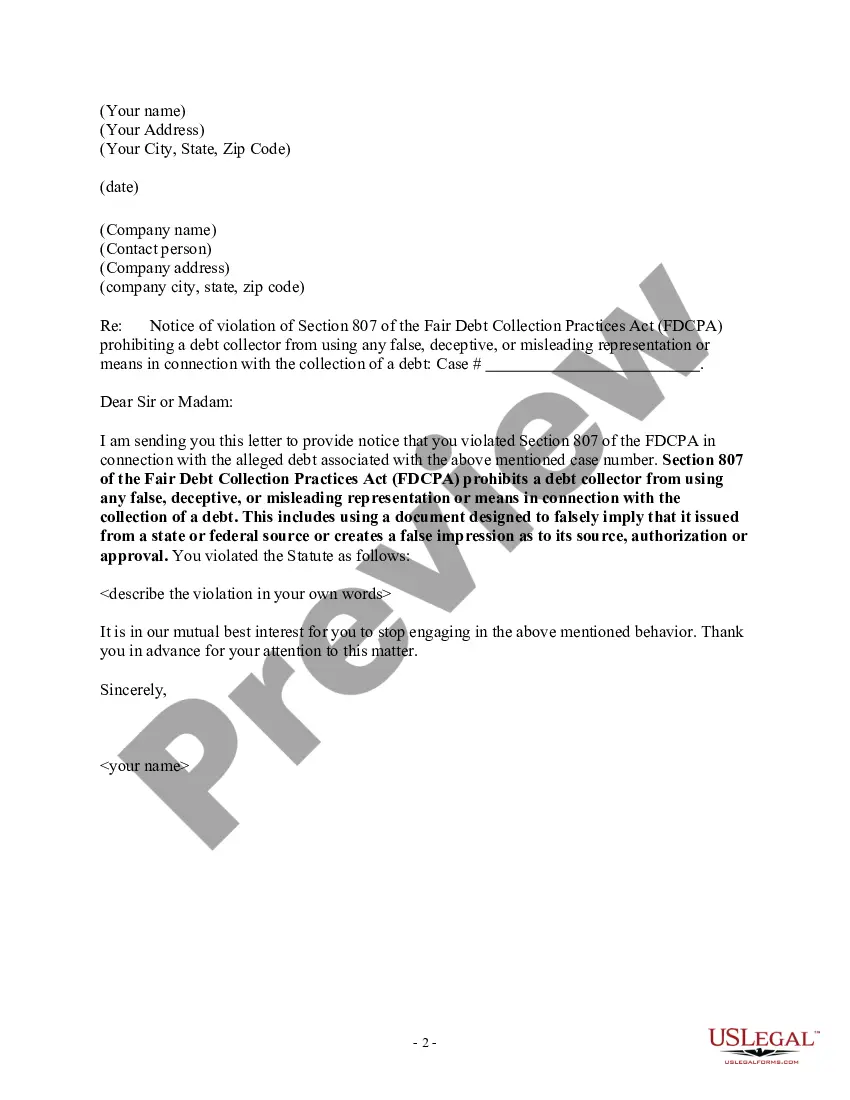

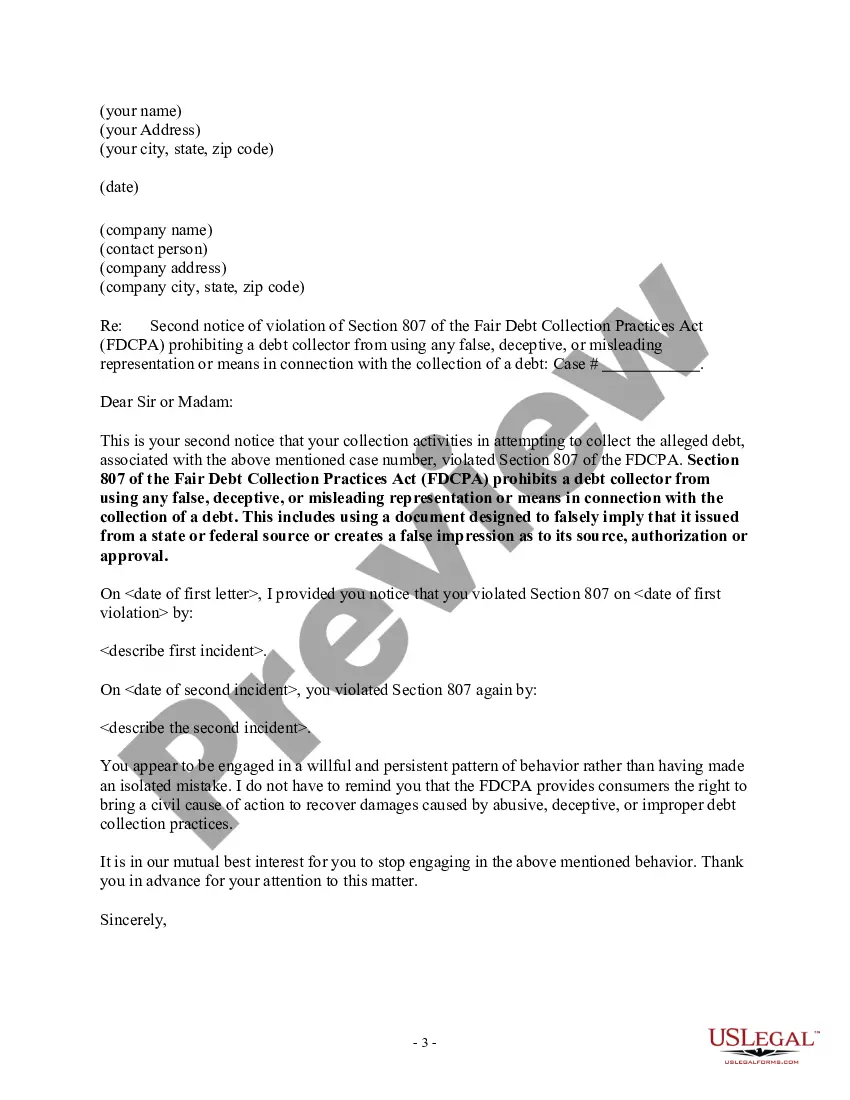

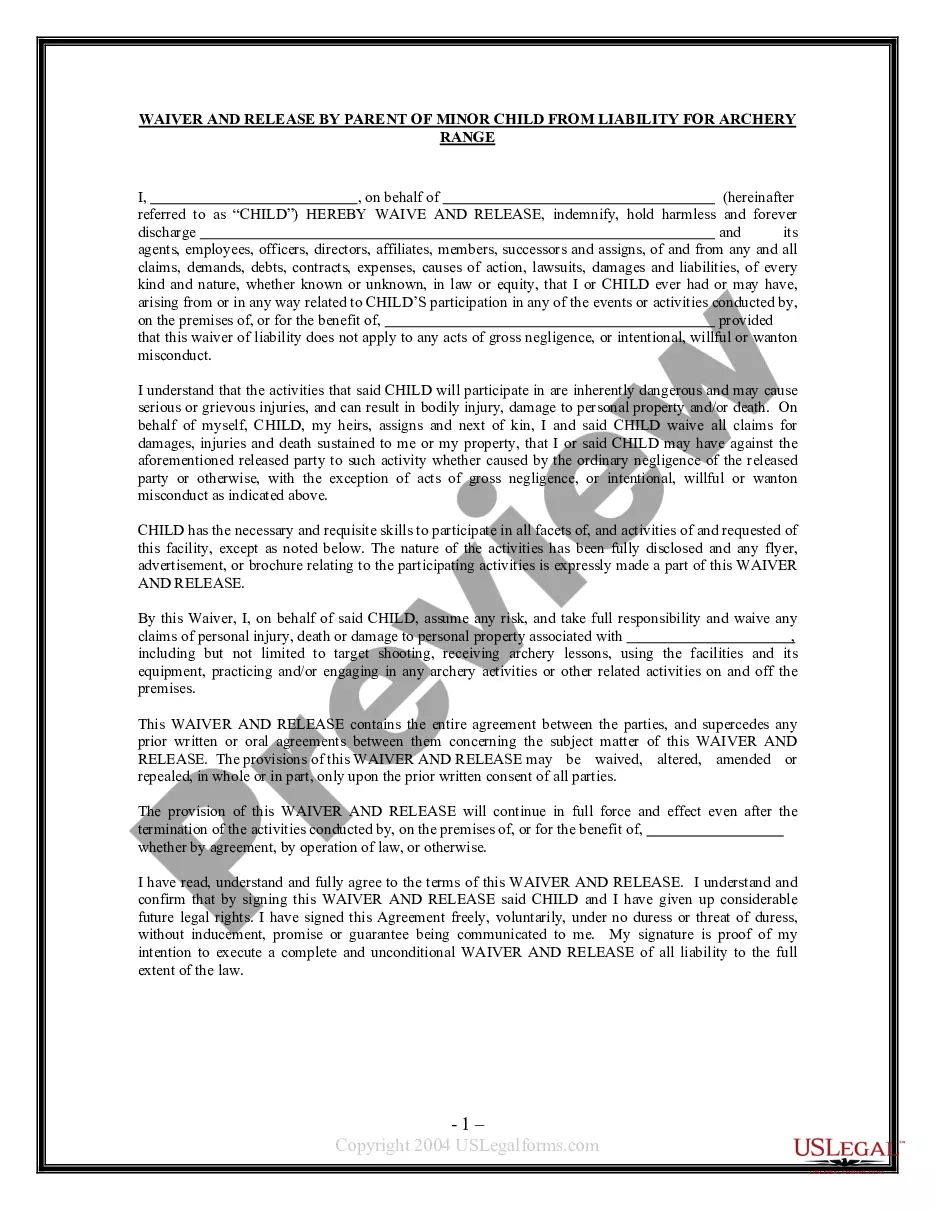

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes using a document designed to falsely imply that it issued from a state or federal source or creates a false impression as to its source, authorization or approval.

Virgin Islands Notice to Debt Collector - Falsely Representing a Document's Authority

