Receipt of Estimates

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Receipt Of Estimates?

Dealing with legal paperwork requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Receipt of Estimates template from our library, you can be certain it meets federal and state regulations.

Working with our service is easy and fast. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your Receipt of Estimates within minutes:

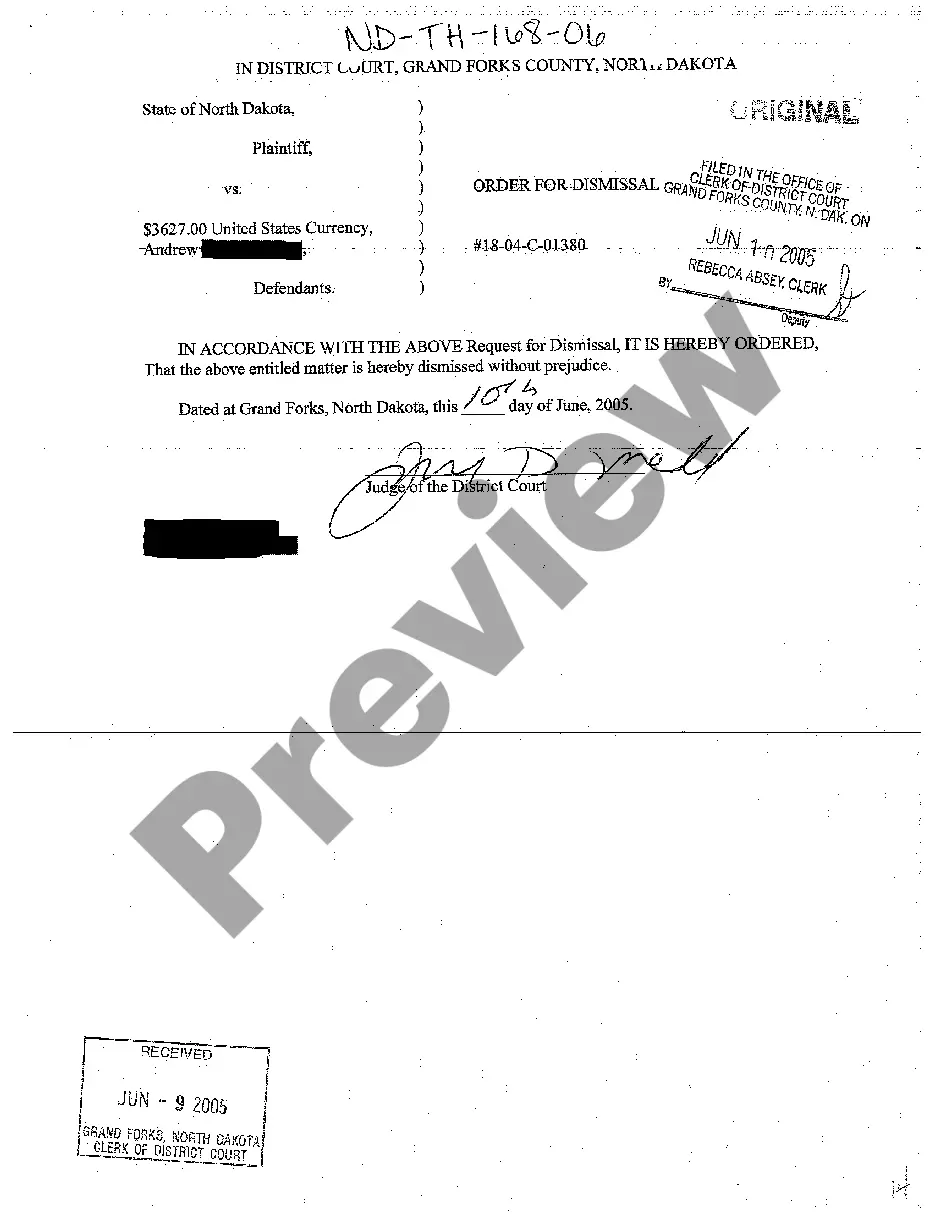

