Washington Recovery Services Contract - Self-Employed

Description

How to fill out Recovery Services Contract - Self-Employed?

You can dedicate hours online trying to locate the legal document template that satisfies the state and federal standards you require.

US Legal Forms offers thousands of legal documents that have been vetted by professionals.

You can easily download or print the Washington Recovery Services Contract - Self-Employed from our service.

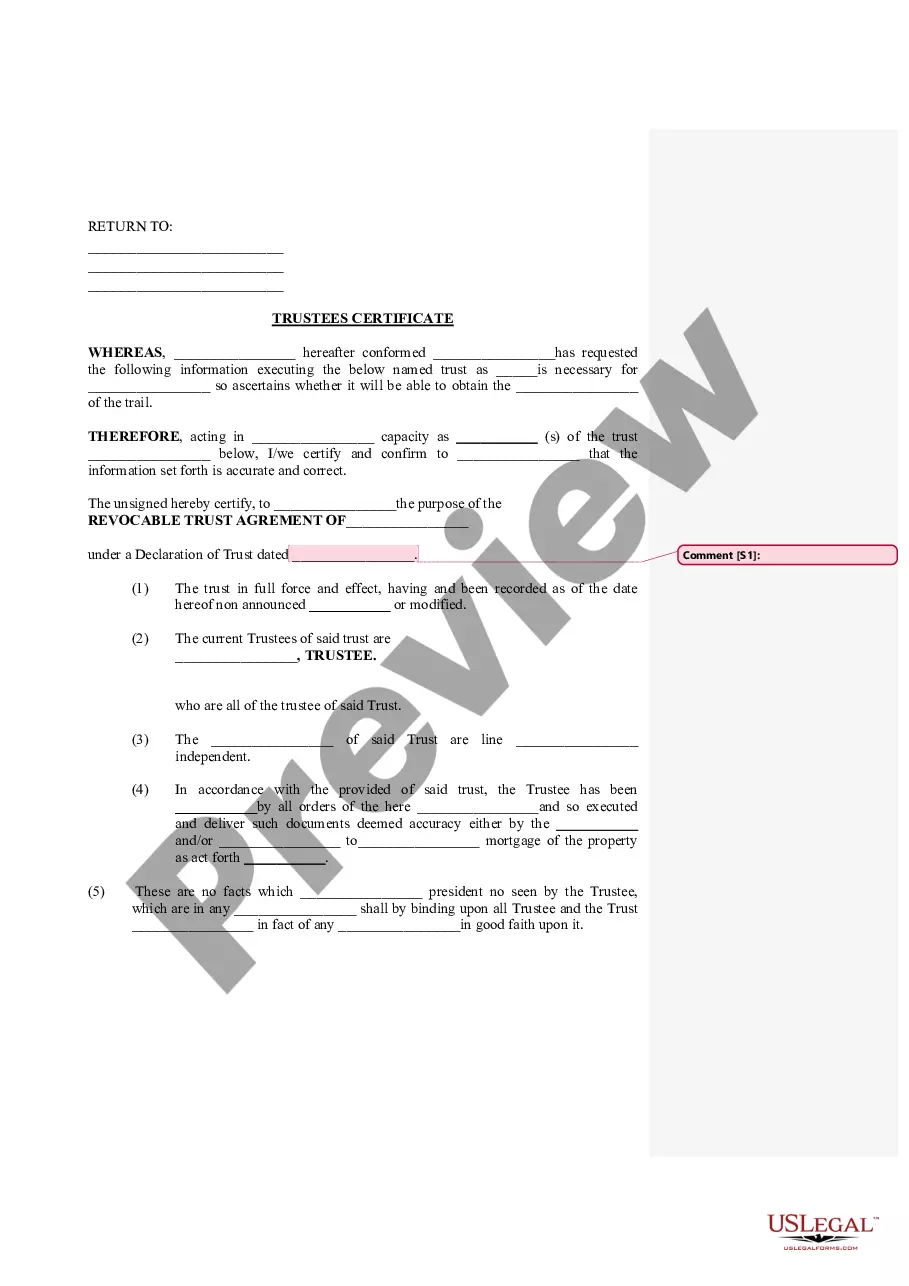

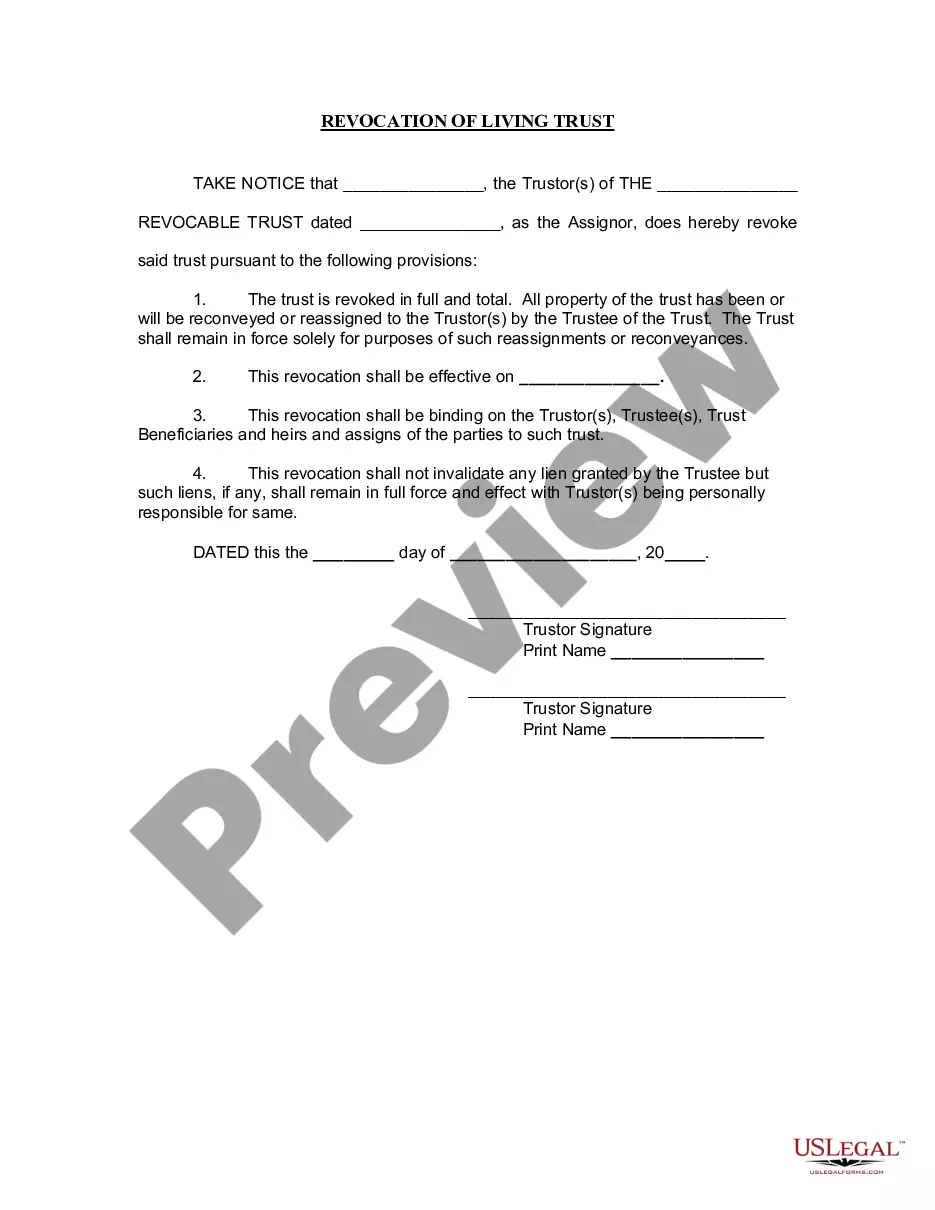

If available, use the Preview button to review the document template as well. To find another version of the document, use the Search section to locate the template that meets your needs and requirements. Once you have found the template you want, click on Download now to proceed. Choose the pricing plan you prefer, enter your credentials, and create an account on US Legal Forms. Complete the transaction. You can use your Visa, Mastercard, or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make modifications to your document if necessary. You can fill out, edit, sign, and print the Washington Recovery Services Contract - Self-Employed. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can fill out, modify, print, or sign the Washington Recovery Services Contract - Self-Employed.

- Every legal document template you download is yours indefinitely.

- To obtain another copy of a downloaded form, go to the My documents section and click on the appropriate button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm you have chosen the right document.

Form popularity

FAQ

To become an independent contractor in Washington state, you first need to be familiar with the Washington Recovery Services Contract - Self-Employed guidelines. Start by completing any necessary registrations or certifications for your trade. You should also obtain required insurance to protect yourself and your business. Once you have met these requirements, you can begin offering your services to clients, leveraging platforms like uslegalforms for guidance and useful resources.

