This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

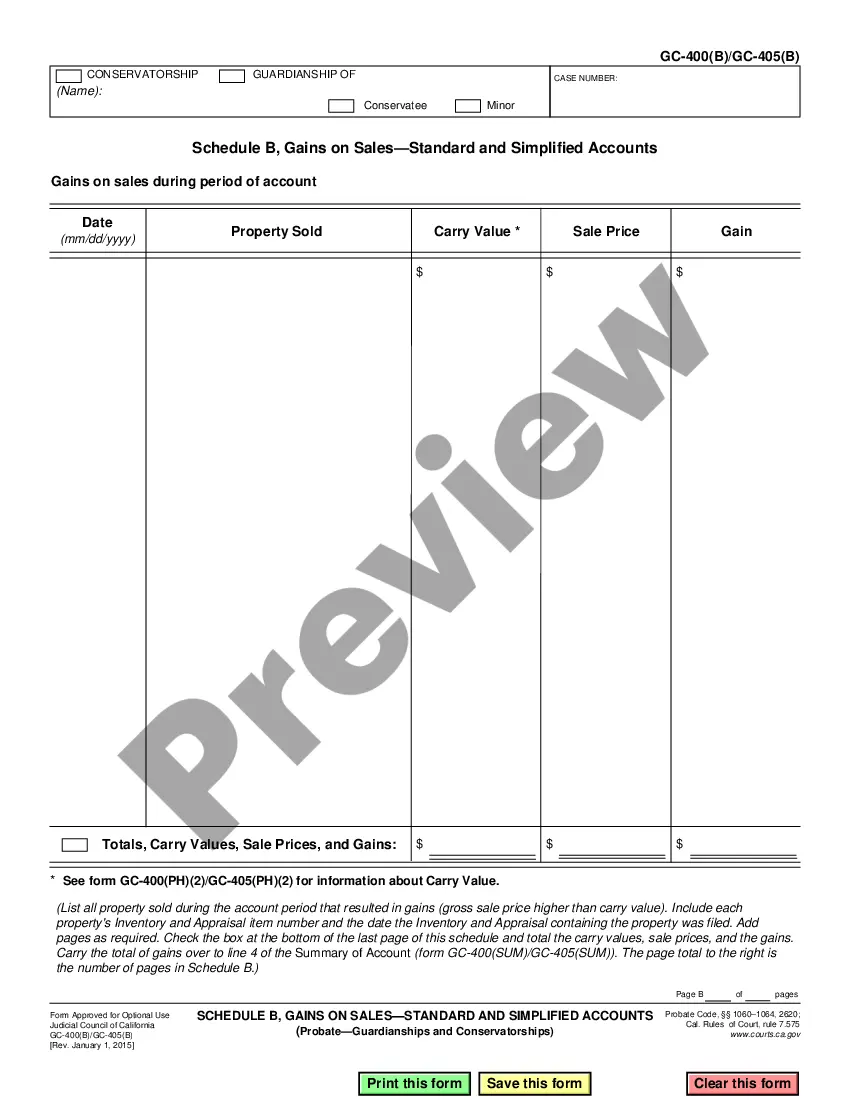

Fontana California Schedule B, Gains on Sales-Standard and Simplified Accounts

Description

How to fill out California Schedule B, Gains On Sales-Standard And Simplified Accounts?

Are you seeking a trustworthy and affordable provider of legal forms to purchase the Fontana California Schedule B, Gains on Sales-Standard and Simplified Accounts? US Legal Forms is your ideal choice.

Whether you need a basic contract to establish guidelines for living together with your partner or a collection of documents to facilitate your separation or divorce through the courts, we have everything you need. Our platform offers more than 85,000 current legal document templates for both personal and business applications. All the templates we provide are not generic and are structured in accordance with the regulations of various states and counties.

To retrieve the form, you must Log In to your account, find the required form, and click on the Download button next to it. Please note that you can retrieve your previously acquired form templates at any time from the My documents section.

Are you unfamiliar with our platform? No problem. You can easily create an account, but first, ensure you complete the following steps.

Now you may create your account. After that, choose a subscription plan and proceed with the payment. Once the payment is finalized, download the Fontana California Schedule B, Gains on Sales-Standard and Simplified Accounts in any format you choose. You can revisit the site anytime to redownload the document at no additional cost.

Obtaining current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your valuable time searching for legal documents online once and for all.

- Verify that the Fontana California Schedule B, Gains on Sales-Standard and Simplified Accounts meets the regulations of your state and locality.

