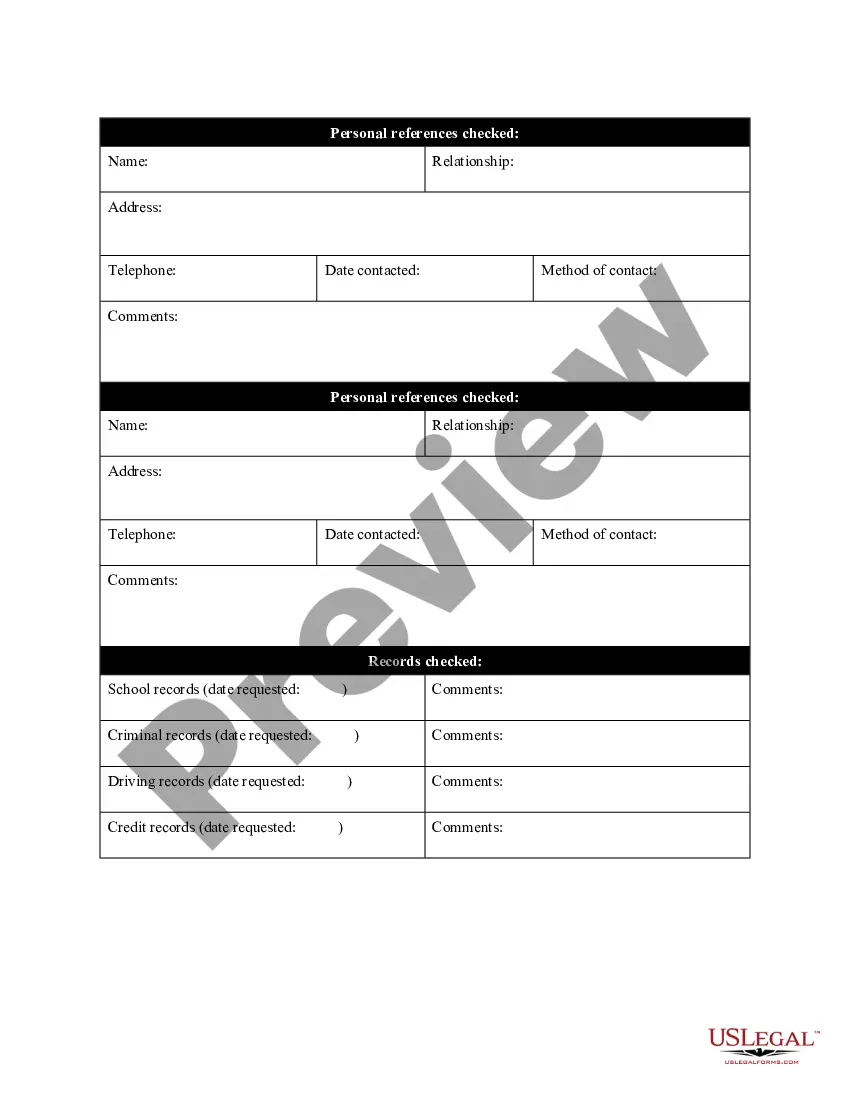

Virgin Islands Reference Check Control Form

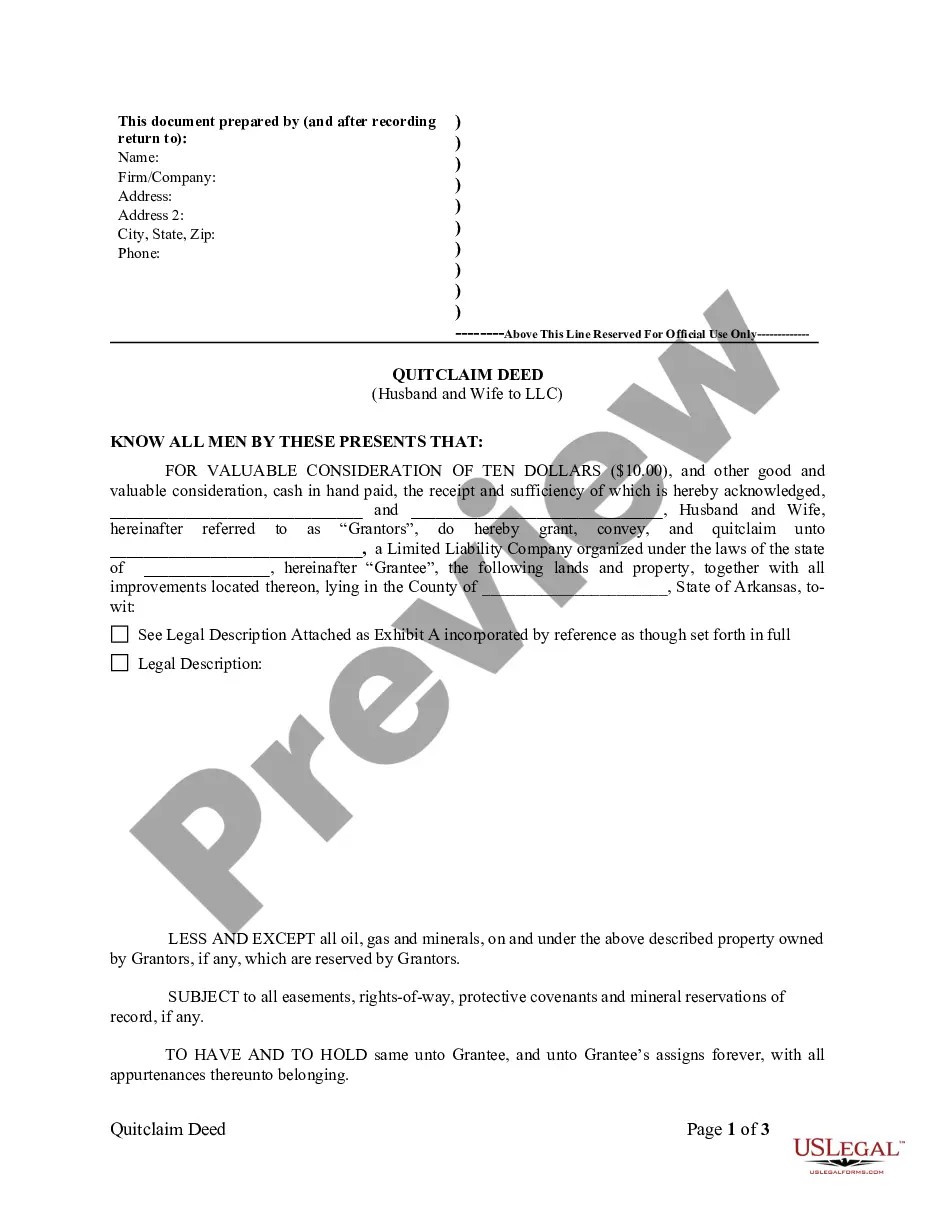

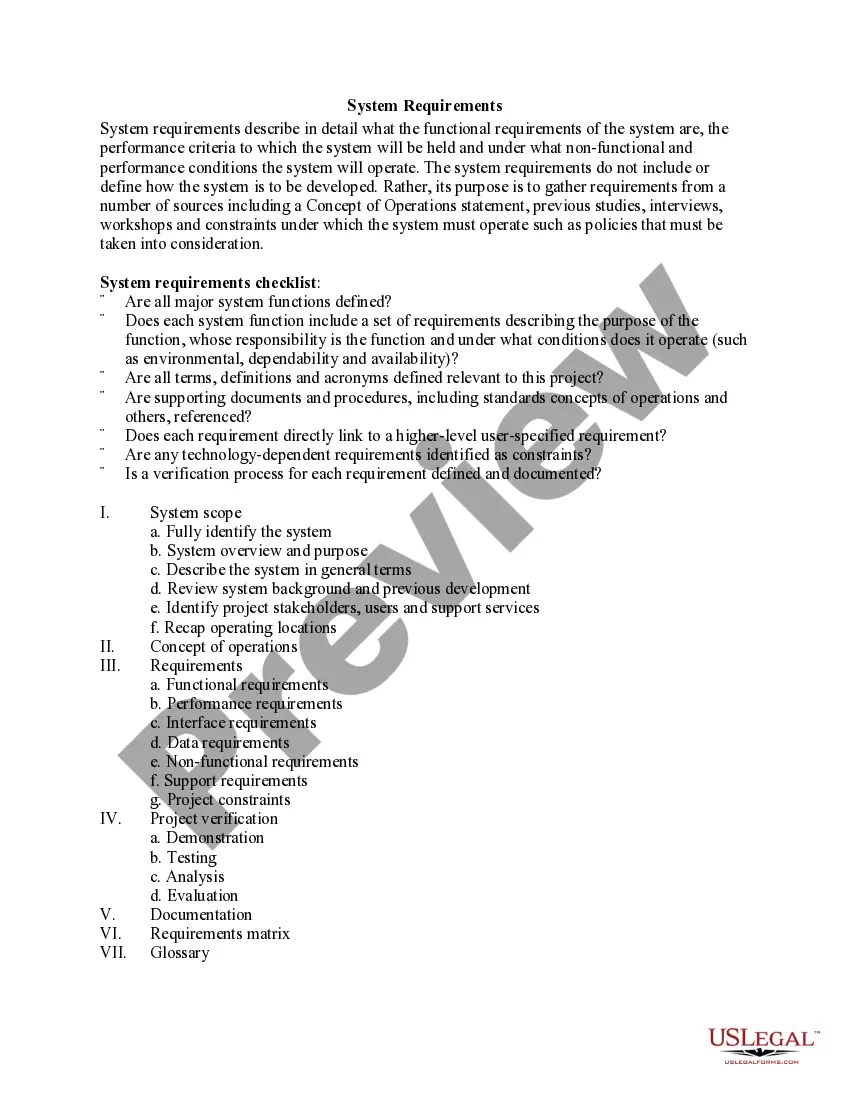

Description

How to fill out Reference Check Control Form?

Are you in the location that you need documentation for sometimes business or personal objectives nearly every single day.

There are numerous legitimate document templates accessible online, but locating ones you can rely on is not simple.

US Legal Forms offers a vast collection of form templates, including the Virgin Islands Reference Check Control Form, which can be tailored to meet state and federal requirements.

Access all the document templates you have purchased in the My documents section.

You can obtain another copy of the Virgin Islands Reference Check Control Form anytime, if needed. Click the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Virgin Islands Reference Check Control Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your specific city/county.

