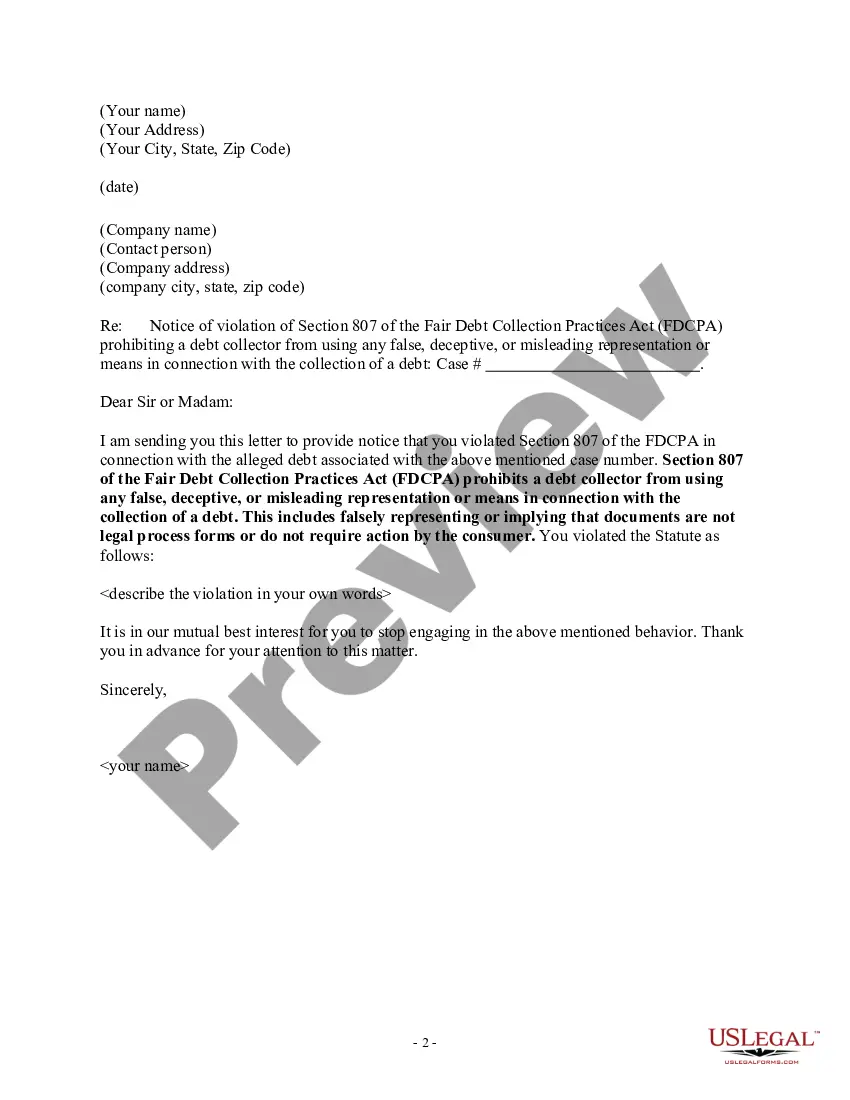

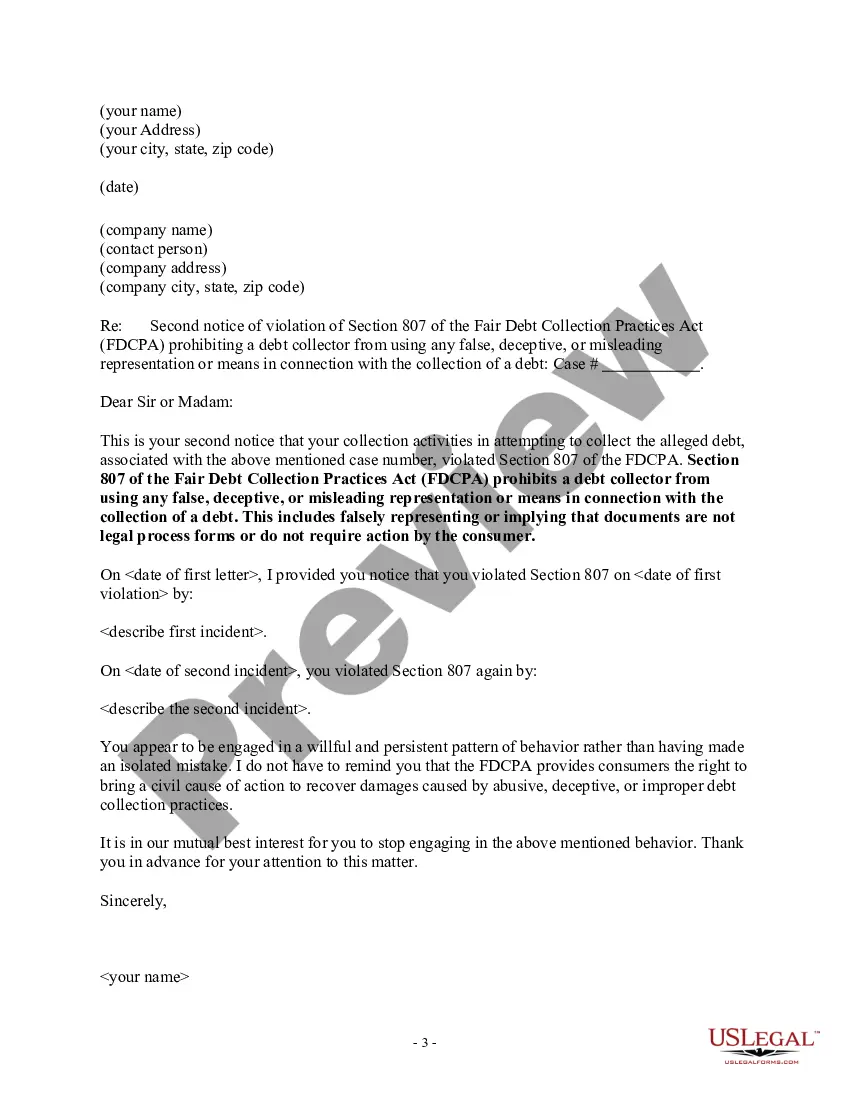

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Virgin Islands Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

If you wish to finish, obtain, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Employ the site's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to locate the Virgin Islands Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to acquire the Virgin Islands Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.

- You can also access forms you have previously saved under the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have chosen the form for your specific city/state.

- Step 2. Use the Preview feature to review the form's content. Don't forget to examine the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

Unless your state law provides otherwise, the FDCPA only requires debt collectors, not original creditors, to verify debts in certain circumstances. This requirement includes law firms that are routinely engaged in collecting debts.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

The creditor has to prove who the borrower is These include: Where there is a dispute as to the identity of the borrower or hirer or as to the amount of the debt, it is for the firm (and not the customer) to establish, as the case may be, that the customer is the correct person in relation to the debt.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

The key is to be thorough in your request for debt verification. In your letter, ask for details on: Why the collector thinks you owe the debt: Ask who the original creditor is and request documentation that verifies you owe the debt, such as a copy of the original contract.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.