Declaration of Trust

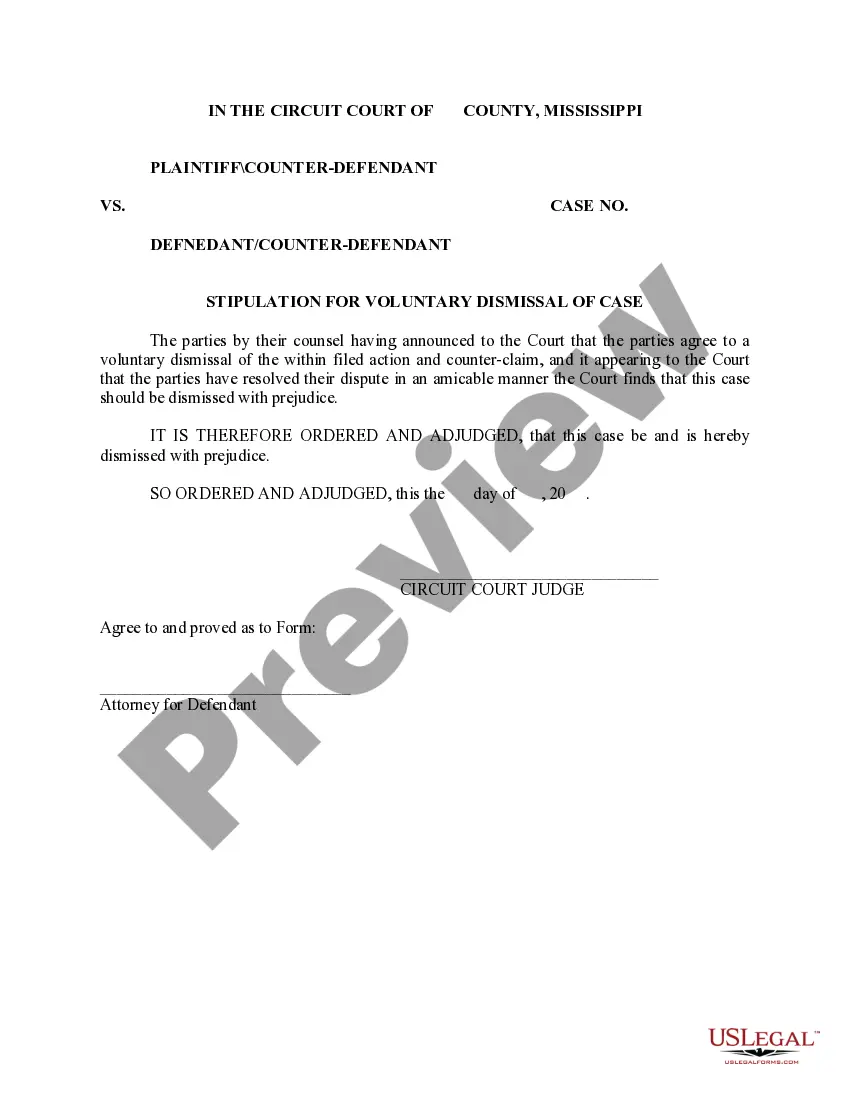

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Declaration of Trust: A legal document that declares one party holds property or assets for the benefit of another. Declaratory Relief: A legal determination that resolves legal uncertainty for the parties involved. Common Law: A body of unwritten laws based on legal precedents established by the courts. Declaration Law: Laws that pertain to the formulation of formal declarations. Canon Law: A system of laws and principles used by religious institutions. Legal Systems: Frameworks governing the administration of justice in a jurisdiction.

Step-by-Step Guide to Creating a Declaration of Trust

- Determine the Trustor, Trustee, and Beneficiary roles.

- Identify the assets to be included.

- Specify the terms and conditions of the trust arrangement.

- Draft the declaration document with clear, legally sound language.

- Have all relevant parties sign the document, preferably with legal witnesses or a notary present.

- Store the document in a safe, accessible location and register it if required by local law.

Risk Analysis in Declarations of Trust

- Legal disputes: Risk of conflicts between stakeholders about terms or asset distribution.

- Financial implications: Potential tax implications or mismanagement of assets.

- Compliance: The necessity to adhere to changes in Declaration Law and other relevant legal systems.

Best Practices for Drafting a Declaration of Trust

- Ensure the language is clear and unambiguous.

- Consult with a legal professional experienced in trust laws.

- Regularly update the trust to reflect any changes in assets or beneficiary circumstances.

Common Mistakes & How to Avoid Them

- Failing to specify details: Always be explicit about the terms and conditions of the trust.

- Neglecting legal compliance: Keep abreast of Declaration Law and ensure ongoing compliance.

- Ignoring tax implications: Consult with a financial advisor to understand potential tax duties.

FAQ

What is the difference between Declaration Law and Common Law? Declaration Law specifically deals with the rules surrounding the creation of legal declarations, whereas Common Law is a broader body of law developed by judges through decisions in court cases. How does Canon Law interact with Declaration of Trusts? Generally, Canon Law would only interact with Declarations of Trust within the context of religious institutions managing their own assets.

How to fill out Declaration Of Trust?

Utilize the most comprehensive legal library of forms. US Legal Forms is the perfect place for getting up-to-date Declaration of Trust templates. Our service provides 1000s of legal forms drafted by licensed attorneys and grouped by state.

To download a template from US Legal Forms, users simply need to sign up for an account first. If you are already registered on our platform, log in and select the template you need and buy it. Right after purchasing forms, users can see them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the guidelines below:

- Check if the Form name you have found is state-specific and suits your requirements.

- If the form has a Preview option, use it to review the sample.

- If the template doesn’t suit you, utilize the search bar to find a better one.

- Hit Buy Now if the template corresponds to your needs.

- Choose a pricing plan.

- Create an account.

- Pay via PayPal or with yourr debit/bank card.

- Select a document format and download the sample.

- As soon as it is downloaded, print it and fill it out.

Save your effort and time with the platform to find, download, and fill in the Form name. Join a large number of happy clients who’re already using US Legal Forms!

Form popularity

FAQ

A document in which a person declares that he holds (or two or more persons declare that they hold) assets on trust for the benefit of one or more beneficiaries.

What's included in a Declaration of Trust will depend on your individual circumstances. It can include: How much each person contributes to the deposit, and how much will be repaid to them. What percentage of the property each person will own, and how the money will be split if the property is sold.

A declaration of trust is usually a statement by the legal owner of property that s/he holds the beneficial interest for someone else.The donor/trustee does not need to register the trust with the Land Registry, nor does the document require delivery or a witness to signatures.

Can I make a declaration of trust myself? Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document.

List Your Assets and Decide Which You'll Include in the Trust. Gather the Paperwork. Decide Whether You Will Be the Sole Grantor. Choose Beneficiaries. Choose a Successor Trustee. Choose Someone to Manage Property for Minor Children. Prepare the Trust Document. Sign and Notarize.

While you can use a free online template for a declaration of trust, it is recommended that you get advice from a solicitor, who can also draft the deed. A declaration of trust is a legally binding document, so getting the wording right is very important, and it can be costly to change.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

What's included in a Declaration of Trust will depend on your individual circumstances. It can include: How much each person contributes to the deposit, and how much will be repaid to them. What percentage of the property each person will own, and how the money will be split if the property is sold.

A declaration of trust under U.S. law is a document or an oral statement appointing a trustee to oversee assets being held for the benefit of one or more other individuals. These assets are held in a trust.The declaration of trust is sometimes referred to as a nominee declaration.