Florida Satisfaction, Release or Cancellation of Mortgage by Individual

What this document covers

The Satisfaction, Release or Cancellation of Mortgage by Individual form is a legal document used in Florida to officially release a mortgage agreement. By completing this form, individuals can confirm that they have satisfied their mortgage obligation, thereby freeing the associated property from the mortgage lien. This form is essential for homeowners who have paid off their loans and want to clear their property title, distinguishing it from other forms related to mortgages that may not convey such releases.

Key parts of this document

- Date of mortgage execution

- Names of the mortgagor(s) and mortgagee

- Details about the recorded mortgage (including Book, Page, and Document/Instrument number)

- Property description as stated in the original mortgage

- Statement indicating the satisfaction of the mortgage

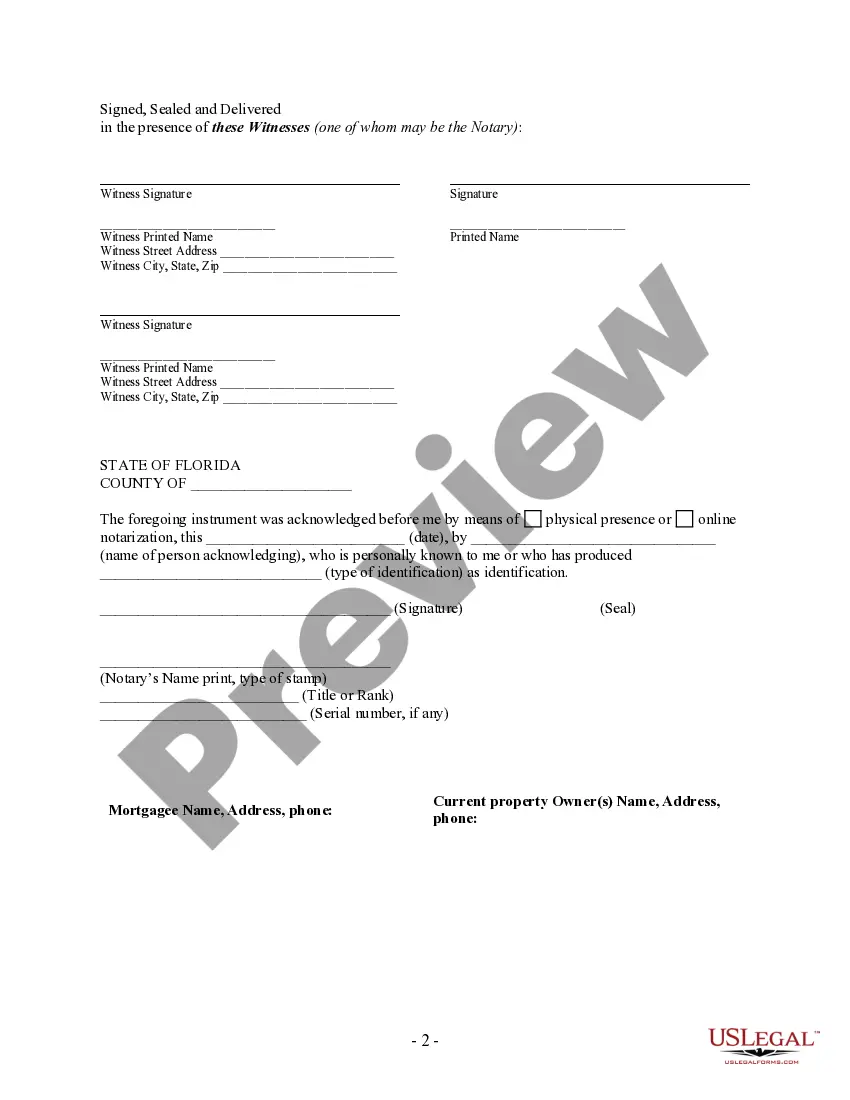

- Notary acknowledgment section

When to use this form

This form should be used when a borrower has fully repaid a mortgage and needs to officially release the mortgage from the property records. It is applicable when a borrower wishes to ensure their property title is clear of any mortgage encumbrances, particularly useful when selling the property or obtaining a new mortgage.