Description

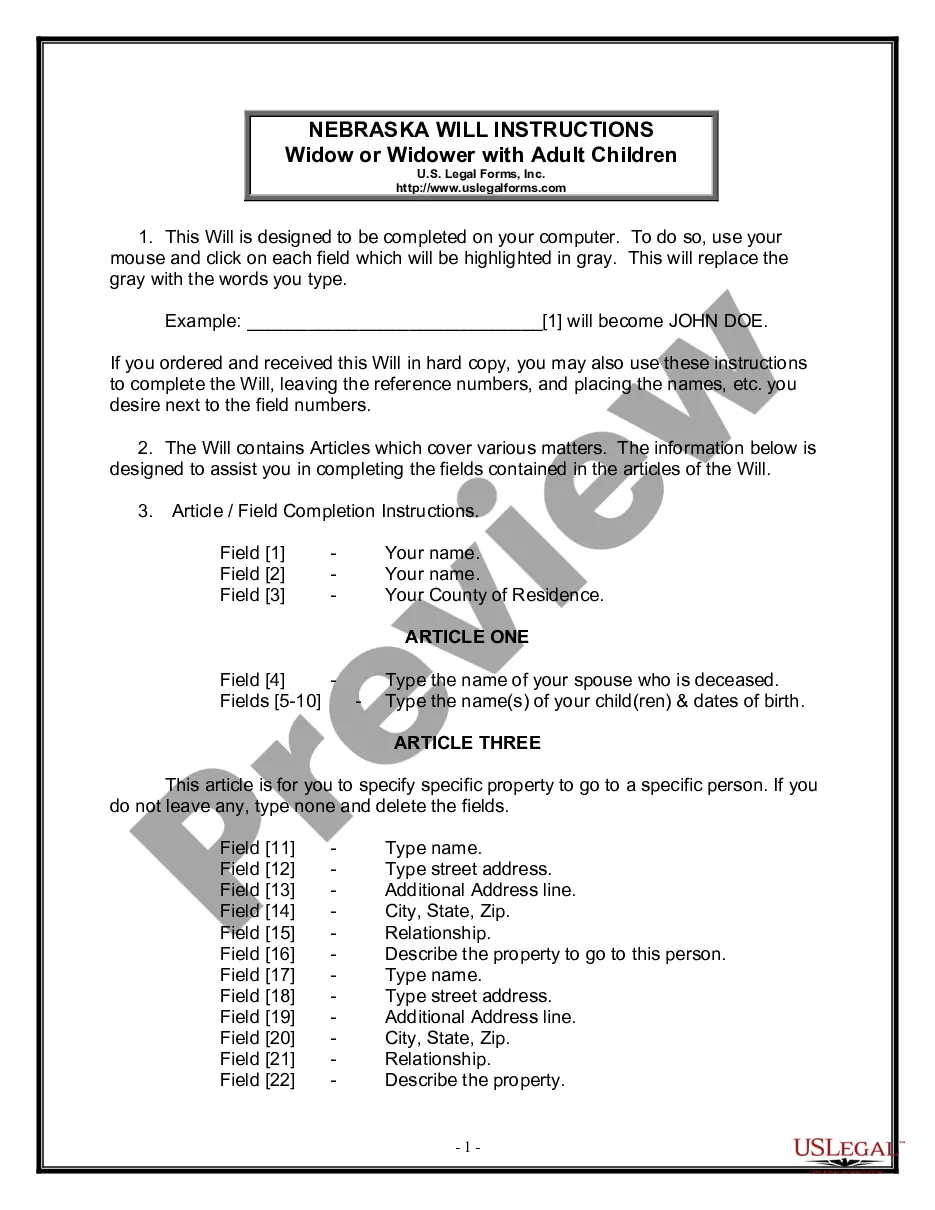

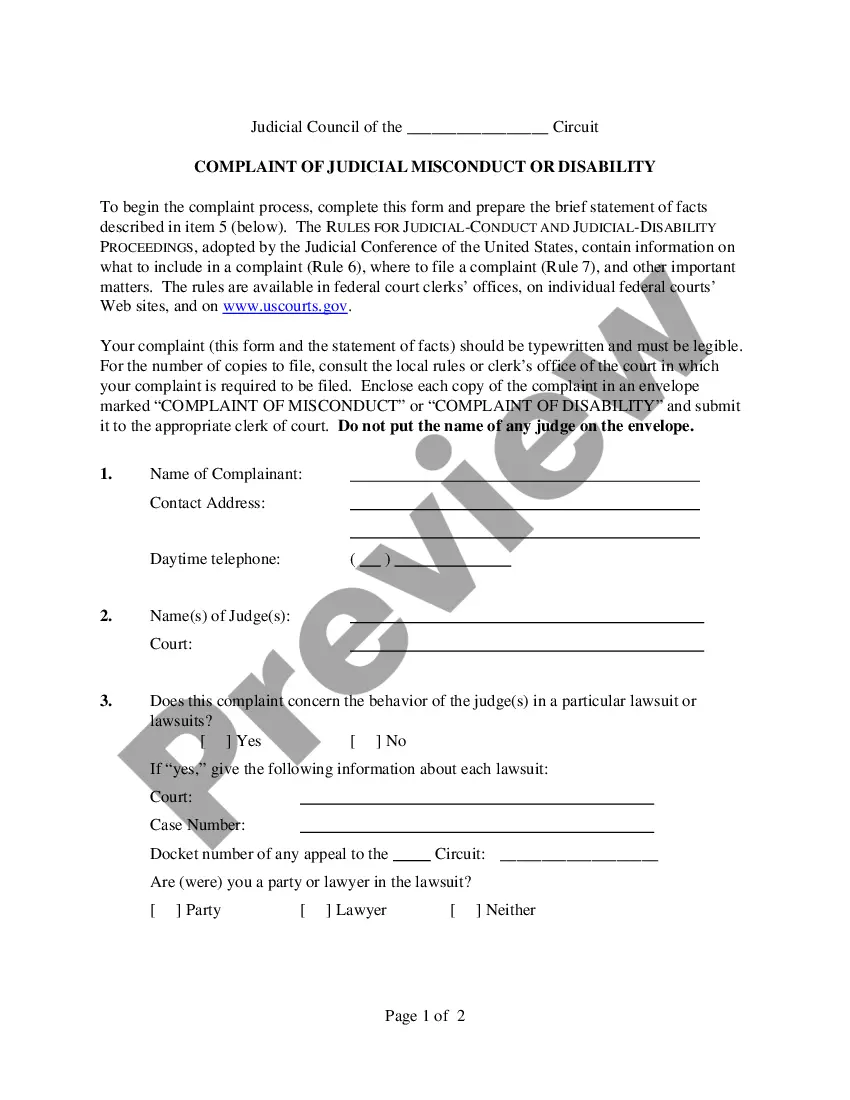

How to fill out Notice To Debt Collector - Falsely Representing A Document's Authority?

