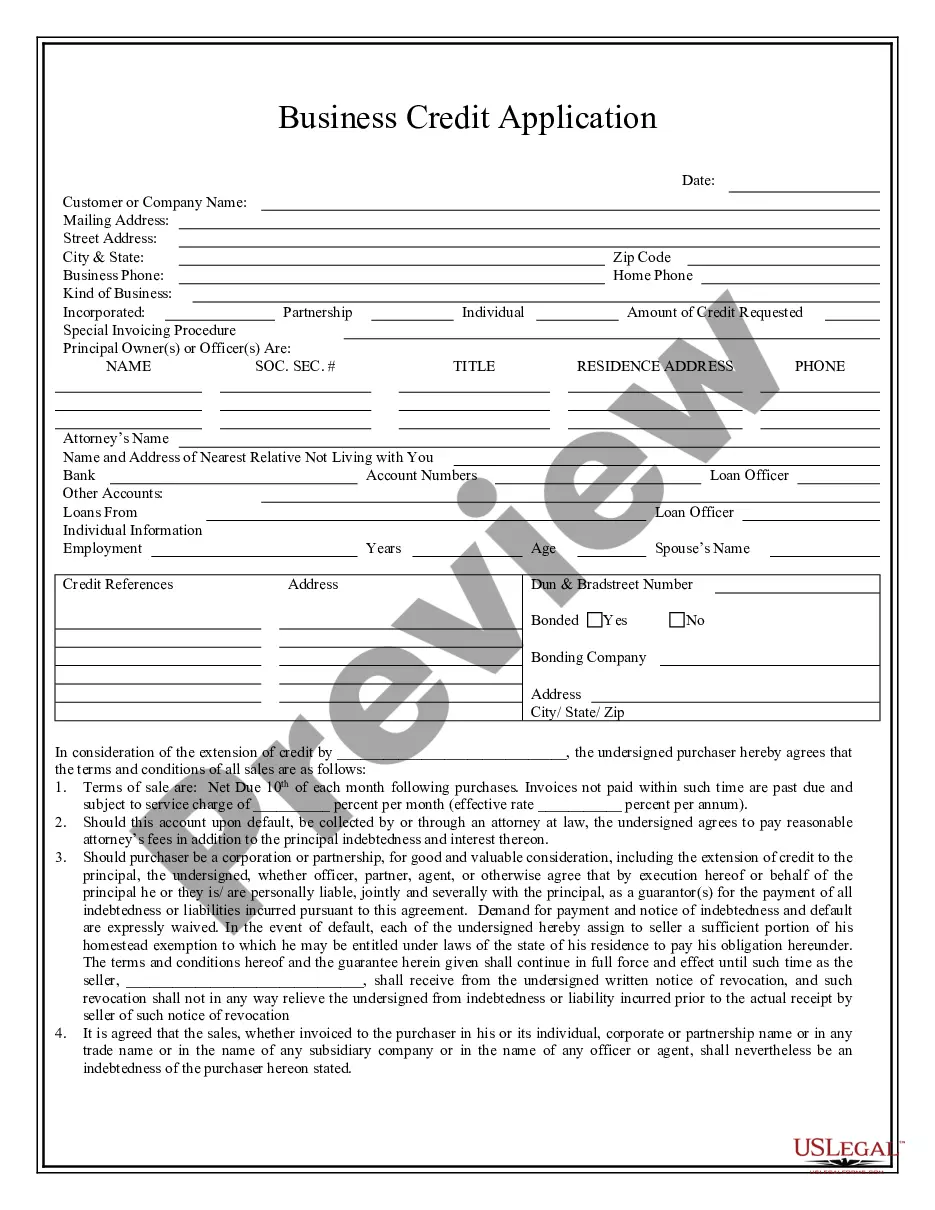

A wraparound mortgage is a junior encumbrance that is ordinarily made when property will support additional financing, and the mortgagor does not want to prepay a favorable existing mortgage obligation but needs additional cash, or where the existing obligation precludes prepayment or contains an excessive prepayment penalty. In such an instrument, the wraparound beneficiary charges interest on the entire amount of the wraparound loan and agrees to make the principal and interest payments on the existing prior encumbrance as it collects principal and interest payments from the mortgagor.

Wraparound Mortgage

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Wraparound Mortgage?

Aren't you sick and tired of choosing from numerous samples each time you need to create a Wraparound Mortgage? US Legal Forms eliminates the lost time millions of American citizens spend browsing the internet for suitable tax and legal forms. Our expert team of attorneys is constantly upgrading the state-specific Templates catalogue, so that it always provides the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have a subscription need to complete easy steps before having the ability to get access to their Wraparound Mortgage:

- Utilize the Preview function and look at the form description (if available) to be sure that it is the right document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right sample to your state and situation.

- Utilize the Search field at the top of the page if you have to look for another document.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your sample in a required format to complete, create a hard copy, and sign the document.

After you have followed the step-by-step recommendations above, you'll always have the capacity to sign in and download whatever document you require for whatever state you need it in. With US Legal Forms, finishing Wraparound Mortgage templates or other official documents is not difficult. Get going now, and don't forget to double-check your samples with accredited attorneys!

Form popularity

FAQ

A loan which wraps an existing loan with a new loan allowing the borrower to make one payment is called a(n): all-inclusive trust deed (AITD). When borrowing under a Cal-Vet loan, the buyer: receives title after completely paying off the loan.

Wraparound mortgages are a form of seller financing where Instead of applying for a conventional bank mortgage, a buyer will sign a mortgage with the seller. The seller then takes the place of the bank and accepts payments from the new owner of the property.

A wrap-around loan takes into account the remaining balance on the seller's existing mortgage at its contracted mortgage rate and adds an incremental balance to arrive at the total purchase price. In a wrap-around loan, the seller's base rate of interest is based on the terms of the existing mortgage loan.

A wrap-around loan allows a homebuyer to purchase a home without having to get a mortgage from an institutional lender, such as a bank or credit union.Wrap-around mortgages can help buyers with bad credit and helps sellers who otherwise may have a hard time selling their home to traditionally financed buyers.

Under a wrap, a seller accepts a secured promissory note from the buyer for the amount due on the underlying mortgage plus an amount up to the remaining purchase money balance. The new purchaser makes monthly payments to the seller, who is then responsible for making the payments to the underlying mortgagee(s).

A wrap-around loan takes into account the remaining balance on the seller's existing mortgage at its contracted mortgage rate and adds an incremental balance to arrive at the total purchase price. In a wrap-around loan, the seller's base rate of interest is based on the terms of the existing mortgage loan.

Are Wrap-Around Mortgages Legal? Yes, wrap-around mortgages are generally held to be legal.One of the main concerns involves the increased use of due on sale clauses in many mortgage agreements. A due-on-sale clause basically requires the borrower to pay the entire balance of a loan whenever the property has sold.

Are Wrap-Around Mortgages Legal? Yes, wrap-around mortgages are generally held to be legal.One of the main concerns involves the increased use of due on sale clauses in many mortgage agreements. A due-on-sale clause basically requires the borrower to pay the entire balance of a loan whenever the property has sold.

A wraparound mortgage is a type of junior loan which wraps or includes, the current note due on the property. The wraparound loan will consist of the balance of the original loan plus an amount to cover the new purchase price for the property. These mortgages are a form of secondary financing.