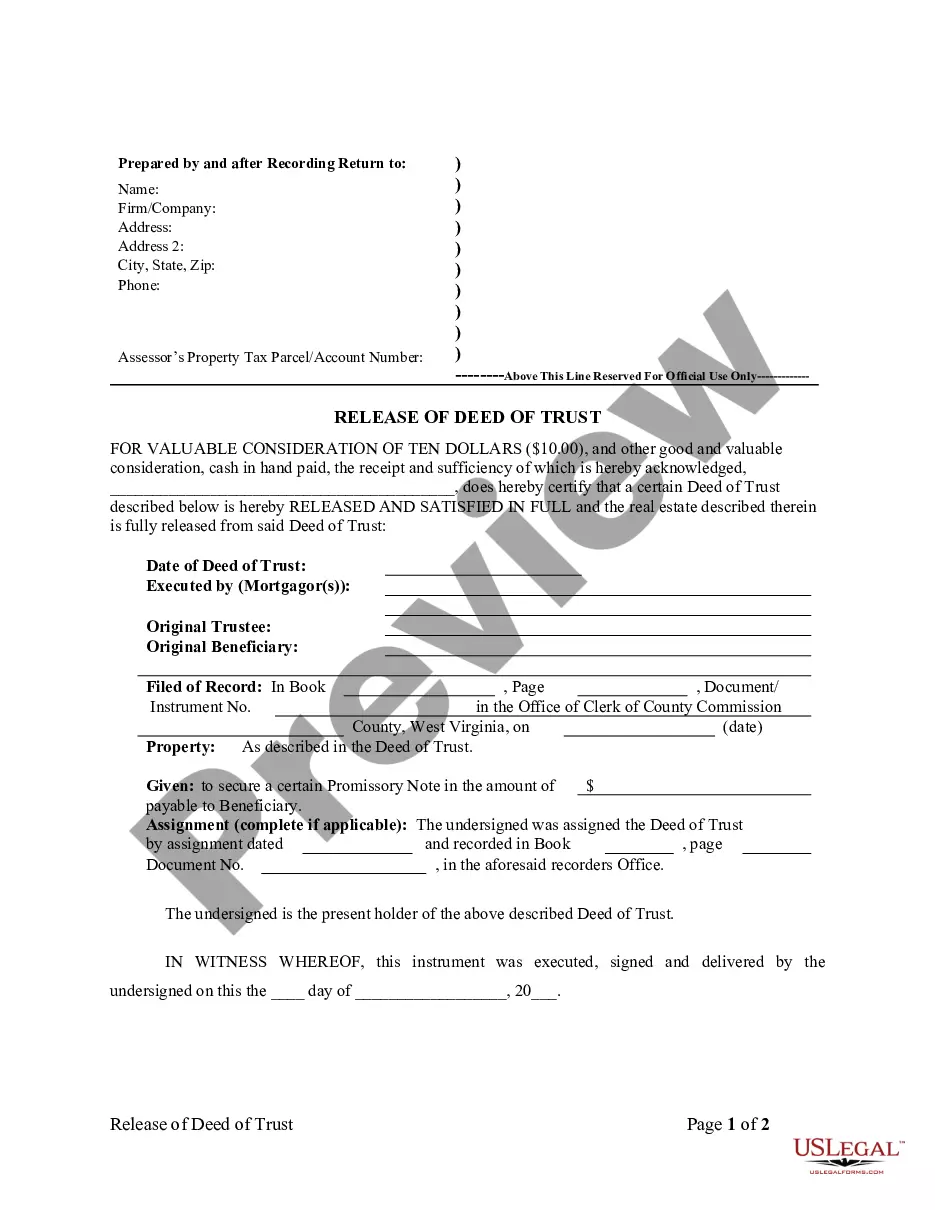

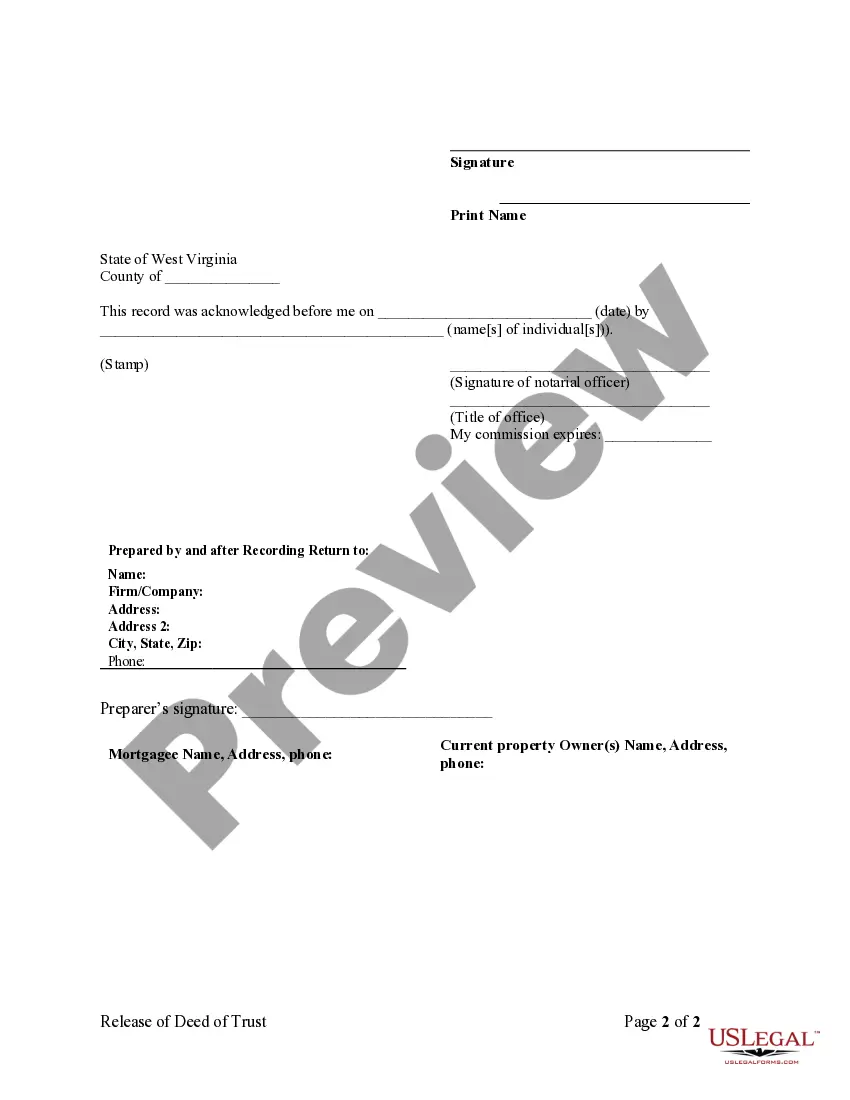

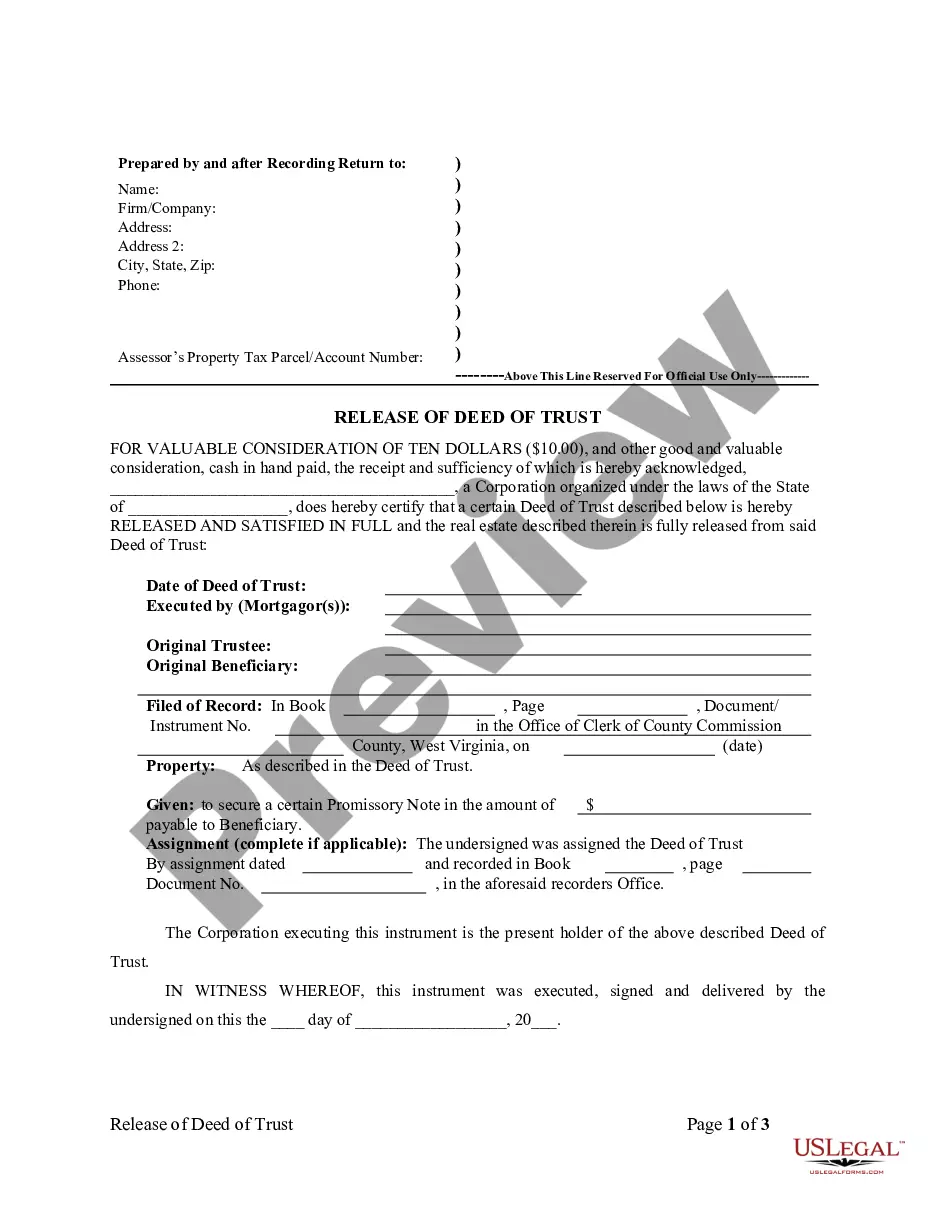

This Release - Satisfaction - Cancellation Deed of Trust - Individual Lender or Holder form is for the satisfaction or release of a deed of trust for the state of West Virginia by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

West Virginia Release - Satisfaction - Cancellation Deed of Trust - Individual Lender or Holder

Description

How to fill out West Virginia Release - Satisfaction - Cancellation Deed Of Trust - Individual Lender Or Holder?

Out of the multitude of services that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing templates before buying them. Its comprehensive catalogue of 85,000 templates is categorized by state and use for simplicity. All of the documents available on the platform have already been drafted to meet individual state requirements by accredited lawyers.

If you already have a US Legal Forms subscription, just log in, look for the template, hit Download and obtain access to your Form name in the My Forms; the My Forms tab keeps all of your saved forms.

Follow the tips listed below to obtain the document:

- Once you see a Form name, ensure it’s the one for the state you need it to file in.