Who this form is for

- Homeowners who have paid off their mortgage

- Individuals acting on behalf of the borrower, such as a title agent

- Real estate professionals assisting clients with mortgage satisfaction

Steps to complete this form

- Identify the date on which the mortgage was executed.

- Fill in the names of the mortgagor(s) and the mortgagee.

- Enter the details from the public records regarding the mortgage, including Book, Page, and Document numbers.

- Provide a clear description of the property as noted in the mortgage.

- Complete the notary acknowledgment section to authenticate the form.

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include all necessary details regarding the mortgage and property.

- Not having the form notarized when required.

- Using incorrect or outdated property descriptions.

Why complete this form online

- Convenient access to legal forms from anywhere.

- Edit and fill out the form at your own pace.

- Forms drafted with the guidance of licensed attorneys, ensuring compliance with state laws.

Looking for another form?

Form popularity

FAQ

The difference between satisfaction and release lies mainly in their usage. Satisfaction is a broader term that encompasses the entire process of repaying the mortgage, leading to the official confirmation of no remaining debt. Release, however, typically refers to the lender's action in legally eliminating the mortgage from public records. When navigating Florida Satisfaction, Release or Cancellation of Mortgage by Individual, understanding these terms will empower you.

While both terms deal with the conclusion of a mortgage agreement, satisfaction of mortgage specifically indicates that the mortgage has been fully repaid. In contrast, a release of mortgage refers to the act of the lender providing formal documentation that acknowledges the mortgage debt has been satisfied. Knowing these definitions helps clarify your path concerning Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

To record a satisfaction of a mortgage, you first need to obtain the satisfaction document from your lender. After securing the document, take it to the county clerk's office where the original mortgage was filed. Filing this document properly ensures that it reflects the release of the mortgage in public records. Using services like UsLegalForms can help guide you through these steps related to Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

In Florida, a satisfaction of mortgage typically does not require notarization, but it does need to be signed by the lender. It is crucial to ensure that the satisfaction is properly executed and recorded with the county clerk's office. When navigating Florida Satisfaction, Release or Cancellation of Mortgage by Individual, checking local requirements will help ensure a smooth process.

A mortgage discharge and a mortgage release are often used interchangeably, but they are technically different. A mortgage discharge typically refers to the complete removal of a mortgage obligation, usually upon full payment. In contrast, a mortgage release can apply to a partial payment, allowing for the removal of a specific lien on a portion of the property. Understanding these terms is essential for those dealing with Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

To record a satisfaction of your mortgage, you must submit the notarized satisfaction document to the county clerk or recorder's office where your property is located. This action ensures that the public records reflect the full satisfaction of the mortgage. Using platforms like USLegalForms can assist you in correctly preparing the document for recording.

Yes, in Florida, a satisfaction of mortgage generally needs to be notarized to be considered valid. Notarization serves to verify the identities of the parties involved and adds a layer of authenticity to the document. This step is essential for a proper Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

Filling out a satisfaction of mortgage form includes entering the borrower and lender's names and the specific details of the mortgage, such as the account number and the property address. Clearly state that you are confirming the payment in full of the mortgage. Using a reliable platform like USLegalForms can help streamline this process and ensure accuracy.

To fill out a mortgage release form, you should start by gathering relevant information, such as the original mortgage details and property information. Clearly enter the borrower and lender's names, property address, and any necessary dates. This process is crucial for ensuring a valid Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

In Florida, a lender must record the satisfaction of mortgage within 60 days after receiving the payoff of the mortgage. This prompt action is essential for providing clear title to the homeowner, underscoring the importance of the Florida Satisfaction, Release or Cancellation of Mortgage by Individual. Delays in recording can result in complications for property owners, so timely follow-up is advised. For clarity and efficiency, using services like US Legal Forms can streamline this process.