Wisconsin Window Contractor Agreement - Self-Employed

Description

How to fill out Window Contractor Agreement - Self-Employed?

Are you currently in the location where you require documentation for either business or personal activities on a daily basis? There are numerous legal document templates available online, but locating reliable ones is challenging.

US Legal Forms offers thousands of form templates, such as the Wisconsin Window Contractor Agreement - Self-Employed, which are crafted to meet federal and state requirements.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Wisconsin Window Contractor Agreement - Self-Employed template.

Select a suitable document format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain another version of the Wisconsin Window Contractor Agreement - Self-Employed at any time, if needed. Just click the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides properly crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct city/county.

- Utilize the Review button to assess the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your needs.

- Once you acquire the appropriate form, click Acquire now.

- Choose the payment plan you prefer, fill in the required information to create your account, and place an order using your PayPal or credit card.

Form popularity

FAQ

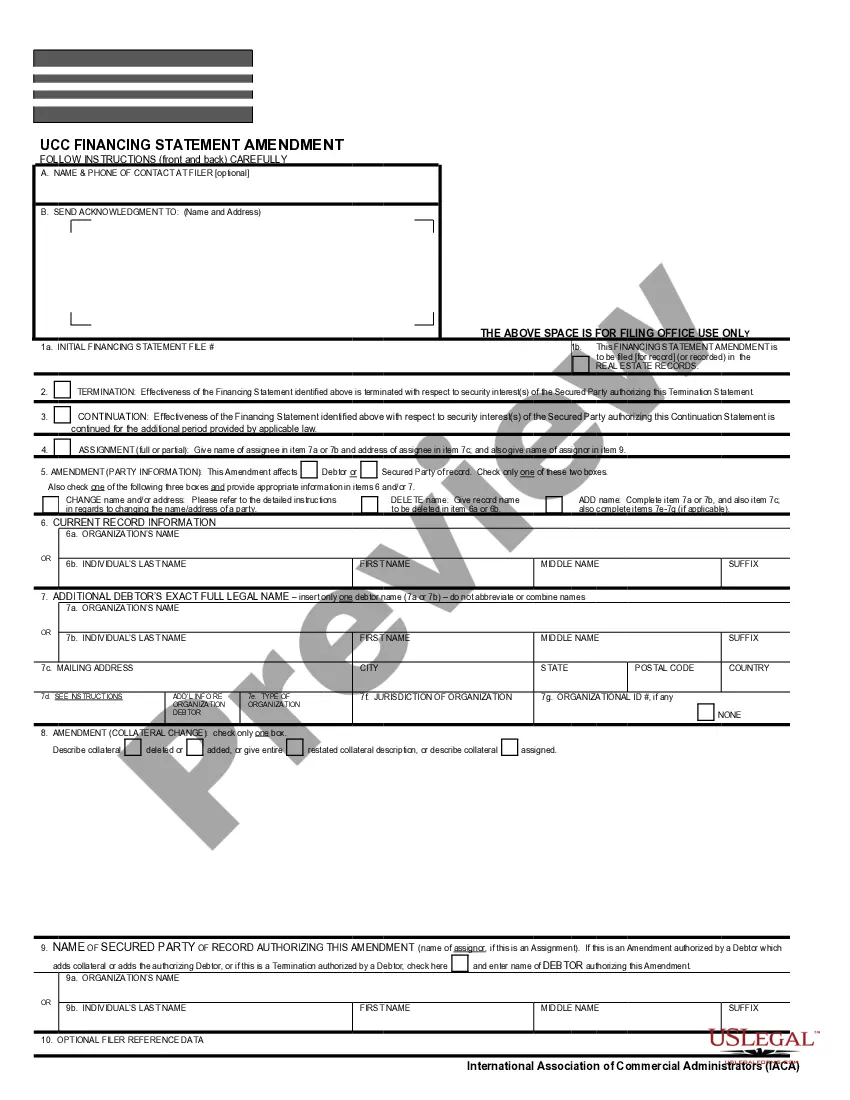

The independent contractor agreement in Wisconsin serves as a legal contract that delineates the rights and responsibilities of the contractor and the client. Specific provisions in a Wisconsin Window Contractor Agreement - Self-Employed might cover local licensing requirements and building codes relevant to window installation. This agreement helps protect both parties in case of disputes and ensures compliance with state laws. Having a clear and well-structured agreement fosters a positive working relationship.

Creating an independent contractor agreement involves several key steps. First, define the project scope, payment terms, and deadlines clearly. Then, include clauses related to ownership of work, confidentiality, and termination terms. By utilizing platforms like USLegalForms, you can easily access templates, such as a Wisconsin Window Contractor Agreement - Self-Employed, and customize them to fit your specific needs.

A basic independent contractor agreement outlines the terms and conditions between the contractor and the client. It typically includes details like payment, project scope, deadlines, and confidentiality clauses. For those in Wisconsin, a Wisconsin Window Contractor Agreement - Self-Employed should specify the unique elements pertinent to window contracting. This document serves to protect both parties and ensure clear expectations.

Independent contractors must comply with various legal requirements to operate legally. This includes obtaining necessary licenses and permits specific to their trade, such as a Wisconsin Window Contractor Agreement - Self-Employed. Additionally, contractors must adhere to tax obligations, including self-employment tax and reporting income correctly. Ensuring contract clarity helps protect both parties involved.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

10 steps to setting up as a contractor:Research the regulations and responsibilities surrounding contractors.Be prepared to leave your permanent role and set up as a limited company.Consider your tax position and understand IR35.Decide whether to form a limited company or join an umbrella organisation.More items...?

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Nine Requirements Test - Independent ContractorRequirement One - Maintain a Separate Business.Requirement Two - Obtain a FEIN or Have Filed Business or Self-Employment Tax Returns.Requirement Three - Operate Under Specific Contracts.Requirement Four - Responsible For Main Expenses.More items...

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...