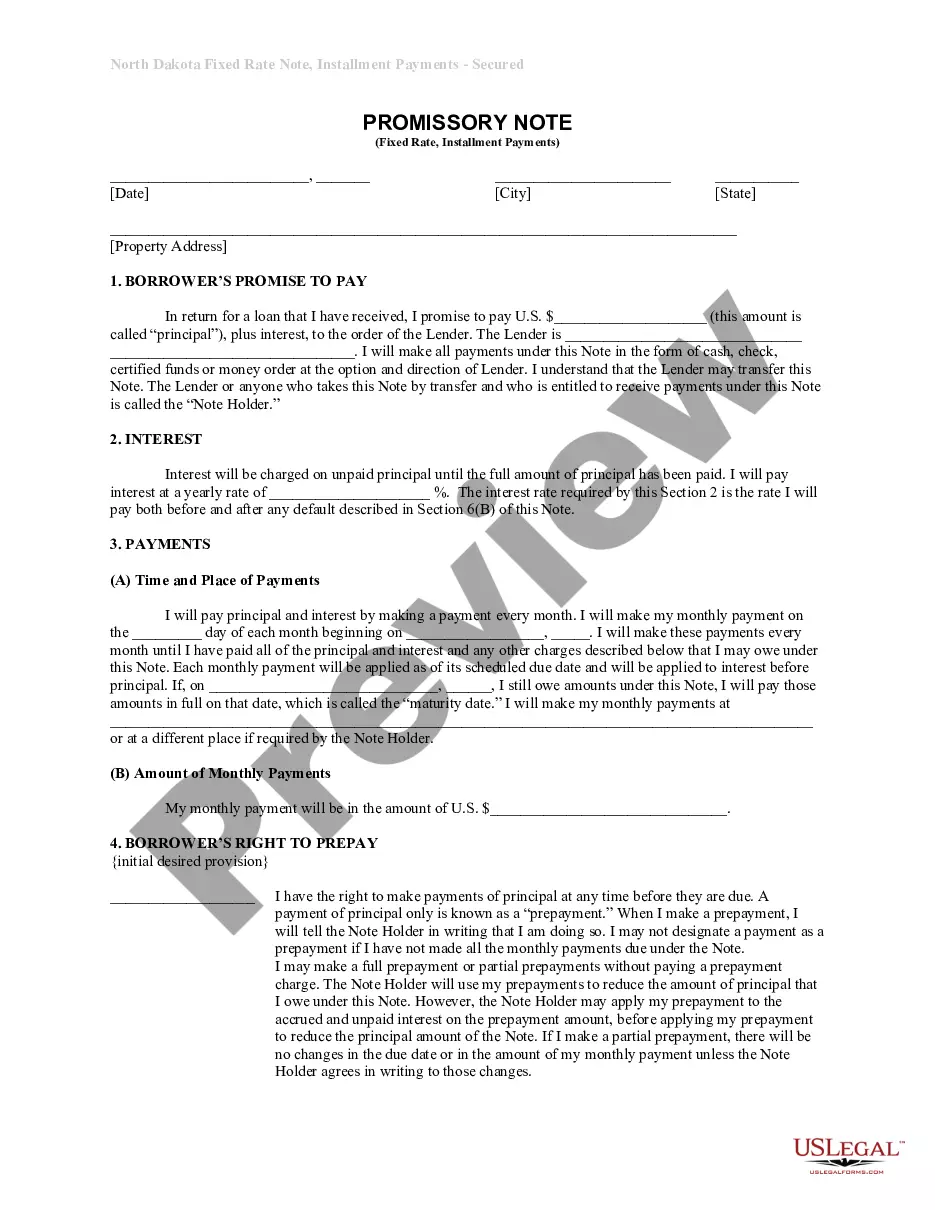

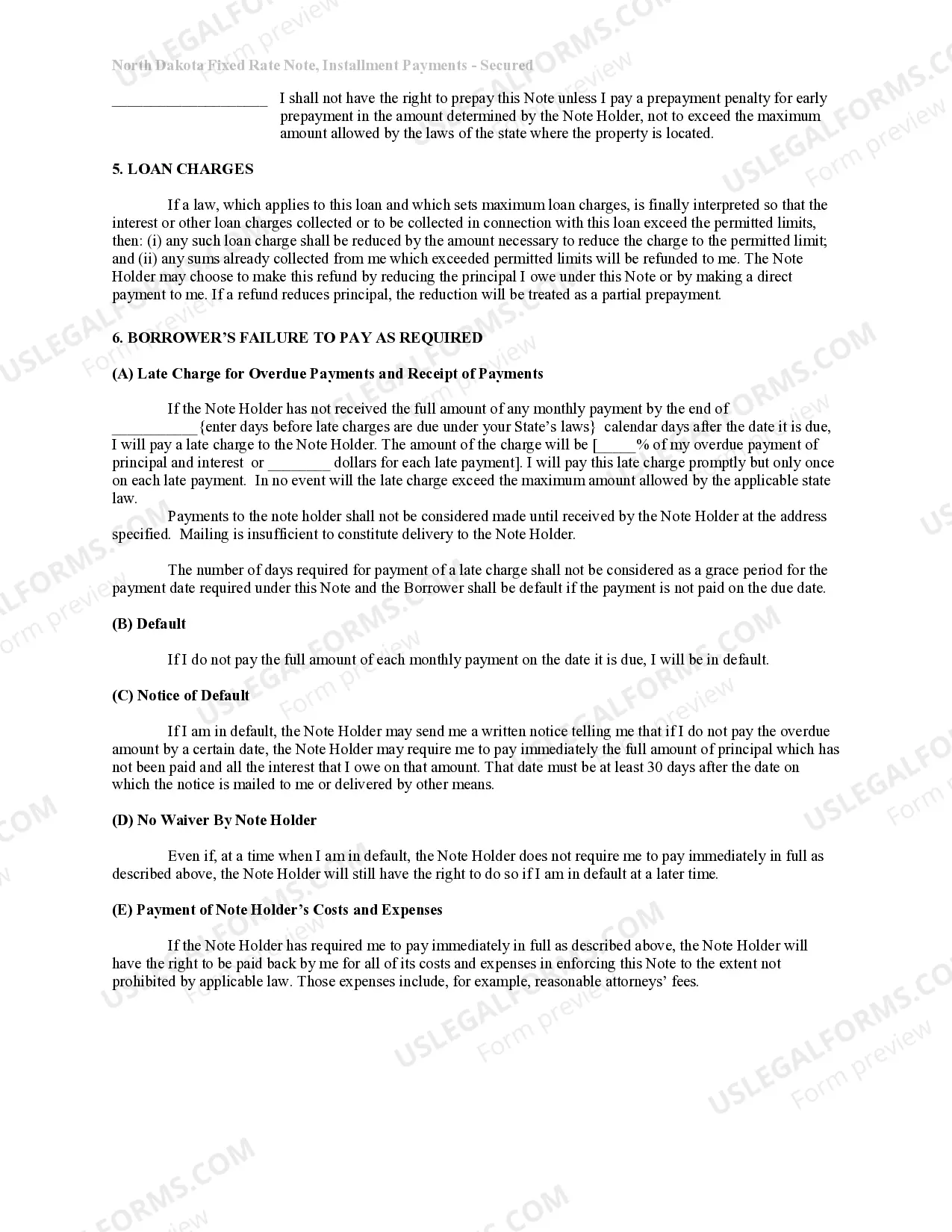

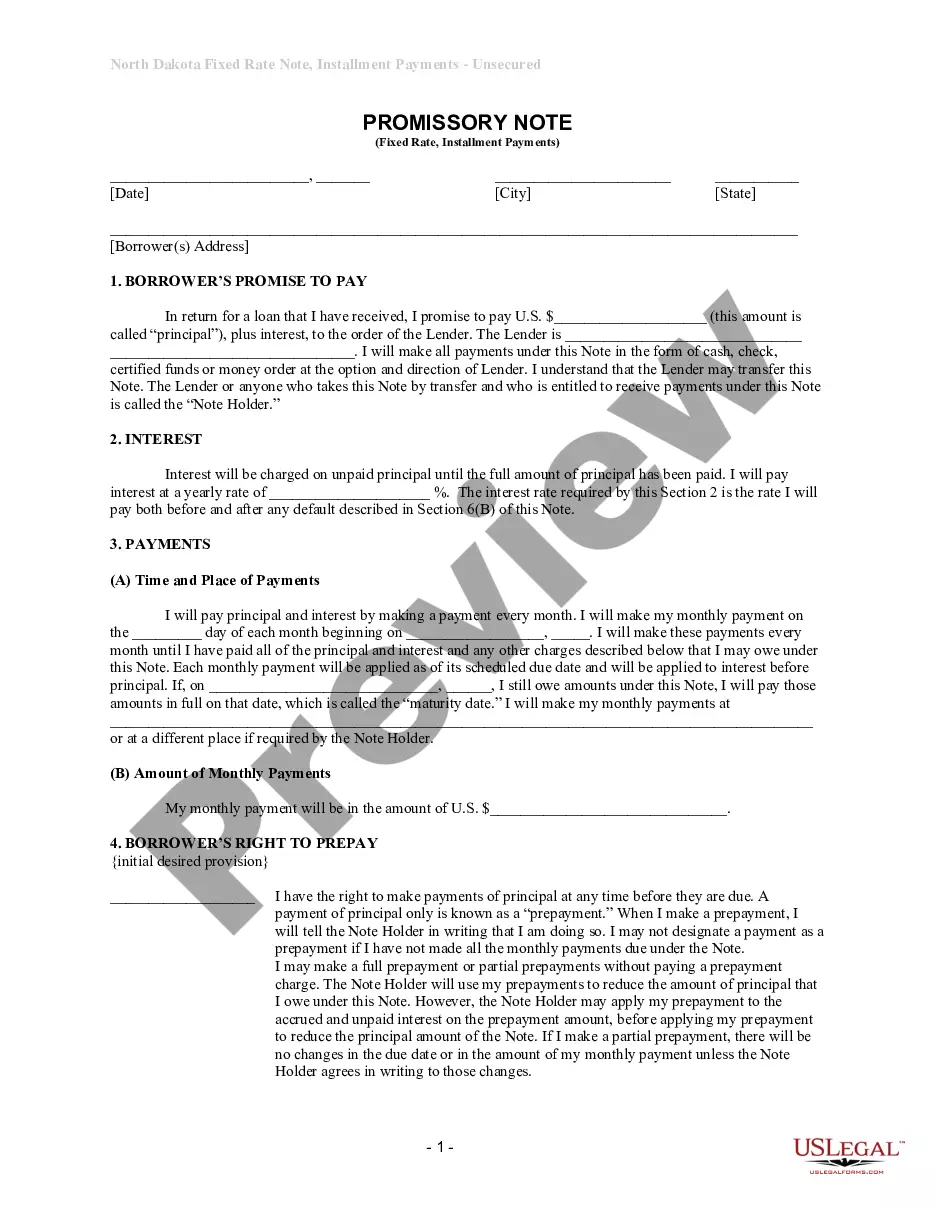

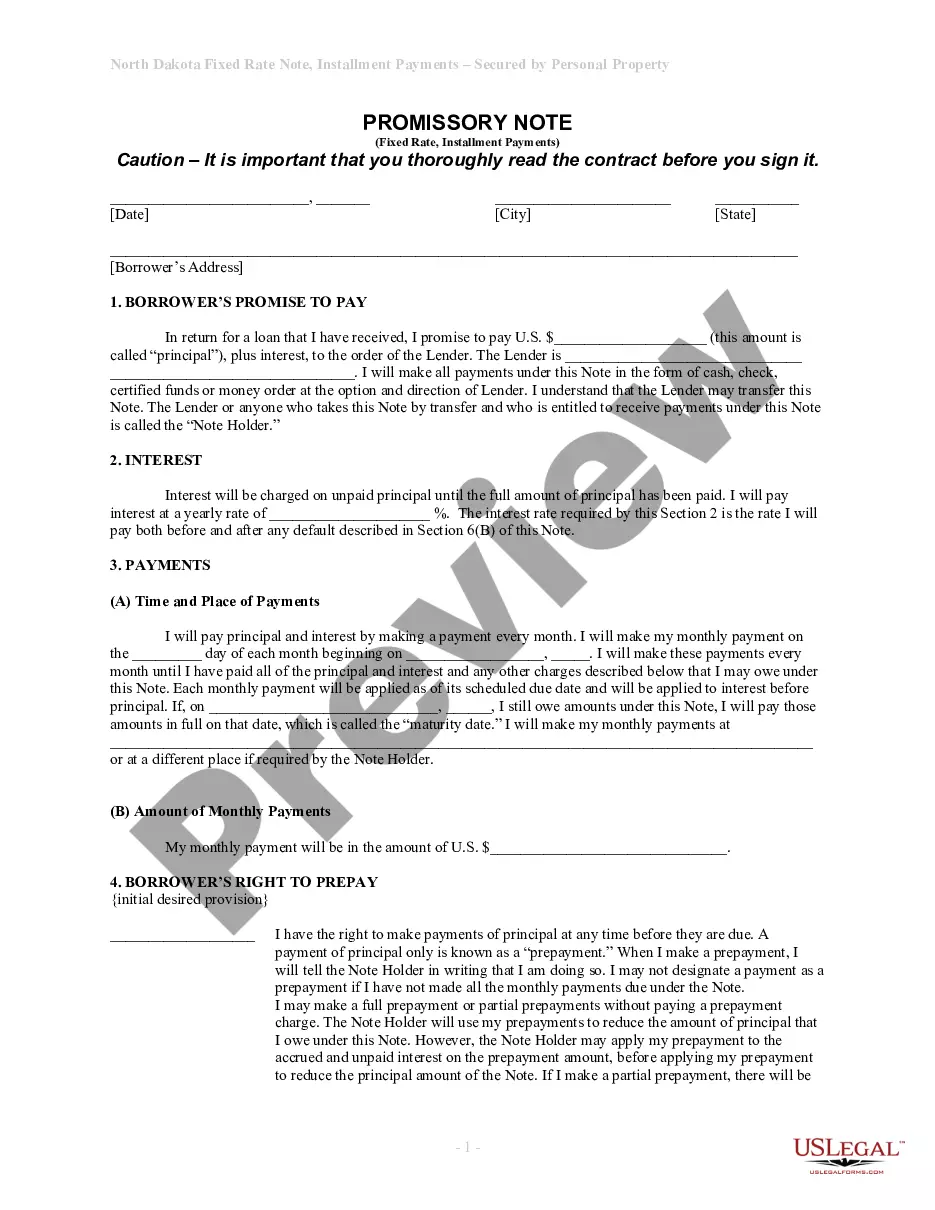

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Do you require a reliable and cost-effective legal document provider to obtain the Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate? US Legal Forms is your primary option.

Whether you need a straightforward arrangement to establish guidelines for cohabitation with your partner or a bundle of documents to expedite your separation or divorce through the legal system, we have you covered.

Our platform provides access to over 85,000 current legal document templates suitable for personal and business purposes. All templates we offer are tailored and compliant with the regulations of specific states and counties.

To download the document, you must Log In to your account, locate the required form, and click the Download button adjacent to it. Please remember that you can retrieve your previously purchased templates at any time from the My documents section.

