Wisconsin Community Property Disclaimer

Description

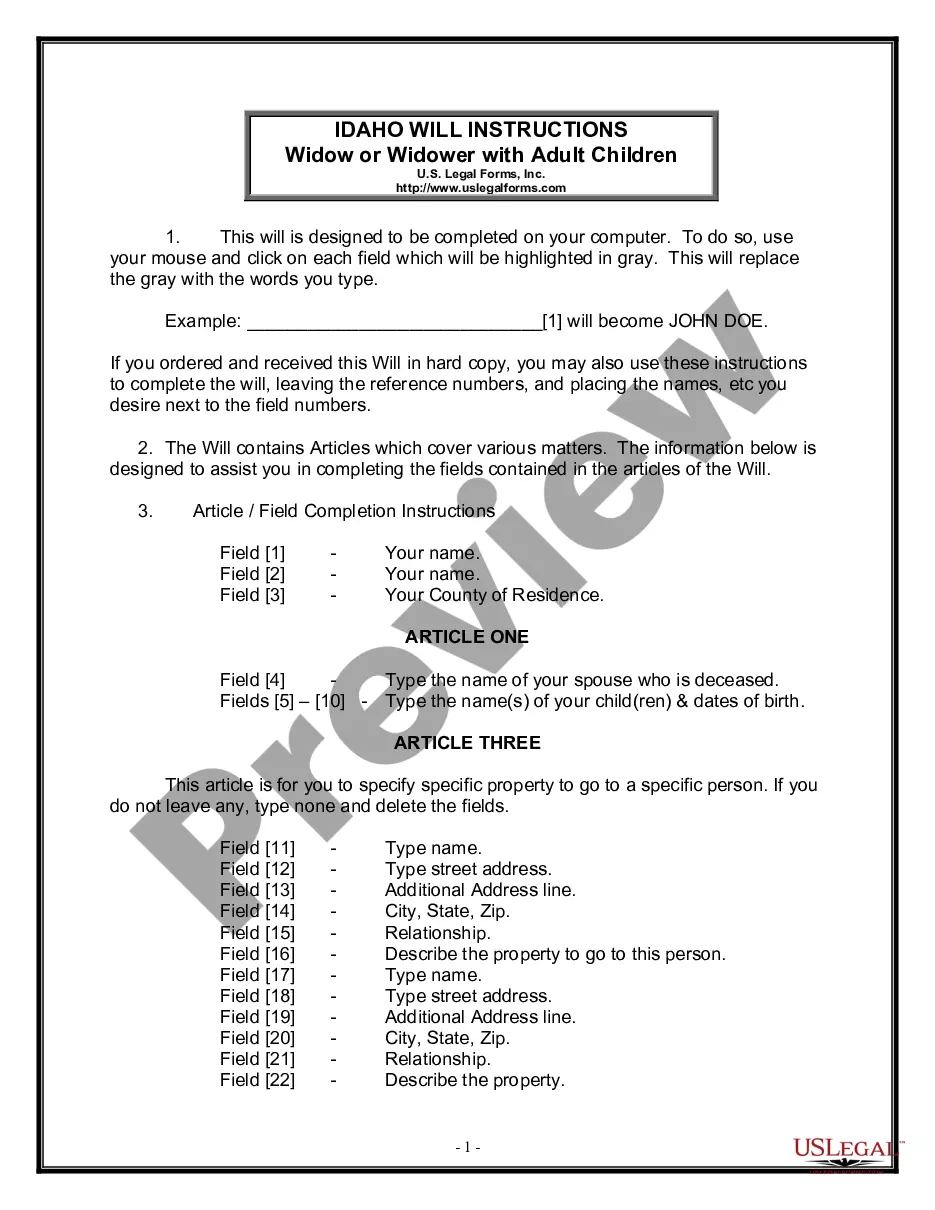

How to fill out Community Property Disclaimer?

Selecting the optimal valid document format can be quite challenging.

Naturally, there are numerous templates accessible online, but how can you find the valid template you need.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Wisconsin Community Property Disclaimer, which you can use for business and personal purposes.

- All the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Obtain button to get the Wisconsin Community Property Disclaimer.

- Use your account to search for the legal forms you have previously acquired.

- Visit the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/region. You can review the form with the Review button and read the form description to confirm it is suitable for you.

Form popularity

FAQ

In Wisconsin, you typically do not inherit your spouse's debts automatically upon marriage. However, any debts incurred during the marriage may be considered marital debts, making both spouses liable. It's essential to be informed about how marriage impacts financial responsibilities. Utilizing a Wisconsin Community Property Disclaimer can provide peace of mind in clarifying financial obligations and protecting your interests.

Marital presumption in Wisconsin refers to the legal assumption that property acquired during marriage is jointly owned by both spouses. This principle stands unless one spouse can prove otherwise through a pre-existing agreement or other evidence. Understanding this presumption can help you navigate marital property disputes more effectively. For clarity on such matters, look into a Wisconsin Community Property Disclaimer to ensure your interests are protected.

Filling out the financial disclosure statement in Wisconsin involves detailing your income, expenses, assets, and debts. Start by gathering all pertinent financial documents, ensuring accuracy and completeness. You can easily access templates and guidance on this process through the US Legal Forms platform, which offers resources tailored for Wisconsin residents. Remember, accurate disclosures help establish transparency and foster trust during legal proceedings.

The Wisconsin Marital Property Act establishes how property is owned and managed between spouses. Under this act, most property acquired during the marriage is considered marital property, which means that both partners have equal ownership. This framework encourages fair division in case of divorce or the death of a spouse. For further clarity on this issue, consider utilizing a Wisconsin Community Property Disclaimer.

The marital property statute in Wisconsin defines how assets are owned and divided among spouses. Under this law, all property acquired during the marriage is generally considered community property, except for certain exceptions. By understanding the Wisconsin Community Property Disclaimer, couples can navigate these rules effectively, ensuring a fair division of assets in case of separation or death.

In real estate, a disclaimer is a legal document that relinquishes a person's claim to property or assets. When individuals execute a Wisconsin Community Property Disclaimer, they effectively remove themselves from ownership claims, often for tax or legal reasons. This process can provide clarity in property dealings and protect individuals from future liabilities.

An estate disclaimer allows an heir to refuse their inheritance from an estate. For example, if someone inherits property but wishes to avoid tax implications or responsibility, they can file a Wisconsin Community Property Disclaimer. This action ensures the property passes directly to other heirs, simplifying the estate distribution process.

A Wisconsin Community Property Disclaimer typically allows one spouse to decline ownership of certain assets. For instance, if a couple acquires property during their marriage, one spouse may use a disclaimer to avoid claiming that property in case of divorce or death. This legal tool helps clarify ownership and prevent disputes later.

To file married filing separately in a community property state, you will calculate your income and deductions separately, but you must also consider what is classified as community property. This often includes salaries or business income earned during the marriage. When dealing with these complexities, utilizing a Wisconsin Community Property Disclaimer can simplify the process and mitigate potential conflicts.

To file married separately, you will start by picking the appropriate tax form, typically Form 1040. You need to report only your income and deductions, taking care to accurately state any community property you or your spouse holds. Using a Wisconsin Community Property Disclaimer is helpful in clearly defining how any shared assets will be treated on your tax return.