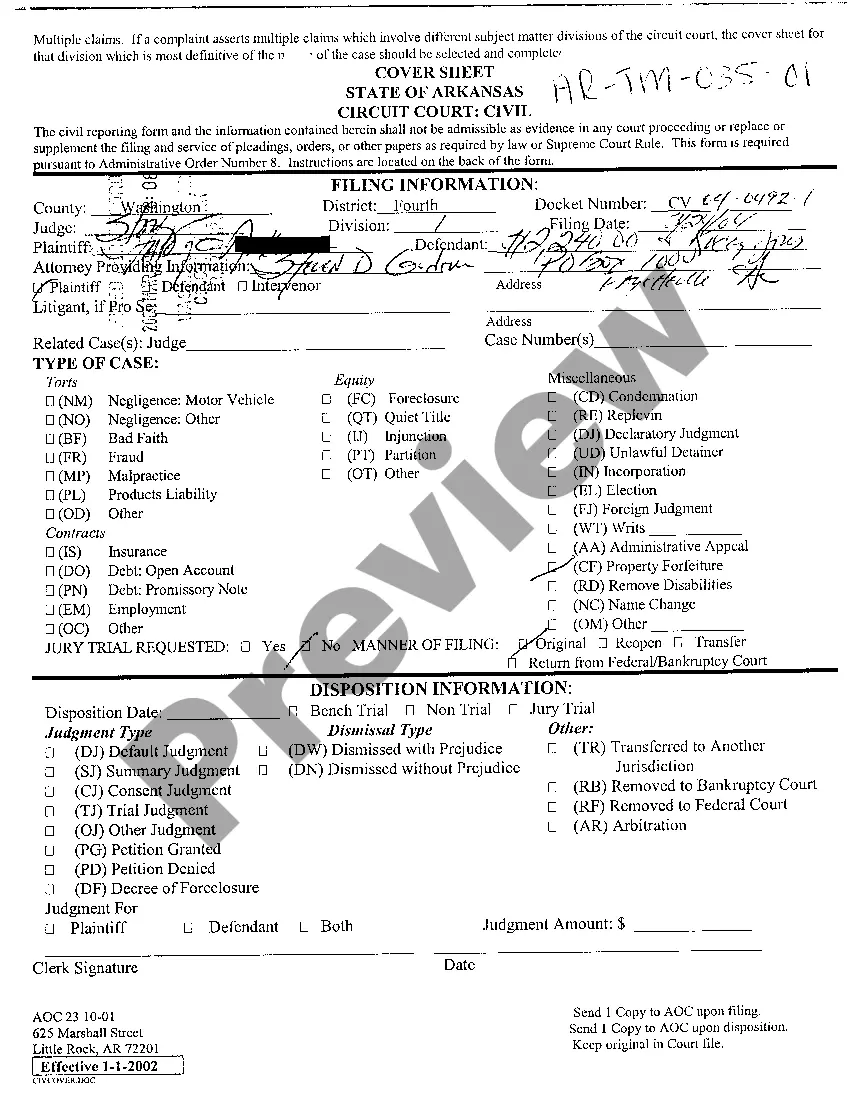

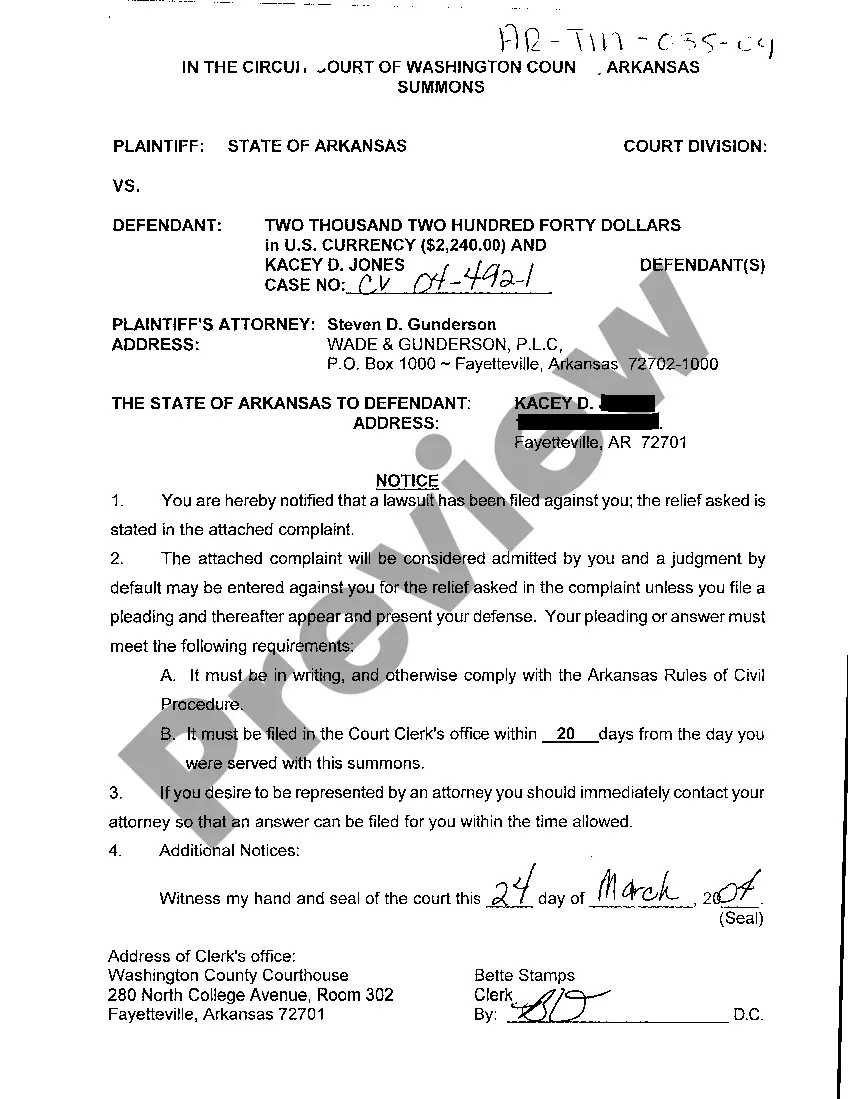

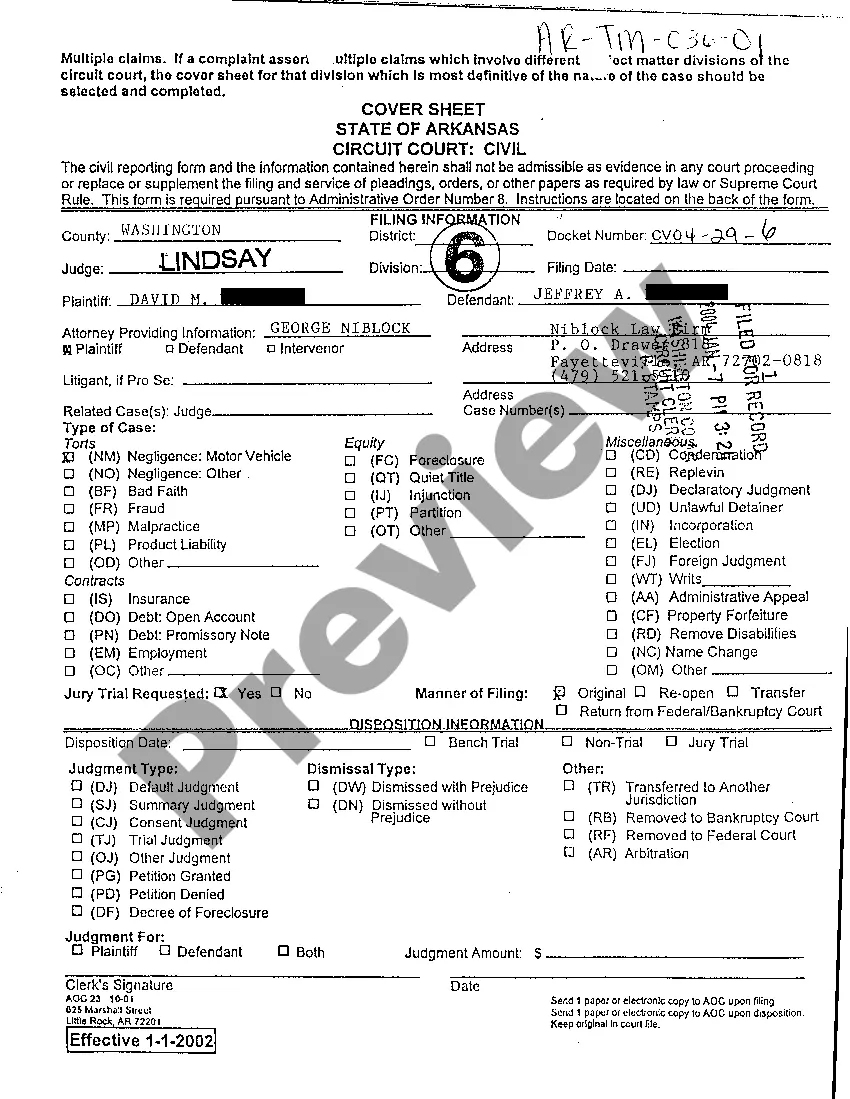

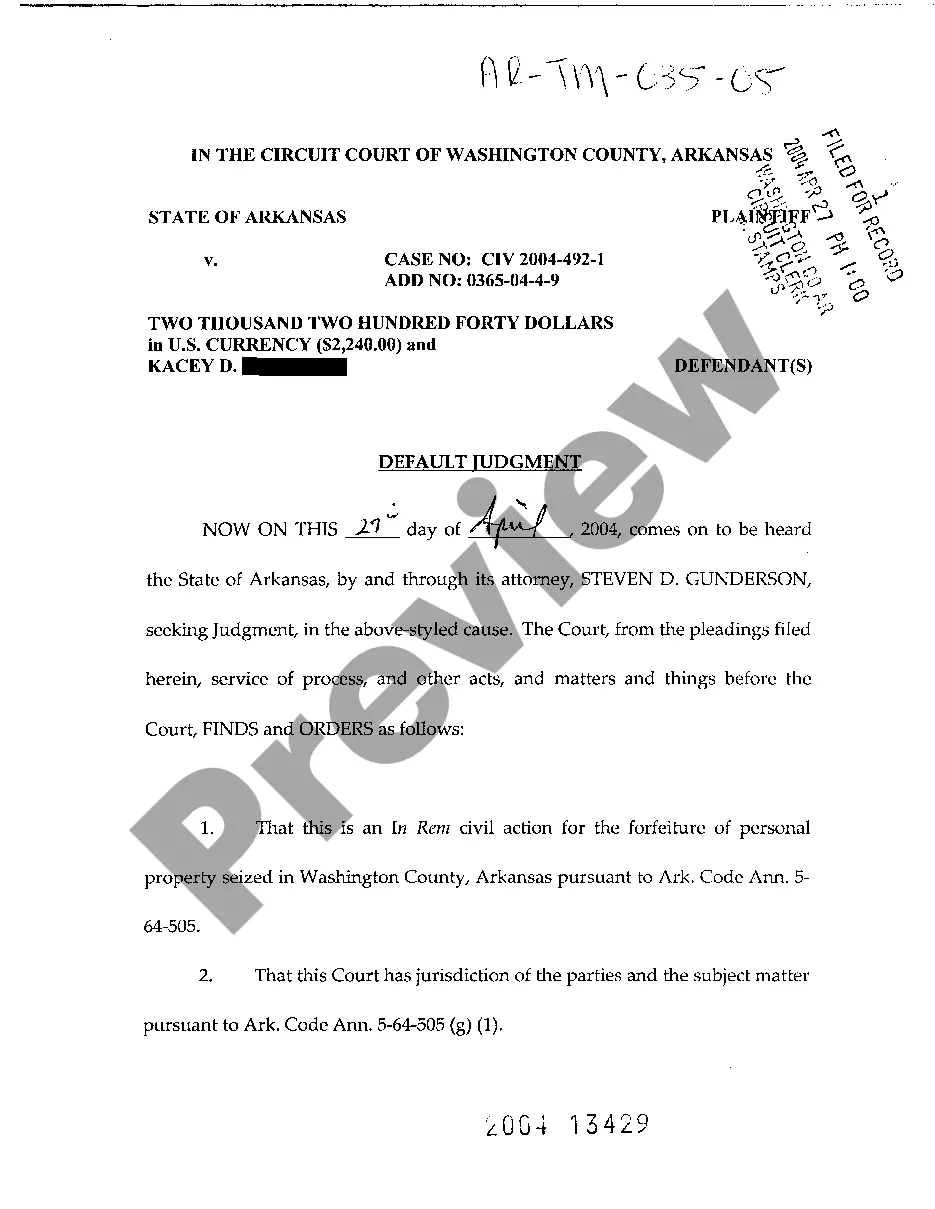

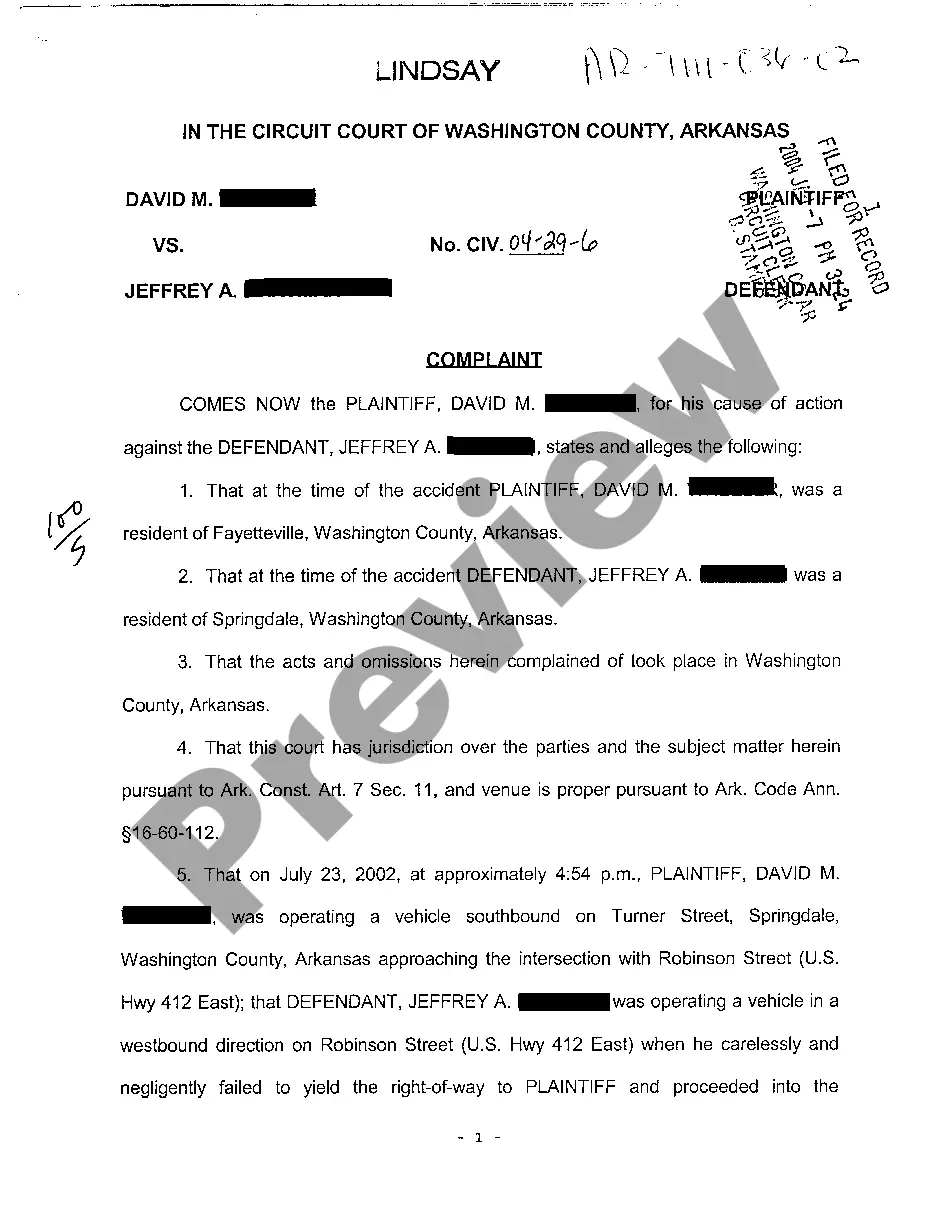

- Make sure to attentively check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Receipt of Estimates in the format you prefer. If it’s your first time with our website, click Buy now to proceed.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the Receipt of Estimates you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

How to Fill Out a Job Estimate Template - YouTube YouTube Start of suggested clip End of suggested clip Choose what you would like to do with your document. Next print out the resulting document. Share itMoreChoose what you would like to do with your document. Next print out the resulting document. Share it with anybody via email fax sms usps or shareable.

Important details included on a receipt Business name and business address. Company phone number or email. Payment date and time. Transaction number. Additional fees or sales tax. Brief description of the product/s or service description. Payment method (cash, cheque, or credit/debit card)

Make a cash sale Sales receipts typically include things like the customer's name, date of sale, itemization of the products or services sold, price for each item, total sale amount, and sales tax (if applicable). If you accept checks, be sure to also include the check number with the sales receipt.

No matter how you're making your receipt, every receipt you issue should include: The number, date, and time of the purchase. Invoice number or receipt number. The number of items purchased and price totals. The name and location of the business the items have been bought from. Any tax charged. The method of payment.