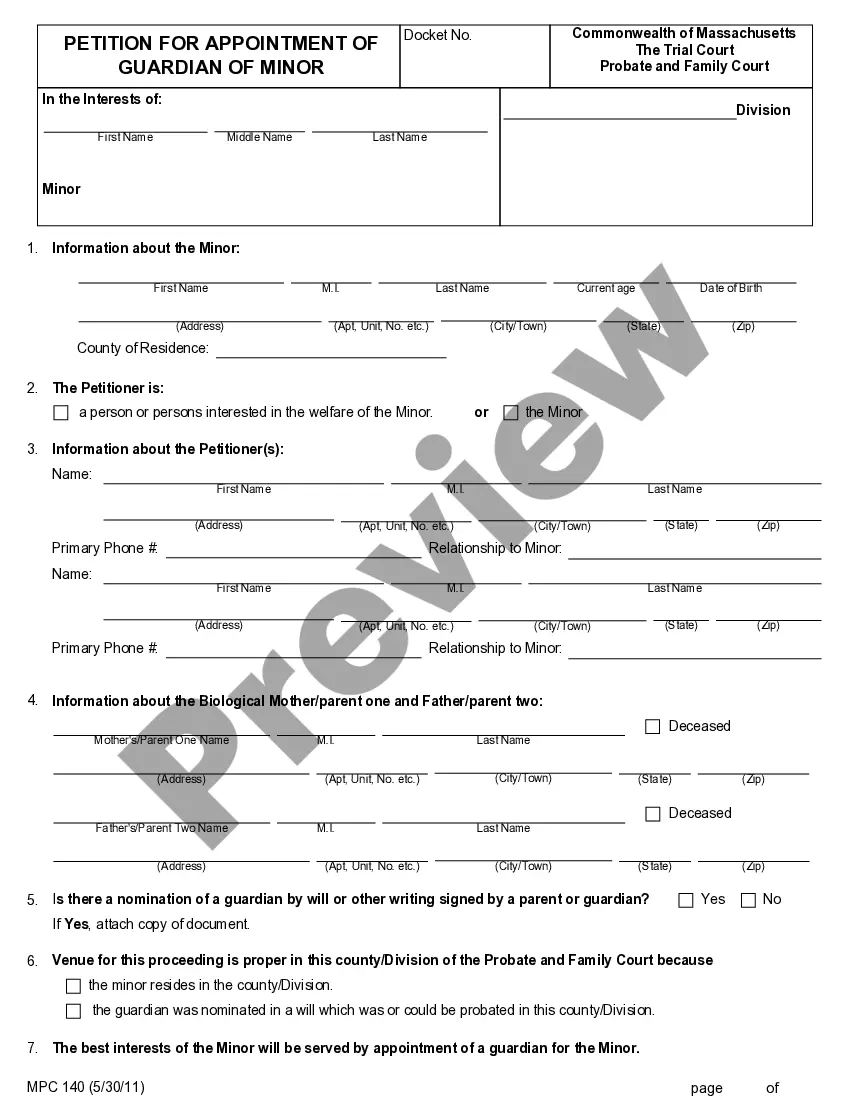

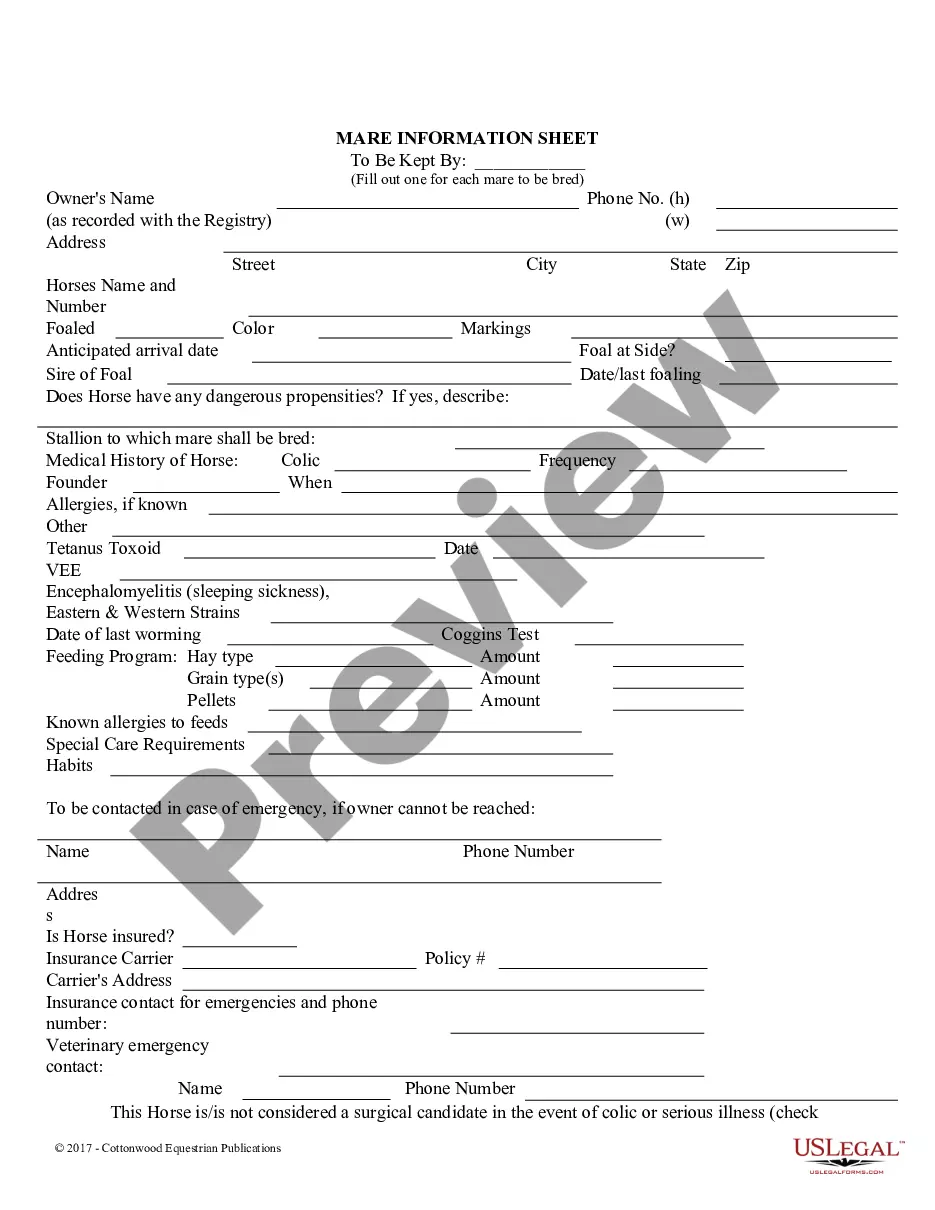

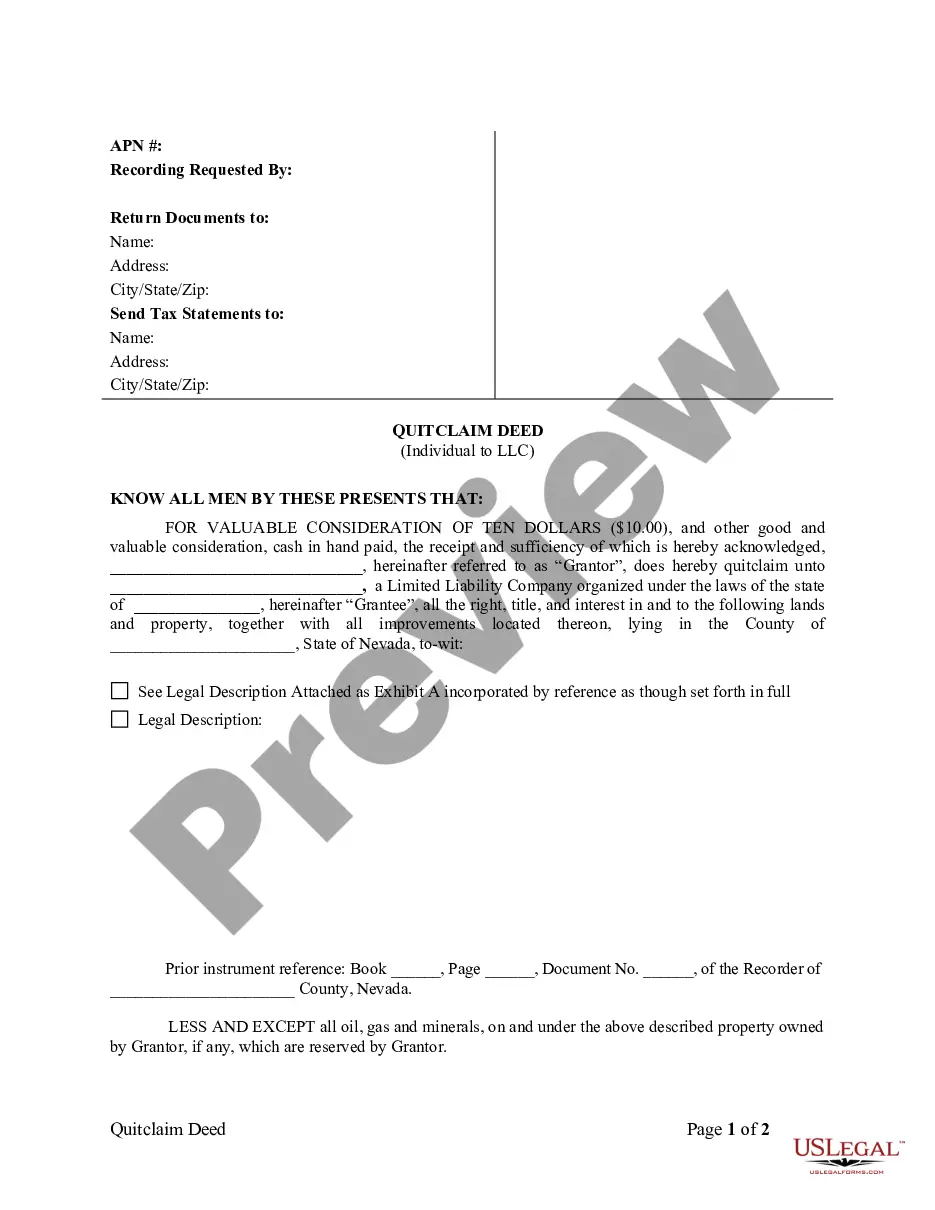

A Personal Data Sheet is a form which is used to notify the Court of all pertinent information regarding the parties to the cause of action.

New Hampshire Personal Data Sheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Hampshire Personal Data Sheet?

US Legal Forms is actually a unique platform where you can find any legal or tax form for filling out, such as New Hampshire Personal Data Sheet. If you’re sick and tired of wasting time searching for suitable samples and paying money on record preparation/lawyer service fees, then US Legal Forms is precisely what you’re trying to find.

To reap all the service’s advantages, you don't need to download any software but just pick a subscription plan and sign up an account. If you have one, just log in and look for an appropriate sample, download it, and fill it out. Downloaded documents are saved in the My Forms folder.

If you don't have a subscription but need to have New Hampshire Personal Data Sheet, have a look at the instructions listed below:

- make sure that the form you’re considering applies in the state you want it in.

- Preview the example its description.

