This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Santa Clarita California Net Loss From a Trade or Business-Standard Account

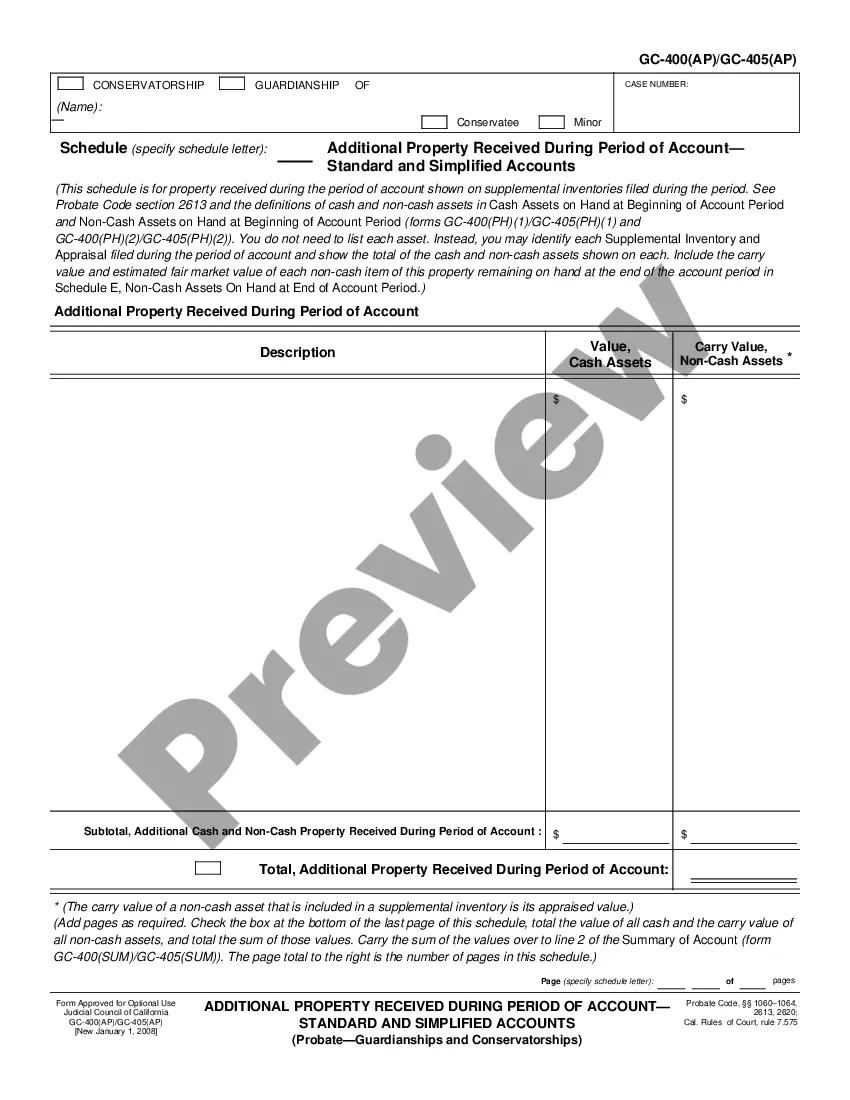

Description

How to fill out California Net Loss From A Trade Or Business-Standard Account?

Do you require a reliable and budget-friendly provider of legal forms to purchase the Santa Clarita California Net Loss From a Trade or Business-Standard Account? US Legal Forms is your ideal choice.

Whether you’re looking for a straightforward arrangement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce through the court, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business purposes. All templates we provide are not generic and are structured according to the requirements of individual states and regions.

To obtain the document, you must Log In to your account, locate the necessary form, and click the Download button next to it. Please note that you can access your previously acquired form templates at any time from the My documents section.

Are you unfamiliar with our website? No problem. You can set up an account in minutes, but before that, ensure to do the following.

Now you can create your account. Then select the subscription plan and proceed with payment. Once the payment is completed, download the Santa Clarita California Net Loss From a Trade or Business-Standard Account in any available format. You can return to the website at any time and redownload the document at no cost.

Obtaining up-to-date legal documents has never been simpler. Try US Legal Forms today and stop wasting hours studying legal paperwork online for good.

- Check whether the Santa Clarita California Net Loss From a Trade or Business-Standard Account complies with the laws of your state and locality.

- Review the form’s details (if available) to determine who and what the document is suitable for.

- Restart the search if the form does not fit your legal needs.

Form popularity

FAQ

As of 2024, California continues to allow net operating loss deductions, but the rules may vary based on the applicable tax changes. Businesses in Santa Clarita California net loss from a trade or business-standard account should stay updated on any changes in legislation that could affect their filings. Knowing the latest information is crucial for maximizing the benefits of NOLs. US Legal Forms can be a valuable resource to help clarify these ever-changing regulations.

The NOL rule in California allows businesses to deduct their net operating losses from their taxable income. This can provide a significant advantage for businesses facing financial challenges in Santa Clarita California net loss from a trade or business-standard account. It's important to note that there are specific rules and limitations based on the tax year and the business structure. For expert insights, consider exploring the solutions offered by US Legal Forms.

California does not conform to the 80% net operating loss limitation established by the federal government. This means businesses can often use their NOLs more effectively in Santa Clarita California net loss from a trade or business-standard account without the federal caps. However, keeping up with the intricacies of tax regulations is paramount. For guidance, the US Legal Forms platform provides resources that can help you navigate these complexities.

California suspended the NOL carryover deduction for tax years 2020 and 2021. This suspension can significantly impact businesses in Santa Clarita California net loss from a trade or business-standard account as it limits the ability to offset taxable income in those years. Understanding these changes is essential for effective tax planning. Always consider consulting with experts for personalized advice.

California Form 3805Q is used to report losses from passive activities, particularly for individuals and partnerships. This form helps taxpayers detail their passive activity losses and properly manage NOL claims. For anyone dealing with Santa Clarita California net loss from a trade or business-standard account, understanding how to fill out Form 3805Q provides clarity and accuracy in your reporting, and uslegalforms offers tools to help with this process.

The NOL utilization 80% rule refers to the limit placed on how much of your net operating loss you can apply against your taxable income in California. Specifically, taxpayers can only apply up to 80% of their taxable income with their NOL. Recognizing this rule is vital for managing your Santa Clarita California net loss from a trade or business-standard account effectively, and uslegalforms can provide detailed assistance.

The limitation on business losses in California is primarily tied to the overall NOL regulations, specifically the 80% utilization rule. Taxpayers must be mindful that they cannot utilize their entire business loss in a single year. Understanding these limitations can significantly impact your Santa Clarita California net loss from a trade or business-standard account, making services like uslegalforms valuable for thorough guidance.

California does allow for net operating losses, but with specific constraints. Taxpayers can carry forward their NOLs to future tax years but are limited in how much they can utilize each year. Recognizing how Santa Clarita California net loss from a trade or business-standard account applies to your situation is essential, and using resources such as uslegalforms can help clarify your eligibility.

Yes, California does indeed limit the use of net operating losses. Specifically, taxpayers are restricted to carrying forward NOLs without the ability to carry them back, along with the aforementioned 80% limit on income offsets. Being aware of these limitations is essential for effectively managing your Santa Clarita California net loss from a trade or business-standard account, and platforms like uslegalforms can assist you with the process.

In California, the primary limitation on NOL utilization is that taxpayers cannot use NOLs to offset more than 80% of their taxable income. This limitation is crucial to understand for those reporting Santa Clarita California net loss from a trade or business-standard account. To navigate this limitation effectively, resources from platforms like uslegalforms can streamline your tax preparation.