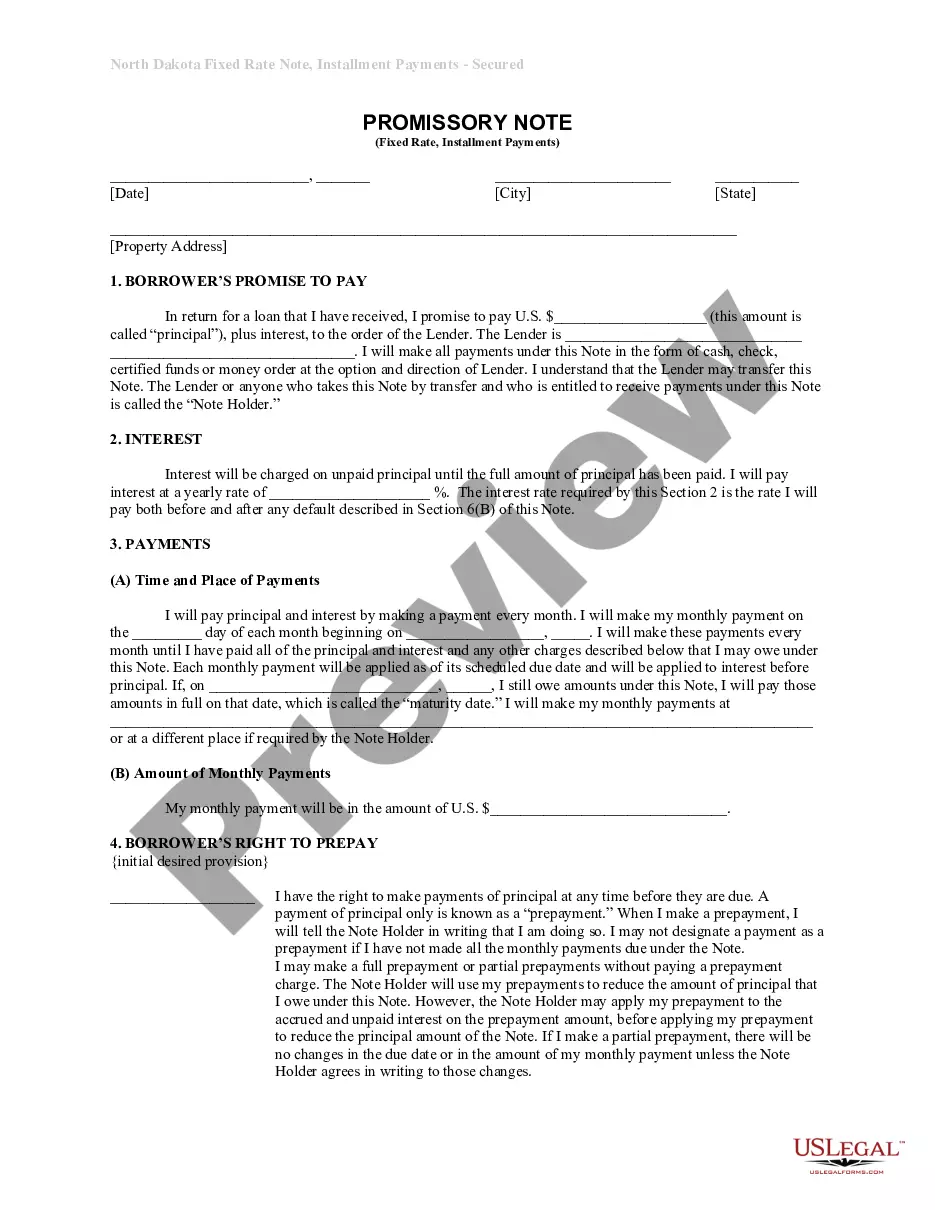

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out North Dakota Installments Fixed Rate Promissory Note Secured By Personal Property?

If you have previously availed yourself of our service, sign in to your account and store the Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Personal Property on your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial encounter with our service, adhere to these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to use it again. Use the US Legal Forms service to quickly discover and save any template for your personal or professional requirements!

- Ensure you’ve found the correct document. Browse the description and utilize the Preview option, if available, to verify if it suits your needs. If it’s not suitable, use the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Personal Property. Select the file format for your document and save it on your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

In many cases, you do not have to report a promissory note directly to tax authorities, but both lenders and borrowers should consider their financial implications. A Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Personal Property may have tax consequences that need to be understood. Consulting with a financial advisor or legal expert can ensure you meet all reporting requirements appropriately.

Promissory notes themselves do not typically have to be recorded, but related security interests in personal property may require filing. For a Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Personal Property, it’s wise to consider recording to protect the lender's rights. Consultation with a legal professional can clarify specific recording requirements in your situation.

Generally, a promissory note does not need to be recorded to be enforceable; however, recording may provide additional legal protection for the lender. In the case of a Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Personal Property, recording can help establish priority in securing claims against the personal property. This step can be beneficial for both parties involved in the agreement.

A promissory note can be invalid for several reasons, such as lack of clear terms regarding repayment, absence of signatures, or failure to include necessary identifying information. A Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Personal Property requires specific language and details to ensure its validity. Therefore, it is essential to follow legal guidelines when creating such a document.

To get a promissory note, you can either draft one yourself or use an online service like US Legal Forms. For a Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Personal Property, it’s crucial to ensure it meets local regulations. Utilizing templates offered by such platforms can streamline the process and provide you with confidence that you have covered all essential elements.

To obtain a Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Personal Property, you can start by exploring online legal form platforms. Websites like US Legal Forms provide customizable templates that help you draft a legally binding promissory note in minutes. Simply select your state and follow the prompts to ensure you're in compliance with local laws. This method saves you time and ensures accuracy.

Yes, a promissory note can indeed be secured by real property, which adds a layer of protection for the lender. However, in the context of a Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Personal Property, it's crucial to recognize that personal property is often used as collateral. This distinction can affect how the note is enforced and the type of security documentation required. Always consult with a legal professional to clarify terms and obligations.

The key difference lies in the security backing the note. A secured promissory note is backed by specific collateral, which protects the lender's interest. In contrast, an unsecured promissory note does not involve collateral, making it riskier for lenders. Understanding the Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Personal Property ensures you grasp how security impacts your investment.

Securing a promissory note with real property involves a few steps. First, you must draft the promissory note and include a legal description of the property. Then, you must execute a mortgage or deed of trust that links the note to the property. This process is central to the Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Personal Property, ensuring both parties understand their rights and obligations.

Yes, promissory notes can absolutely be backed by collateral. When a promissory note is secured by collateral, it increases the likelihood that the lender will be repaid. This arrangement provides security to the lender, especially in scenarios like the Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Personal Property. Collateral gives a legal claim to the property, ensuring the lender has recourse if the borrower defaults.