- Click on Buy Now button to reach the sign up page.

- Select a pricing plan and carry on registering by entering some info.

- Pick a payment method to finish the sign up.

- Download the file by selecting the preferred format (.docx or .pdf)

Now, fill out the document online or print out it. If you are uncertain about your New Hampshire Personal Data Sheet sample, speak to a lawyer to analyze it before you send out or file it. Start hassle-free!

Form popularity

FAQ

No broad-base personal income tax. No personal property or machinery tax. No sales or use taxes. No inventory tax. No capital gains tax. No professional service tax. No customs or software tax.

Shopping in NH With Live Free as the first half of our state motto, it's only fitting we'd offer tax-free shopping. That's right, you read that correctly. Here in New Hampshire, we still say, no to taxing purchases.

New Hampshire is also third highest when the state median home value is considered. New Hampshire's median home value of $252,800 is the 12th highest in the country, and the property taxes on that are a median of about $5,550.That would cost a car owner $449, a 1.8% property tax rate.

Overview of New Hampshire TaxesNew Hampshire is known as a low-tax state. But while the state has no personal income tax and no sales tax, it has the fourth-highest property tax rates of any U.S. state, with an average effective rate of 2.05%.

Seven states (Delaware, Hawaii, Illinois, Iowa, New York, Ohio, and Pennsylvania) exempt all TPP from taxation, while another five states (Minnesota, New Hampshire, New Jersey, North Dakota, and South Dakota) exempt most TPP from taxation except for select industries that are centrally assessed, such as public

Vehicle registration in New Hampshire is done at the Town Clerk's Office in the town in which you reside. There are two fees that you will be paying; the local fee is a personal property tax and is based on the original list price of the vehicle.Most vehicles fall in the $43.20 or $55.20 weight category.

Shopping in NH With Live Free as the first half of our state motto, it's only fitting we'd offer tax-free shopping. That's right, you read that correctly. Here in New Hampshire, we still say, no to taxing purchases.

Overview of New Hampshire Taxes New Hampshire has no income tax on wages and salaries. However, there is a 5% tax on interest and dividends. The state also has no sales tax. Homeowners in New Hampshire pay the fourth-highest average effective property tax rate in the country.