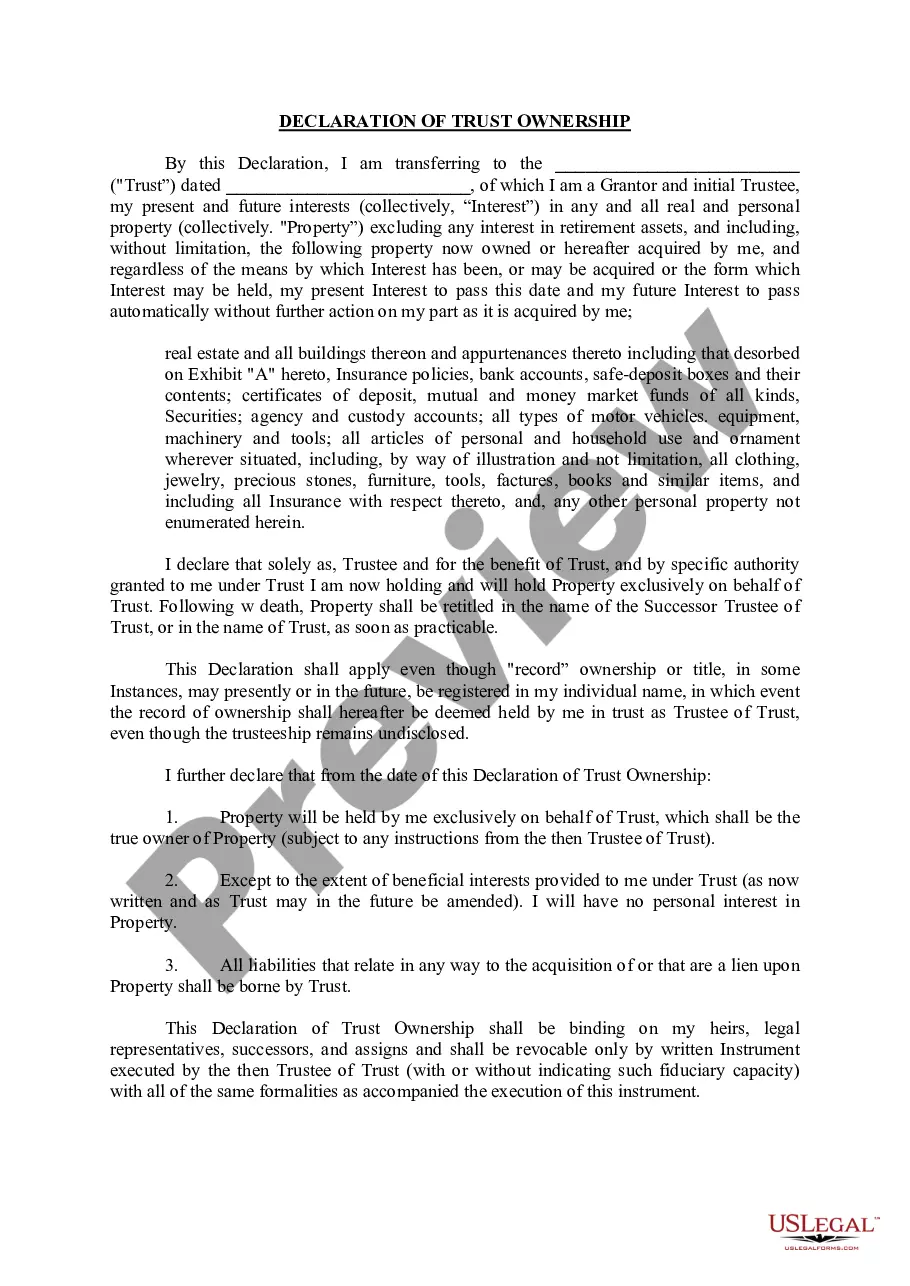

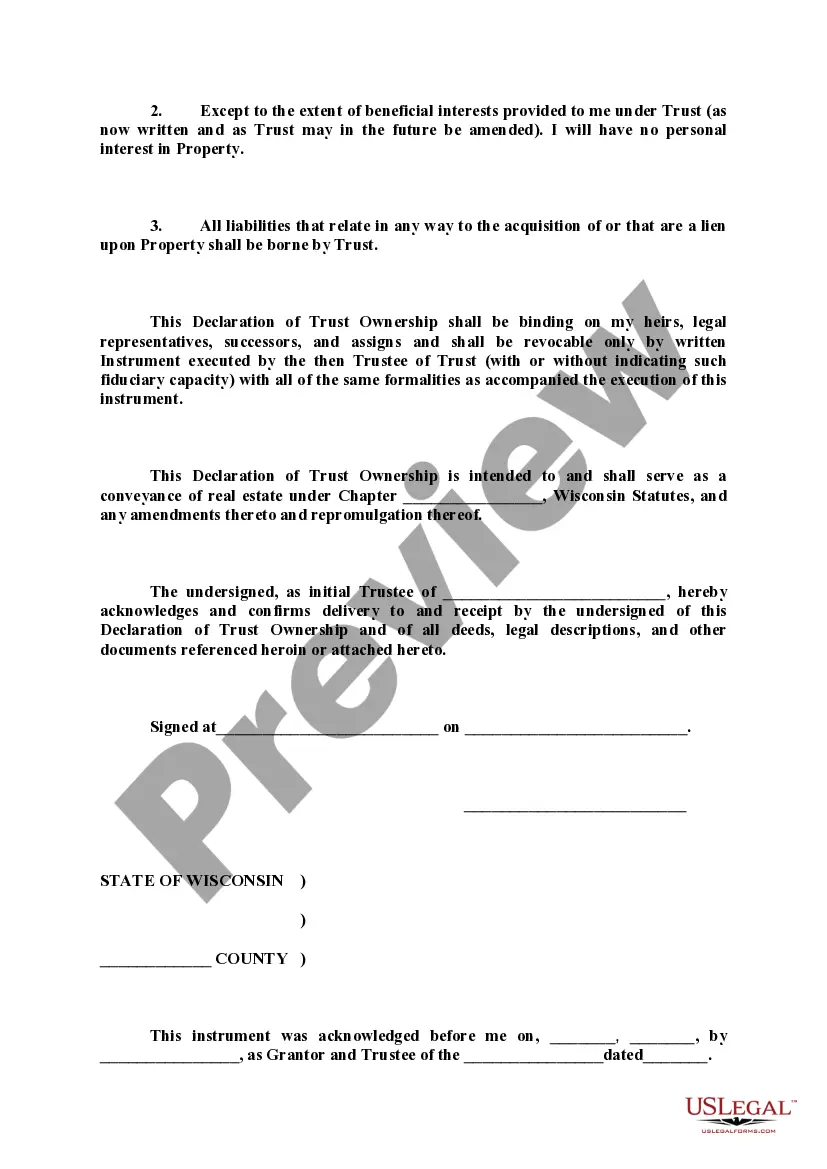

Wisconsin Declaration of Trust Ownership

Description

How to fill out Wisconsin Declaration Of Trust Ownership?

Out of the great number of services that provide legal templates, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates before purchasing them. Its comprehensive library of 85,000 samples is grouped by state and use for simplicity. All the documents available on the platform have already been drafted to meet individual state requirements by certified lawyers.

If you have a US Legal Forms subscription, just log in, look for the template, hit Download and obtain access to your Form name in the My Forms; the My Forms tab holds your downloaded forms.

Keep to the tips below to get the form:

- Once you find a Form name, make certain it is the one for the state you need it to file in.

- Preview the form and read the document description before downloading the sample.

- Search for a new template via the Search field if the one you’ve already found is not correct.

- Click on Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

After you have downloaded your Form name, you are able to edit it, fill it out and sign it with an online editor that you pick. Any document you add to your My Forms tab can be reused multiple times, or for as long as it remains to be the most up-to-date version in your state. Our service offers easy and fast access to templates that fit both lawyers as well as their clients.

Form popularity

FAQ

The trustees are the legal owners of the assets held in a trust. Their role is to: deal with the assets according to the settlor's wishes, as set out in the trust deed or their will.

