West Virginia Complaint for Wrongful Termination and Wage Payment and Collection

Description

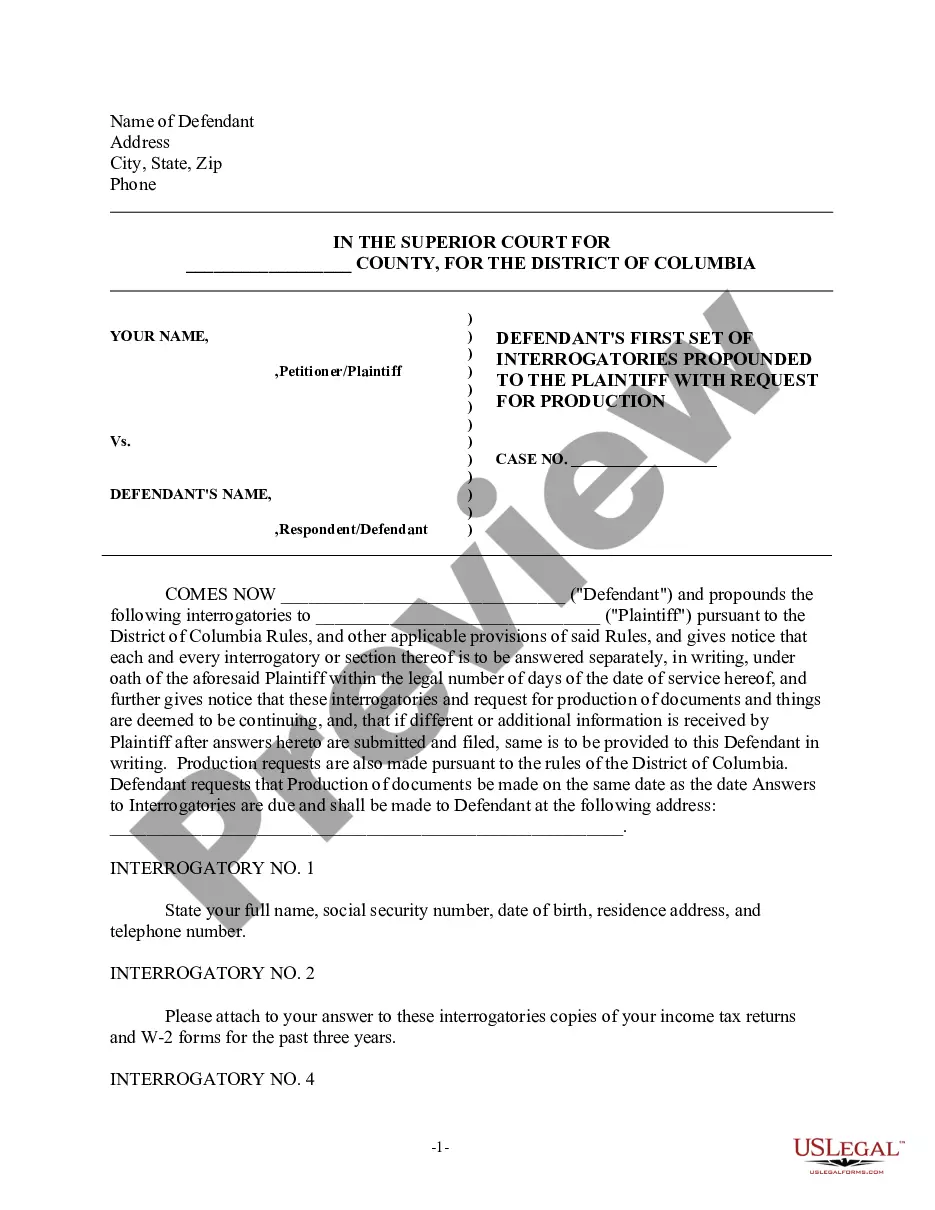

How to fill out West Virginia Complaint For Wrongful Termination And Wage Payment And Collection?

Among lots of paid and free examples that you get on the net, you can't be certain about their accuracy and reliability. For example, who made them or if they are qualified enough to deal with what you need them to. Always keep calm and utilize US Legal Forms! Get West Virginia Complaint for Wrongful Termination and Wage Payment and Collection templates created by skilled attorneys and prevent the expensive and time-consuming procedure of looking for an attorney and then paying them to write a document for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the file you’re looking for. You'll also be able to access your earlier downloaded documents in the My Forms menu.

If you are utilizing our website for the first time, follow the tips below to get your West Virginia Complaint for Wrongful Termination and Wage Payment and Collection quickly:

- Make sure that the document you discover is valid in your state.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing process or find another sample using the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

As soon as you have signed up and paid for your subscription, you may use your West Virginia Complaint for Wrongful Termination and Wage Payment and Collection as many times as you need or for as long as it stays valid where you live. Revise it in your favored offline or online editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

If your complaint is about pay, conditions or workplace rights under Commonwealth legislation, enterprise agreements or modern awards, you should contact the Fair Work Ombudsman's Infoline on 13 13 94.

A) Approach Labour Commissioner:If an employer doesn't pay up your salary, you can approach the labour commissioner. They will help you to reconcile this matter and if no solution is reached labour commissioner will hand over this matter to the court whereby a case against your employer may be pursued.

When an employer fails to pay an employee the applicable minimum wage or the agreed wage for all hours worked, the employee has a legal claim for damages against the employer. To recover the unpaid wages, the employee can either bring a lawsuit in court or file an administrative claim with the state's labor department.

Seyfarth Synopsis: California Labor Code § 221 states it is unlawful for any employer to collect or receive from an employee any part of wages 2026 paid 2026 to said employee. In other words, employers cannot just take money back to correct an overpayment of wages.

1. How long does my employer have to deliver my last paycheck after I quit or am terminated? Generally, the employer has a reasonable time to pay you your last check, usually within 30 days. The most common requirement is that you be paid by the next payday when you would have been paid.

Can You Sue a Company for Underpaying You? Yes, you can sue for being underpaid. First, you need to submit a claim through WHD (more on this below) and wait for WHD to investigate the claim. They will decide if the claim is valid and submit a legal order for your employer to pay what you are owed.

No, employers cannot charge employees for mistakes, shortages, or damages. Only if you agree (in writing) that your employer can deduct from your pay for the mistake.

Under a Title VII wage discrimination claim, an employee must first prove: 1) membership in a protected group and that he or she was qualified for the position worked in; 2) an employer is practicing wage differentials based on the employee's membership in the protected group and this has given rise to an inference of

Step 1: speak to a trade union. If you're in a trade union, they might be able to negotiate with your employer for you. Step 2: raise a grievance. Check if your employer has a formal grievance procedure you can use. Step 3: early conciliation. Step 4: take your employer to a tribunal.