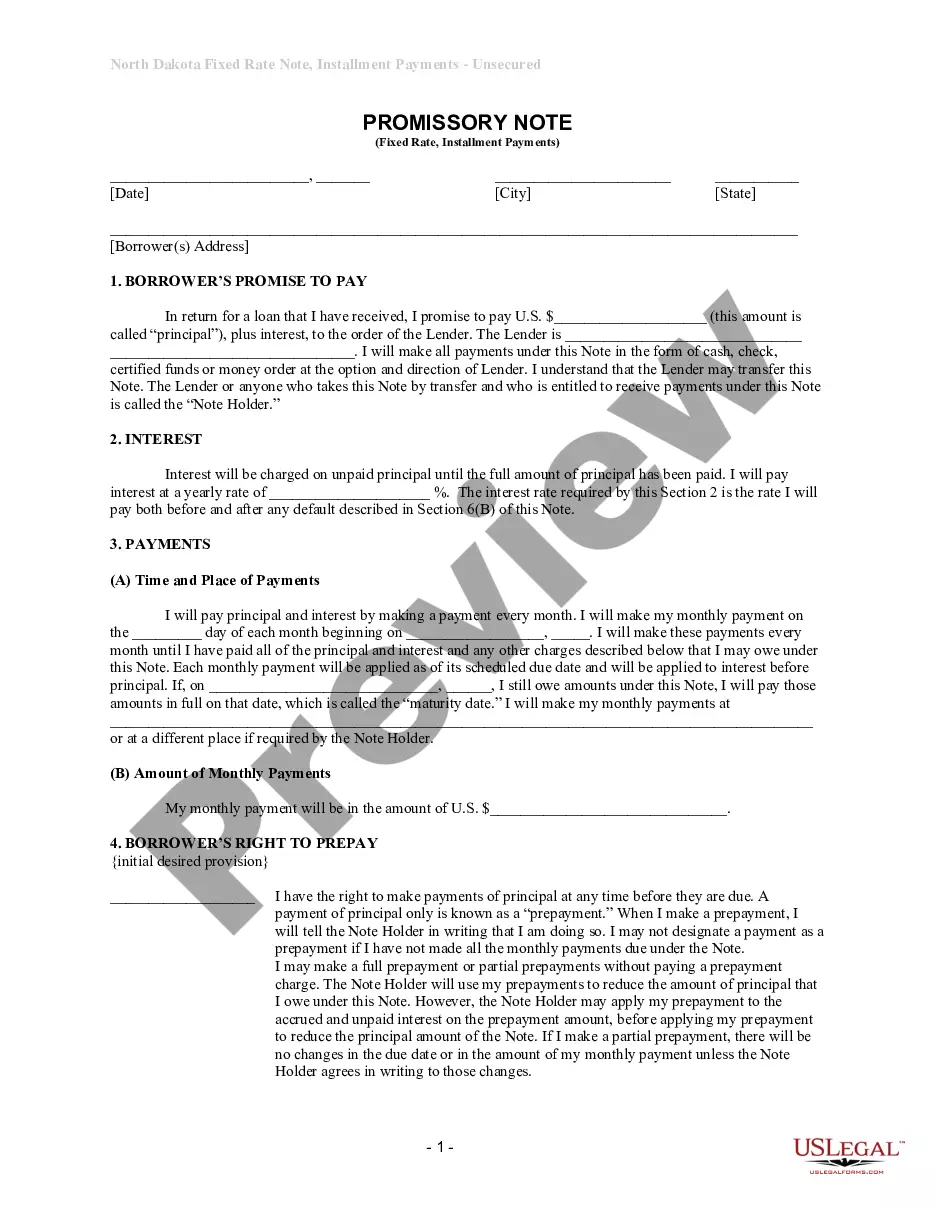

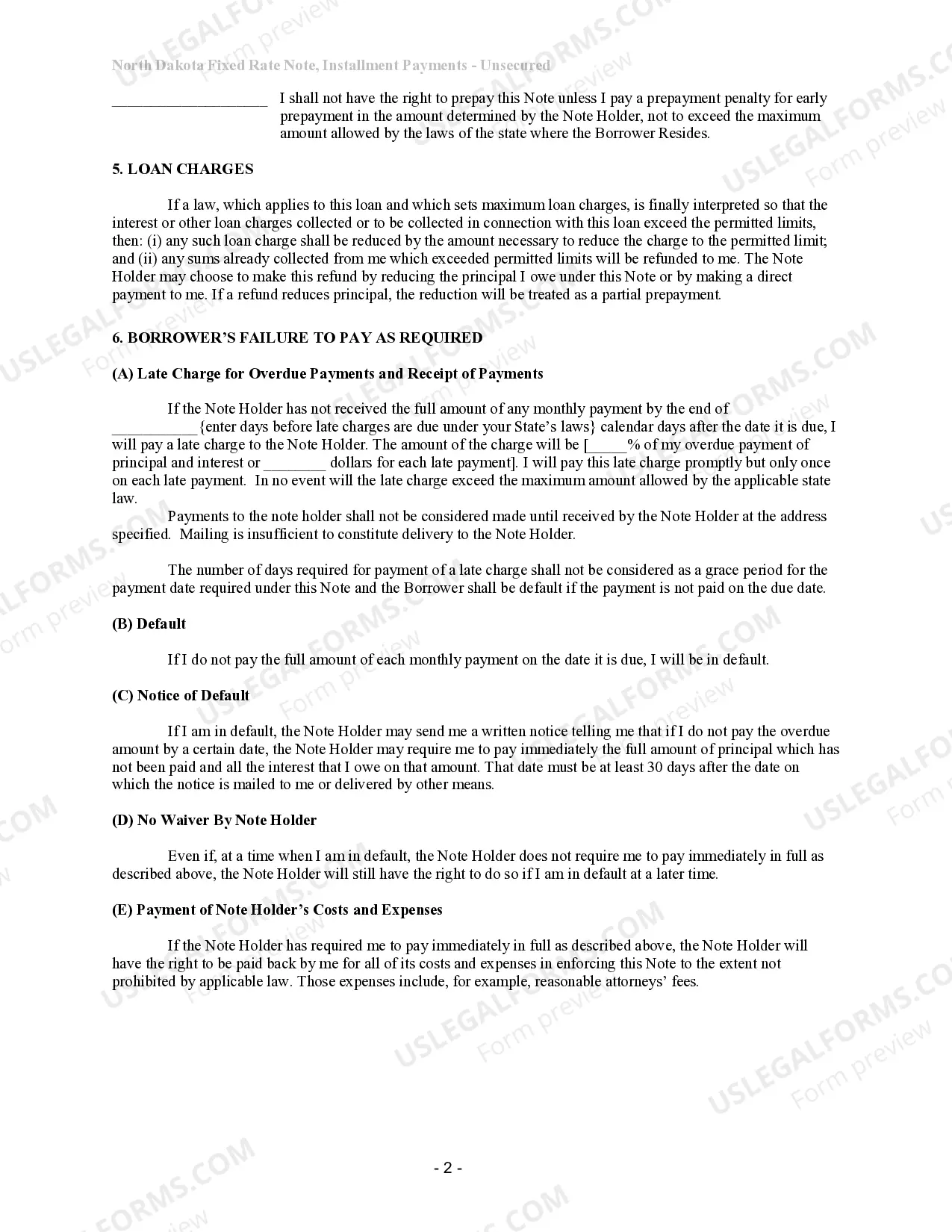

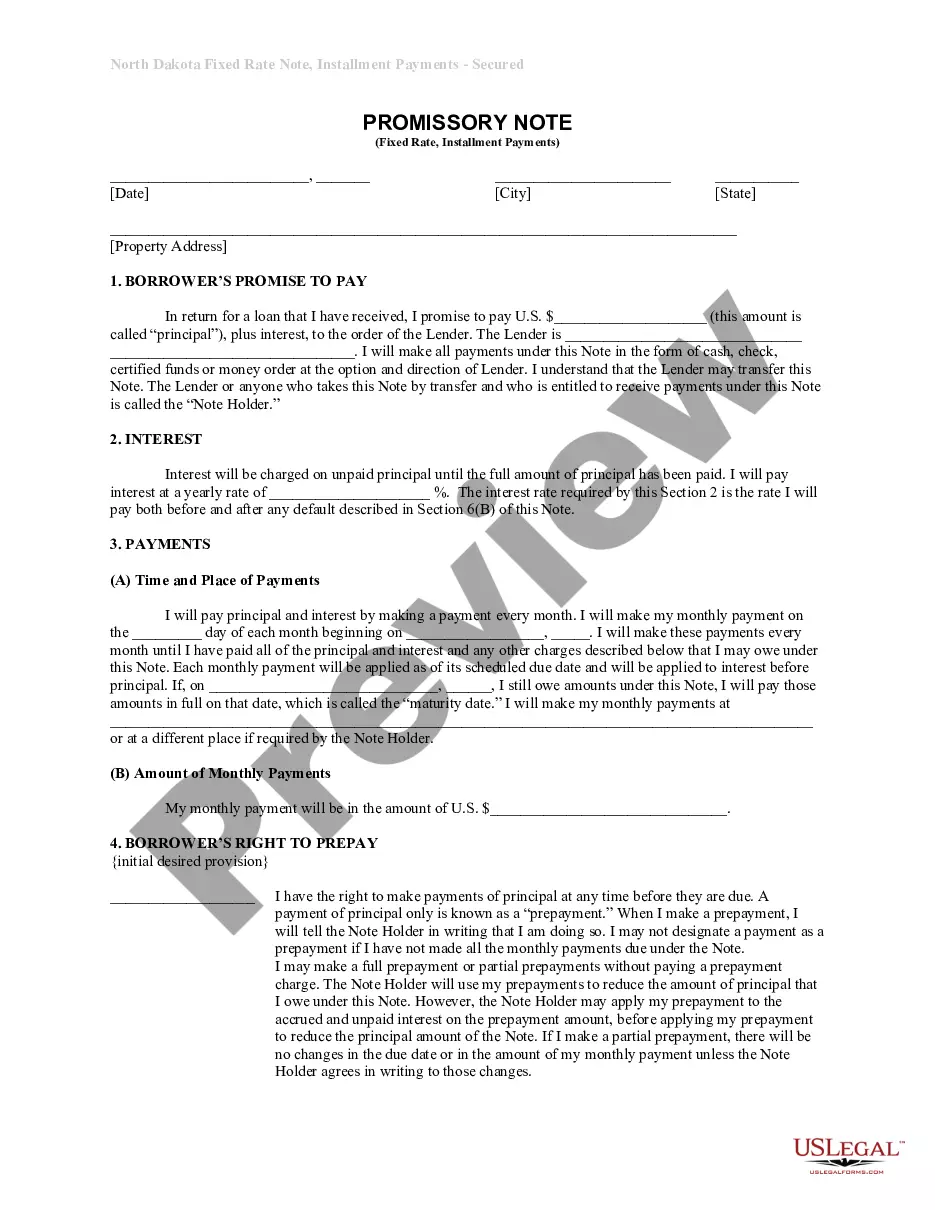

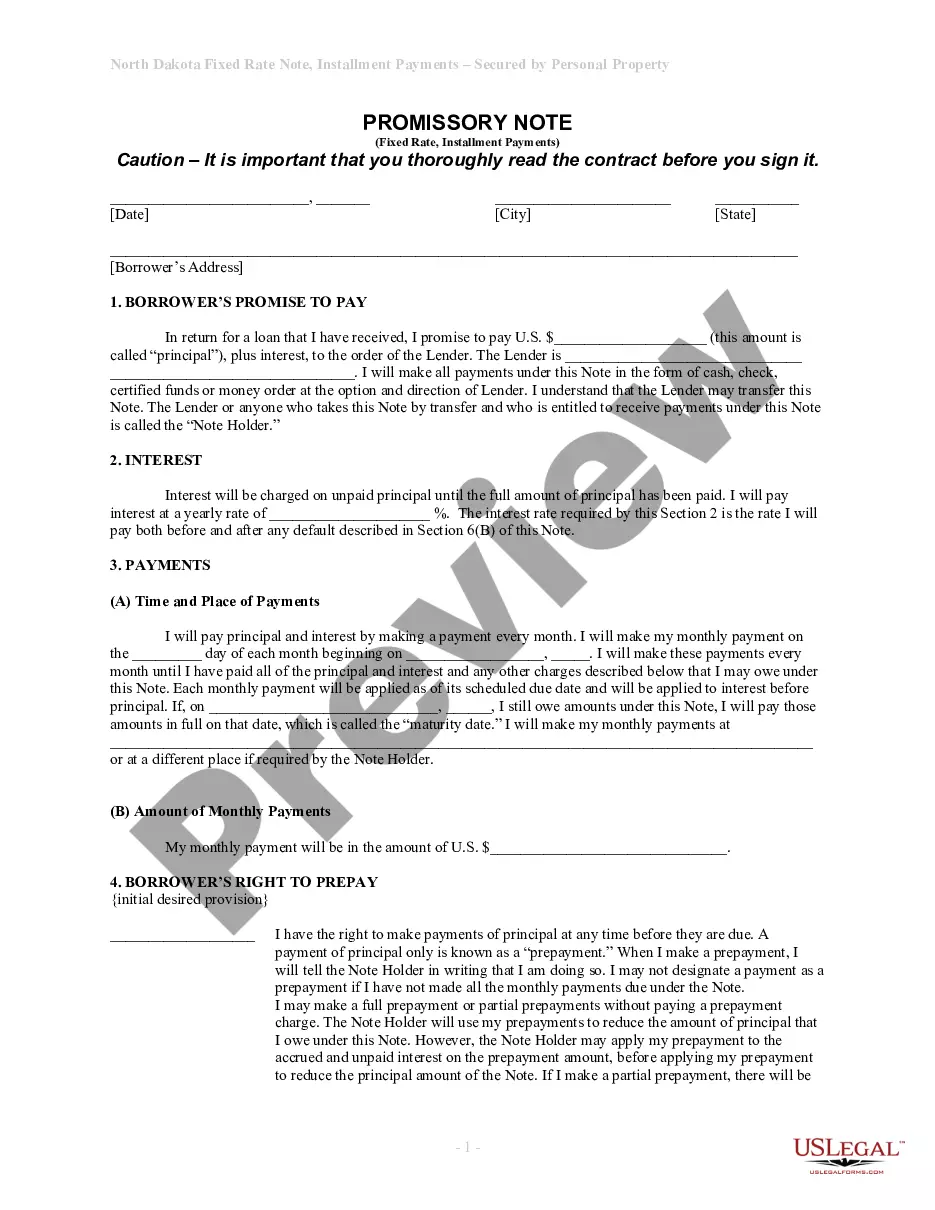

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Fargo North Dakota Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out North Dakota Unsecured Installment Payment Promissory Note For Fixed Rate?

Utilize the US Legal Forms and obtain instant access to any document you require.

Our user-friendly platform featuring thousands of templates streamlines the process of locating and obtaining nearly any document sample you desire.

You can download, complete, and authenticate the Fargo North Dakota Unsecured Installment Payment Promissory Note for Fixed Rate within minutes instead of spending hours searching online for an appropriate template.