- Preview the template and read the document description just before downloading the sample.

- Look for a new sample using the Search engine in case the one you have already found isn’t correct.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

Once you have downloaded your Form name, it is possible to edit it, fill it out and sign it in an web-based editor of your choice. Any form you add to your My Forms tab can be reused many times, or for as long as it remains to be the most updated version in your state. Our service provides quick and simple access to samples that fit both attorneys as well as their customers.

Form popularity

FAQ

According to independent rankings, the top states with the best trust laws are South Dakota trust law and Nevada in the US.

The trustee can use trust funds to pay filing fees, registration fees, title fees as necessary when transferring assets into the trust's name. If the trustee is responsible for investments, they can pay for management and trading fees with the trust's money.

Cash. There's no way to transfer actual cash to a living trust. You can, however, transfer ownership of a cash accountsavings account, money market account, or certificate of deposit, for exampleto your living trust. You can then name a beneficiary to receive the contents of the account.

Key Takeaways. Trust funds are designed to allow a person's money to continue to be useful well after they pass away. You can place cash, stock, real estate, or other valuable assets in your trust. A traditional irrevocable trust will likely cost a minimum of a few thousand dollars and could cost much more.

Cash Accounts. Rafe Swan / Getty Images. Non-Retirement Investment and Brokerage Accounts. Non-qualified Annuities. Stocks and Bonds Held in Certificate Form. Tangible Personal Property. Business Interests. Life Insurance. Monies Owed to You.

Putting money in a trust lets you pass property to someone in a structured way, where you can impose rules. For example, you might say that your beneficiary can't use these funds to pay off debt. Or, you might impose rules on how old the beneficiary needs to be before she gains control over the money.

Inheritance AdvantagesPutting your house in an irrevocable trust removes it from your estate. Unlike placing assets in an revocable trust, your house is safe from creditors and from estate tax. If you use an irrevocable bypass trust, it does the same for your spouse.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

A trustee has a duty to conform to the terms of the trust. Legally a trustee cannot spend money in a trust on themselves (unless the are also a beneficiary).