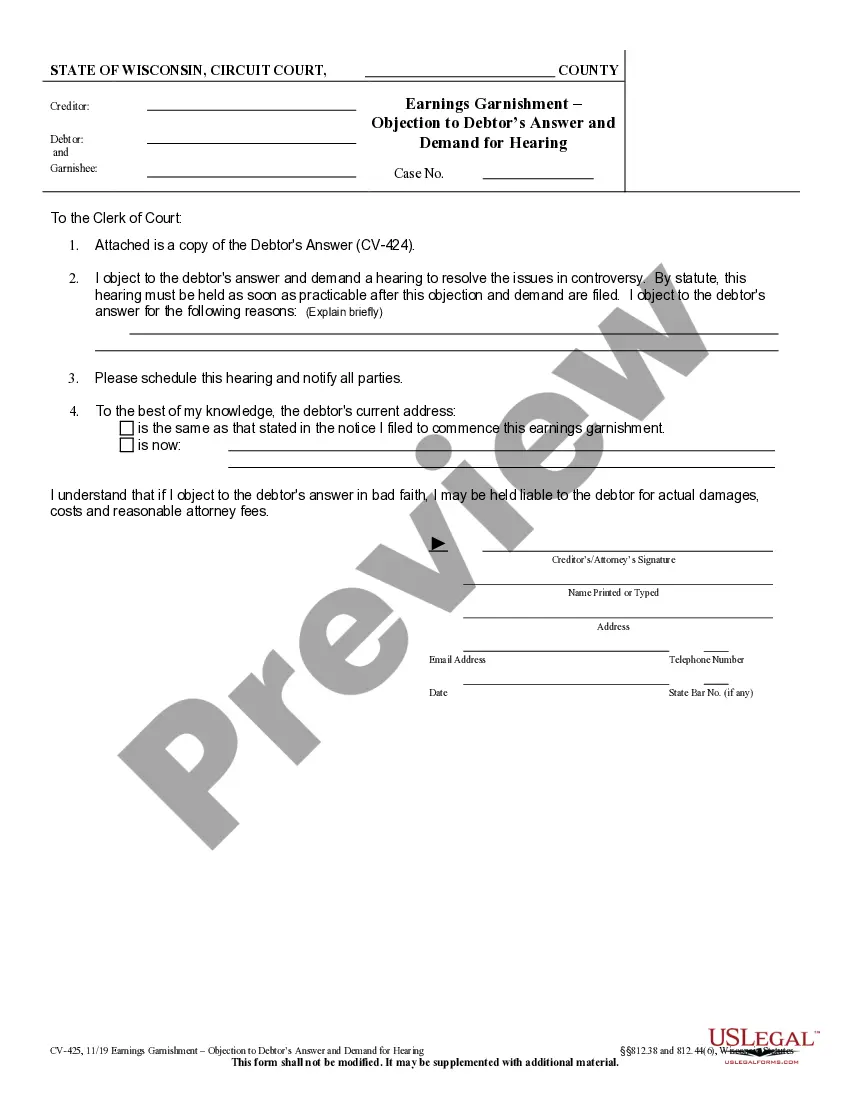

The Wisconsin CV-425 Earnings Garnishment — Objection to Debtor's Answer & Demand for Hearing is a form used to file an objection to a debtor's answer to a creditor's garnishment. It is a legal document used to dispute the debtor's response and requires the debtor to attend a hearing. The form includes the name, address, and phone number of the debtor, the name and address of the creditor, the date of service, the amount of the garnishment, and the reasons for the objection. There are two types of Wisconsin CV-425 Earnings Garnishment — Objection to Debtor's Answer & Demand for Hearing: one for wage garnishments (Form CV-425A) and one for bank account garnishments (Form CV-425B).

Wisconsin CV-425 Earnings Garnishment - Objection to Debtor's Answer & Demand for Hearing

Description

How to fill out Wisconsin CV-425 Earnings Garnishment - Objection To Debtor's Answer & Demand For Hearing?

How much time and resources do you often spend on drafting formal documentation? There’s a greater opportunity to get such forms than hiring legal experts or spending hours searching the web for an appropriate blank. US Legal Forms is the top online library that provides professionally designed and verified state-specific legal documents for any purpose, like the Wisconsin CV-425 Earnings Garnishment - Objection to Debtor's Answer & Demand for Hearing.

To obtain and prepare a suitable Wisconsin CV-425 Earnings Garnishment - Objection to Debtor's Answer & Demand for Hearing blank, follow these simple instructions:

- Examine the form content to ensure it complies with your state regulations. To do so, check the form description or use the Preview option.

- If your legal template doesn’t meet your needs, find another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Wisconsin CV-425 Earnings Garnishment - Objection to Debtor's Answer & Demand for Hearing. If not, proceed to the next steps.

- Click Buy now once you find the right document. Choose the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is absolutely safe for that.

- Download your Wisconsin CV-425 Earnings Garnishment - Objection to Debtor's Answer & Demand for Hearing on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously acquired documents that you securely keep in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most reliable web solutions. Sign up for us now!

Form popularity

FAQ

If your employee has any concerns about the amount of wages being withheld, they should contact us directly at 608-266-7879 or DORCompliance@wisconsin.gov.

CLAIMING AN EXEMPTION Call the Wisconsin State Bar's Lawyer Referral and Information Service (800) 362-9082 to find an area lawyer who handles cases like yours. To claim an exemption, the debtor must inform the creditor, or creditor's agent or attorney, of the specific property in which the debtor takes an exemption.

(1) The creditor shall pay a $15 fee to the garnishee for each earnings garnishment or each stipulated extension of that earnings garnishment. This fee shall be included as a cost in the creditor's claim in the earnings garnishment.

You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep. (If you're unable to pay your bills, learn which debts get wiped out in Chapter 7 bankruptcy.)

(1) The creditor shall pay a $15 fee to the garnishee for each earnings garnishment or each stipulated extension of that earnings garnishment. This fee shall be included as a cost in the creditor's claim in the earnings garnishment. (2) In addition to the $15 garnishee fee under sub.

CV- 423,424, 426, 427 within 60 days of filing the Earnings Garnishment Notice but not more than 7 days after garnishee served, at least 3 days before next payday. Garnishment is good for 13 weeks unless debtor agrees to continued withholding in writing. Must renew every 13 weeks add cost to debtors owed amount.

If the IRS is garnishing your wages, working with a tax professional may help you stop the garnishment. Your tax professional will analyze your financial situation and tax debt to determine the best way to move forward. In many cases, this can be done through a free consultation.