Wisconsin Lien Notice

Description

How to fill out Lien Notice?

If you want to finalize, download, or print legitimate document templates, utilize US Legal Forms, the leading selection of legal forms, which are accessible online.

Employ the site's straightforward and user-friendly search function to locate the documents you require.

A variety of templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you require, click the Purchase now button. Choose the payment plan you prefer and input your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize your purchase.

- Utilize US Legal Forms to find the Wisconsin Lien Notice with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Wisconsin Lien Notice.

- You can also access documents you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have chosen the form for the correct region/state.

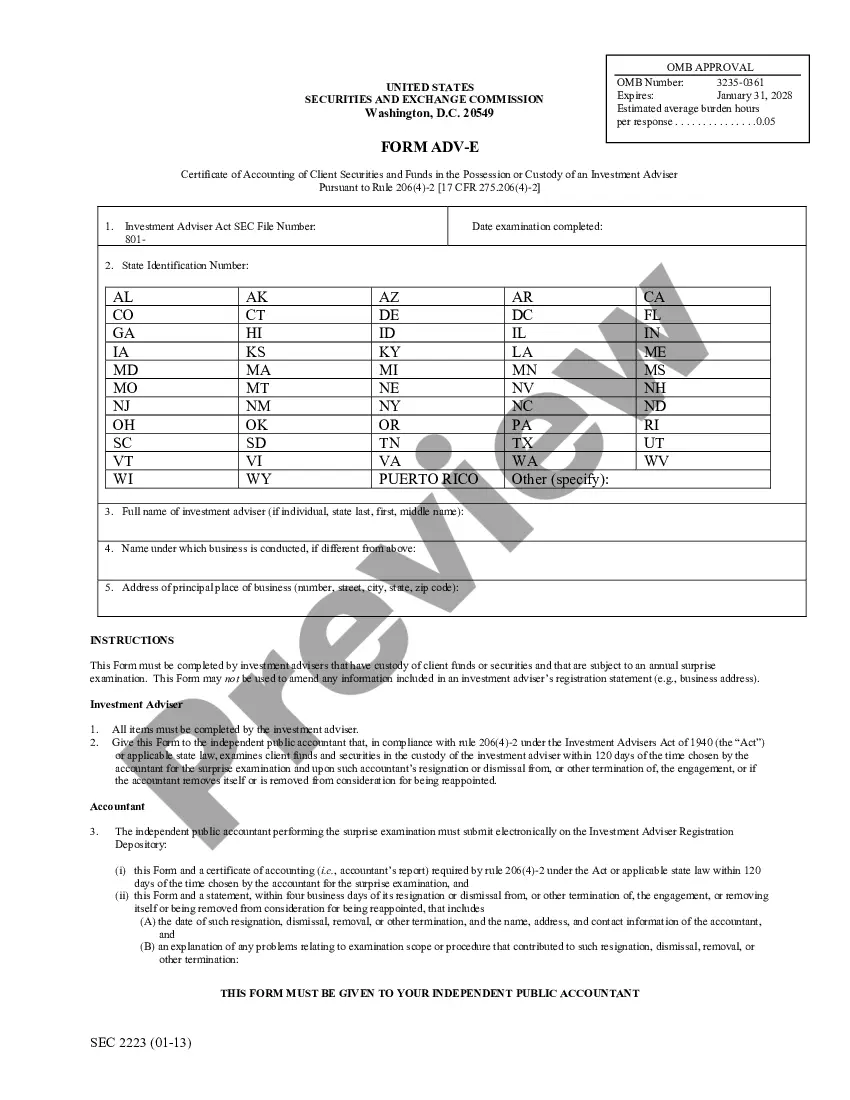

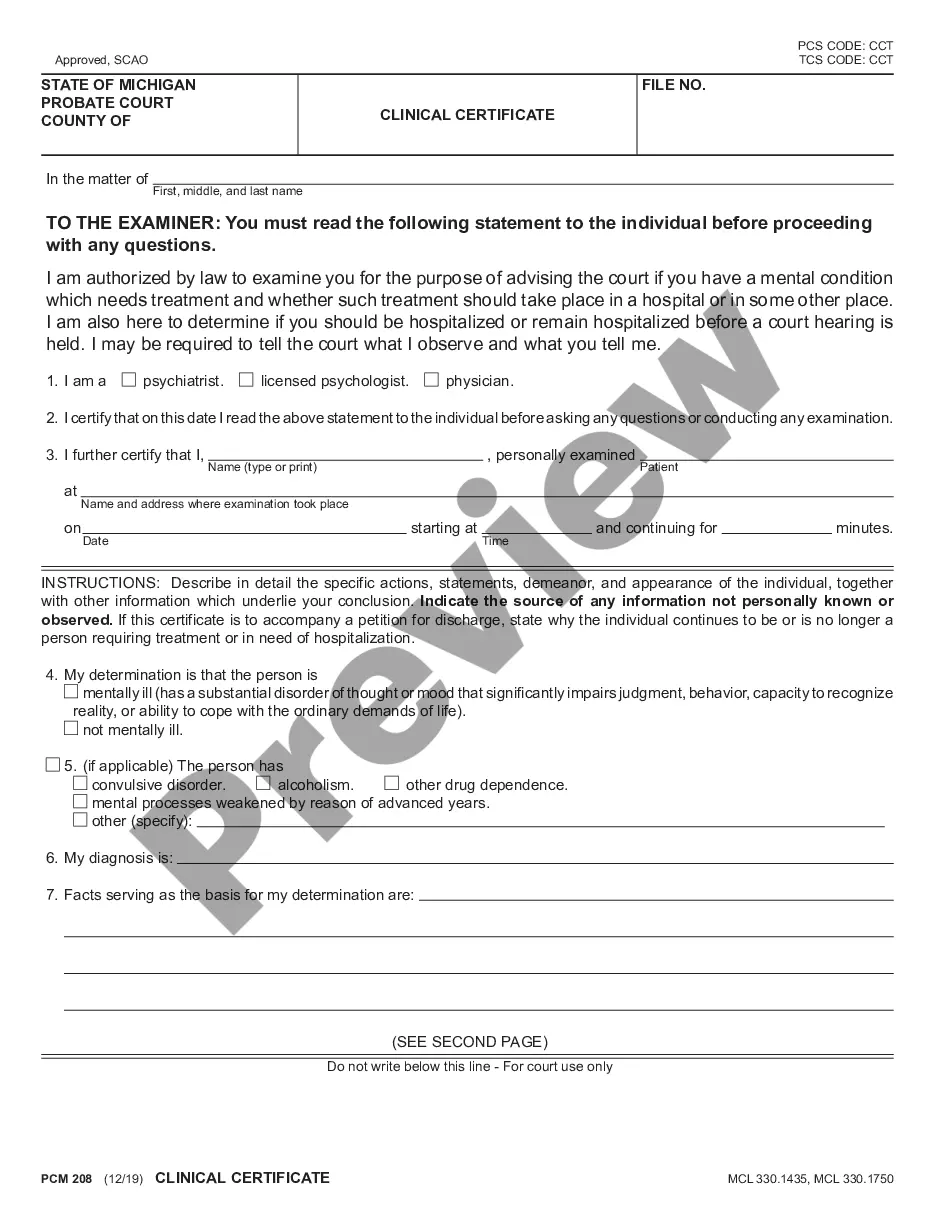

- Step 2. Use the Preview option to view the contents of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal document template.

Form popularity

FAQ

In Wisconsin, filing a lien typically takes a few days to a couple of weeks, depending on your preparedness and the county's processing time. After you submit your Wisconsin Lien Notice, the county clerk will record it and update public records. Timeliness is crucial, so gather your documentation and complete the form accurately to avoid delays. Platforms like US Legal Forms can expedite this process with clear instructions and templates.

A preliminary notice of lien in Wisconsin serves as a warning to property owners of potential lien claims. This notice informs the owner that contractors, subcontractors, or suppliers may seek a lien if payment is not made. It is an essential step to preserving your lien rights under Wisconsin law. Utilizing a resource like US Legal Forms can help you create this notice correctly and efficiently.

Filing a lien on a property in Wisconsin involves several key steps. First, you must gather the necessary information about the property and the parties involved. Next, you should complete the Wisconsin Lien Notice form, ensuring all details are accurate. Finally, submit the completed form to your county clerk's office for recording, and consider using platforms like US Legal Forms for assistance with templates and guidance.

