Wisconsin Notice of Violation of Fair Debt Act - False Information Disclosed

Description

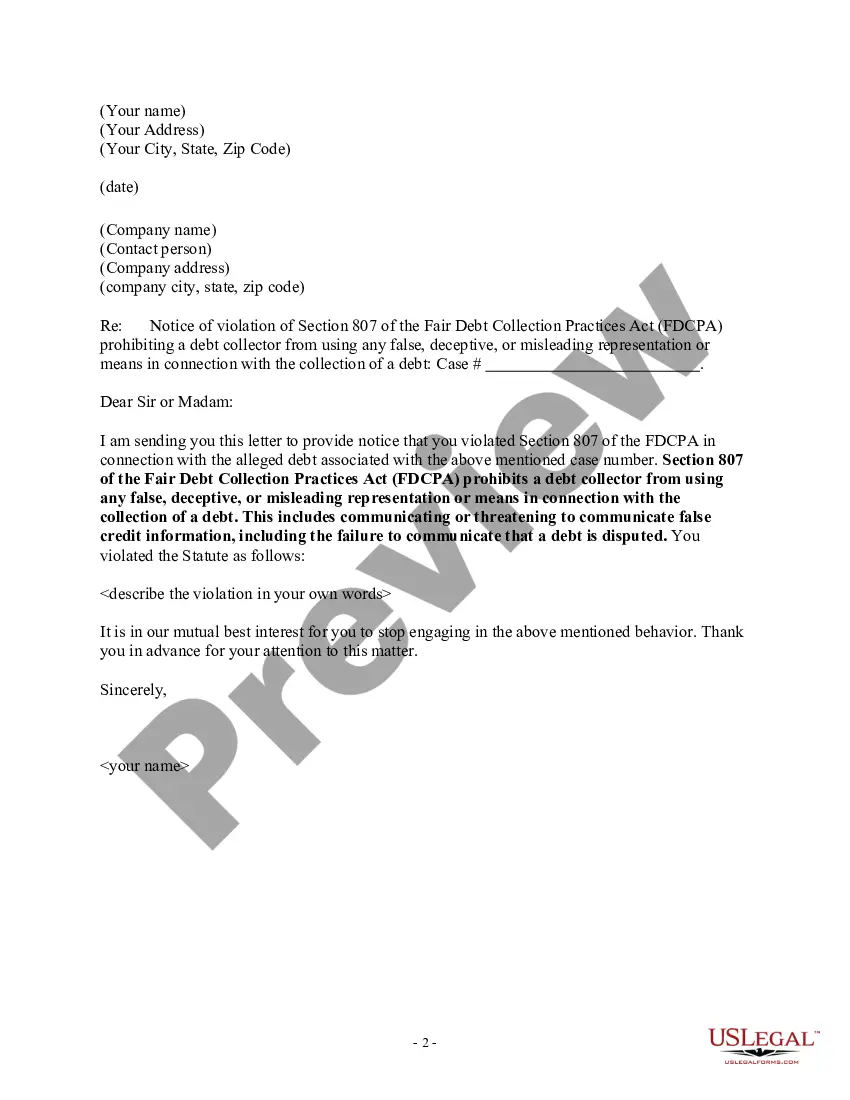

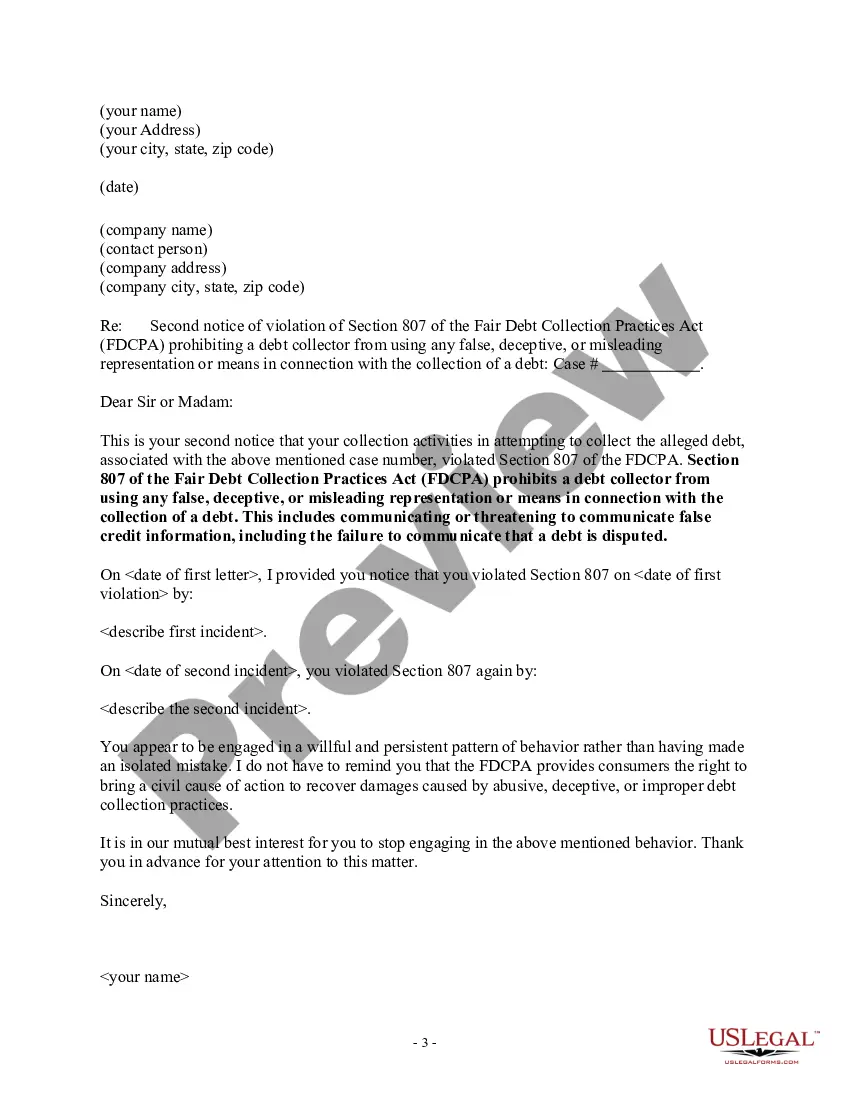

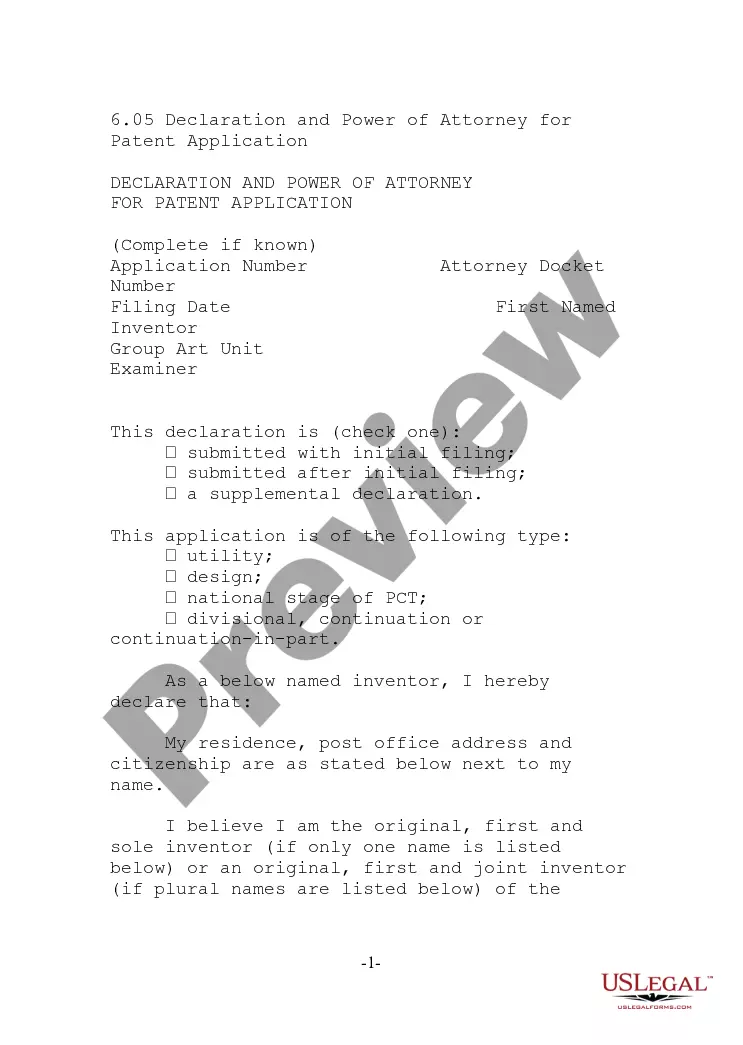

How to fill out Notice Of Violation Of Fair Debt Act - False Information Disclosed?

You can invest hours online seeking the legal document format that fulfills the state and federal specifications you need. US Legal Forms offers a vast array of legal templates that can be examined by experts.

You can obtain or print the Wisconsin Notice of Violation of Fair Debt Act - False Information Disclosed from our services.

