Virgin Islands Carrier Services Contract - Self-Employed Independent Contractor

Description

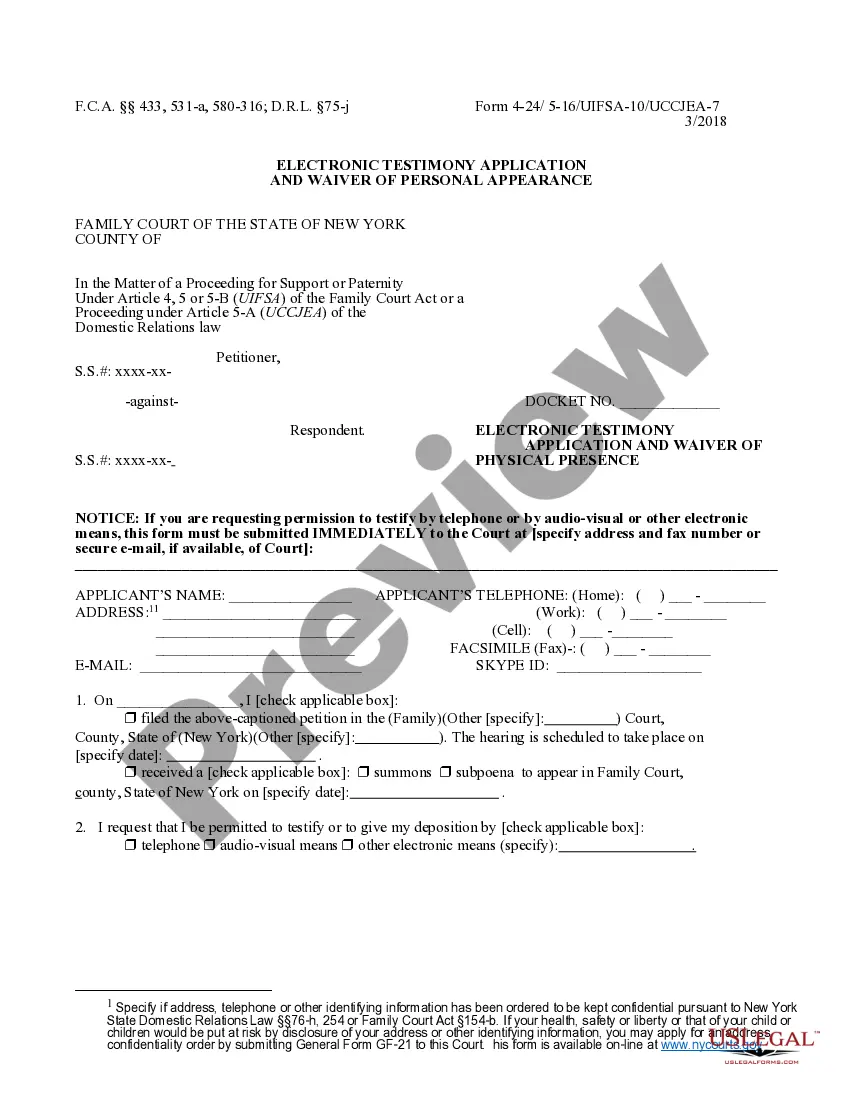

How to fill out Carrier Services Contract - Self-Employed Independent Contractor?

You can spend numerous hours online trying to locate the approved document template that fulfills the national and regional requirements you need.

US Legal Forms offers a vast array of legal documents that are evaluated by experts.

You can conveniently download or print the Virgin Islands Carrier Services Contract - Self-Employed Independent Contractor from my services.

Review the form description to confirm you have chosen the right document. If available, use the Review button to preview the document template as well.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- Then, you can fill out, modify, print, or sign the Virgin Islands Carrier Services Contract - Self-Employed Independent Contractor.

- Every legal document template you buy belongs to you for years.

- To acquire an additional copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the region/area of your choice.

Form popularity

FAQ

Getting contracts as an independent courier requires building a robust client network and showcasing your reliability. Attend industry events, join online forums, and connect with businesses needing courier services. Utilizing a Virgin Islands Carrier Services Contract - Self-Employed Independent Contractor can further legitimize your operations and improve your chances of attracting reputable clients.

To perform services as an independent contractor in the US, you typically need to obtain any necessary licenses and permits for your specific area. It’s also crucial to understand local regulations, which may vary. A Virgin Islands Carrier Services Contract - Self-Employed Independent Contractor will clarify your responsibilities and facilitate your compliance with relevant laws.

Finding clients for your courier business involves using multiple strategies, such as online advertising, social media engagement, and word-of-mouth referrals. By establishing a strong online presence and offering reliable services, you can attract clients effectively. Additionally, a Virgin Islands Carrier Services Contract - Self-Employed Independent Contractor can help you market your services professionally.

Becoming an independent courier can be very rewarding if you enjoy flexible hours and the opportunity to meet various clients. It allows you to operate your own business and make decisions that suit your life. Consider the potential earnings and satisfaction you can gain from a Virgin Islands Carrier Services Contract - Self-Employed Independent Contractor to improve your financial outlook.

To secure contracts as a courier, you should start by actively networking within your community and online. Building relationships with businesses that require delivery services is crucial. Meanwhile, leveraging a Virgin Islands Carrier Services Contract - Self-Employed Independent Contractor can give you a professional edge and showcase your commitment to quality service.

While it is not mandatory to form an LLC to become a courier, having one can provide personal liability protection and enhance your business credibility. Opting for a Virginia Islands Carrier Services Contract - Self-Employed Independent Contractor may also simplify your tax obligations, making it a sensible choice. Additionally, it allows you to separate your business finances from personal ones, helping you grow your courier services effectively.

Writing an independent contractor agreement starts with defining the scope of work clearly. Include terms on payment, deadlines, and the responsibilities of each party. It’s also essential to discuss how disputes will be resolved and any confidentiality obligations. By drafting a well-structured Virgin Islands Carrier Services Contract - Self-Employed Independent Contractor, you can establish a solid foundation for your work relationship.

Filling out an independent contractor form involves entering key details such as your name, contact information, and tax identification number. You should also include your work details, including the nature of your services and payment schedule. Always double-check the form for accuracy to avoid issues later. Resources like uslegalforms can guide you in creating a comprehensive Virgin Islands Carrier Services Contract - Self-Employed Independent Contractor form.

To fill out an independent contractor agreement, start by including the names of both parties and their addresses. Next, specify the services that the self-employed independent contractor will provide, along with the payment terms. Also, outline any deadlines or deliverables, and clarify the relationship between the parties. This process will ensure that your Virgin Islands Carrier Services Contract - Self-Employed Independent Contractor is clear and legally binding.

The terms self-employed and independent contractor are often used interchangeably, but they can have subtle differences based on context. Self-employed may suggest broader entrepreneurial activities, while independent contractor specifically refers to those who provide services under a contract. Regardless of the term, being clear about your status, particularly when engaging in contracts like the Virgin Islands Carrier Services Contract, is beneficial for all parties involved.