Hollywood Florida Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Florida Satisfaction, Release Or Cancellation Of Mortgage By Individual?

We continually strive to mitigate or avert legal complications when engaging with complex legal or financial matters.

To achieve this, we seek legal assistance that, typically, is quite expensive. However, not every legal matter is of equal intricacy. Most can be managed independently.

US Legal Forms is a digital repository of current DIY legal templates covering everything from wills and power of attorney to articles of incorporation and petitions for annulment.

Our collection enables you to take control of your affairs without the need for an attorney. We provide access to legal form models that aren’t consistently readily available. Our templates are tailored to specific states and regions, which greatly streamlines the searching process.

Ensure to verify if the Hollywood Florida Satisfaction, Release or Cancellation of Mortgage by Individual adheres to the regulations and laws of your state and locality.

- Make use of US Legal Forms whenever you require to obtain and download the Hollywood Florida Satisfaction, Release or Cancellation of Mortgage by Individual or any other form promptly and securely.

- Simply Log In to your account and click the Get button adjacent to it.

- If you misplace the document, you can always download it again in the My documents section.

- The procedure is similarly straightforward if you’re not familiar with the platform! You can create your account in a few minutes.

Form popularity

FAQ

If you need to file a complaint against a mortgage lender in Florida, you can begin by gathering all relevant information and documentation pertaining to your issue. Then, contact the Florida Department of Financial Services, or use online platforms that specialize in consumer complaints to record your issue. Utilizing these channels can help ensure that your concerns are heard while also supporting your endeavor to achieve a Hollywood Florida satisfaction, release or cancellation of mortgage by individual.

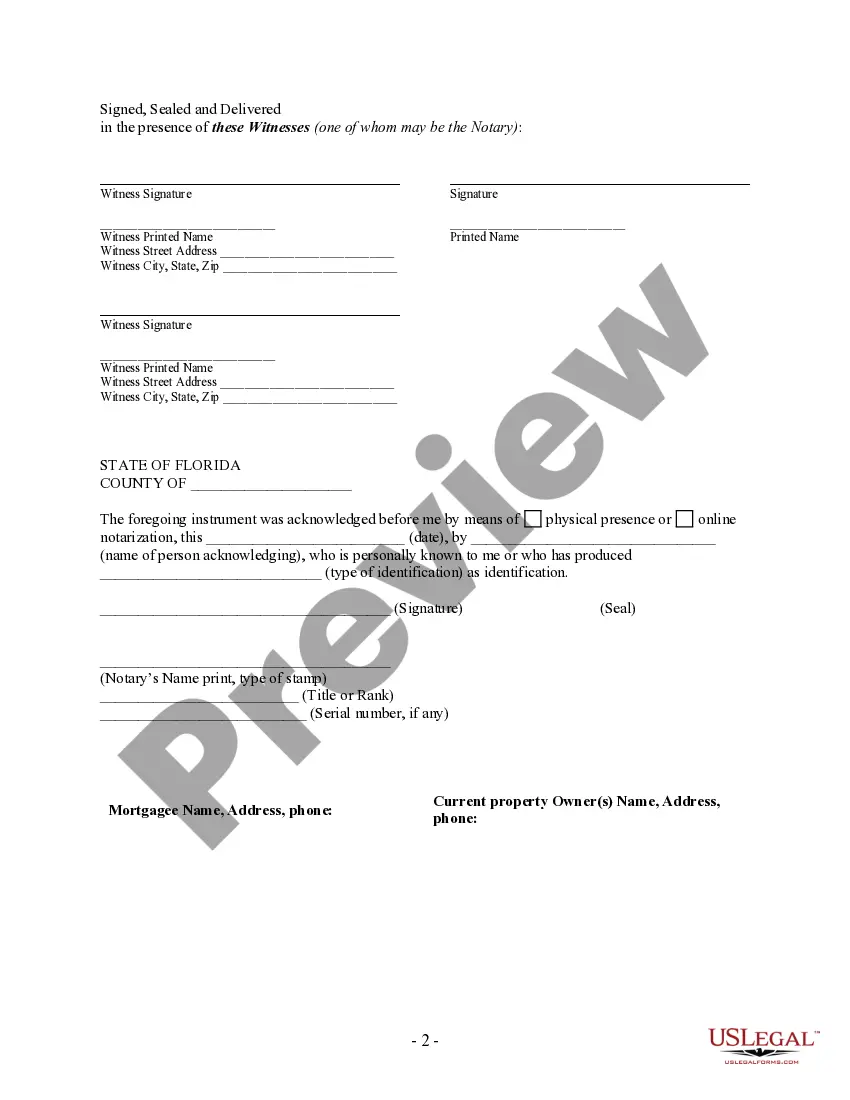

To record a satisfaction of a mortgage in Florida, you should first obtain a satisfaction document signed by the lender. Once you have this, take it to the county clerk's office for recording. It's essential to include any applicable fees and ensure that the document is properly notarized. This action serves to officially document the Hollywood Florida satisfaction, release or cancellation of mortgage by individual, clearing the title for future transactions.

To file a mortgage release in Hollywood, Florida, you must first obtain the original promissory note and mortgage document. After confirming that all obligations have been satisfied, you should prepare a satisfaction document and have it notarized. You will then file this document with the appropriate county clerk's office, which officially releases the mortgage. This process helps clear your property title and confirms the release or cancellation of mortgage by individual.

To fill out a satisfaction of mortgage form for Hollywood Florida Satisfaction, Release or Cancellation of Mortgage by Individual, start by providing your name and the details of the mortgage that is being satisfied. Next, include the lender's information and the property address. Finally, ensure that all information is accurate and sign the document. This completed form not only signifies the release of your mortgage but also protects your rights.

In Florida, a satisfaction of a mortgage does not need to be witnessed, but it must be notarized. The primary requirement is notarization, which authenticates the document and provides legal validity. Having a notarized satisfaction can prevent potential legal issues down the line. If you need help navigating this process, US Legal Forms has tools and samples that can simplify obtaining your Hollywood Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

Yes, a mortgage must be notarized in Florida to be legally binding. Notarization ensures that all parties involved in the transaction have confirmed their identities and the authenticity of their signatures. This process helps protect both borrowers and lenders. Accessing the resources on the US Legal Forms platform can assist you in understanding the notarization requirements for your specific situation.

In general, the satisfaction of a mortgage in Florida must be notarized to ensure its validity. This step is essential for confirming that the mortgage is officially released. Notarization provides a layer of security and helps prevent any future disputes. If you are seeking assistance with this process, the US Legal Forms platform offers resources to guide you through the necessary steps.

The terms 'release of mortgage' and 'satisfaction of mortgage' are often used interchangeably, but there are subtle differences. A release indicates that the lender has removed its claim on the property, while a satisfaction confirms that you have fulfilled the repayment terms of the mortgage. When dealing with Hollywood Florida Satisfaction, Release or Cancellation of Mortgage by Individual, understanding these nuances prepares you for clear communication with your lenders.

To file a satisfaction of mortgage in Florida, you first need to prepare a satisfaction document that identifies the mortgage, the mortgagor, and the lender. Once completed and notarized, you can file it with the county clerk's office where the original mortgage was recorded. It is essential to ensure accuracy in all details to avoid future complications.

Yes, in Florida, a satisfaction of mortgage must be notarized to be considered valid. This requirement ensures that the document is authentic and provides legal protection for both you and the lender. Utilizing the US Legal Forms platform can simplify this process by offering access to templates that comply with Florida's notarization laws.