- Use the Review button to verify the form.

- Check the summary to ensure you have selected the right form.

- If the form does not match what you are looking for, use the Search section to find the form that fits your needs and requirements.

- Once you find the appropriate form, click Buy now.

- Select the pricing plan you desire, provide the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

Box 14: Your employer may report additional tax information here. If any amounts are reported in Box 14, they should include a brief description of what they're for. For example, union dues, employer-paid tuition assistance or after-tax contributions to a retirement plan may be reported here.

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Employers can put just about anything in box 14; it's a catch-all for items that don't have their own dedicated box on the W-2. In TurboTax, enter the description from your W-2's box 14 on the first field in the row. Enter the dollar amount and select the correct tax category that goes with that description.

Upper-case (capital) letters in Box 12 stand for different things: 2022 A and B: Uncollected social security and Medicare tax on tips. This. amount represents the social security and Medicare tax on the tips you reported to your employer.

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee's Form W-2, Wage and Tax Statement, in Box 12, using Code DD.

Generally, the amount in Box 14 is for informational purposes only; however, some employers use Box 14 to report amounts that should be entered elsewhere on your return.

9 Form InstructionsLine 1 Name.Line 2 Business name.Line 3 Federal tax classification.Line 4 Exemptions.Lines 5 & 6 Address, city, state, and ZIP code.Line 7 Account number(s)Part I Taxpayer Identification Number (TIN)Part II Certification.