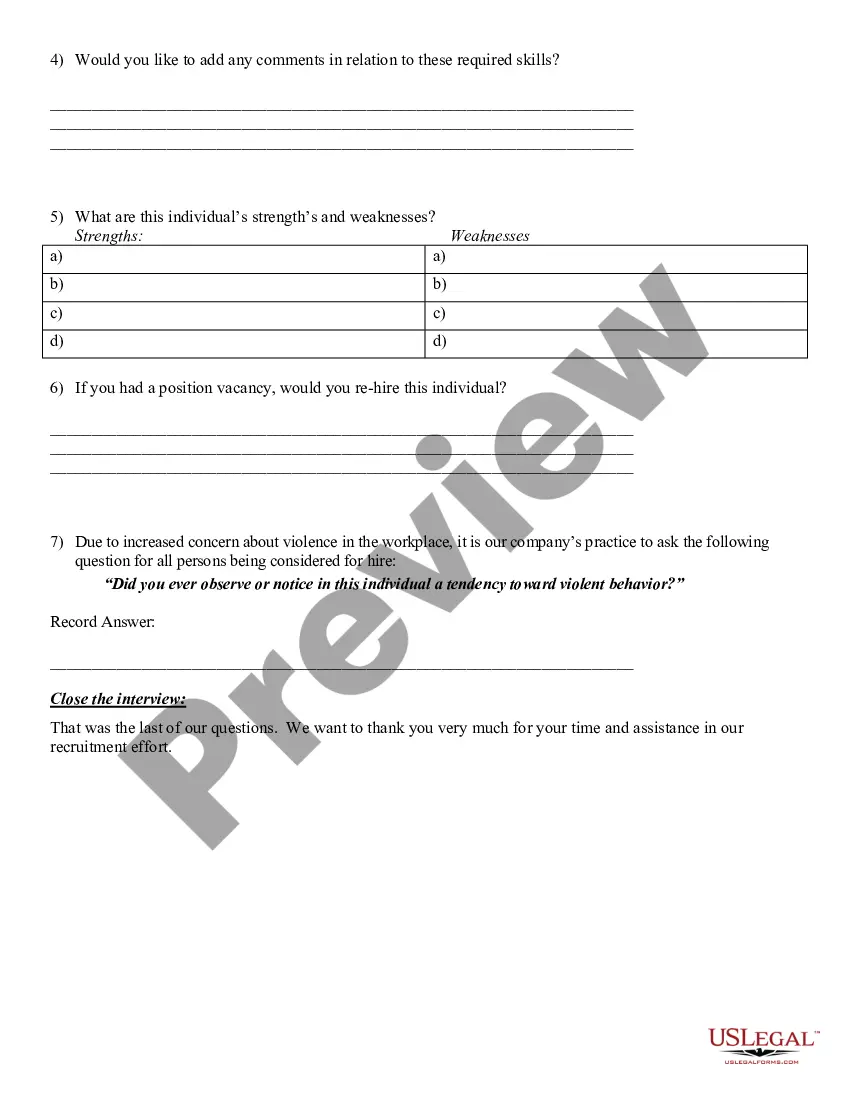

Virgin Islands Reference Check Format Form

Description

How to fill out Reference Check Format Form?

Are you currently in the location where you require documentation for either business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers a vast array of document templates, including the Virgin Islands Reference Check Format Form, which can be printed to comply with state and federal regulations.

Once you have the correct document, simply click Acquire now.

Choose the payment plan you prefer, provide the necessary information to create your account, and complete your purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Virgin Islands Reference Check Format Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the document you need and ensure it corresponds to the proper area/region.

- Utilize the Review button to examine the document.

- Check the outline to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the template that meets your requirements.

Form popularity

FAQ

How Do I Fill Out Form W-8BEN?Part I Identification of Beneficial Owner:Line 1: Enter your name as the beneficial owner.Line 2: Enter your country of citizenship.Line 3: Enter your permanent residence/mailing address.Line 4: Enter your mailing address, if different.More items...

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.

9 Form InstructionsLine 1 Name.Line 2 Business name.Line 3 Federal tax classification.Line 4 Exemptions.Lines 5 & 6 Address, city, state, and ZIP code.Line 7 Account number(s)Part I Taxpayer Identification Number (TIN)Part II Certification.

1. Line 1 should be filled out if you have two jobs, or you are married filing jointly and both employed. Use the Higher Paying Job row and Lower Paying Job column from the table on page 4 of your W-4 to find the value at the intersection of your two salaries. Enter that number here.

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

Generally, the amount in Box 14 is for informational purposes only; however, some employers use Box 14 to report amounts that should be entered elsewhere on your return.

Box 14: Your employer may report additional tax information here. If any amounts are reported in Box 14, they should include a brief description of what they're for. For example, union dues, employer-paid tuition assistance or after-tax contributions to a retirement plan may be reported here.

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?