Now you can establish your account. Then choose the subscription plan and proceed with payment. Once the transaction is complete, download the Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate in any available format. You can return to the website anytime to redownload the document at no additional charge.

Acquiring current legal forms has never been simpler. Try US Legal Forms today, and stop spending your precious time trying to understand legal documents online once and for all.

- Are you unfamiliar with our website? No problem.

- You can create an account quickly, but before that, ensure you do the following.

- Verify that the Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate meets the laws of your jurisdiction.

- Review the form’s description (if provided) to determine its applicability.

- Reinitiate your search if the form does not fit your particular circumstances.

Form popularity

FAQ

A secured promissory note is backed by collateral, giving the lender a claim to the asset if the borrower defaults. In contrast, a standard promissory note does not include such security. For instance, a Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate offers more protection for the lender compared to an unsecured note. This difference can impact the lending terms, including interest rates and repayment flexibility.

While promissory notes offer flexibility, they do have some disadvantages. The borrower may face higher interest rates, especially if the note isn’t secured, such as in a Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Additionally, defaulting on a note can lead to loss of collateral and a damaged credit rating. It’s crucial to weigh these potential downsides against the benefits before entering into any agreement.

A reasonable interest rate for a promissory note varies based on market conditions, credit risk, and the terms of the note. Generally, rates for a Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate will be lower than unsecured notes due to the lower risk for lenders. It’s essential to research current market rates and consult with a financial advisor to determine a fair rate. Overall, understanding the terms and implications of the interest rate can lead to better financial decisions.

Yes, promissory notes can be backed by collateral, which adds security for the lender. A Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a perfect example of a secured note, where the property itself acts as collateral. This arrangement provides more assurance to lenders, as they have the option to reclaim the secured asset in case of default. Using collateral can also lead to better terms for the borrower.

Yes, a promissory note can be secured by real property, making it a common practice in real estate transactions. By securing the note with property, the lender has a claim against the asset if payments are missed. With a Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you can confidently address your financing needs, knowing that the real estate serves as collateral.

