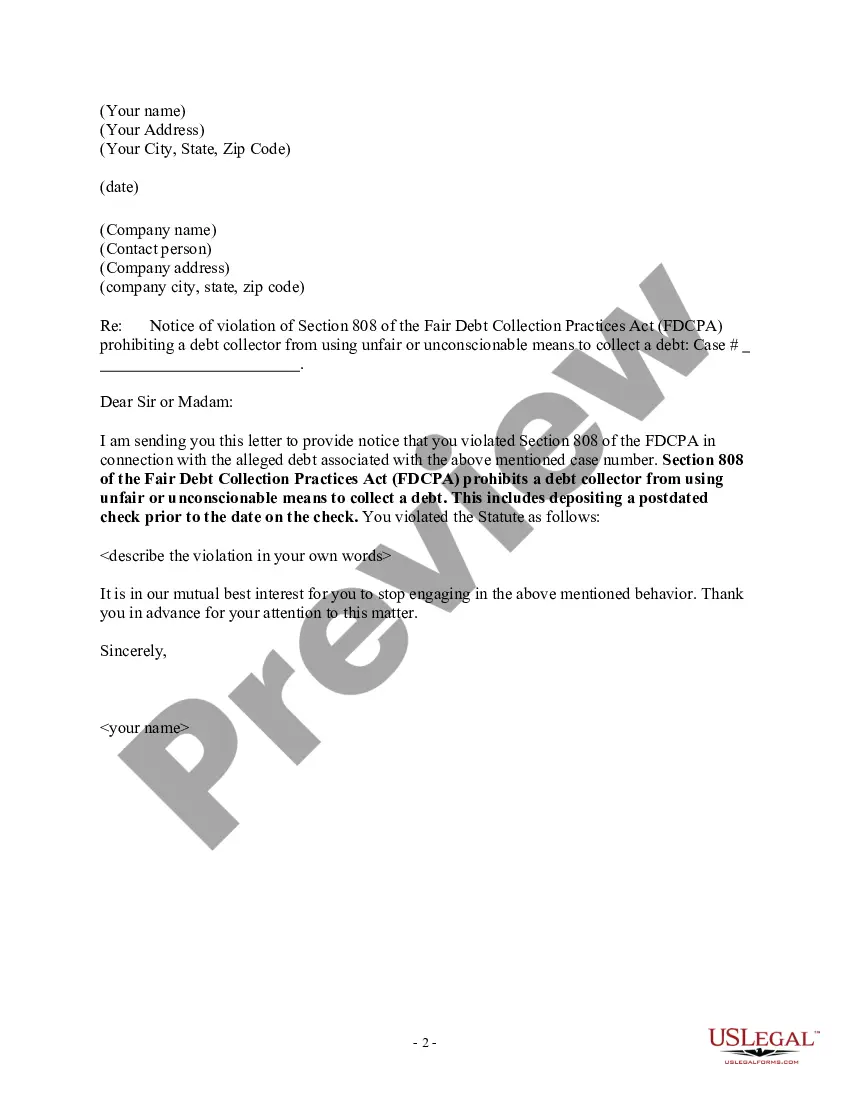

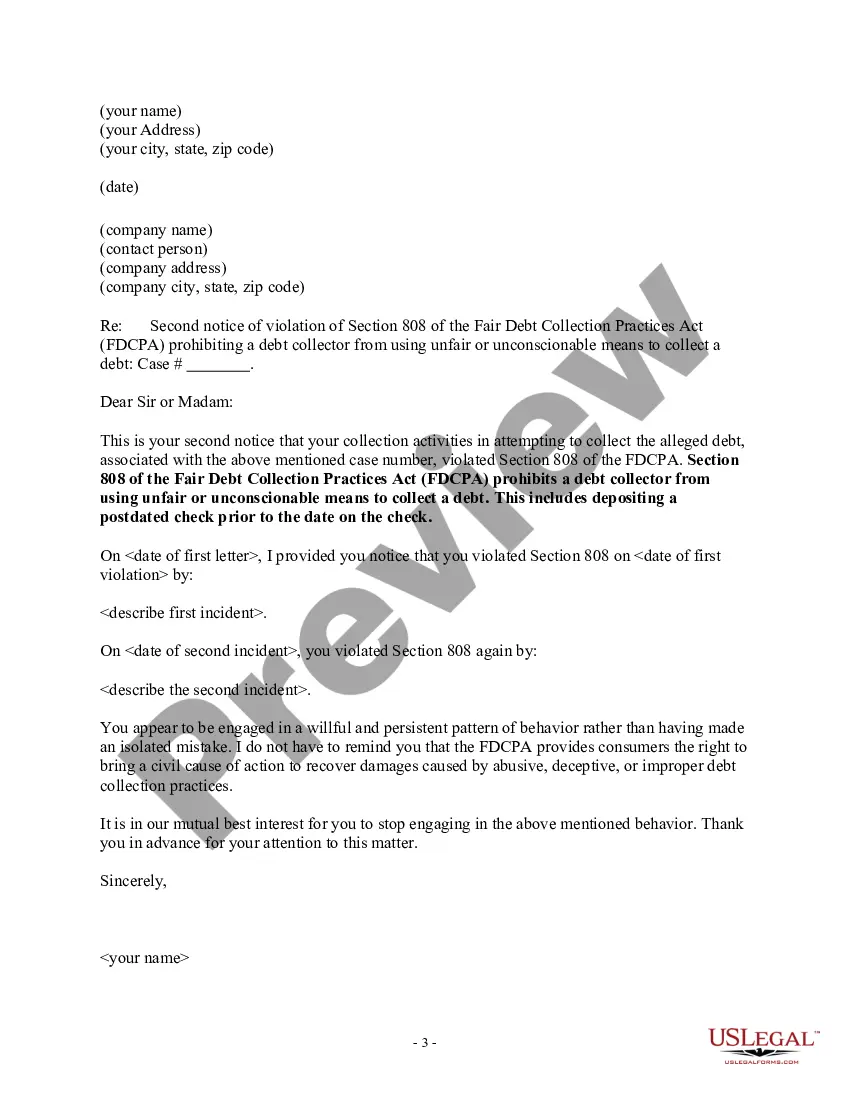

A debt collector may not use unfair or unconscionable means to collect a debt. This includes depositing a postdated check prior to the date on the check.

Wisconsin Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check

Description

How to fill out Notice To Debt Collector - Depositing A Postdated Check Prior To The Date On The Check?

Are you currently in the location where you need documents for either business or personal purposes every single day.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of form templates, including the Wisconsin Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check, designed to meet state and federal regulations.

Select a convenient format and download your copy.

Find all the document templates you have purchased in the My documents section. You can download an additional copy of the Wisconsin Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check at any time, if necessary. Click on the desired form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal forms, to save time and prevent mistakes. The service provides professionally created legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Wisconsin Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Obtain the form you need and ensure it is for the correct city/state.

- 2. Use the Review button to examine the form.

- 3. Read the description to ensure you have chosen the right form.

- 4. If the form is not what you are looking for, use the Search area to find the form that matches your needs and requirements.

- 5. Once you find the correct form, click Get Now.

- 6. Choose the payment plan you want, enter the required information to set up your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

You should send a debt verification letter promptly after you receive a notice from a debt collector. This letter ensures that you request validation of the debt, especially if you believe it may not be yours or if you need more information. It's important to state your reasons clearly in the letter and mention the Wisconsin Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check, as this communicates your understanding of your rights. By using platforms like US Legal Forms, you can easily create and send a debt verification letter to ensure your interests are protected.

