Vermont Self-Employed Shuttle Services Contract

Description

How to fill out Self-Employed Shuttle Services Contract?

Are you in a situation where you require documents for potentially business or particular tasks almost every day? There are numerous legal document templates accessible online, but finding versions you can trust is not simple.

US Legal Forms provides a vast selection of form templates, including the Vermont Self-Employed Shuttle Services Agreement, which are designed to comply with state and federal regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the Vermont Self-Employed Shuttle Services Agreement template.

Select a preferred document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Vermont Self-Employed Shuttle Services Agreement anytime if needed. Just click the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service provides accurately crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct state/region.

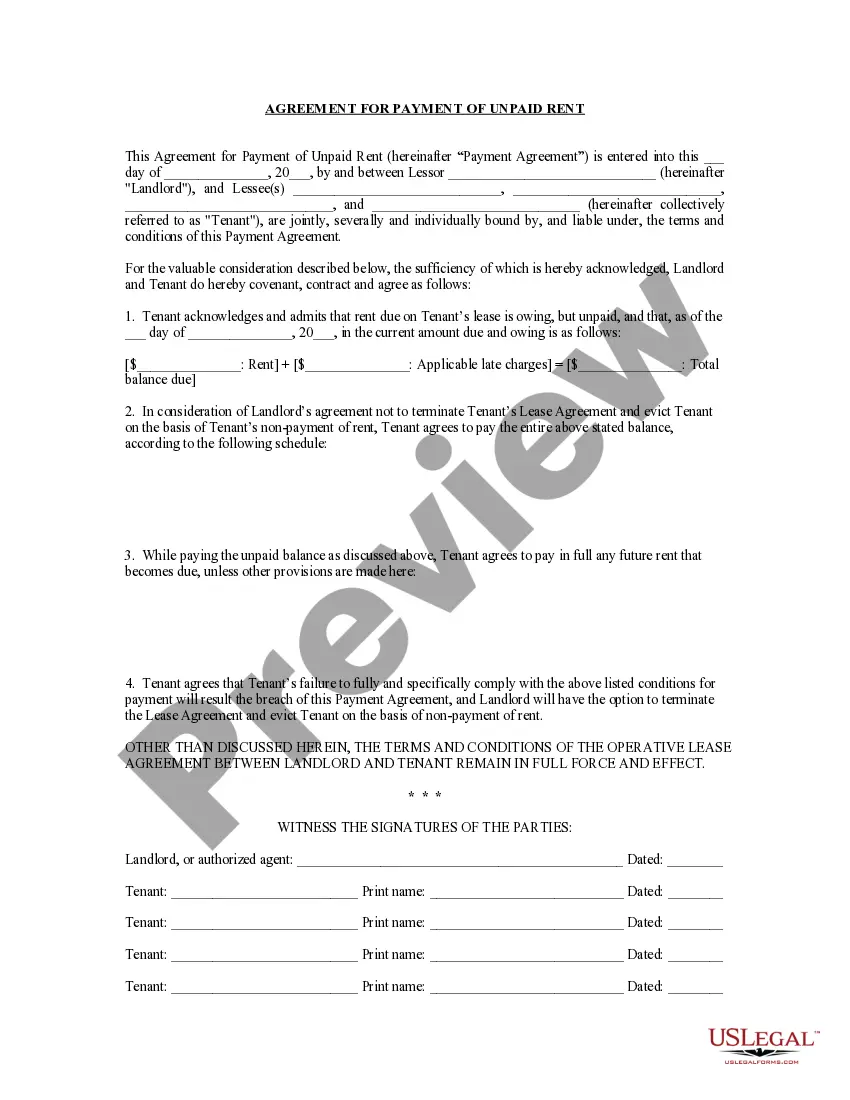

- Use the Review button to examine the document.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the document that suits your needs and requirements.

- Once you find the right form, click Buy now.

- Choose the pricing plan you prefer, fill out the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

Form popularity

FAQ

In Vermont, contract labor is generally not subject to sales tax unless it involves a taxable service or tangible goods. For shuttle service providers, understanding the distinction is crucial when signing a Vermont Self-Employed Shuttle Services Contract. You must ensure that your service offerings align with state tax regulations. Utilizing platforms like uslegalforms can assist you in creating compliant contracts that reflect the tax implications accurately.

Vermont has specific guidelines for taxable services, which include services related to tangible goods, such as repair and maintenance services. Additionally, certain personal services, like landscaping or cleaning, may also be taxable. When drafting a Vermont Self-Employed Shuttle Services Contract, you should consider if your services fall under taxable categories. Referencing state tax resources or seeking expert advice can provide the necessary clarity.

In Vermont, service contracts may be subject to sales tax depending on the nature of the services provided. Generally, if the service involves tangible personal property or is explicitly listed as taxable, it will incur sales tax. Therefore, when entering into a Vermont Self-Employed Shuttle Services Contract, it is essential to assess the specific services being offered. Consulting with a tax professional can help clarify any uncertainties.