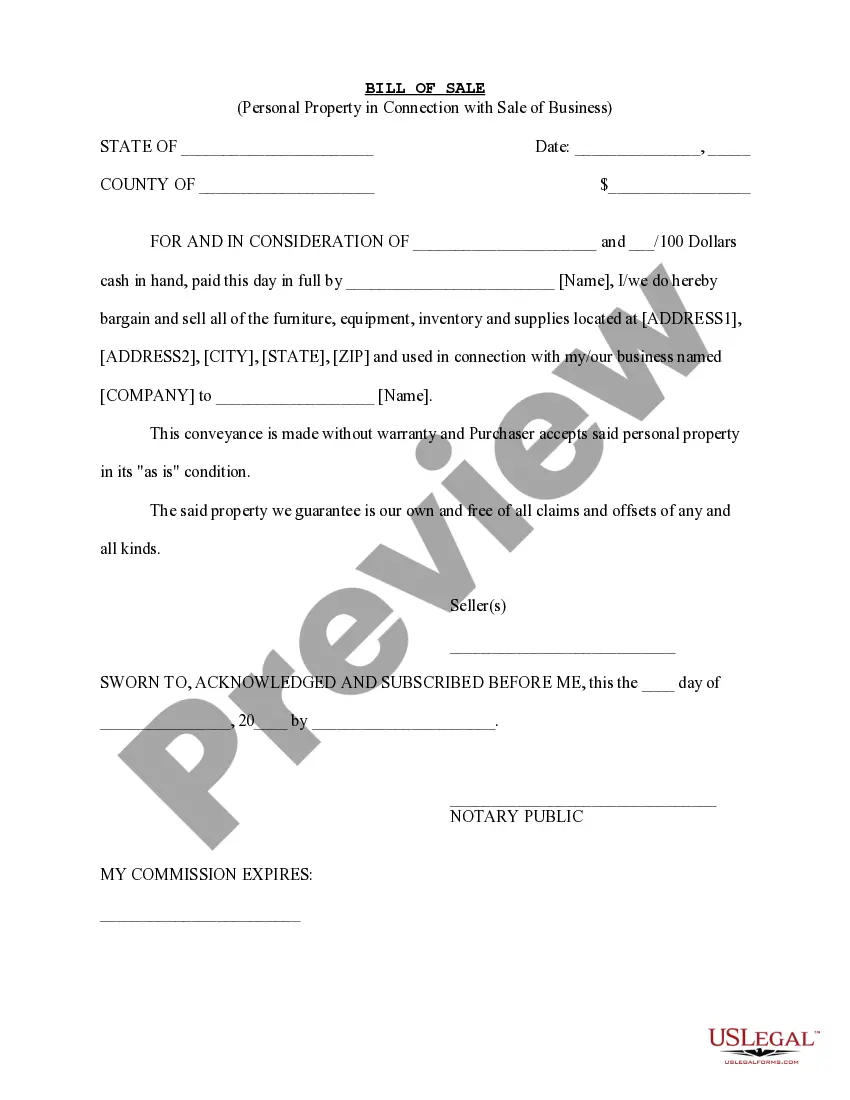

US Legal Forms - one of the largest collections of legal documents in the United States - offers a selection of legal paperwork templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Virgin Islands Notice to Debt Collector - Falsely Misrepresenting a Document's Authority in just a few minutes.

If the document does not meet your requirements, use the Search field at the top of the screen to find the one that does.

Once you are satisfied with the document, confirm your selection by clicking the Get now button. Then, choose your preferred pricing plan and provide your information to register for an account.

- If you have a monthly subscription, Log In and download the Virgin Islands Notice to Debt Collector - Falsely Misrepresenting a Document's Authority from the US Legal Forms library.

- The Download button will appear on each document you view.

- You have access to all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are some simple steps to help you begin.

- Ensure that you have selected the correct document for your city/state. Click the Preview button to review the document's content.

- Check the document description to make sure you have chosen the correct form.

Form popularity

FAQ

The creditor has to prove who the borrower is These include: Where there is a dispute as to the identity of the borrower or hirer or as to the amount of the debt, it is for the firm (and not the customer) to establish, as the case may be, that the customer is the correct person in relation to the debt.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Honesty: Debt collectors cannot mislead you about who they are, how much money you owe or the legal repercussions of not paying your debt for instance, by threatening arrest. Challenging the debt: You have a right to dispute the debt.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

Debt collectors cannot make false or misleading statements. For example, they cannot lie about the debt they are collecting or the fact that they are trying to collect debt, and they cannot use words or symbols that falsely make their letters to you seem like they're from an attorney, court, or government agency.

Your debt could be statute barred if, during the time limit:you (or if it's a joint debt, anyone you owe the money with), haven't made any payments towards the debt.you, or someone representing you, haven't written to the creditor saying the debt's yours.the creditor hasn't gone to court for the debt.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

A debt collector's No. 1 goal is to collect their missing funds. They can't curse at you or make empty threats, but they can say other things to try and scare you into paying up. Staying calm, keeping the call short and keeping your comments to a minimum are the best ways to deal with persistent bill collectors.