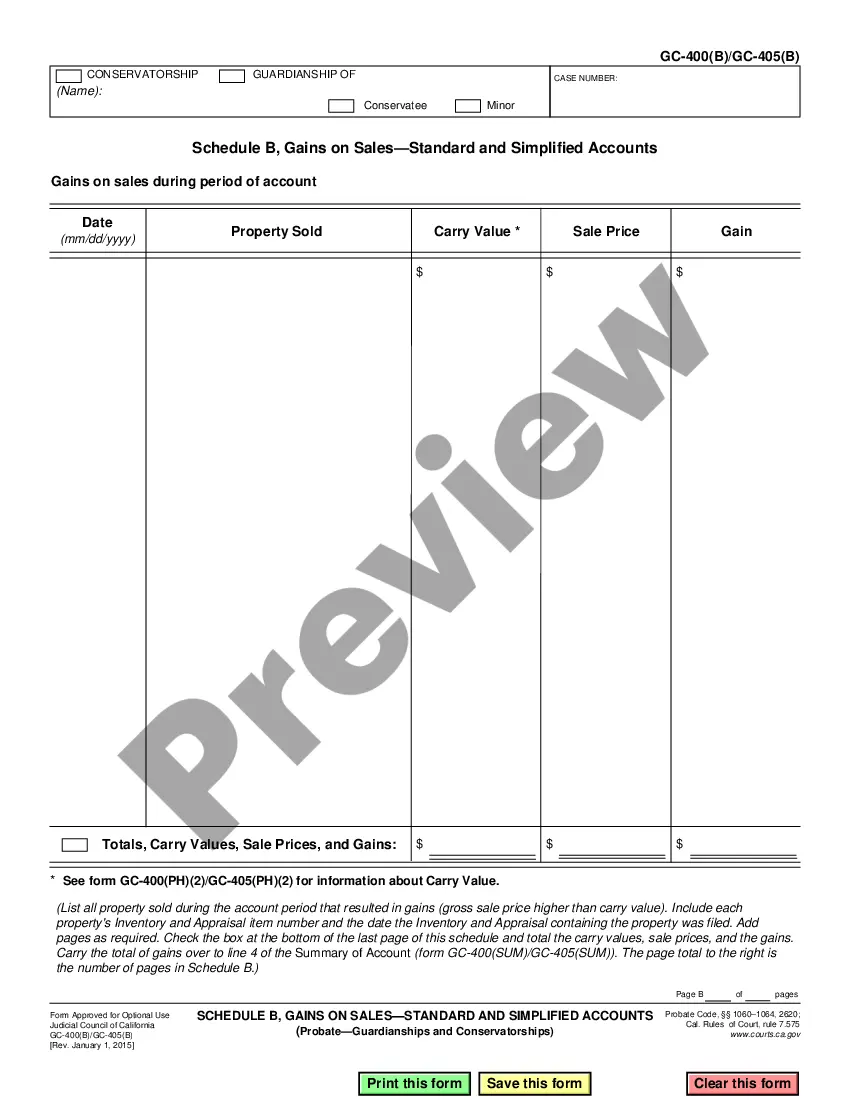

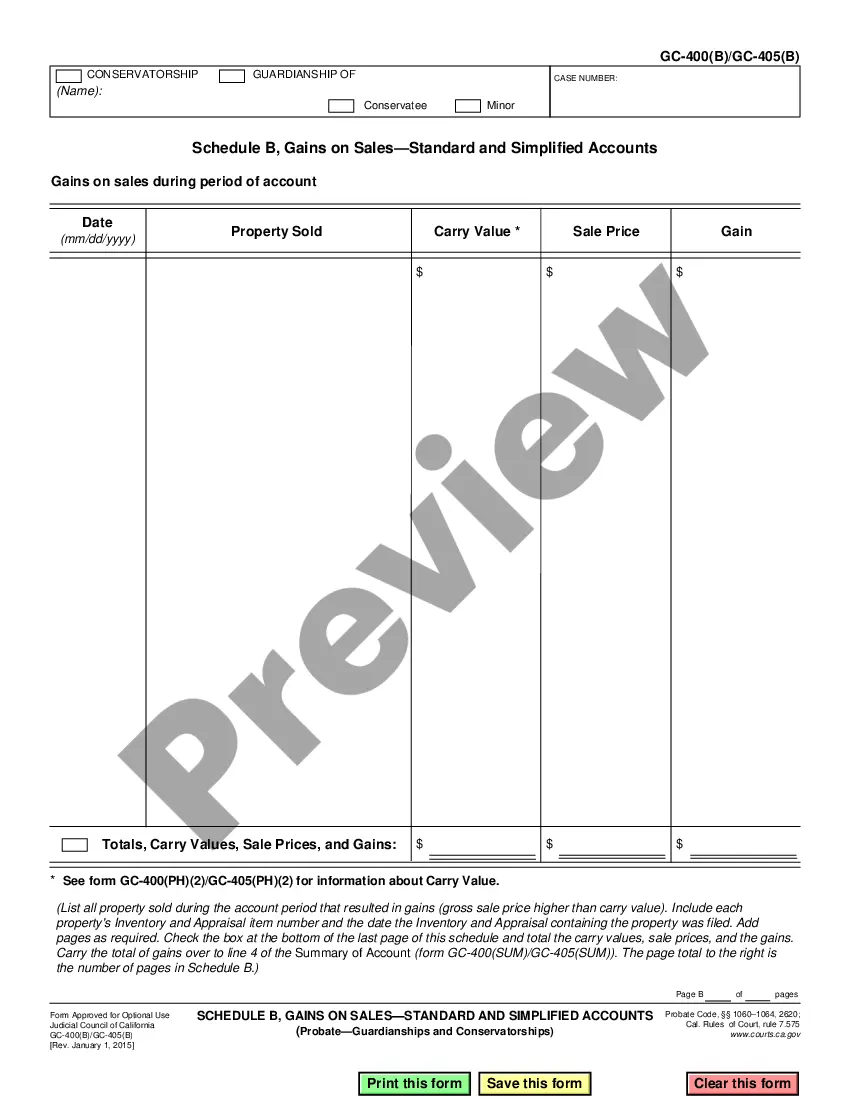

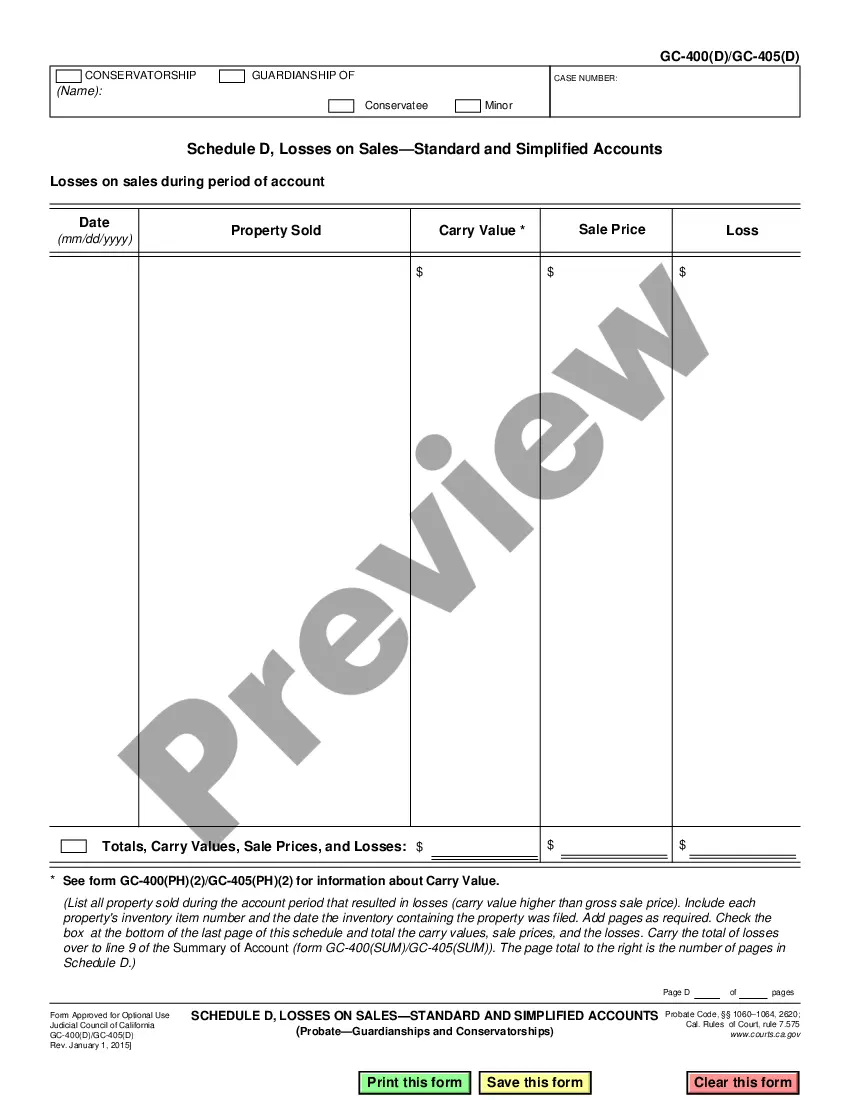

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Orange California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D)

Description

How to fill out California Schedule D, Losses On Sales-Standard And Simplified Accounts 405(D)?

If you have previously utilized our service, Log In to your account and download the Orange California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) to your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it as per your payment arrangement.

If this is your first time using our service, follow these straightforward steps to acquire your document.

You have continuous access to all documents you have purchased: you can find them in your profile under the My documents section whenever you wish to reuse them. Utilize the US Legal Forms service to swiftly locate and save any template for your personal or business requirements!

- Ensure you have located the correct document. Review the description and utilize the Preview feature, if available, to verify that it satisfies your requirements. If it’s not suitable, use the Search tab above to find the right one.

- Buy the template. Click the Buy Now button and opt for a monthly or yearly subscription plan.

- Create an account and submit payment. Enter your credit card information or select the PayPal option to finalize the transaction.

- Access your Orange California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D). Choose the file format for your document and save it to your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

To figure out California capital loss carryover, first, calculate your total capital gains and losses for the year. If your capital losses exceed capital gains, you can carry over the unused portion to future years. By carefully documenting this on your Orange California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D), you ensure that you optimize your tax strategy over time. US Legal Forms provides resources to assist you in understanding and completing your tax forms accurately.

A Schedule D is a form used by taxpayers to report capital gains and losses in their annual income tax returns. It outlines the financial details regarding sales or exchanges of assets, showing how losses can be claimed. Utilizing the Orange California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) allows you to document your losses systematically, ensuring compliance while maximizing your tax benefits.