Washington Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Self-Employed Independent Contractor Payment Schedule?

You might spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that can be reviewed by professionals.

You can easily download or print the Washington Self-Employed Independent Contractor Payment Schedule from the service.

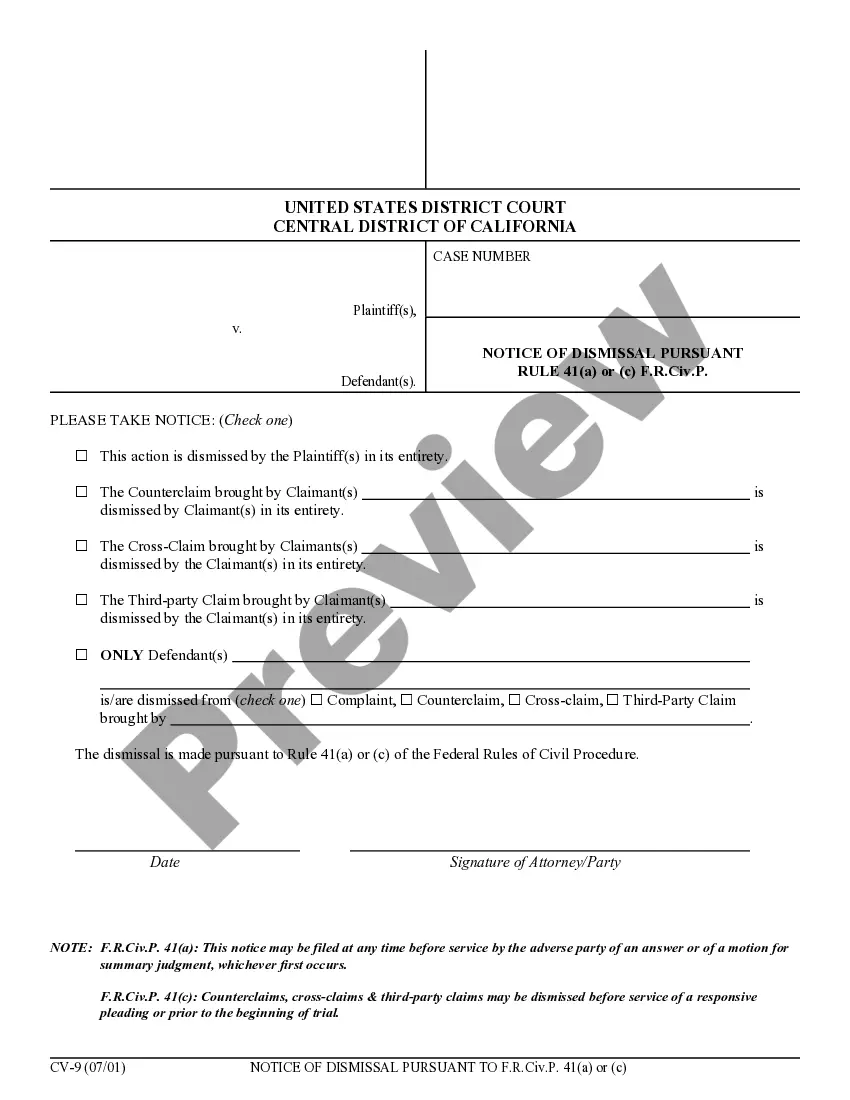

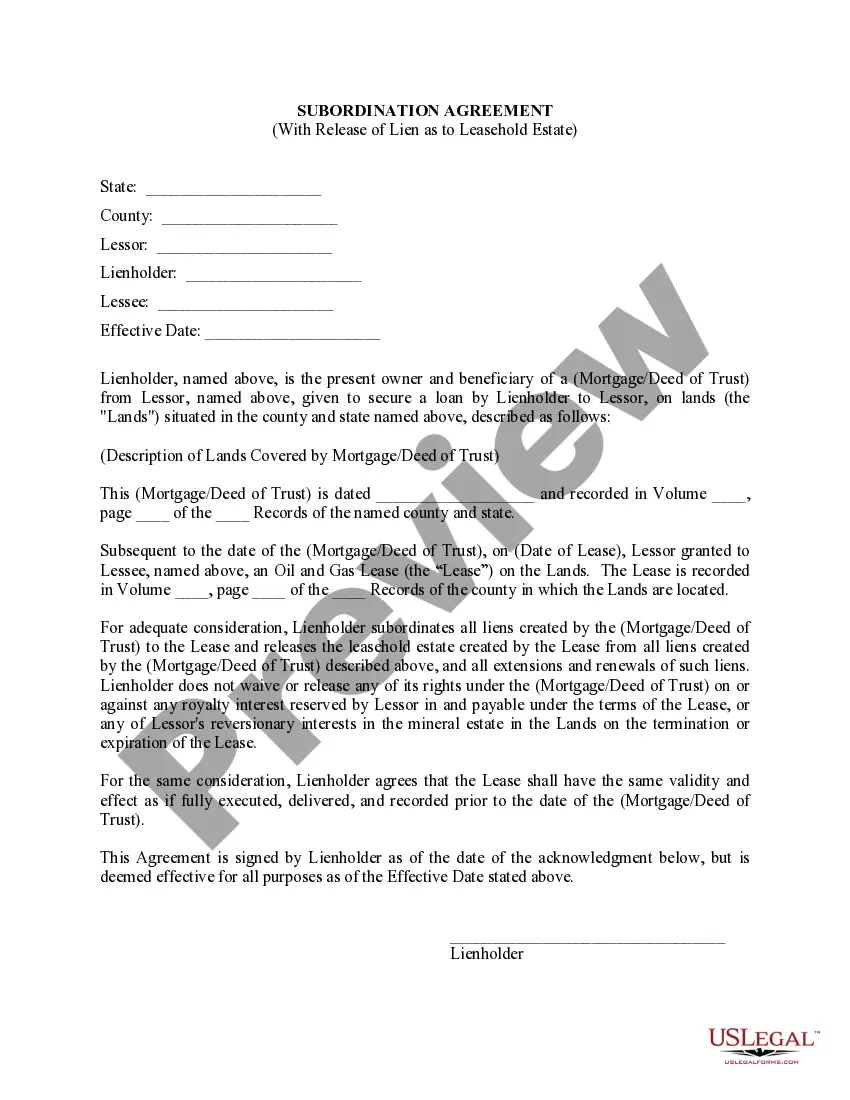

If you wish to find another version of your form, use the Search section to locate the template that fits you and your needs. Once you’ve found the template you require, click on Purchase now to continue. Select the pricing plan you want, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of your document and download it to your device. Make changes to the document as necessary. You can complete, modify, sign, and print the Washington Self-Employed Independent Contractor Payment Schedule. Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to cater to your business or personal needs.

- If you already possess a US Legal Forms account, you can sign in and click the Obtain button.

- After that, you can complete, modify, print, or sign the Washington Self-Employed Independent Contractor Payment Schedule.

- Every legal document template you obtain is yours permanently.

- To get another copy of the purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Read the form description to confirm you have chosen the right form.

- If available, use the Review button to view the document template as well.

Form popularity

FAQ

The $600 rule, as established by the IRS, states that you must report any payments made to independent contractors if the total exceeds $600 within a calendar year. This rule is crucial for complying with the Washington Self-Employed Independent Contractor Payment Schedule. By adhering to this guideline, you ensure proper tax reporting and avoid potential penalties. Utilizing resources from US Legal Forms can help you navigate these requirements effectively.

To report payments to independent contractors in Washington, you must gather all relevant information, such as their Social Security number or Employer Identification Number. You should document each payment made throughout the year, ensuring you meet the Washington Self-Employed Independent Contractor Payment Schedule. At the end of the year, you will typically need to issue a Form 1099-NEC if the total payments exceed $600. Using platforms like US Legal Forms can simplify this process, providing templates and guidance for accurate reporting.

