Virgin Islands Courier Services Contract - Self-Employed

Description

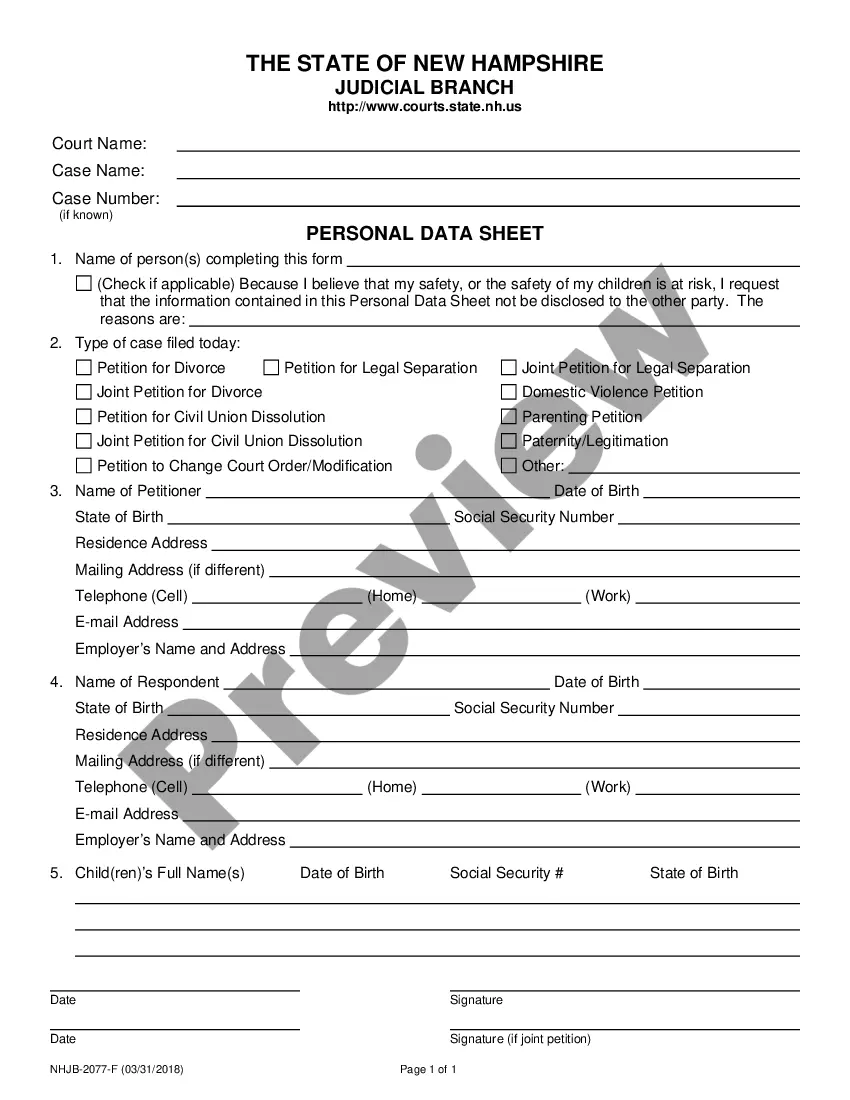

How to fill out Courier Services Contract - Self-Employed?

If you need to finalize, acquire, or create sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online. Take advantage of the site's straightforward and user-friendly search to find the documents you require. Various templates for business and personal purposes are organized by categories and regions, or keywords. Use US Legal Forms to locate the Virgin Islands Courier Services Contract - Self-Employed in just a few clicks.

If you are already a US Legal Forms subscriber, Log In to your account and click the Acquire button to download the Virgin Islands Courier Services Contract - Self-Employed. You can also access forms you have previously retrieved in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the guidelines below: Step 1. Ensure you have selected the form for the correct city/country. Step 2. Utilize the Review option to examine the form’s details. Don’t forget to read the information. Step 3. If you are dissatisfied with the document, use the Search field at the top of the screen to find other versions of the legal document format. Step 4. Once you have located the form you need, click on the Purchase now button. Choose the pricing option you prefer and provide your details to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Select the format of the legal document and download it to your device. Step 7. Fill out, modify and print or sign the Virgin Islands Courier Services Contract - Self-Employed.

- Every legal document template you purchase is yours indefinitely.

- You have access to every form you downloaded within your account.

- Select the My documents section and choose a form to print or download again.

- Complete and acquire, and print the Virgin Islands Courier Services Contract - Self-Employed with US Legal Forms.

- There are millions of professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

To secure contracts for your courier business, start by leveraging online platforms and local networking opportunities. Utilize resources like the Virgin Islands Courier Services Contract - Self-Employed, which provides a framework for your agreements. Building relationships with local businesses and offering quality services is essential. Additionally, consider platforms that connect couriers with clients to help expand your reach.

Yes, a courier can be self-employed, allowing for flexibility and control over business operations. As a self-employed courier, you enter into various contracts, such as the Virgin Islands Courier Services Contract - Self-Employed, to formalize your work agreements. This status also allows you to manage your hours and select contracts that meet your preferences. Remember to keep track of your earnings and expenses for tax purposes.

To start as a self-employed courier, you'll need reliable transportation, essential equipment, and a keen understanding of local logistics. It's also important to familiarize yourself with the Virgin Islands Courier Services Contract - Self-Employed to protect your interests. Additionally, investing in a good marketing strategy can greatly enhance your visibility and client reach.

Being an independent courier can be a fulfilling venture, offering flexibility and the potential for good income. As you build your client base, your earning potential increases significantly. Moreover, with a proper Virgin Islands Courier Services Contract - Self-Employed, you can enjoy the benefits of being your own boss while ensuring job security.

To land contracts as a courier, focus on understanding the needs of your target market. Attend local business expos, connect with potential clients, and promote your reliable services. Using a Virgin Islands Courier Services Contract - Self-Employed can make the process smoother, ensuring you and your clients are aligned on expectations.

While forming an LLC is not strictly necessary to become a courier, it provides legal protection for your personal assets. An LLC can enhance your business’s credibility, which may be appealing to clients seeking Virgin Islands Courier Services Contract - Self-Employed. Consider consulting with a legal expert to decide what structure best suits your needs.

To attract clients for your courier business, focus on building an online presence. Create a professional website, utilize social media, and join local business directories. Networking with other local businesses and using targeted advertising can also help you find potential customers interested in Virgin Islands Courier Services Contract - Self-Employed.