Wisconsin Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

If you wish to obtain, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Use the site's simple and user-friendly search to find the documents you need.

A variety of templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you wish to use, click the Get Now button. Select your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to access the Wisconsin Door Contractor Agreement - Self-Employed with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Get button to find the Wisconsin Door Contractor Agreement - Self-Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have chosen the form for the appropriate city/state.

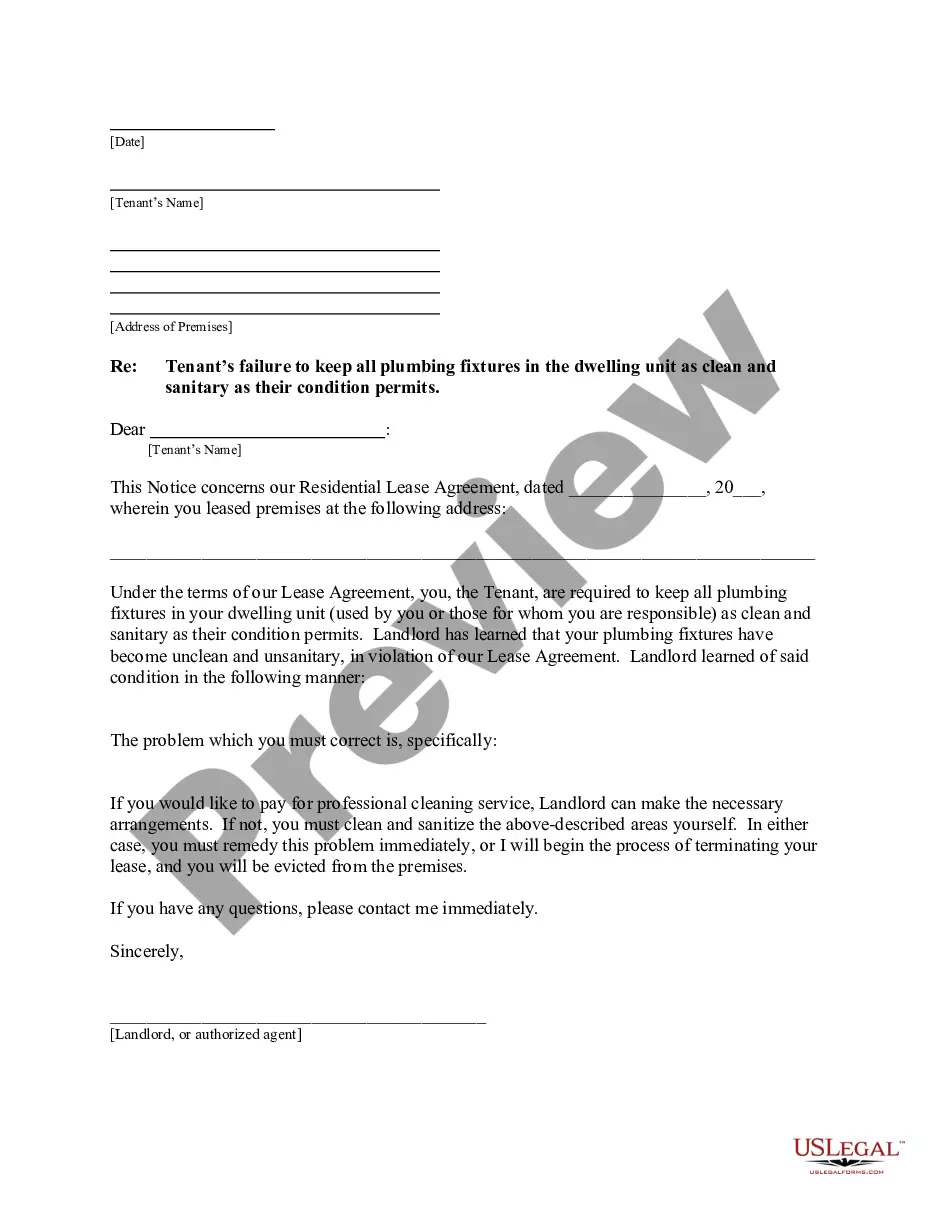

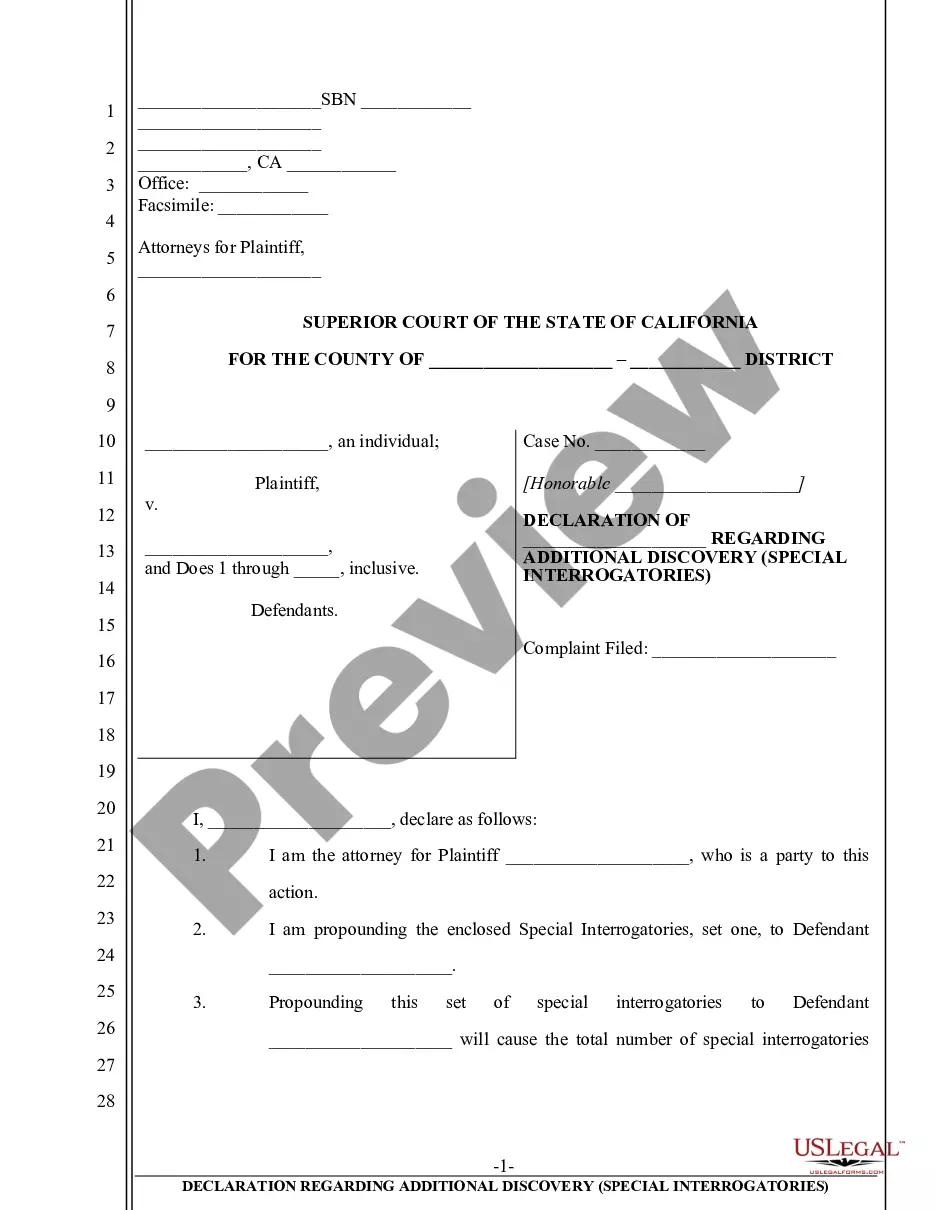

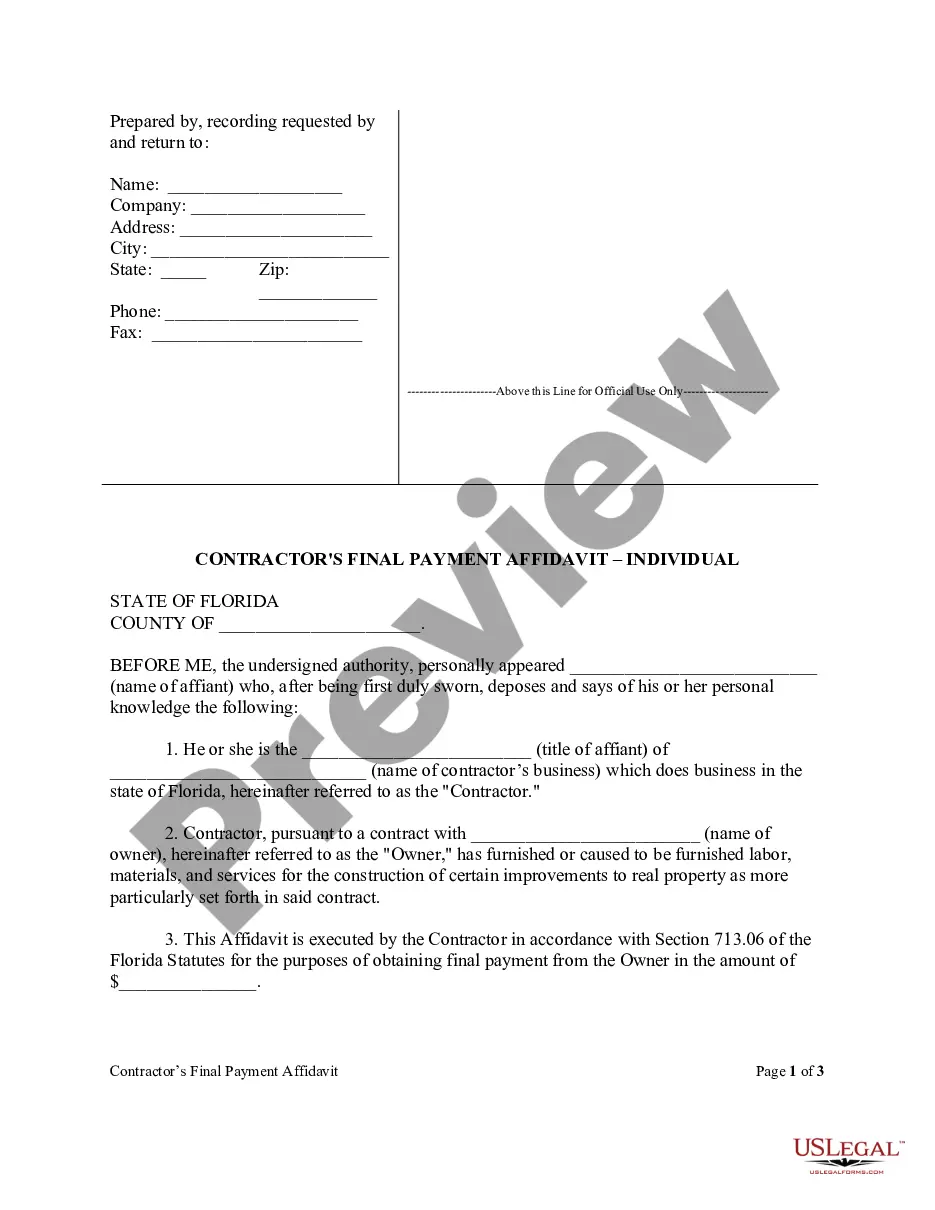

- Step 2. Utilize the Preview option to review the form's details. Don’t forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other templates within the legal form category.

Form popularity

FAQ

To create an independent contractor agreement, start by clearly outlining the parties involved, including their names and addresses. Next, specify the work to be performed and the compensation terms. Don't forget to include any necessary clauses related to confidentiality and termination. For a reliable template, consider using US Legal Forms, which provides a comprehensive Wisconsin Door Contractor Agreement - Self-Employed that is easy to customize to fit your specific needs.

