Wisconsin Direct Deposit Form for Social Security

Description

How to fill out Direct Deposit Form For Social Security?

Are you currently in a position where you require documents for both professional or personal purposes almost every single day.

There are many legitimate document templates available online, but finding ones you can rely on is not straightforward.

US Legal Forms provides a wide array of form templates, including the Wisconsin Direct Deposit Form for Social Security, which can be printed to meet state and federal guidelines.

Once you obtain the appropriate form, click Buy now.

Select the pricing plan you want, provide the necessary information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wisconsin Direct Deposit Form for Social Security template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

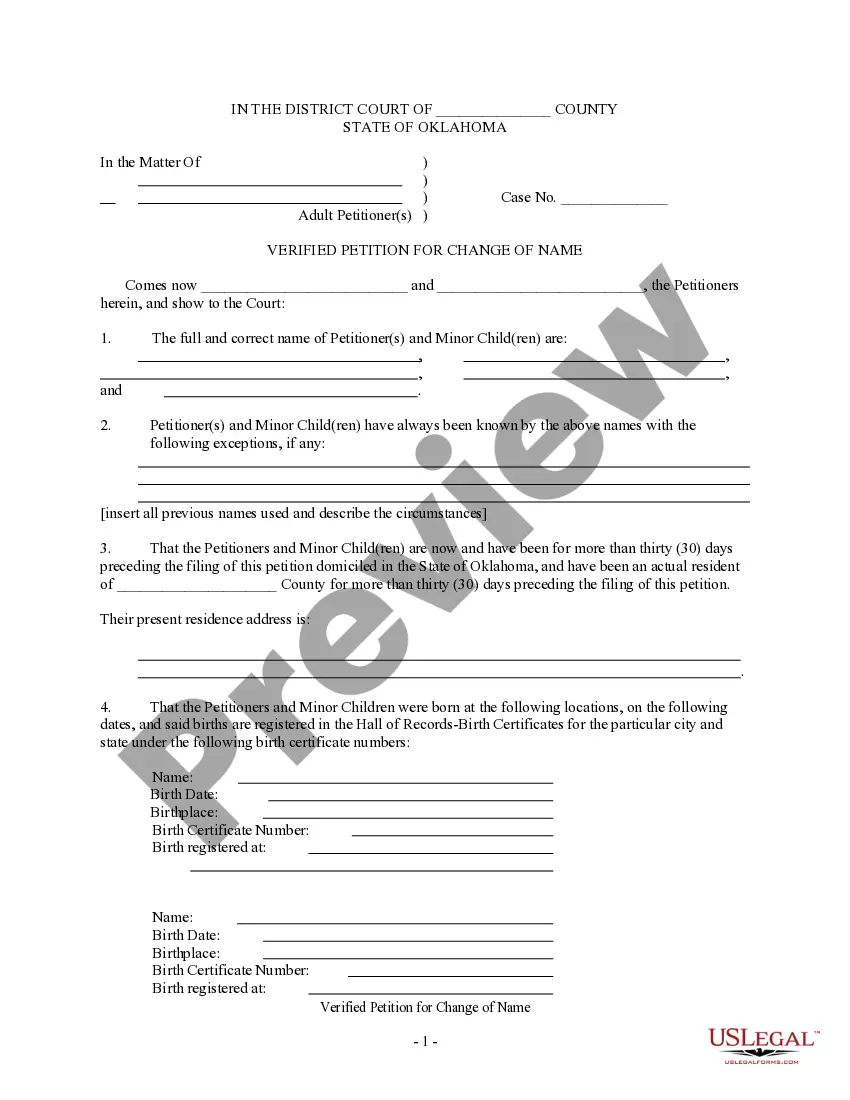

- Use the Preview option to review the form.

- Read the description to confirm you have selected the correct form.

- If the form is not what you’re looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

To obtain a Direct Express card for Social Security, you can apply online or call the Direct Express customer service. This card allows you to access your benefits directly and provides a convenient means to manage your funds. Using US Legal Forms can simplify your application process, making it easier to fulfill your financial needs.

To set up direct deposit for your Social Security disability, complete the Wisconsin Direct Deposit Form for Social Security. You can provide this form to your local Social Security office or submit it online. Doing so guarantees that your disability benefits will be electronically deposited into your bank account, ensuring timely access to your funds.

Filling out direct deposit information is straightforward. On the Wisconsin Direct Deposit Form for Social Security, you will enter your name, Social Security number, and relevant banking details. Be sure to double-check your entries for accuracy before submitting the form to avoid any delays in receiving your benefits.

An example of direct deposit is when your monthly Social Security benefits are deposited directly into your bank account. Instead of receiving a paper check, the Wisconsin Direct Deposit Form for Social Security allows for seamless electronic transfers. This not only saves time but also provides peace of mind knowing your funds are available without the need to visit a bank.

When setting up your direct deposit, provide your employer with your banking information, specifically the Wisconsin Direct Deposit Form for Social Security. This includes your bank's name, routing number, and your account number. By providing this information, your employer can process your paycheck directly into your bank account, making income management easier.

To fill out the Wisconsin Direct Deposit Form for Social Security, start by entering your personal information, such as your name, address, and Social Security number. Next, you will need to provide your bank details, including the account type, account number, and the bank's routing number. Make sure to review everything carefully, as accurate information ensures that your funds will be deposited directly into your account.

The most convenient way to change your direct deposit information with us is by creating a my Social Security account online at . Once you create your account, you can update your bank information from anywhere.

Complete a direct deposit form yourselfDownload the form (PDF)Locate your 9-digit routing and account number - here's how to find them.Fill in your other personal information.Give the completed form to your employer.

Step 1: Choose an account. On EasyWeb, go to the Accounts page.Step 2: Select the direct deposit form. On the Account Activity page, select Direct deposit form (PDF) to download and open a copy of your form.Step 3: Access the form. If you're using Adobe Reader, the form will open in a new window.

If you already receive benefits (retirement, survivors, or disability) and you have a bank account, you can start or update your direct deposit by using the My Profile tab in your personal my Social Security account. You can also decide when your change will take effect.