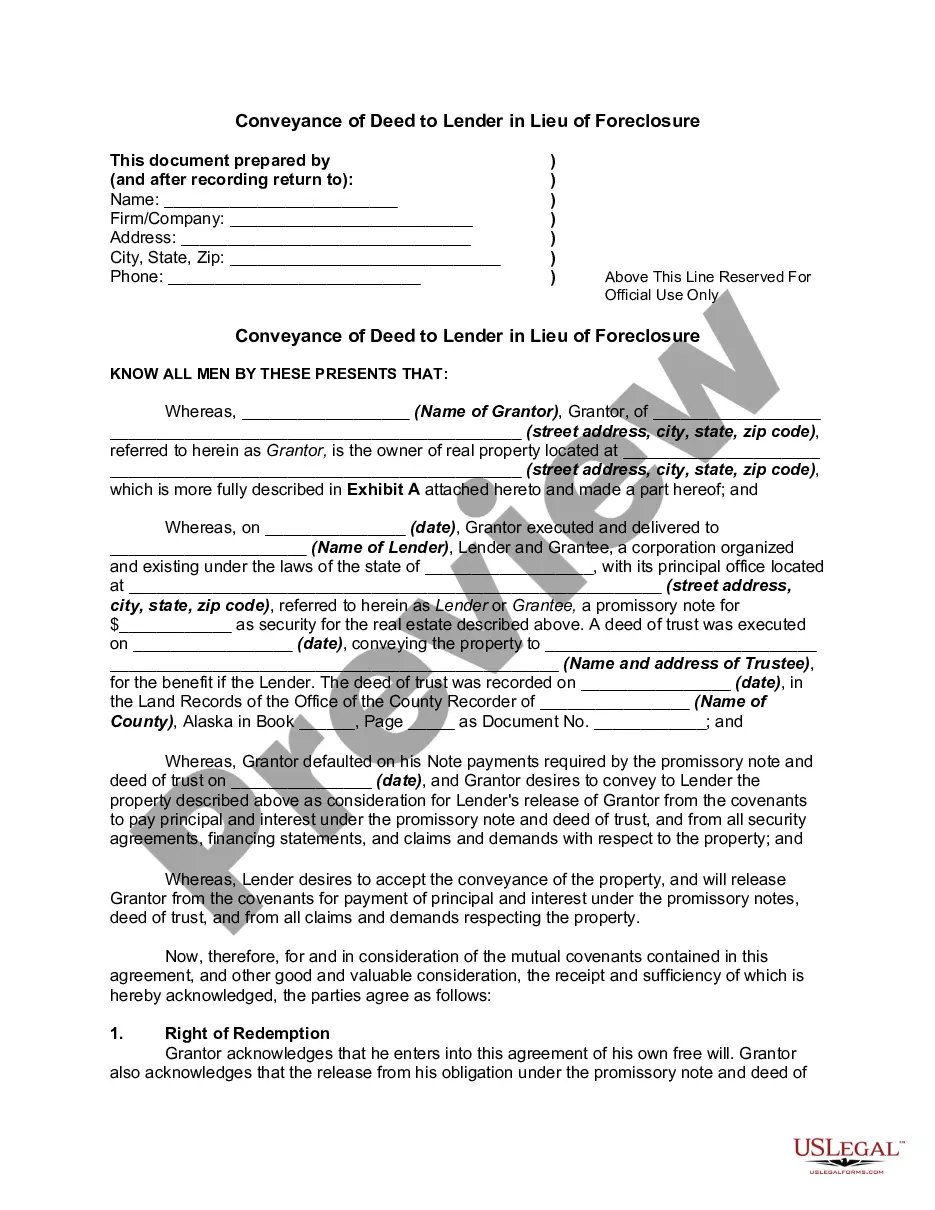

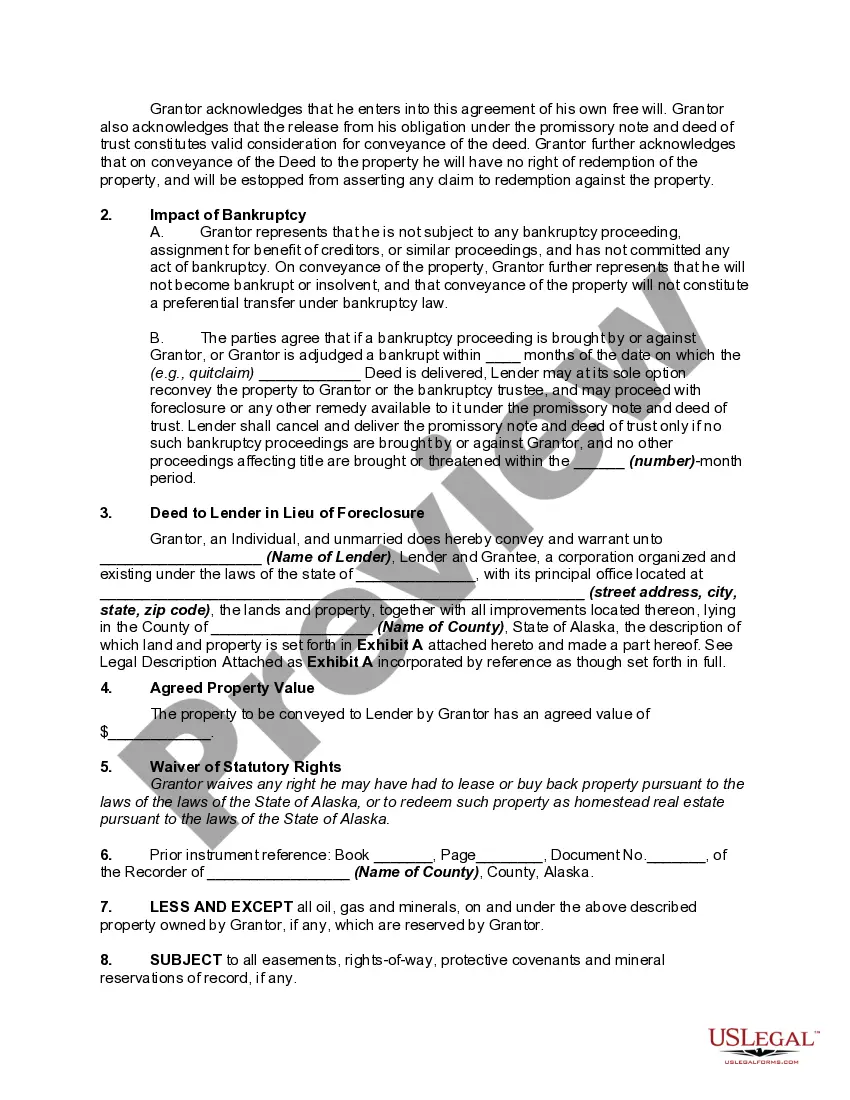

A deed in lieu of foreclosure is an agreement reached between a homeowner and a lender in which the homeowner turns over the deed to the home, and the lender agrees to halt foreclosure proceedings. Negotiating a deed in lieu of foreclosure agreement is a way to avoid foreclosure. As a general rule, in a deed in lieu of foreclosure settlement, the homeowner signs away the deed, giving the home to the lender, and the lender writes off the homeowner's debt, essentially canceling the mortgage or deed of trust.

Anchorage Alaska Conveyance of Deed to Lender in Lieu of Foreclosure

Description

How to fill out Alaska Conveyance Of Deed To Lender In Lieu Of Foreclosure?

If you are searching for a legitimate document, it’s challenging to discover a superior service than the US Legal Forms website – arguably the most extensive collections available online.

With this collection, you can locate a vast array of document samples for corporate and personal use categorized by types and states, or keywords.

With the efficient search functionality, locating the most recent Anchorage Alaska Conveyance of Deed to Lender in Lieu of Foreclosure is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal to finalize the registration process.

Obtain the form. Choose the format and download it to your device.

