pie to find the Omaha Nebraska Notice of Articles of Conversion.

Ensure all documents are organized and adhere to legal requirements is highly important. Utilize the US Legal Forms library to consistently have vital document templates for any needs at your fingertips!

- Review the Preview mode and form description.

- Ensure you’ve chosen the correct one that aligns with your needs and fully complies with your local regulatory requirements.

- Search for another template if necessary.

- If any discrepancies are found, utilize the Search tab above to locate the correct one. If it fits your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

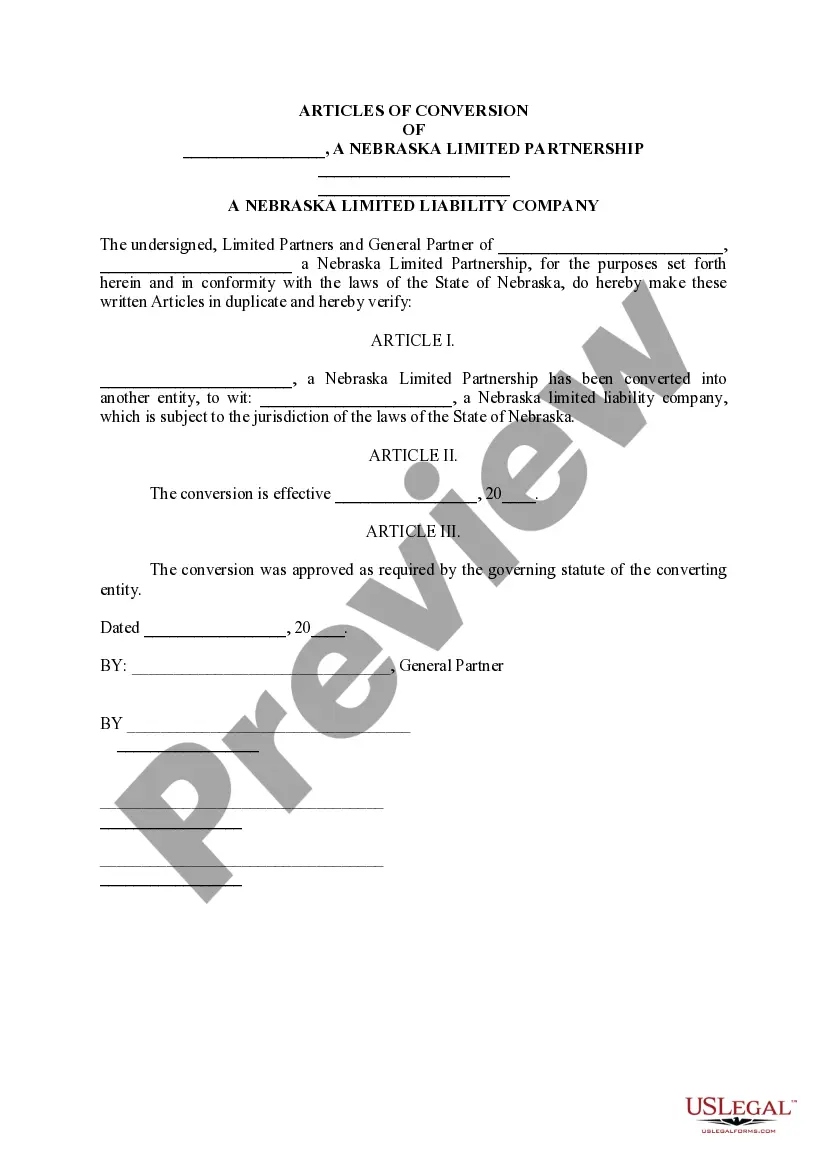

Nebraska articles of incorporation are filed to create a corporation. Preparing and filing your articles of incorporation is the first step in starting your business corporation. Approval of this document secures your corporate name and creates the legal entity of the corporation.

Nebraska businesses are not legally required to obtain a certificate of good standing. However, your business may choose to get one if you decide to do business outside of Nebraska or get a business bank account.

