North Carolina Retirement Benefits Plan

Description

How to fill out Retirement Benefits Plan?

Are you presently inside a placement in which you need to have papers for both company or individual uses nearly every time? There are a lot of legitimate record templates accessible on the Internet, but finding versions you can rely is not simple. US Legal Forms delivers a huge number of develop templates, much like the North Carolina Retirement Benefits Plan, which can be composed in order to meet federal and state demands.

When you are currently knowledgeable about US Legal Forms web site and also have your account, basically log in. Afterward, you are able to down load the North Carolina Retirement Benefits Plan web template.

If you do not come with an bank account and want to begin to use US Legal Forms, abide by these steps:

- Discover the develop you will need and make sure it is for your correct metropolis/state.

- Utilize the Review switch to examine the form.

- Read the explanation to actually have selected the correct develop.

- In case the develop is not what you`re looking for, make use of the Search discipline to find the develop that meets your needs and demands.

- If you get the correct develop, click on Purchase now.

- Choose the rates strategy you would like, fill out the required information and facts to make your money, and buy the transaction with your PayPal or bank card.

- Select a convenient paper file format and down load your duplicate.

Discover all of the record templates you possess purchased in the My Forms menus. You can aquire a more duplicate of North Carolina Retirement Benefits Plan any time, if possible. Just click the needed develop to down load or print the record web template.

Use US Legal Forms, by far the most comprehensive variety of legitimate forms, to conserve time and stay away from mistakes. The services delivers professionally manufactured legitimate record templates that you can use for an array of uses. Generate your account on US Legal Forms and initiate creating your lifestyle easier.

Form popularity

FAQ

You may retire with unreduced service retirement benefits after: you reach age 65 and complete five years of creditable service, or. you reach age 60 and complete 25 years of creditable service, or. you complete 30 years of creditable service, at any age.

North Carolina is retiree-friendly with respect to Social Security benefits, inheritance, and estate taxes because you won't get taxed in these areas, allowing you to pocket more money and leave more to your heirs.

Service Retirement (Unreduced Benefits) You may retire with unreduced service retirement benefits after: you reach age 65 and complete five years of creditable service, or. you reach age 60 and complete 25 years of creditable service, or. you complete 30 years of creditable service, at any age.

A refund of your contributions (along with four percent interest compounded annually) is available to you 60 days after your effective date of resignation or termination. The 60-day waiting period is required by the General Statutes of North Carolina.

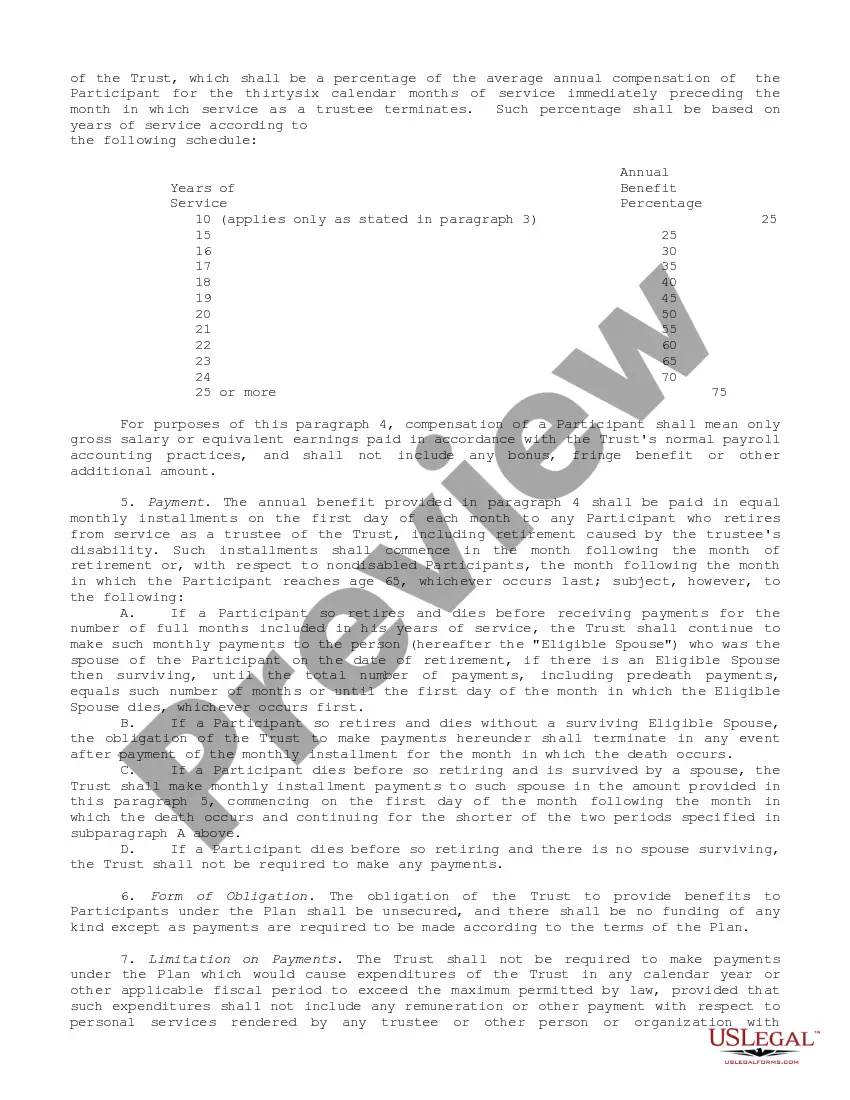

TSERS is as a defined benefit plan and the benefit you receive at retirement is based on a formula. This formula considers your years and months of creditable service, your age, and your ?average final compensation,? which is the average of your salary during your four highest paid consecutive years.

When you retire under TSERS, you are eligible for health coverage under the State Health Plan (SHP) if you have at least five years of TSERS membership service earned as a teacher or state employee.

North Carolina exempts all Social Security retirement benefits from income taxes, has no State Estate Tax, and low corporate income tax for those looking to indulge their entrepreneurial spirit. 2. Low Cost of Living.

Yes, you should report your retirement benefits on your federal and North Carolina tax returns regardless of whether you owe any income tax.