- Furthermore, the accuracy of every document is confirmed by a team of proficient attorneys who frequently assess the templates on our site and update them according to the latest state and county laws.

- If you are already familiar with our site and possess a registered account, simply Log In to your account and click the Download button to obtain the Anchorage Alaska Conveyance of Deed to Lender in Lieu of Foreclosure.

- If you are using US Legal Forms for the first time, just follow the guidelines below.

- Ensure you have located the sample you need. Review its description and utilize the Preview feature to examine its content. If it doesn’t fulfill your requirements, use the Search bar at the top of the page to find the desired document.

- Verify your selection. Click the Buy now button. Next, select the preferred subscription plan and provide your details to register for an account.

Form popularity

FAQ

If a lender accepts an Anchorage Alaska Conveyance of Deed to Lender in Lieu of Foreclosure, they may forgo the chance to recover legal fees and other costs associated with the foreclosure process. This choice can limit the lender's ability to maximize their recovery from the property. Moreover, lenders might take on the responsibility of property maintenance and related expenses after accepting the deed.

No, a lender is not obligated to accept a deed in lieu of foreclosure. Each lender has the authority to determine their policies regarding such transactions. Typically, lenders might prefer traditional foreclosure processes due to potential financial benefits, so it's essential for borrowers to understand that acceptance is at the lender's discretion.

When a lender accepts an Anchorage Alaska Conveyance of Deed to Lender in Lieu of Foreclosure, they may face the loss of potential recovery through the foreclosure process. Foreclosure can sometimes lead to greater financial returns if the property sells for more than the owed debt. Additionally, lenders may incur costs related to maintaining the property once they take ownership, which can impact their bottom line.

Negotiating a deed in lieu of foreclosure starts with understanding your financial position and the lender's needs. Prepare to present your case, demonstrating the benefits for both sides. A collaborative approach, often aided by a real estate professional, can help navigate the complexities. In Anchorage, Alaska, resources like US Legal Forms can support you in drafting the necessary documentation efficiently.

Obtaining a deed in lieu of foreclosure often requires patience, as it may take anywhere from a few weeks to a couple of months. Each situation is unique, based on how quickly negotiations progress and legal processes unfold. Engaging with local legal expertise ensures you handle the conveyance of deed to lender in lieu of foreclosure effectively, making the timeline more predictable.

The duration of the deed in lieu of foreclosure process can vary, typically taking a few weeks to several months. This timeframe hinges on factors like lender requirements and document preparation. After all parties reach an agreement, the necessary legal documents must be prepared and submitted. In Anchorage, Alaska, facilitating this process through a knowledgeable platform can streamline your experience.

Negotiating a deed in lieu of foreclosure involves discussing the terms with your lender to agree on a transfer of the property. Both parties must consider the home's value, outstanding mortgage, and any liens. This process requires clear communication and may necessitate assistance from a real estate attorney. For those in Anchorage, Alaska, understanding the local laws related to the conveyance of deed to lender in lieu of foreclosure is crucial.

A significant disadvantage of a deed in lieu of foreclosure is the potential tax implications. Homeowners may incur tax liabilities on the forgiven debt, classifying it as taxable income. This can complicate your financial situation further, reinforcing the importance of discussing all aspects of the Anchorage Alaska Conveyance of Deed to Lender in Lieu of Foreclosure with a financial advisor.

There are several disadvantages to a deed in lieu of foreclosure for homeowners. First, it can negatively impact your credit score, although less severely than a foreclosure. Additionally, you may still be held liable for any deficiency balance if the home's sale does not cover the remaining mortgage. Understanding these factors is crucial when considering the Anchorage Alaska Conveyance of Deed to Lender in Lieu of Foreclosure.

One major disadvantage for lenders accepting a deed in lieu of foreclosure is the potential for title issues. If there are any outstanding liens or claims on the property, the lender may face additional legal challenges down the line. Furthermore, it could also lead to decreased property values within the surrounding area, making the Anchorage Alaska Conveyance of Deed to Lender in Lieu of Foreclosure less favorable for lenders.