- Review the details of the form (if accessible) to understand its intended purpose and appropriateness.

- Initiate the search again if the form does not suit your particular circumstance.

Form popularity

FAQ

Schedule B for California sales tax helps taxpayers report their qualifying sales that could affect tax obligations. It's essential for businesses to correctly fill this out to avoid potential penalties and ensure they are paying the correct amount of tax. For guidance, platforms like US Legal Forms can assist you in understanding the nuances of Fontana California Schedule B, Gains on Sales-Standard and Simplified Accounts.

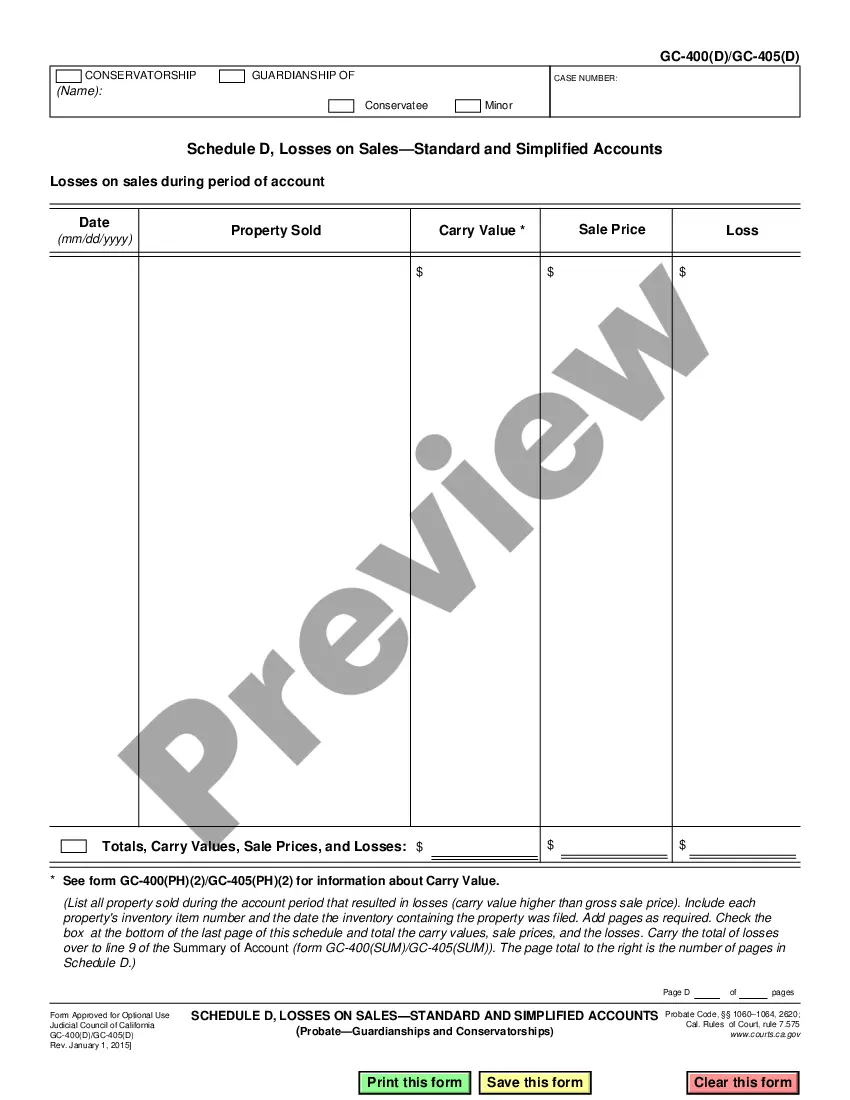

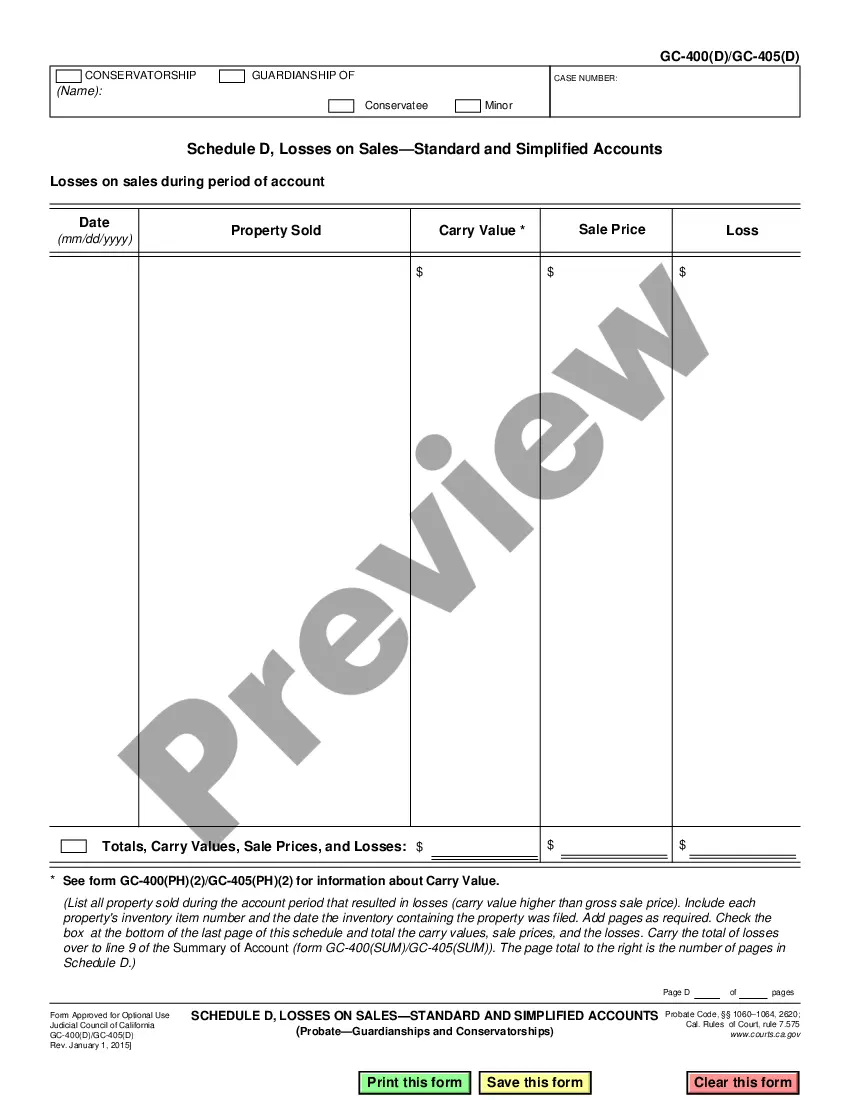

Schedule B on the California sales tax return details specific sales or transactions that may be subject to different tax rates or exemptions. Completing this schedule accurately ensures compliance with California tax laws and proper allocation of sales tax. Maintaining good records will facilitate this process, particularly when navigating Fontana California Schedule B, Gains on Sales-Standard and Simplified Accounts.

California sales tax includes various components, such as the state rate, local taxes, and district taxes. These funds support various public services and infrastructure projects. Knowing the components of sales tax can help you better manage your finances, especially when dealing with Fontana California Schedule B, Gains on Sales-Standard and Simplified Accounts.

Schedule B is a form that taxpayers use to report interest and dividend income. This schedule helps the IRS keep track of your investment income and ensures correct taxation. If you have sales related income, understanding how this interacts with Fontana California Schedule B, Gains on Sales-Standard and Simplified Accounts is crucial.

In California, the general fund portion of the sales tax is typically around 1%. This portion helps fund critical state services, such as education, public safety, and health services. It's important to be aware of how this tax impacts your business or personal finances, especially when exploring Fontana California Schedule B, Gains on Sales-Standard and Simplified Accounts.

It is only required when the total exceeds certain thresholds. In 2021 for example, a Schedule B is only necessary when you receive more than $1,500 of taxable interest or dividends.

The use tax generally applies to the storage, use, or other consumption in California of goods purchased from retailers in transactions not subject to the sales tax. Use tax may also apply to purchases shipped to a California consumer from another state, including purchases made by mail order, telephone, or Internet.

If you are a nonresident, you will not pay California tax on income from stocks, bonds, notes, or other intangible personal property unless (1) the property has its business situs in California (meaning, it is located by here by law), or (2) you regularly, systematically, and continuously buy and sell such property in

Even if you did not receive a Form 1099-INT, or if you received interest under $10 for the tax year, you are still required to report any interest earned and credited to your account during the year. The interest earned is entered in the Investment Income section of the program.

Some items are exempt from sales and use tax, including: Sales of certain food products for human consumption (many groceries) Sales to the U.S. Government. Sales of prescription medicine and certain medical devices.