To report payments to an independent contractor, you typically use Form 1099-NEC, especially for amounts over $600 in a year. Ensure you have the contractor's correct tax identification number, which you can obtain through the AW-9 form. This process helps both parties maintain compliance with tax obligations related to the Washington Self-Employed Independent Contractor Payment Schedule.

Filling out the AW-9 requires you to provide your tax information as an independent contractor for your Washington Self-Employed Independent Contractor Payment Schedule. Simply include your name, business name if applicable, and taxpayer identification number. This information helps clients accurately report payments made to you.

Yes, independent contractors typically use Schedule C. This form is essential for reporting their earnings and expenses, which reflect their work for clients and customers. By utilizing Schedule C, you ensure that you accurately report your income in accordance with IRS guidelines.

The $2500 expense rule simplifies the reporting of certain business expenses for your Washington Self-Employed Independent Contractor Payment Schedule. It allows you to deduct items costing $2500 or less in the year they are purchased rather than depreciating them over several years. This can save you time and effort in maintaining detailed records for smaller purchases.

Filling out Schedule C as an independent contractor requires a focus on reporting your business income and expenses. Start by detailing your revenue from all your contracting work. Then, list your expenses in logical categories, ensuring you keep receipts and documentation for each line item to support your claims.

To fill out Schedule C for your Washington Self-Employed Independent Contractor Payment Schedule, start by gathering all necessary income and expense data. You will need details like your gross receipts, costs of goods sold, and operating expenses. Next, follow the form's sections accurately to ensure you report everything correctly.

Yes, you can fill out your own Schedule C for your Washington Self-Employed Independent Contractor Payment Schedule. This form reports your income and expenses to the IRS. It's designed for self-employed individuals, so as an independent contractor, you can complete it with the information you keep on your earnings and expenses.

Payment terms for independent contractors often depend on the contract they negotiate. Common arrangements include hourly rates, project-based payments, or retainers, which all should reflect completed work rather than a set timeline. In Washington, establishing a clear payment schedule significantly benefits self-employed independent contractors, as it provides transparency and legal protection. When navigating these terms, utilizing a reliable platform like uslegalforms can simplify this process.