This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

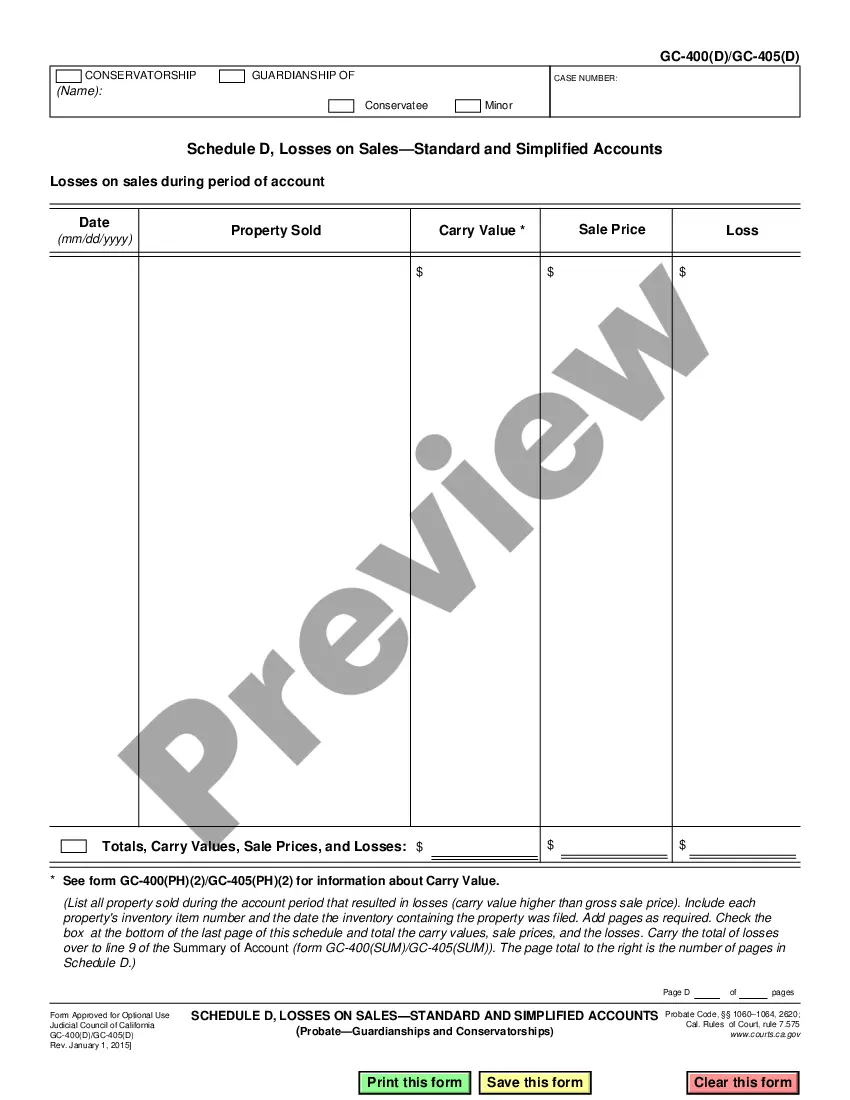

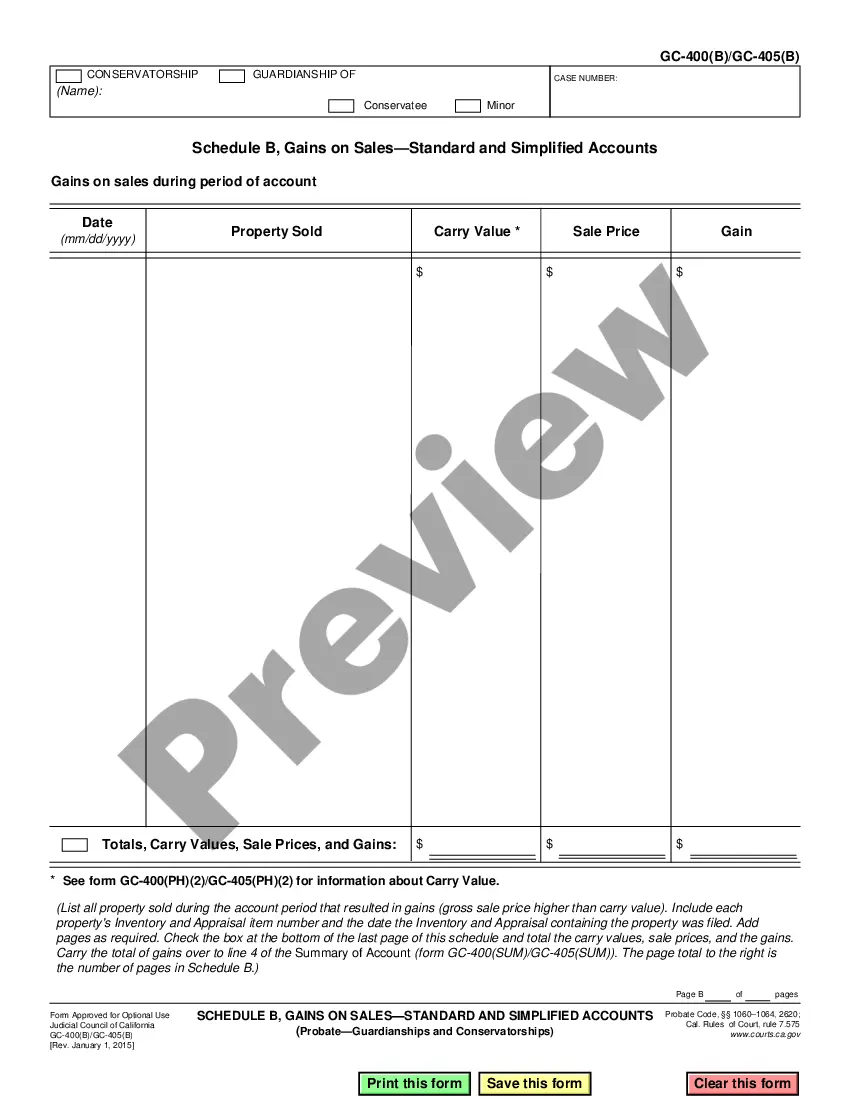

Contra Costa California Schedule B, Gains on Sales-Standard and Simplified Accounts

Description

How to fill out California Schedule B, Gains On Sales-Standard And Simplified Accounts?

Regardless of social or occupational rank, filling out legal documents is a regrettable requirement in the contemporary world.

Frequently, it’s nearly impossible for individuals without a legal background to create such forms independently, primarily due to the intricate language and legal subtleties they entail.

This is where US Legal Forms can be a lifesaver.

Ensure the document you have selected is tailored to your area since the laws of one state or county may not apply to another state or county.

Examine the document and read any brief description (if available) of situations for which the paper can be utilized.

- Our platform provides an extensive archive with more than 85,000 state-specific templates that cater to nearly any legal situation.

- US Legal Forms is also a fantastic tool for associates or legal advisors who aim to enhance their efficiency in managing time with our DIY papers.

- Whether you require the Contra Costa California Schedule B, Gains on Sales-Standard and Simplified Accounts or any other documentation that will be applicable in your state or county, with US Legal Forms, everything is accessible.

- Here’s how to acquire the Contra Costa California Schedule B, Gains on Sales-Standard and Simplified Accounts within minutes using our reliable platform.

- If you are already a member, feel free to Log In to your account to retrieve the necessary form.

- However, if you are new to our collection, be sure to follow these guidelines before obtaining the Contra Costa California Schedule B, Gains on Sales-Standard and Simplified Accounts.

Form popularity

FAQ

California Schedule B is a supplementary form used to assist taxpayers in reporting their sales transactions accurately. It is integral for distinguishing between taxable and non-taxable sales. For businesses, understanding Schedule B is essential for managing the Contra Costa California Schedule B, Gains on Sales-Standard and Simplified Accounts.

California sales tax applies to most transactions involving the sale of tangible personal property. This includes items sold online or in stores, but certain services and goods are exempt. Knowing what qualifies for sales tax is important for preparing your Contra Costa California Schedule B, Gains on Sales-Standard and Simplified Accounts.