To establish yourself as an independent contractor under the Washington Recovery Services Contract - Self-Employed, begin by choosing a business name and forming a legal entity if necessary. Next, register for any required licenses and permits at the state and local levels. It's also important to set up a separate bank account for your business funds to simplify your accounting and finances. Finally, market your services effectively to gain clients and build a solid reputation.

Both terms describe similar roles, but they can imply different aspects of work. 'Self-employed' is a broader term indicating you own your business, while 'independent contractor' specifically refers to your working relationship. Depending on your situation, using 'Washington Recovery Services Contract - Self-Employed' might resonate more with your audience, as it specifies the unique nature of your contractual agreements. Ultimately, choose the term that best represents your work and professional style.

To perform services as an independent contractor in the US, you generally need to complete certain registration and licensing processes. Check your state’s requirements to ensure compliance, and consider utilizing a Washington Recovery Services Contract - Self-Employed to formalize your agreement with clients. This contract can help set clear expectations and protect your rights. Moreover, staying updated on local business regulations will help you operate smoothly.

Yes, contract work typically counts as self-employment. Whether you are under a Washington Recovery Services Contract - Self-Employed or any similar agreement, you are running your own business by providing services independently. This arrangement requires you to manage your taxes and finances responsibly. Gaining clarity on the terms of your contracts is essential to navigate this self-employment landscape successfully.