Postdated checks can usually be cashed or deposited at any time unless the person who wrote the check specifically told their bank not to honor the check until a certain date. Rather than writing a postdated check, it may be better to use online payment services or coordinate with your biller to move back the due date.

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

If a post-dated cheque you wrote is mistakenly processed before its date, you should contact your bank to let them know. The cheque can be returned and the amount credited back to your account up to the day before the date written on the cheque.

From a criminal law perspective, there is nothing inherently illegal about postdating a check, says Eric Hintz, a criminal defense attorney in Sacramento, California. Hintz says that only criminal intent, such as intentionally not having enough money for a payment, can be grounds for check fraud.

That means the bank must wait to cash the payment until the date stated on the paper or until six months is up, whichever comes first. But if the consumer gives oral notice to the bank, the institution must only wait 14 days before processing the note even if that happens to be before the date on the check.

Postdating a check refers to writing a check but putting a future date on the check instead of the date that the person writes the check. People typically postdate checks intending that the recipient not deposit or cash the check until a later date, because payment is not due until that later date.

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

The FDCPA says that it's illegal for a debt collector to take a check that is postdated by more than five days, unless the consumer is notified in writing of the debt collector's intent to deposit the check between 10 and three days prior to the deposit.

So, yes, you can deposit a post-dated check before the date shown, but it isn't advised. Be prepared for the possibility that the check funds won't be available. Not only do you not want to incur an insufficient funds fee, you don't want to go through the trouble of obtaining a reissued check.