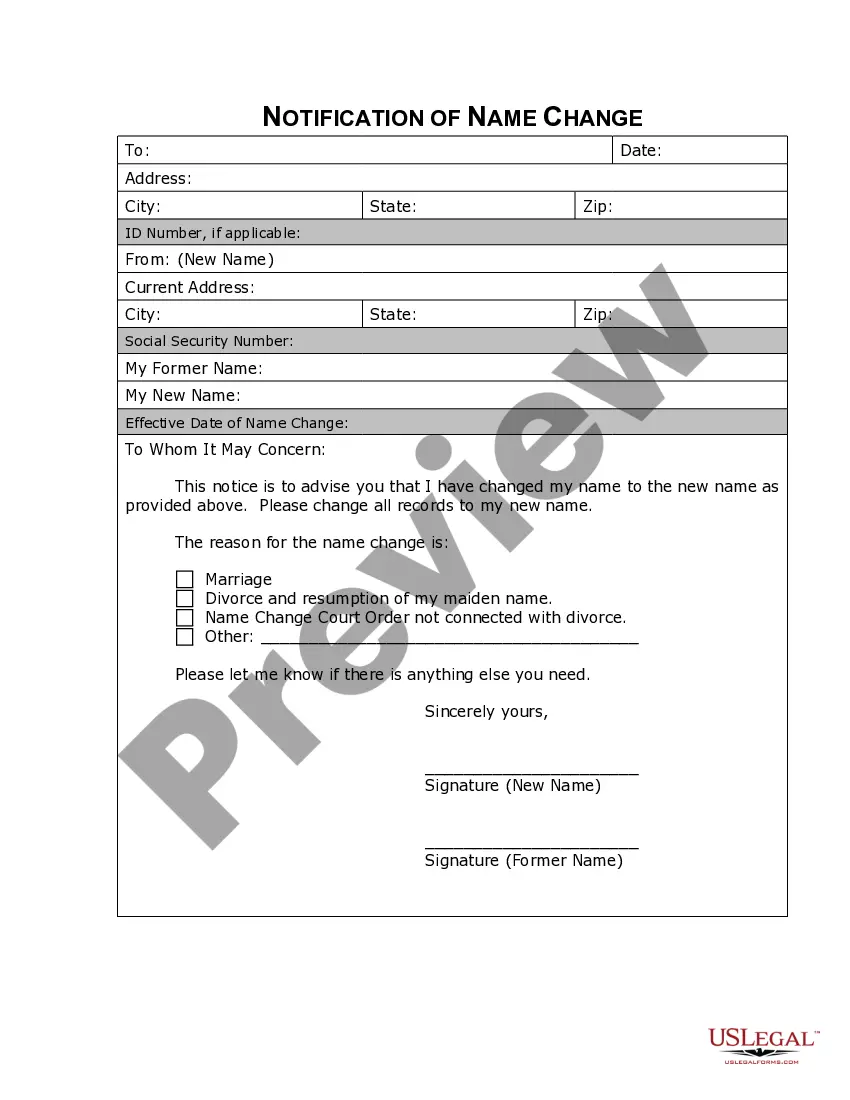

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Thousand Oaks California Non-Foreign Affidavit Under IRC 1445

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

We consistently endeavor to reduce or avert legal repercussions when handling intricate legal or financial matters.

To achieve this, we seek legal options that, by and large, can be quite pricey.

Nevertheless, not every legal issue is of equal complexity.

The majority can be managed independently.

Take advantage of US Legal Forms whenever you require to obtain and download the Thousand Oaks California Non-Foreign Affidavit Under IRC 1445 or any other document easily and securely.

- US Legal Forms is a digital repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to take control of your affairs without needing to consult legal professionals.

- We offer access to legal document templates that are not always readily available.

- Our templates cater to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

According to FIRPTA, a foreign person includes non-U.S. citizens, non-permanent residents, and foreign corporations or partnerships. If you do not have U.S. citizenship or residency, you are likely classified as a foreign person. In the context of a property sale in Thousand Oaks, California, understanding your status will help determine if a FIRPTA affidavit is necessary.

No, a FIRPTA affidavit does not need to be notarized to be considered valid under the current regulations. However, having the document notarized can add an extra layer of authenticity, which may be beneficial when handling real estate transactions in Thousand Oaks, California. It is always advisable to confirm specific requirements with a legal professional to ensure compliance.

To navigate around FIRPTA withholding, sellers can utilize an affidavit declaring their non-foreign status. This statement must meet the requirements set under IRC 1445 and clearly identify the seller's local residency. When selling property in Thousand Oaks, California, submitting a valid Thousand Oaks California Non-Foreign Affidavit Under IRC 1445 can exempt the seller from withholding obligations.

An example of a FIRPTA statement might include a declaration from a seller specifying their U.S. citizenship and attaching relevant documentation, like a Social Security number. In the case of a property sale in Thousand Oaks, California, this statement indicates to the buyer that no tax withholding is required. Crafting a detailed and accurate FIRPTA statement can streamline the closing process for everyone involved.

To create a FIRPTA affidavit, you must provide a declaration that states you are not a foreign person under the Foreign Investment in Real Property Tax Act. You will need to include your full name, address, and taxpayer identification number, along with specific details about the property in Thousand Oaks, California. This affidavit serves to inform the buyer that withholding is not necessary in your transaction.

Section 1445 of the Internal Revenue Code outlines the rules regarding the withholding tax on real estate sales by foreign individuals. This section is crucial for compliance, as it requires withholding unless a buyer obtains a Thousand Oaks California Non-Foreign Affidavit Under IRC 1445 from the seller. Knowing the provisions of this section can save parties from unexpected withholding tax liabilities.

IRS notice 1445 provides guidance on the requirements for withholding tax on foreign real estate transactions. It specifies that buyers must withhold a certain percentage unless they receive documentation, like a Thousand Oaks California Non-Foreign Affidavit Under IRC 1445, confirming the seller's non-foreign status. Understanding this notice is essential for both buyers and sellers in real estate transactions.

A Section 1445 affidavit serves as a declaration that a seller is a non-foreign person under the regulations of the Internal Revenue Code. By executing a Thousand Oaks California Non-Foreign Affidavit Under IRC 1445, sellers can protect themselves from FIRPTA withholding requirements. This affidavit must be completed accurately to avoid potential issues at the time of sale.

The IRC code 1445 refers to the Internal Revenue Code section that governs the withholding tax for foreign persons selling real estate in the United States. It mandates that buyers withhold taxes unless the seller can provide a Thousand Oaks California Non-Foreign Affidavit Under IRC 1445, confirming their non-foreign status. This section aims to ensure compliance with tax duties for foreign investors in U.S. real estate.

To avoid paying FIRPTA, you should consider obtaining a Thousand Oaks California Non-Foreign Affidavit Under IRC 1445. This affidavit can certify that you are a non-foreign person, thereby exempting you from the withholding tax associated with FIRPTA. Additionally, understanding the criteria for non-foreign status and ensuring your documentation is accurate can also help you navigate this process smoothly.