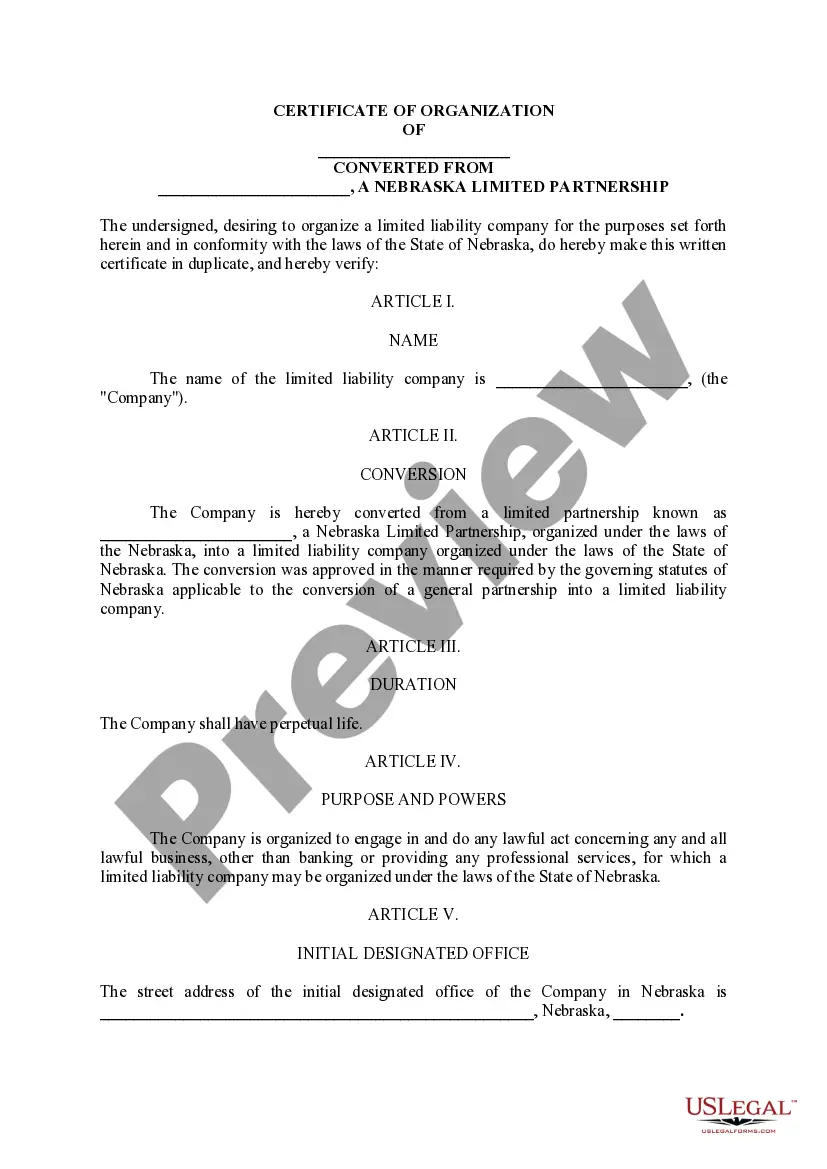

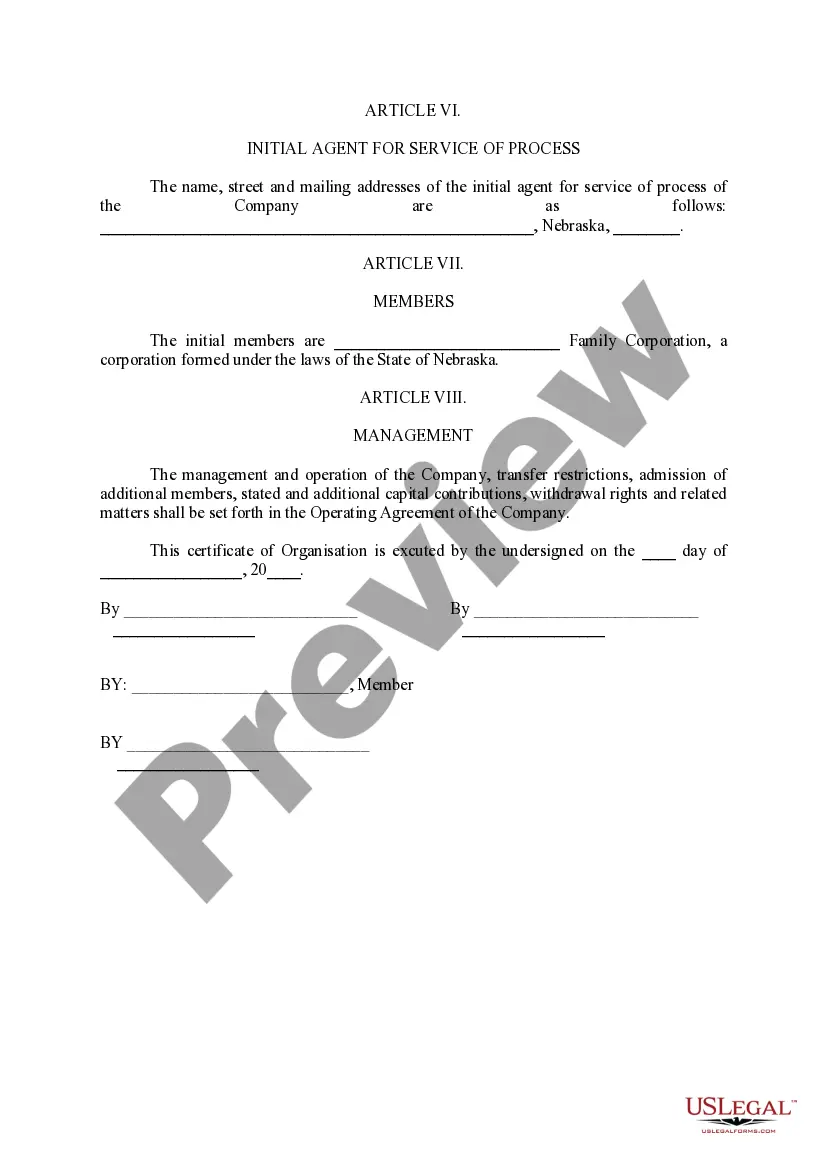

A certificate of organization is a type of document filed with the secretary of state in some states to form an LLC. An LLC certificate is also sometimes called a certificate of formation. Each state will have different requirements to file and fill out the form.

The Secretary of State where the company is incorporated You can find out whether the company is a corporation in good standing and has filed annual reports with the state through the secretary of state where the company is incorporated.

If you plan on forming a corporation or limited liability company, you will need to choose a registered agent. The registered agent is designated by law as the entity's agent for service of process and official government communications.

To change your registered agent in Nebraska, you must complete and file a Change of Registered Agent form with the Nebraska Secretary of State. The Nebraska Change of Registered Agent must be submitted by mail or in person and costs $25 for corporations, $10 for LLCs to file.

The Nebraska Certificate of Organization is the LLC form you fill out and file with the state to form an LLC.

If you are starting a new business in Nebraska, you may need to register with the Nebraska Department of Revenue (DOR). Registration is required if you will have employees, intend to engage in retail sales, renting/leasing tangible personal property, or will be providing services which are subject to sales tax.

How to Incorporate in Nebraska. To start a corporation in Nebraska, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State. You can file this document online or by mail. The articles cost a minimum of $65 to file.