Absolutely, you can have a contract when you are self-employed. A clear Washington Recovery Services Contract - Self-Employed can serve as a solid foundation for your business agreements. Such contracts clarify the services you provide, the payment terms, and expectations for both you and your clients. Having a formal agreement helps prevent misunderstandings and fosters trust.

Yes, 1099 contract work is generally considered self-employment. When you receive a 1099 form, it indicates that you’re earning income as an independent contractor, as opposed to an employee. This distinction means you will need to manage your taxes and financial responsibilities, particularly regarding the Washington Recovery Services Contract - Self-Employed. Understanding this classification will help you navigate your rights and obligations as a contractor.

New rules for self-employed individuals often focus on taxation and benefits adjustments. For instance, understanding your obligations regarding self-employment taxes and potential eligibility for certain assistance programs is crucial. Familiarizing yourself with these changes, especially related to the Washington Recovery Services Contract - Self-Employed, can help you adapt quickly and effectively. Staying informed will allow you to make empowered decisions for your business.

Yes, a self-employed person can have a contract. In fact, entering into a Washington Recovery Services Contract - Self-Employed can help clarify the terms of your work and responsibilities. Contracts provide legal acknowledgment of the services you offer, ensuring both parties understand their obligations. This structure not only protects you but also enhances your professional relationships.