Breaking an independent contractor agreement can lead to legal consequences, such as financial penalties or legal disputes. To avoid this, review your Wisconsin Door Contractor Agreement - Self-Employed carefully, and understand your obligations. If a breach occurs, communicate with your contractor to resolve issues amicably, as this may prevent litigation. Ultimately, engaging with a legal platform like uslegalforms can provide valuable resources and templates for crafting these agreements to mitigate risks.

Legal requirements for independent contractors vary by state, but typically include proper licensing, tax obligations, and adherence to labor laws. In Wisconsin, it is essential to have a well-drafted Wisconsin Door Contractor Agreement - Self-Employed that aligns with state regulations. This agreement helps clarify your status as an independent contractor and outlines necessary responsibilities. Familiarizing yourself with local laws can protect you and your business.

The basic independent contractor agreement is a legal document that defines the relationship between the contractor and the client. This agreement should include key elements such as payment details, scope of work, and deadlines. For those seeking specific terms, a Wisconsin Door Contractor Agreement - Self-Employed can be tailored to fit your needs. This clarity is vital to prevent misunderstandings and protect all parties involved.

To protect yourself when paying a contractor, always use a written agreement that outlines payment terms, project scope, and timelines. A Wisconsin Door Contractor Agreement - Self-Employed offers clarity and ensures both parties understand their obligations. Additionally, consider making payments in installments, tied to project milestones. This approach mitigates risk and helps maintain control over the project's progress.

Writing an independent contractor agreement requires attention to key elements. Begin with identifying the parties, then outline the work to be performed, payment terms, and duration of the project. Clearly state any confidentiality or non-compete clauses if applicable. For an efficient approach, consider using the Wisconsin Door Contractor Agreement - Self-Employed available through uslegalforms, which simplifies the process.

To fill out an independent contractor form, start by entering your details as the contractor, along with the client’s information. Include specific project details, such as tasks, deadlines, and payment options. It is essential to review all terms carefully to ensure clarity. A Wisconsin Door Contractor Agreement - Self-Employed can serve as a useful guide for completing your form accurately.

Filling out an independent contractor agreement involves several key steps. First, identify the parties involved, including their legal names and contact information. Next, specify the services to be provided, payment amounts, and due dates. Using a well-structured Wisconsin Door Contractor Agreement - Self-Employed template can simplify this process for you.

The independent contractor agreement in Wisconsin outlines the working relationship between a contractor and a client. This document clarifies expectations, payment terms, and the scope of work. It serves to protect both parties by clearly defining responsibilities and rights. Utilizing a Wisconsin Door Contractor Agreement - Self-Employed can help ensure compliance with state regulations.