Indiana Restated Employee Annual Incentive Bonus Plan with attachments

Description

How to fill out Restated Employee Annual Incentive Bonus Plan With Attachments?

US Legal Forms - one of the biggest libraries of authorized varieties in the United States - gives a variety of authorized papers layouts you can acquire or print. Using the web site, you may get a large number of varieties for business and individual purposes, categorized by classes, says, or key phrases.You can get the newest models of varieties like the Indiana Restated Employee Annual Incentive Bonus Plan with attachments in seconds.

If you have a monthly subscription, log in and acquire Indiana Restated Employee Annual Incentive Bonus Plan with attachments through the US Legal Forms local library. The Obtain option will appear on every type you perspective. You have accessibility to all formerly delivered electronically varieties in the My Forms tab of your accounts.

If you wish to use US Legal Forms for the first time, listed below are simple guidelines to get you started off:

- Ensure you have selected the proper type for the area/area. Go through the Preview option to check the form`s articles. Browse the type description to actually have selected the proper type.

- If the type does not suit your demands, utilize the Search discipline on top of the display to obtain the one that does.

- In case you are pleased with the form, verify your option by simply clicking the Purchase now option. Then, opt for the pricing strategy you want and give your references to sign up to have an accounts.

- Approach the financial transaction. Utilize your Visa or Mastercard or PayPal accounts to finish the financial transaction.

- Pick the structure and acquire the form on your own system.

- Make adjustments. Fill out, edit and print and indicator the delivered electronically Indiana Restated Employee Annual Incentive Bonus Plan with attachments.

Every single design you included in your bank account does not have an expiration day which is your own property permanently. So, if you would like acquire or print an additional duplicate, just go to the My Forms portion and then click about the type you will need.

Get access to the Indiana Restated Employee Annual Incentive Bonus Plan with attachments with US Legal Forms, probably the most substantial local library of authorized papers layouts. Use a large number of expert and status-distinct layouts that satisfy your business or individual requires and demands.

Form popularity

FAQ

An incentive pay plan is a 'bonus' pay over and above their hourly wage that an associate can attain if they meet certain pre-set requirements or criteria. Incentive pay can be productivity based, quality based, safety based, etc.

Bonuses ? like all incentives ? are separate from salary and commissions. They are awarded at the employer's will and decided upon once reps have hit their targets. The primary difference between bonuses vs. incentives is that incentives are decided upon ahead of time, while bonuses are granted after goals are met.

An annual incentive plan is a plan for compensation that is earned and paid based upon the achievement of performance goals over a one-year period. These plans motivate performance and align executives' work with the company's short-term performance goals.

An annual incentive plan outlines compensation to be paid to employees when they achieve certain performance-related goals over 12 months. This compensation is in addition to their regular salary ? it may be an employee gift, cash incentive, or another type of bonus or reward.

Multiply total sales by total bonus percentage. For example, you make $10,000 in sales, and your company offers you a 5% commission. ... $10,000 x .05 = $500. One employee makes $50,000 per year, and the bonus percentage is 3%. ... $50,000 x .03 = $1,500.

Incentive compensation management is the strategic use of incentives to drive better business outcomes and more closely align sales rep behavior with the organization's goals. Incentives can be structured in multiple ways, including straight commissions, bonuses, prizes, ?spiffs,? awards, and recognition.

An employee bonus plan provides compensation beyond annual salary to employees as an incentive or reward for reaching certain predetermined individual or team goals. The purpose of bonus plans is to provide recognition for employees who go above and beyond normal work obligations.

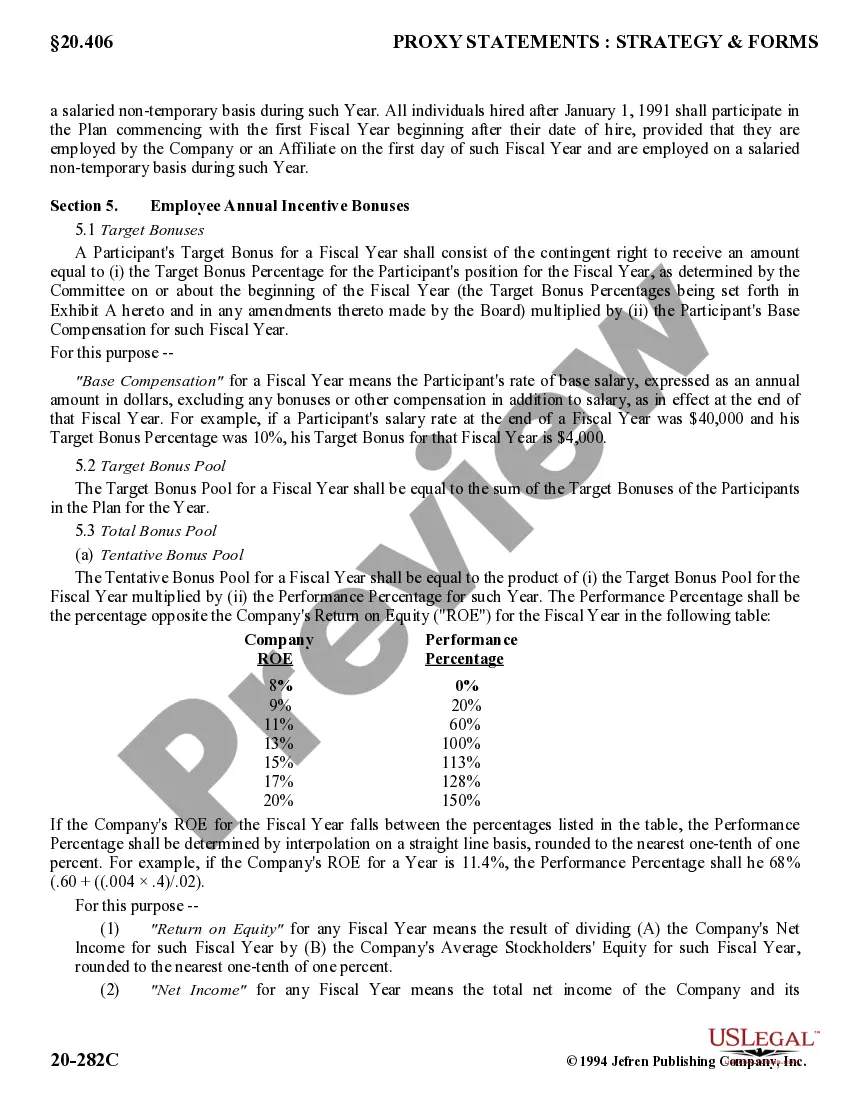

Payout Opportunity A Participant's payout target amount under the Plan is determined by pay grade as follows: The range of incentive opportunity for a Plan Participant is 0% to 200% of the Participant's total value target. This means the maximum payout that a Participant can receive from this Plan is 200%.