Washington Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005

Description

How to fill out Chapter 7 Individual Debtors Statement Of Intention - Form 8 - Post 2005?

Choosing the best legal file design can be quite a have a problem. Obviously, there are tons of themes available on the Internet, but how would you find the legal kind you need? Use the US Legal Forms website. The support provides thousands of themes, for example the Washington Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005, that you can use for company and private requires. Every one of the types are examined by pros and meet up with state and federal requirements.

In case you are previously signed up, log in in your profile and click the Acquire switch to find the Washington Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005. Use your profile to search throughout the legal types you might have ordered formerly. Go to the My Forms tab of your profile and obtain another copy of your file you need.

In case you are a whole new user of US Legal Forms, allow me to share easy recommendations for you to stick to:

- Very first, make sure you have selected the appropriate kind for your personal area/area. You can check out the form utilizing the Review switch and read the form explanation to make sure this is the best for you.

- If the kind does not meet up with your needs, make use of the Seach industry to obtain the proper kind.

- When you are sure that the form is suitable, click the Get now switch to find the kind.

- Opt for the prices prepare you desire and enter the needed information. Make your profile and purchase your order using your PayPal profile or credit card.

- Select the document formatting and download the legal file design in your product.

- Total, revise and produce and indication the received Washington Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005.

US Legal Forms may be the greatest library of legal types that you can see different file themes. Use the service to download appropriately-produced paperwork that stick to status requirements.

Form popularity

FAQ

Examples of nonexempt assets that can be subject to liquidation: Additional home or residential property that is not your primary residence. Investments that are not part of your retirement accounts. An expensive vehicle(s) not covered by bankruptcy exemptions.

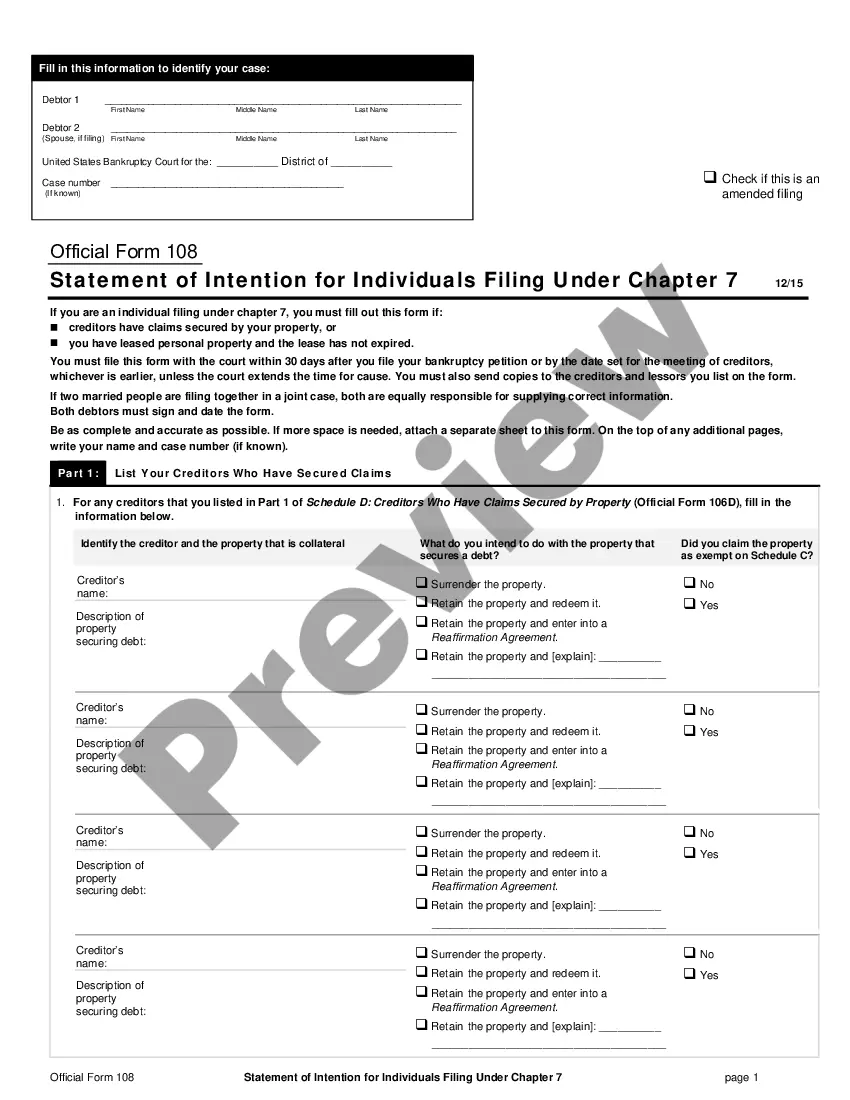

When you file for Chapter 7 bankruptcy, you will have to complete a form called the Statement of Intention for Individuals Filing Under Chapter 7. On this form, you tell the court whether you want to keep your secured and leased property?such as your car, boat, or home?or let it go back to the creditor.

Chapter 7 is your better bet if you are hopelessly awash in debt from credit cards, medical bills, personal loans, and/or car loans and your income simply cannot keep up. As noted above, you're most likely going to get to keep most of your assets while erasing your unsecured debt.

The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or your car while also discharging unsecured debt.

If your company owes a current employee wages when it files for Chapter 11, then the employee's paychecks should not be interrupted. The company will ask the court's permission to keep paying its employees as long as it stays in business.

Filing for Chapter 7 bankruptcy will wipe out your mortgage obligation. Still, if you aren't willing to pay the mortgage, you'll have to give up the home because your lender's right to foreclose doesn't go away when you file for Chapter 7.

The federal government, as well as 42 states, have a homestead exemption that allows a person filing for bankruptcy to protect a certain amount of equity in a home. The federal exemption, which changes every three years, is $25,150 until April 2022. State exemptions may be higher or lower.

Chapter 7 is a ?liquidation? bankruptcy that doesn't require a repayment plan but does require you to sell some assets to pay creditors. Chapter 11 is a ?reorganization? bankruptcy for businesses that allows them to maintain day-to-day operations while creating a plan to repay creditors.