Trust property refers to the assets placed into a trust, which are controlled by the trustee on behalf of the trustor's beneficiaries.Estate planning allows for trust property to pass directly to the designated beneficiaries upon the trustor's death without probate.

The trustee is the legal owner of the property in trust, as fiduciary for the beneficiary or beneficiaries who is/are the equitable owner(s) of the trust property. Trustees thus have a fiduciary duty to manage the trust to the benefit of the equitable owners.

A declaration of trust under U.S. law is a document or an oral statement appointing a trustee to oversee assets being held for the benefit of one or more other individuals. These assets are held in a trust.

Once property has been transferred to a trust, the trust itself becomes the rightful owner of the assets. In an irrevocable trust, the assets can no longer be controlled or claimed by the previous owner.

Trusts aren't public record, so they're not usually recorded anywhere. Instead, the trust attorney determines who is entitled to receive a copy of the document, even if state law doesn't require it.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

A trust is not considered confidential when the trustee is given discretion to provide statements to beneficiaries.However, families establishing irrevocable trusts to transfer wealth worry about the impact access to large sums of wealth could have on their beneficiaries.

Family trust can be searched using a stack of individual searches, including property search and people search. It can be challenging to find the trustee and it can take some detective work. The key is to use the last name of the family and the property address as your starting point for your search.