Currently, the city with the highest sales tax in California is Los Angeles, where the rate exceeds 10.25%. This higher tax burden can impact businesses operating in the area. Understanding local sales tax variations is essential for compliance, particularly for those filing the Contra Costa California Schedule B, Gains on Sales-Standard and Simplified Accounts.

Worksheet B serves as a preparatory tool for businesses reporting sales tax obligations in California. It helps organize sales data and categorize transactions effectively. By using Worksheet B, business owners can ensure they accurately complete the Contra Costa California Schedule B, Gains on Sales-Standard and Simplified Accounts.

The Schedule B form is utilized to document and report sales of tangible personal property in California. It helps businesses identify the type of items sold and the corresponding tax due. Proper use of Schedule B can streamline your tax process, especially for those working with the Contra Costa California Schedule B, Gains on Sales-Standard and Simplified Accounts.

Schedule B in California sales tax refers to a specific form used for reporting sales and transactions. It aids in determining taxable and exempt sales, making it essential for accurate tax filings. Using Schedule B correctly can prevent errors in your Contra Costa California Schedule B, Gains on Sales-Standard and Simplified Accounts.

The California sales tax base includes the total amount charged for taxable goods and services. This base does not cover certain exempt items like food and prescription medicines. Identifying the correct sales tax base is important for proper reporting, especially when dealing with Contra Costa California Schedule B, Gains on Sales-Standard and Simplified Accounts.

While California's base sales tax rate is 7.25%, local additions can raise this to approximately 10.25% in many areas, including Contra Costa County. Therefore, it's crucial to be aware of local rates when calculating sales tax. Accurately applying sales tax ensures compliance, particularly for those completing the Contra Costa California Schedule B, Gains on Sales-Standard and Simplified Accounts.

In Concord, California, the sales tax mirrors that of Contra Costa County, which is currently 10.25%. This rate applies to most taxable goods and services sold in the city. Knowing the sales tax rate in Concord is particularly useful for accountants and business owners working with the Contra Costa California Schedule B, Gains on Sales-Standard and Simplified Accounts.

In California, sales tax is collected at the point of sale by retailers. Retailers are responsible for reporting and remitting collected sales tax to the state. This collection process is vital, especially for businesses preparing their Contra Costa California Schedule B, Gains on Sales-Standard and Simplified Accounts.