You can find out if you have a lien on your property by checking with your county’s property records office. Many counties provide online portals where you can search for Wisconsin Lien Notices related to your property. Additionally, if you suspect a lien exists, consulting with a legal professional can guide you through the process. Staying informed about potential liens safeguards your financial interests.

Finding out if there is a lien on a property in Wisconsin involves searching public records at the county level. Many counties now offer online access to these records, making it easier to retrieve relevant information about Wisconsin Lien Notices. You can also consider hiring a title company, which specializes in uncovering lien information. This approach can provide peace of mind regarding property ownership.

To check for a lien on a property in Wisconsin, you can visit the county clerk’s office or access their online databases. These resources often provide information about recorded liens, including Wisconsin Lien Notices. It is advisable to have the property details on hand for a more efficient search. Regular monitoring of these records helps you stay informed about any claims.

Yes, a lien can be placed on your property without your immediate knowledge. Creditors often file liens as a legal way to secure payment for debts you owe. In Wisconsin, you might not receive direct notification of this action, making it essential to regularly check for Wisconsin Lien Notices. Being proactive protects your property from unexpected claims.

Liens in Wisconsin generally last for a period of 10 years from the date they are filed. However, the lien may be renewed before it expires if the creditor wishes to maintain their claim. It's crucial to monitor any liens against your property, as they can affect your ability to sell or refinance. US Legal Forms can help you navigate the duration and renewal aspects of Wisconsin lien notices.

To request a lien release letter, you should contact the lien holder directly, either by phone or in writing. Clearly state your request, providing relevant details about the lien and your identification. Be sure to include any proof of debt payment to expedite the process. If you need templates for your request, US Legal Forms can provide helpful resources.

Finding liens on a property in Wisconsin involves searching public records at the county Register of Deeds office where the property is located. You can conduct a search by property owner's name or address. Additionally, many counties offer online databases for easier access to lien information. Utilizing US Legal Forms can help guide you through the search process.