If you already have a US Legal Forms account, you can Log In and then click the Download button. Afterwards, you can fill out, modify, print, or sign the Wisconsin Notice of Violation of Fair Debt Act - False Information Disclosed. Every legal document format you purchase is yours indefinitely.

Complete the payment. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Choose the format of your file and download it to your device. Make modifications to your document if necessary. You can fill out, edit, sign, and print the Wisconsin Notice of Violation of Fair Debt Act - False Information Disclosed. Download and print a multitude of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To get another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct format for the county/city of your choice. Review the form details to confirm that you have chosen the appropriate file.

- If available, utilize the Review button to browse the format as well.

- If you want to obtain another copy of your form, use the Search field to find the format that suits your needs and requirements.

- Once you have found the format you want, click Get now to proceed.

- Choose the payment plan you desire, enter your information, and create an account on US Legal Forms.

Form popularity

FAQ

Unfair practices are prohibitedDeposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.

Here are a few suggestions that might work in your favor:Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing.Dispute the debt on your credit report.Lodge a complaint.Respond to a lawsuit.Hire an attorney.

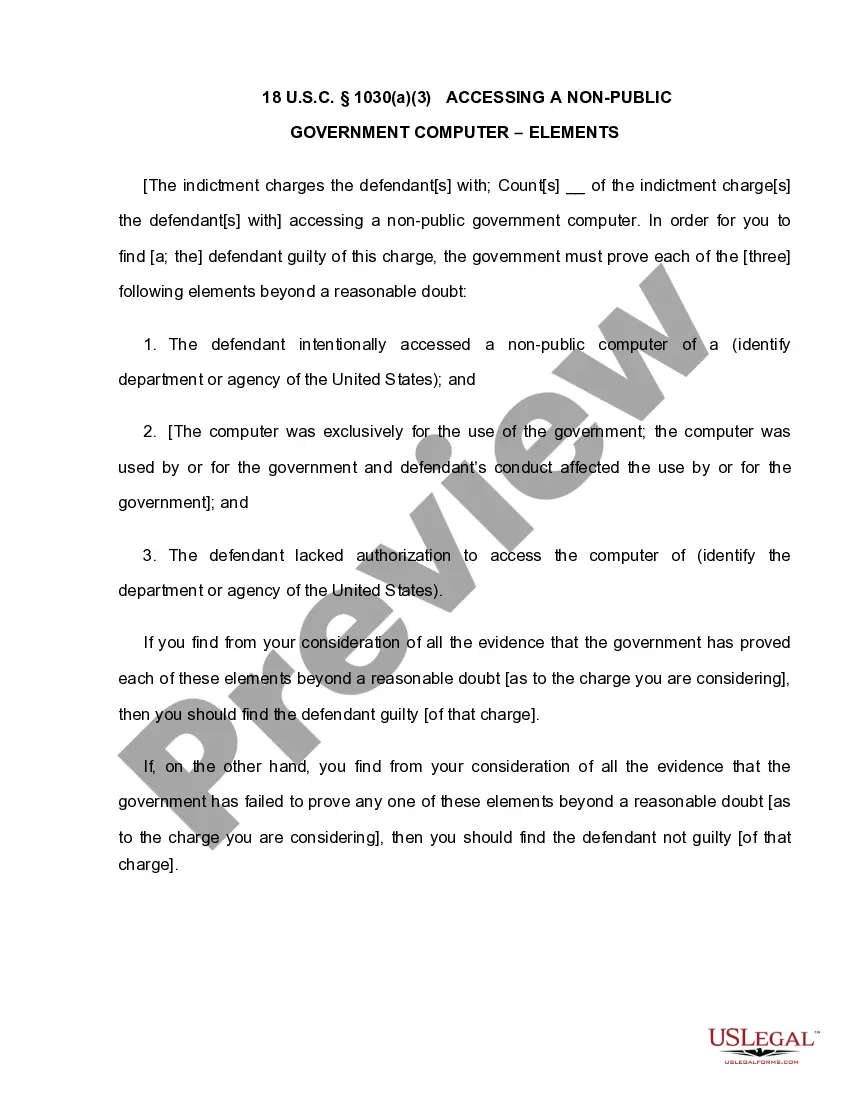

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

What Is an FDCPA Validation Letter? The FDCPA is a federal law that protects consumers from abusive collection practices by debt collectors and collection agencies. Whether the FDCPA applies to foreclosures generally depends on if the foreclosure is judicial or nonjudicial.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

Under the amended FDCPA, if a debt collector is collecting a time-barred debt, the collector must include on the front of the validation notice any time-barred debt disclosure that's required by law. (12 C.F.R. § 1006.34).

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.