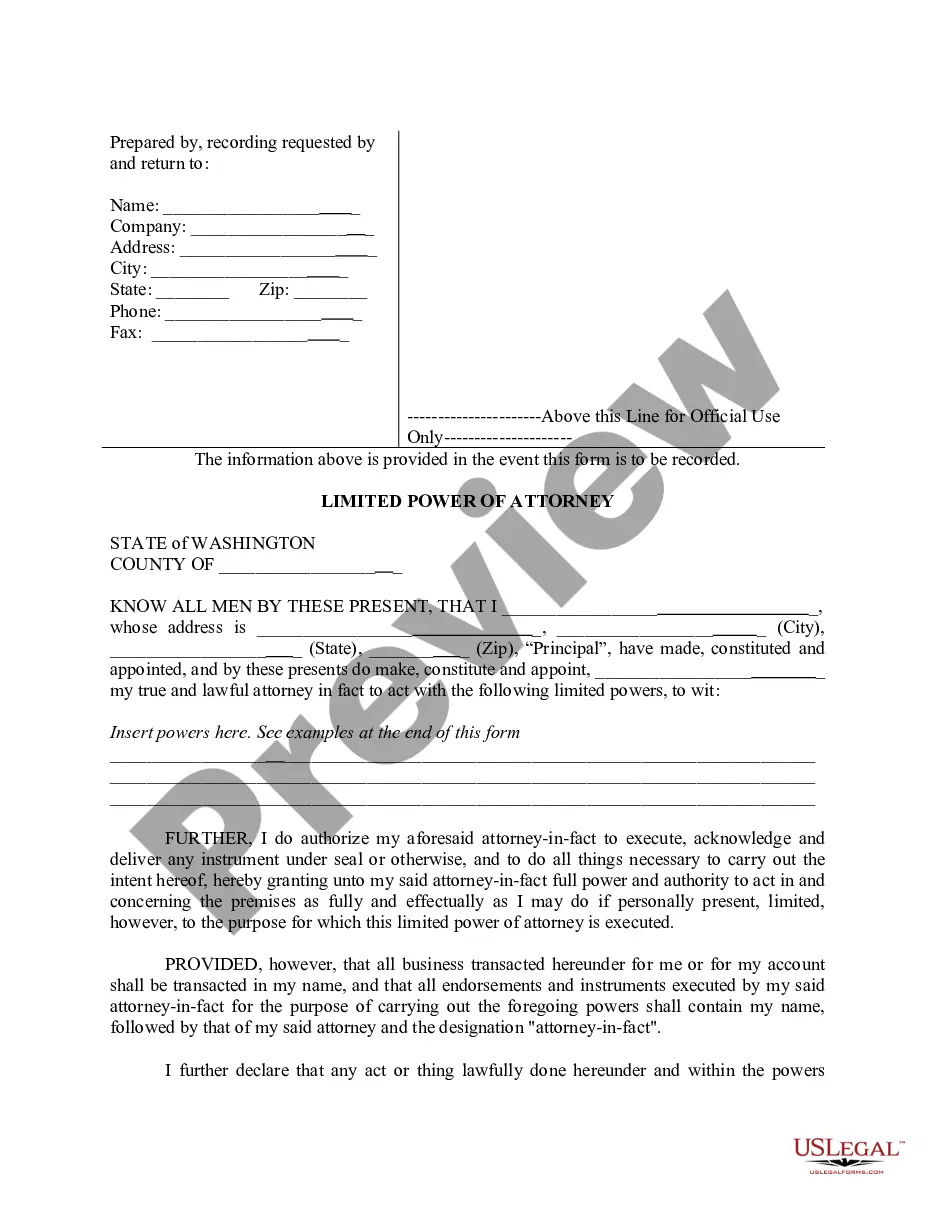

West Virginia Application for Refund of Fees Paid Electronically is an interactive online form used to request a refund for fees paid electronically for various state services. This form is available for use by the public, businesses, and government agencies. It is used to apply for a refund for fees paid via credit card, debit card, or electronic check for state services such as vehicle registration and driver’s license renewal. The West Virginia Application for Refund of Fees Paid Electronically includes fields for the applicant’s contact information, the type of service for which the fees were paid, the date of the transaction, the amount of the fees paid, and the reason for the refund request. There are two types of West Virginia Application for Refund of Fees Paid Electronically: one for individuals and one for businesses and government agencies.

West Virginia Application for Refund of Fees Paid Electronically

Description

How to fill out West Virginia Application For Refund Of Fees Paid Electronically?

How much time and resources do you often spend on drafting official documentation? There’s a greater option to get such forms than hiring legal specialists or spending hours browsing the web for a proper blank. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, including the West Virginia Application for Refund of Fees Paid Electronically.

To get and complete a suitable West Virginia Application for Refund of Fees Paid Electronically blank, follow these simple steps:

- Examine the form content to make sure it meets your state regulations. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your requirements, find another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the West Virginia Application for Refund of Fees Paid Electronically. If not, proceed to the next steps.

- Click Buy now once you find the right document. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely secure for that.

- Download your West Virginia Application for Refund of Fees Paid Electronically on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you securely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as often as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most trustworthy web solutions. Join us today!

Form popularity

FAQ

The typical refund timeframes for correctly filed returns are: For an e-filed return: Seven to 8 weeks after the acknowledgement is received from the state. For a paper return: Ten to 11 weeks after the return is received by the West Virginia Tax Division.

You may check on your refund on our MyTaxes website, or by going to our website at Tax.WV.Gov and clicking on the ?Where's My Refund? banner. You should receive your amended refund within 10-12 weeks from the date the amended return is filed.

If you e-filed your return and chose direct deposit to receive your refund, you'll usually receive your refund in 8-15 days. However, you should allow an extra 1-5 business days for your bank to process the funds. If you chose the Refund Transfer option, the refund will come from the Axos Bank®, not the IRS.

Form IT-140 is the Form used for the Tax Amendment. You can prepare a 2022 West Virginia Tax Amendment Form on eFile.com, however you cannot submit it electronically. In comparison, the IRS requires a different Form - Form 1040X - to amend an IRS return (do not use Form 1040 for an IRS Amendment).

The IRS has warned it can take as long as 6 months or more to process paper returns. In a best-case scenario, a paper tax return could have you waiting about four weeks for a refund, ing to the IRS.

You may also e-mail us questions at TaxHelp@WV.Gov, but please keep in mind that information submitted via e-mail is not encrypted and could possibly be seen by others on the Internet. Please take caution sharing personal, sensitive details like your Social Security number via e-mail.

How can I check the status of my refund? You can check the status of your refund online by using our Where's My Refund? web service. In order to view status information, you can visit our website at Tax.WV.Gov and click on the ?Where's My Refund? banner at the top of the page.

Assuming no issues, IRS issues tax refunds in less than 21 calendar days after IRS receives the tax return. IRS has an on-line tool, "Where's My Tax Refund", at .irs.gov that will provide the status of a tax refund using the taxpayer's SSN, filing status, and refund amount.