Wisconsin Social Security Reverse Offset Worksheet is a form used by the Wisconsin Department of Revenue to calculate the amount of money a taxpayer should receive from Social Security benefits after the state has taken an offset, or deduction, from the amount due. This worksheet is used to ensure that taxpayers receive the amount owed to them from Social Security benefits, and to provide the Department of Revenue with the information necessary to determine the amount of the offset. There are three types of Wisconsin Social Security Reverse Offset Worksheets: one for individuals, one for married couples filing jointly, and one for married couples filing separately.

Wisconsin Social Security Reverse Offset Worksheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Wisconsin Social Security Reverse Offset Worksheet?

US Legal Forms is the most straightforward and affordable way to locate appropriate formal templates. It’s the most extensive web-based library of business and individual legal paperwork drafted and verified by lawyers. Here, you can find printable and fillable templates that comply with national and local laws - just like your Wisconsin Social Security Reverse Offset Worksheet.

Getting your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Wisconsin Social Security Reverse Offset Worksheet if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make sure you’ve found the one corresponding to your demands, or find another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you prefer most.

- Register for an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your Wisconsin Social Security Reverse Offset Worksheet and save it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more effectively.

Take full advantage of US Legal Forms, your reputable assistant in obtaining the required official paperwork. Try it out!

Form popularity

FAQ

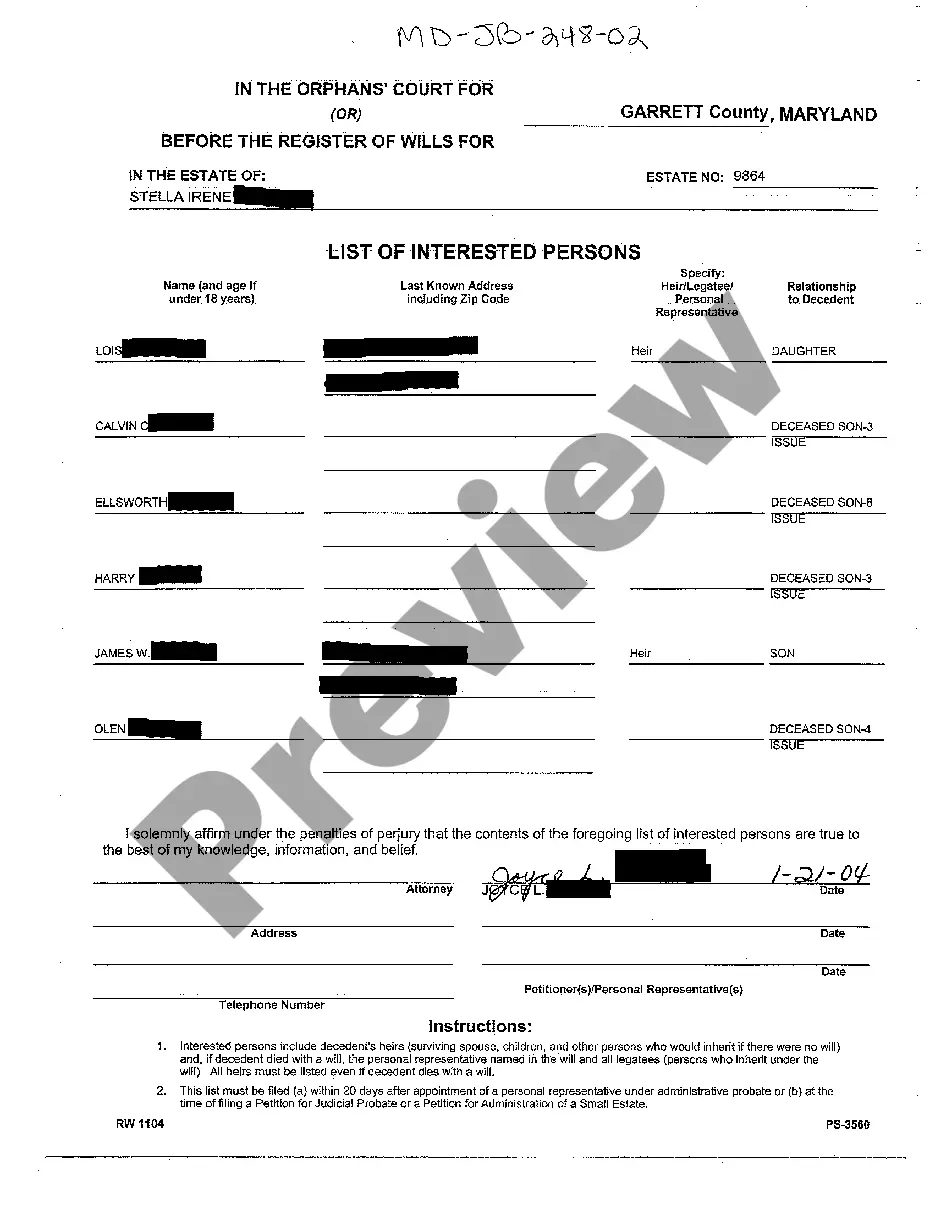

80% of the worker's ?average current earnings,? or. the ?total family benefit? measured by the total amount of SSDI received by all of the members of the recipient's family in the first-month worker's compensation is received.

Q: What are offsets? A. Offsets are provisions in your disability coverage that allow your insurer to deduct from your regular benefit other types of income you receive or are eligible to receive from other sources due to your disability.

To file a claim, an injured worker must: complete an Uninsured Employers Fund Claim Application (by calling (608) 266-3046 and requesting the UEF application form be mailed to them)

Other states, such as Florida and Ohio are ?reverse? offset states, in which the full Social Security benefits are paid, and the employer/worker's compensation insurance carrier is allowed to reduce the worker's compensation benefits paid to keep the injured worker under the cap.

Reverse Offset States · California. · Colorado. · Florida. · Louisiana. · Minnesota. · Montana. · Nevada. · New Jersey.

Reverse offset states are Alaska, California, Colorado, Florida, Louisiana, Minnesota, Montana, New Jersey, New York, North Dakota, Ohio, Oregon, Washington, and Wisconsin.