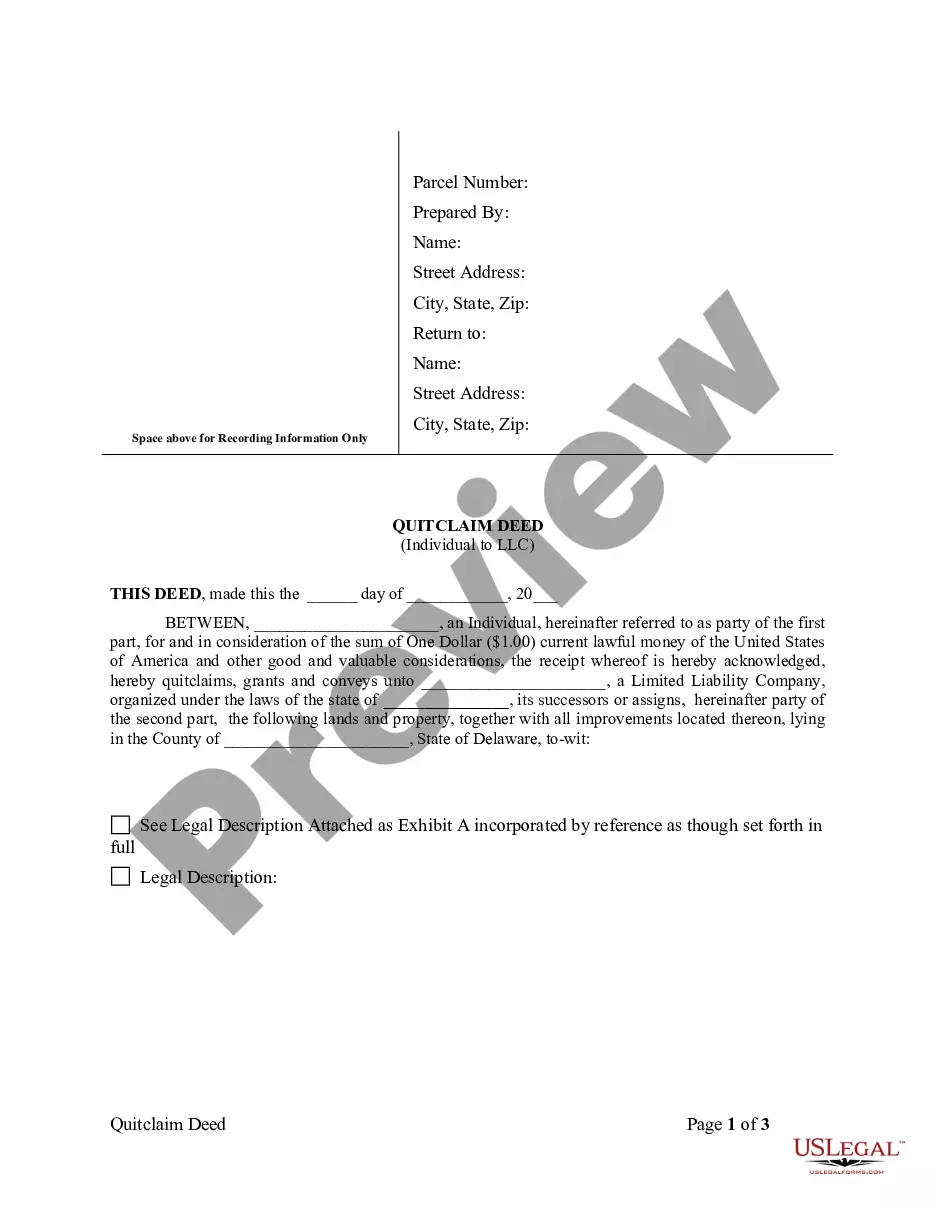

The document that secures the promissory note to the real property is commonly referred to as a mortgage or a deed of trust. This legal instrument ensures that the lender has a claim to the property if the borrower defaults. By utilizing a Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you can easily navigate this process with proper documentation from uslegalforms.

When writing a promissory note for payment, start with the date, the parties' names, and the total payment amount. Clearly specify repayment terms, including any applicable interest rates and due dates. Using resources like USLegalForms can streamline the process, especially for creating a Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

To fill out a promissory note sample, carefully insert the required information into the designated fields. Include details such as the amount being borrowed, the interest rate, payment terms, and a thorough description of the collateral involved, especially for a Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Reviewing a complete, filled-out sample can help you understand the necessary components.

To write a secured promissory note, start by outlining the details of the borrower, lender, and the secured collateral, such as residential real estate. Specify the repayment schedule, interest rates, and any conditions for default. For examples, consider utilizing a template specifically designed for Fargo North Dakota Installments Fixed Rate Promissory Notes to ensure compliance and effectiveness.

Yes, a handwritten promissory note is generally legal, provided it includes all the required elements such as the amount borrowed, interest, and repayment terms. However, for a Fargo North Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it is wise to ensure that the note complies with local state laws. Using a platform like USLegalForms can provide you templates that meet legal standards and offer clarity.