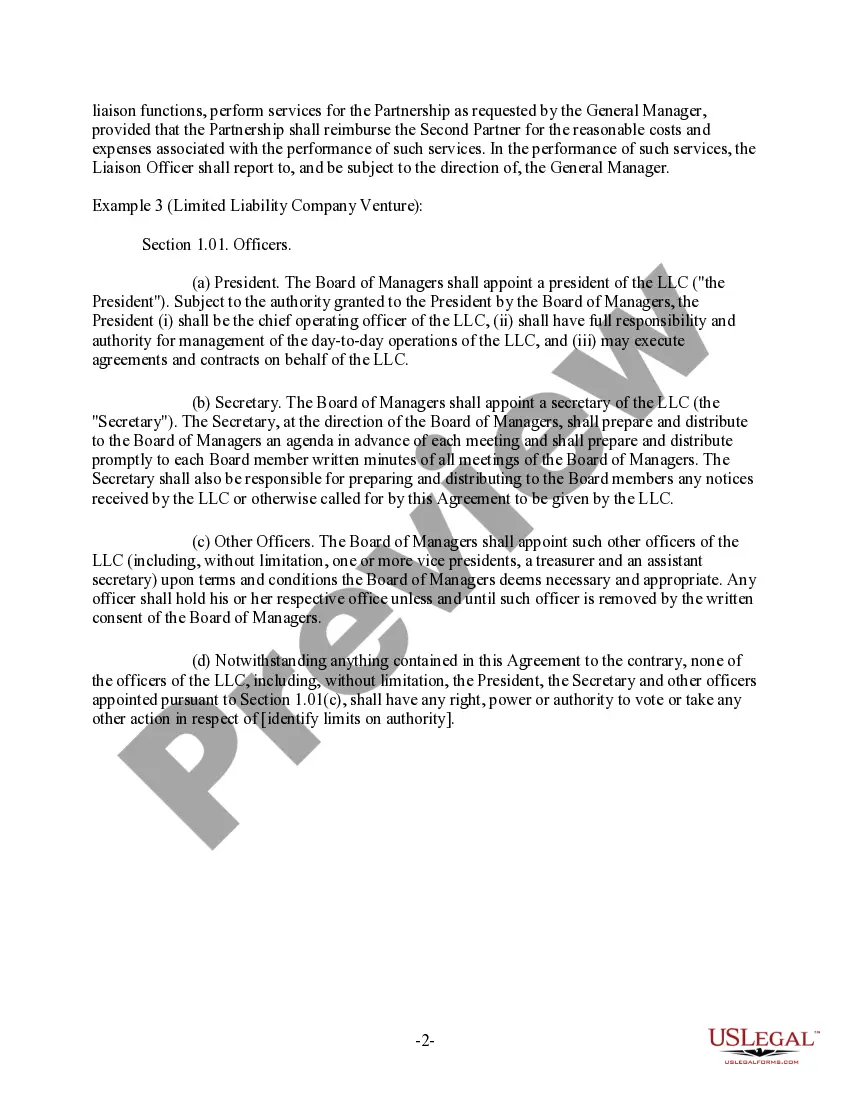

Virgin Islands Clauses Relating to Venture Officers

Description

How to fill out Clauses Relating To Venture Officers?

US Legal Forms - among the largest libraries of lawful types in America - delivers a variety of lawful file themes you can download or print. While using web site, you can find a huge number of types for company and person reasons, categorized by groups, suggests, or keywords.You will discover the most up-to-date versions of types such as the Virgin Islands Clauses Relating to Venture Officers within minutes.

If you currently have a subscription, log in and download Virgin Islands Clauses Relating to Venture Officers through the US Legal Forms collection. The Obtain button can look on each type you view. You get access to all previously acquired types inside the My Forms tab of your own account.

If you would like use US Legal Forms the first time, listed below are simple instructions to help you get started:

- Be sure you have picked out the right type for your city/area. Click on the Preview button to analyze the form`s content. Read the type explanation to ensure that you have selected the right type.

- In case the type doesn`t fit your needs, take advantage of the Search field towards the top of the monitor to obtain the one who does.

- Should you be content with the shape, affirm your selection by clicking the Purchase now button. Then, opt for the costs program you want and offer your accreditations to sign up for an account.

- Approach the purchase. Utilize your bank card or PayPal account to accomplish the purchase.

- Find the structure and download the shape on the device.

- Make adjustments. Complete, change and print and indication the acquired Virgin Islands Clauses Relating to Venture Officers.

Each and every format you included with your money does not have an expiration particular date which is your own for a long time. So, if you want to download or print one more copy, just visit the My Forms portion and click around the type you require.

Obtain access to the Virgin Islands Clauses Relating to Venture Officers with US Legal Forms, the most comprehensive collection of lawful file themes. Use a huge number of professional and express-specific themes that meet up with your small business or person needs and needs.

Form popularity

FAQ

The shareholders agreement should set out matters that are reserved for the board and those matters that will require shareholder approval. It will also set out the level of majority required to pass a particular resolution. Decisions reserved for the board typically relate to the day?to?day management of the company.

Pre-emptive rights and right of first refusal clause These clauses protect existing shareholders from the involuntary dilution of their stake in the company. Pre-emption rights provide the company's existing shareholders first offer on an issue of new shares; or first refusal over the sale of existing shares.

Protecting Your Rights As A Shareholder First, every shareholders' agreement that you sign should include a buy-sell provision. This allows you to get rid of your shares and leave a company if you need to do so, or acquire more if you are so inclined.

A good shareholders agreement should set out the decisions a shareholder-director may and may not make without agreement from others. These are known as reserved matters. Disclosure of decision making is also important. A shareholder-director may be able to make decisions that aren't reported to other shareholders.

Main Features of Shareholders Agreements A list of material things which cannot be done without the prior consent of the investors. ... A right to information. ... Warranties from the management team. ... Restrictions on transfers of shares. ... Restrictive covenants.

This section is intended to offer protection to the value of members' shareholdings. The deceptively straightforward provision requires members to approve any disposition of more than 50% of a company's assets that is to be made outside the ordinary course of the business.

In the BVI, companies are required to keep a PSC register that lists the individuals and entities that have significant control over the company. This information is required to be filed with the Registrar of Corporate Affairs, who may make this information available to the public.

Under BVI law, shareholders are not entitled to intervene directly in decisions made or actions that may be taken by the directors. The directors of the business company are required to comply with their common law duties as well as specific duties which are imposed on the directors under the BC Act.