Using our collection is a great approach to enhance the security of your document management.

Locate the template you need. Ensure that it is the template you are looking for: review its title and description, and utilize the Preview feature if available. Otherwise, use the Search bar to find the suitable one.

Initiate the saving process. Click Buy Now and select the pricing option that works best for you. Then, create an account and complete your purchase using a credit card or PayPal.

- Our knowledgeable attorneys frequently review all files to confirm that the templates are applicable for a specific area and adhere to current regulations and policies.

- How can you acquire the Fargo North Dakota Unsecured Installment Payment Promissory Note for Fixed Rate.

- If you already possess an account, simply Log In to your profile. The Download button will be visible on all the samples you peruse.

- Additionally, you can access all previously saved documents in the My documents section.

- If you haven’t created an account yet, follow the steps outlined below.

Form popularity

FAQ

Enforcing an unsecured promissory note involves communicating with the borrower to remind them of their payment obligations. If necessary, you may need to send formal notices and eventually seek legal counsel to explore collection options. By ensuring the details are clear from the beginning with a Fargo North Dakota Unsecured Installment Payment Promissory Note for Fixed Rate, you strengthen your position for enforcing the agreement.

If a borrower defaults on a promissory note, the lender can take several steps to recover the debt. First, reach out to the borrower to discuss the issue and explore repayment options. If the debt remains unpaid, you may consider legal action. Utilizing a Fargo North Dakota Unsecured Installment Payment Promissory Note for Fixed Rate can simplify this process by providing documented terms for enforcement.

In Fargo, North Dakota, filing a promissory note typically does not require a formal filing process with the government. However, it is advisable to keep a copy of the note for personal records and to provide one to all parties involved in the agreement. For those using a Fargo North Dakota Unsecured Installment Payment Promissory Note for Fixed Rate, storing the document securely can help prevent disputes down the line.

Yes, a handwritten Fargo North Dakota Unsecured Installment Payment Promissory Note for Fixed Rate is legal, provided it includes the essential elements like the amount, interest rate, and repayment terms. Handwritten notes can be binding as long as both parties agree to the terms and sign the document. For added assurance and to avoid potential misunderstandings, using a formal template from uslegalforms is advisable to ensure all legal requirements are met.

In Fargo, North Dakota, it is not mandatory for a promissory note to be notarized for it to be enforceable. However, notarization often adds a layer of security and authenticity to the agreement. If you choose to use uslegalforms, you can find templates that may recommend notarization to strengthen the document’s credibility and protect against disputes.

An example of a Fargo North Dakota Unsecured Installment Payment Promissory Note for Fixed Rate might involve a borrower agreeing to repay $10,000 at a fixed interest rate of 5% over five years. It would outline the payment structure, indicating monthly payments due on a specific day of each month. This example illustrates how promissory notes are used to formalize lending agreements and protect both parties involved.

Losing an original promissory note can complicate financial agreements, but you can still manage the situation. Contact the party involved in the agreement to discuss possible solutions, such as drafting a replacement note. Uslegalforms provides templates to create a new Fargo North Dakota Unsecured Installment Payment Promissory Note for Fixed Rate as a safeguard.

To get a copy of your promissory note, you should start by contacting the entity that issued it, such as a bank or financial institution. If you have used a service like uslegalforms, they may offer easy access to your documents through their online platform. Always keep your financial records organized for quick reference.

Yes, promissory notes often get notarized to add an extra layer of authenticity and ensure all parties agree to the terms. This process simplifies legal disputes in the future. Be sure to consult with your legal advisor if you are creating a Fargo North Dakota Unsecured Installment Payment Promissory Note for Fixed Rate.

To obtain a copy of your Fargo North Dakota Unsecured Installment Payment Promissory Note for Fixed Rate, you can reach out to the lender or the party who issued the note. They typically hold the original document and can provide you with a copy. If you used a legal service, consider checking their online platform for document access.