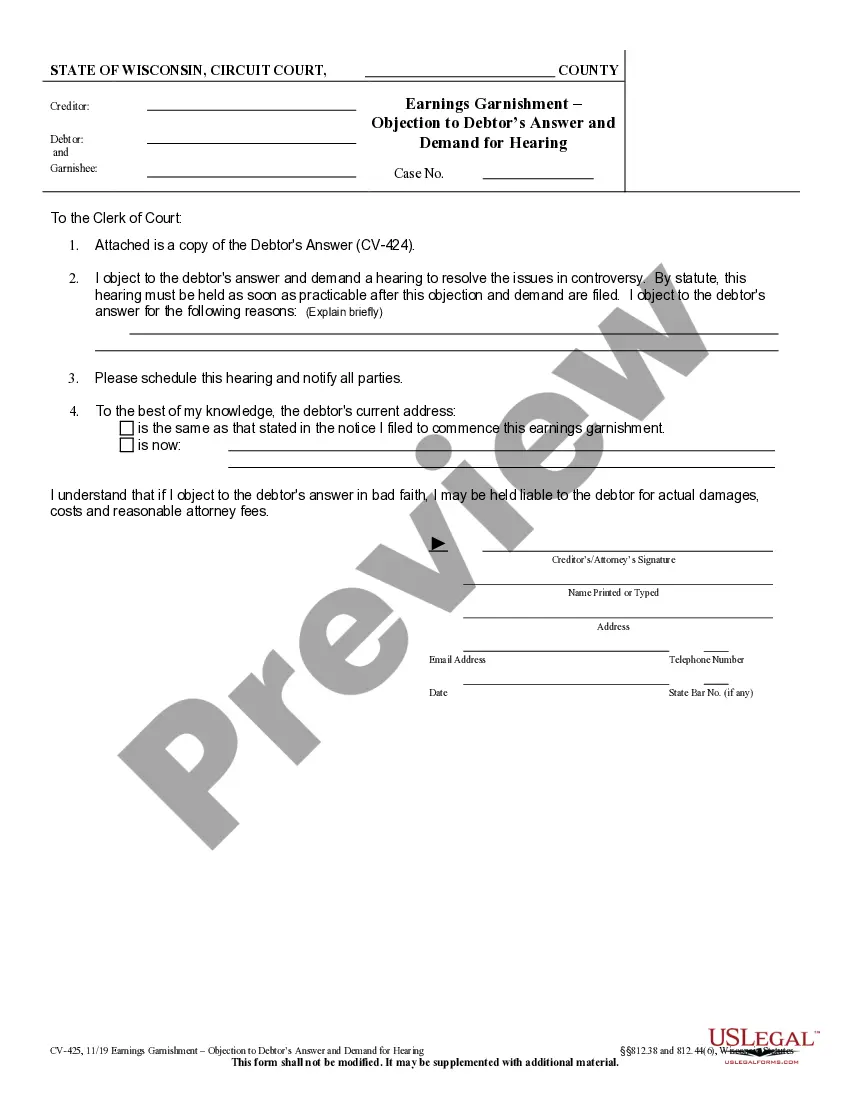

Wisconsin Creditor's Objection to Answer(s) and Demand for Hearing Non-Earnings Garnishment is a legal document filed by a creditor with the court. It is used to challenge the answers given by the debtor in response to a non-earnings garnishment action. This document is used by creditors to file objections to the answers given by the debtor, as well as to demand a hearing on the matter. There are two types of Wisconsin Creditor's Objection to Answer(s) and Demand for Hearing Non-Earnings Garnishment: 1. Objection to Answer(s) and Demand for Hearing Non-Earnings Garnishment for Earnings: This type of objection is filed when the debtor has provided answers to the non-earnings garnishment action that the creditor believes are incorrect or incomplete. The creditor is then requesting a hearing to challenge the answers given by the debtor. 2. Objection to Answer(s) and Demand for Hearing Non-Earnings Garnishment for Non-Earnings: This type of objection is filed when the debtor has provided answers to the non-earnings garnishment action that the creditor believes are incorrect or incomplete. The creditor is then requesting a hearing to challenge the answers given by the debtor.

Wisconsin Creditor's Objection to Answer(s) and Demand for Hearing Non-Earnings Garnishment

Description

How to fill out Wisconsin Creditor's Objection To Answer(s) And Demand For Hearing Non-Earnings Garnishment?

Preparing official paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state laws and are examined by our specialists. So if you need to prepare Wisconsin Creditor's Objection to Answer(s) and Demand for Hearing Non-Earnings Garnishment, our service is the best place to download it.

Getting your Wisconsin Creditor's Objection to Answer(s) and Demand for Hearing Non-Earnings Garnishment from our library is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they locate the proper template. Afterwards, if they need to, users can take the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a quick instruction for you:

- Document compliance verification. You should attentively review the content of the form you want and make sure whether it suits your needs and fulfills your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab above until you find a suitable template, and click Buy Now when you see the one you want.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Wisconsin Creditor's Objection to Answer(s) and Demand for Hearing Non-Earnings Garnishment and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service today to obtain any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

(1) The creditor shall pay a $15 fee to the garnishee for each earnings garnishment or each stipulated extension of that earnings garnishment. This fee shall be included as a cost in the creditor's claim in the earnings garnishment.

You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep. (If you're unable to pay your bills, learn which debts get wiped out in Chapter 7 bankruptcy.)

By law, you are entitled to an exemption of not less than 80% of your disposable earnings. Your "disposable earnings" are those remaining after social security and federal and state income taxes are withheld.

If the IRS is garnishing your wages, working with a tax professional may help you stop the garnishment. Your tax professional will analyze your financial situation and tax debt to determine the best way to move forward. In many cases, this can be done through a free consultation.

CV- 423,424, 426, 427 within 60 days of filing the Earnings Garnishment Notice but not more than 7 days after garnishee served, at least 3 days before next payday. Garnishment is good for 13 weeks unless debtor agrees to continued withholding in writing. Must renew every 13 weeks add cost to debtors owed amount.

If your employee has any concerns about the amount of wages being withheld, they should contact us directly at 608-266-7879 or DORCompliance@wisconsin.gov.

812.01 Commencement of garnishment. (1) Any creditor may proceed against any person who is indebted to or has any property in his or her possession or under his or her control belonging to such creditor's debtor or which is subject to satisfaction of an obligation described under s.